Are you in need of financial assistance but unsure how to articulate your request? Writing a formal loan request letter can be daunting, but it doesn't have to be! In this article, we'll guide you through crafting a professional and persuasive letter that clearly outlines your needs and financial situation. Ready to take the next step towards securing that loan? Let's dive in!

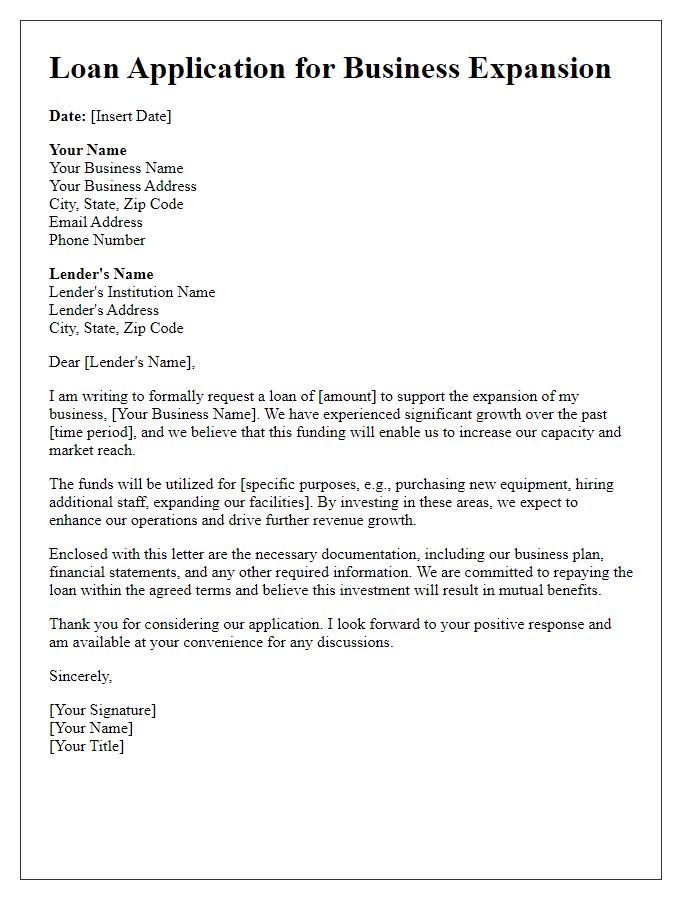

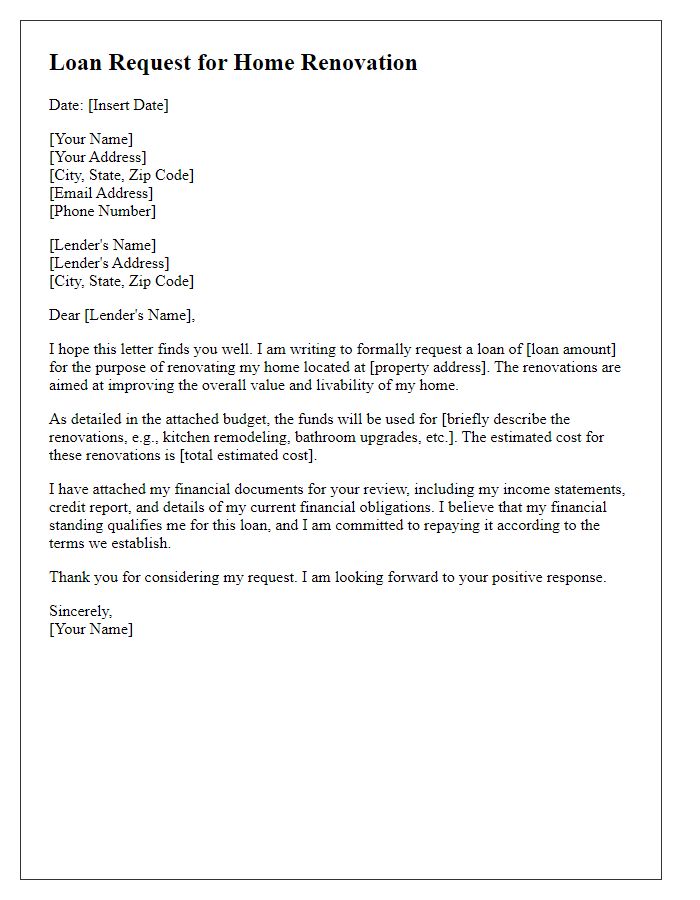

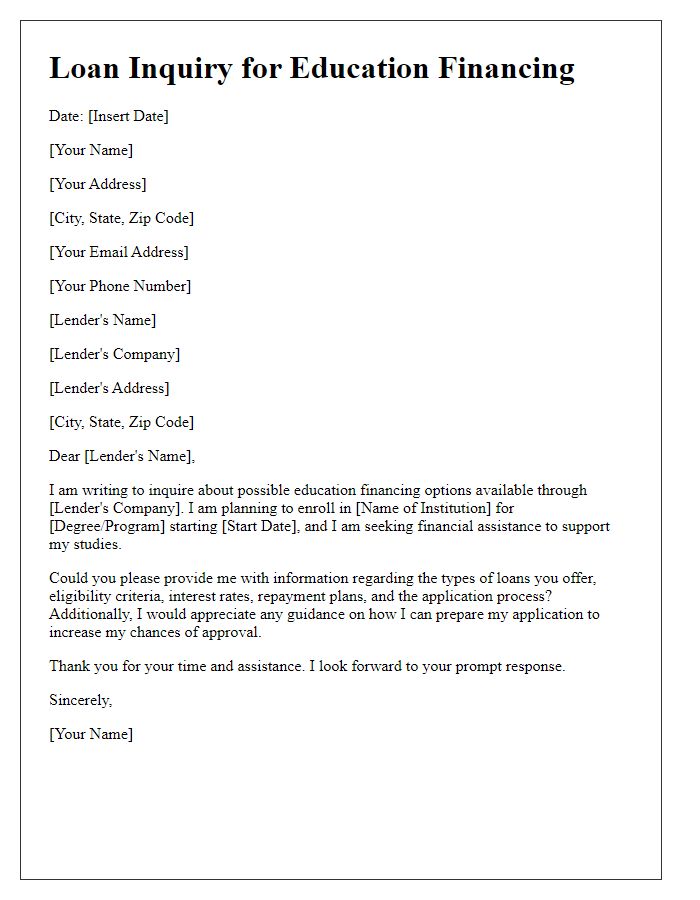

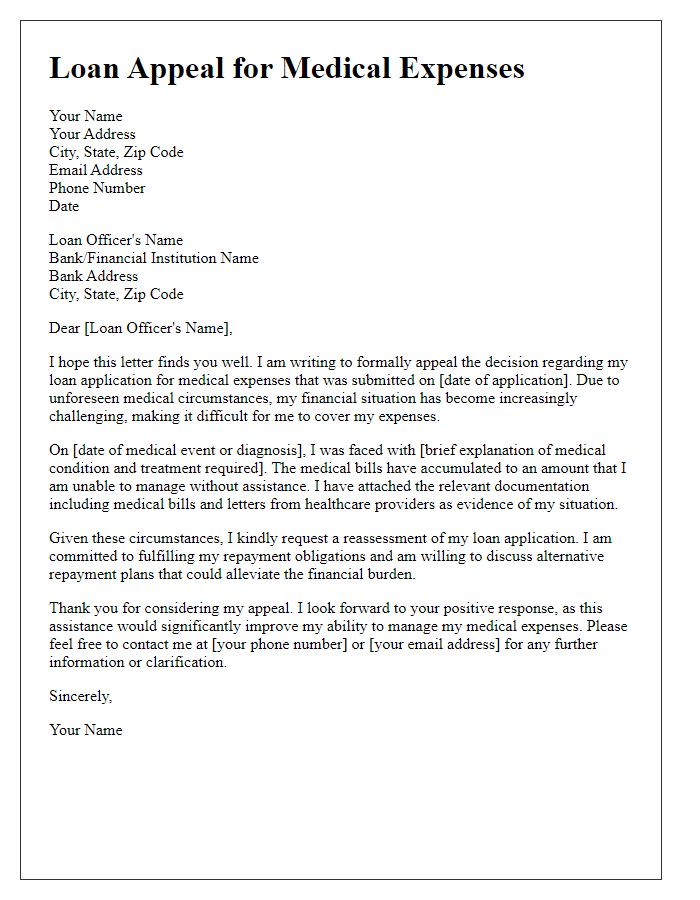

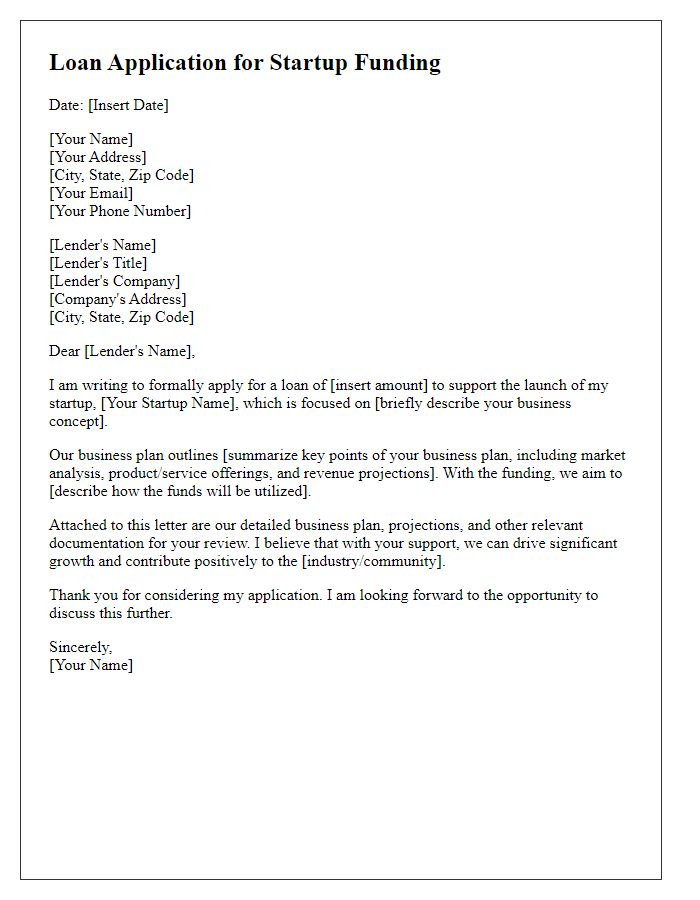

Contact Information

A formal loan request typically includes personal contact information, which should consist of the applicant's full name, home address including city and zip code, telephone number, and email address. It is essential to specify the purpose of the loan, such as home renovation or business expansion, and to provide details about the loan amount requested and repayment terms. Including financial information, such as income level and credit score, supports the loan application. Additionally, any relevant identification numbers like Social Security or Tax ID numbers may enhance credibility. Proper formatting with clear presentation enhances professionalism in the request.

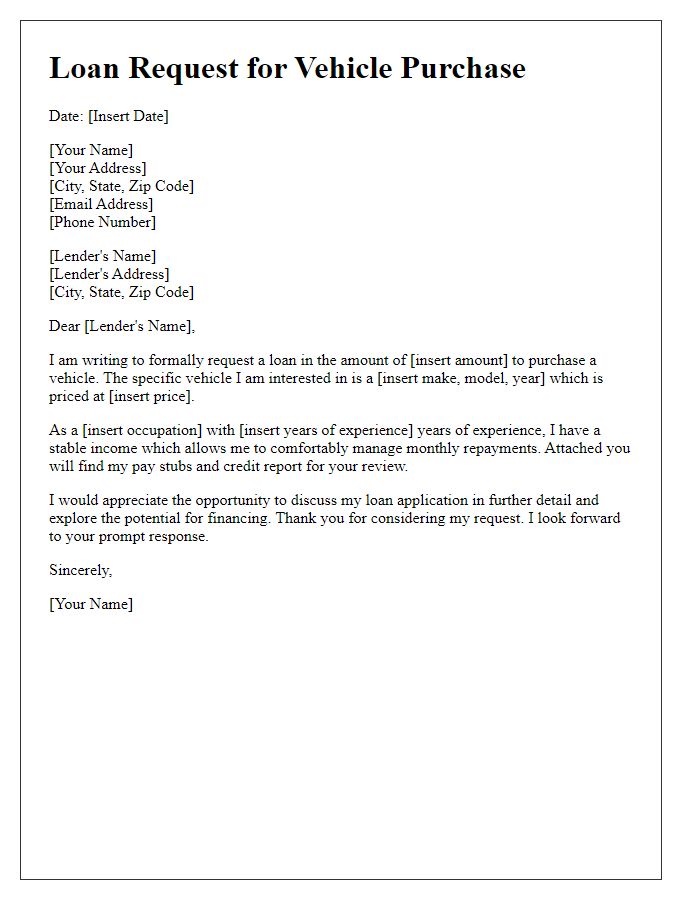

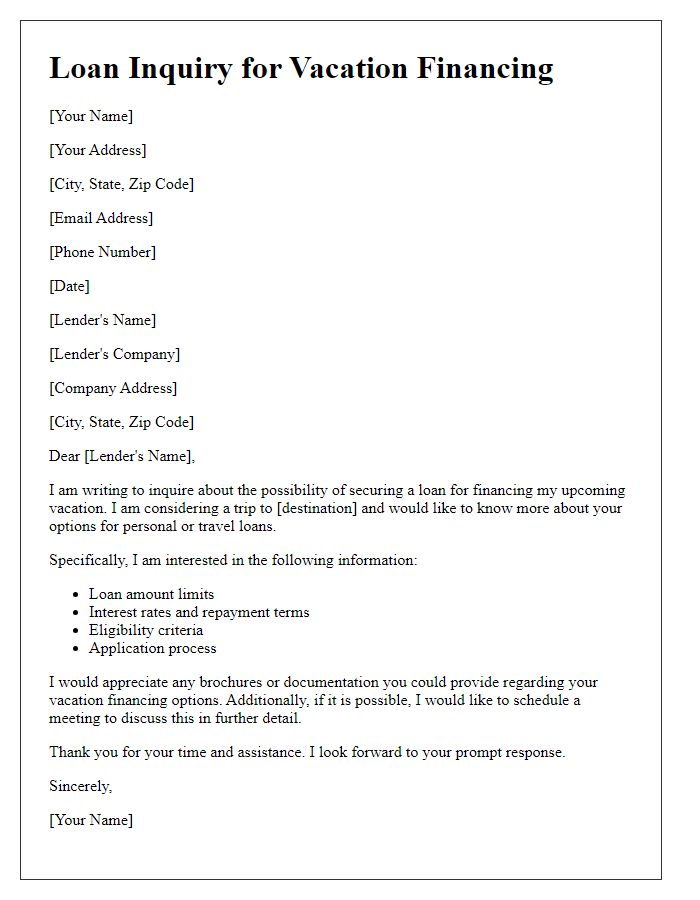

Loan Details

A formal loan request typically includes essential details such as the loan amount, purpose, repayment terms, and borrower information. A specific loan amount, for example, $50,000, may be requested to finance home renovations, targeting improvements like energy-efficient windows or a new roof. The loan purpose can be highlighted, emphasizing how these renovations will potentially increase property value. Repayment terms should be outlined, for instance, a 5-year period with monthly payments, reflecting the borrower's ability to manage finances efficiently. Additionally, borrower information should include credit score details, employment history, and annual income, providing the lender a comprehensive view of the borrower's financial standing.

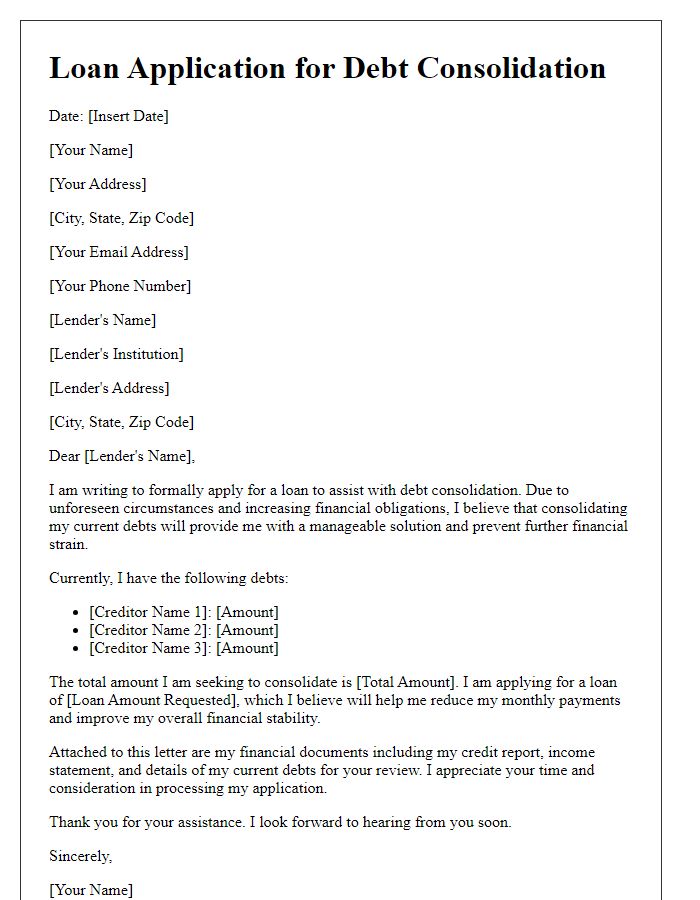

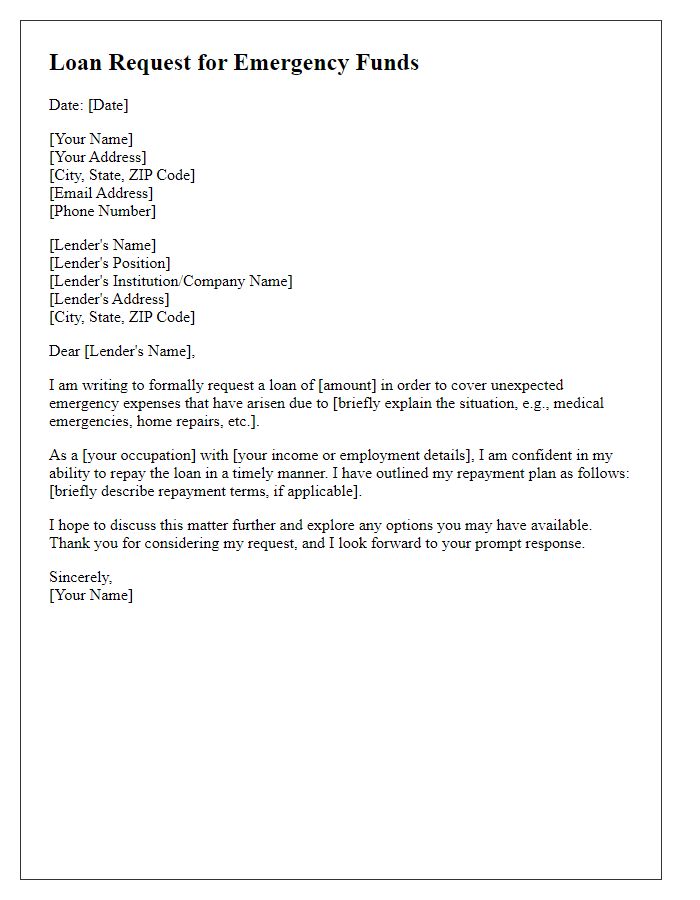

Purpose of the Loan

A formal loan request typically outlines the specific purpose for the funding. For instance, a business expansion loan might be sought to increase production capacity at a manufacturing facility in Detroit, Michigan, where annual revenues have grown by 25% over the past three years. The request could detail plans to acquire new equipment, such as state-of-the-art CNC machines costing approximately $500,000, or to renovate existing warehouse space totaling 10,000 square feet to improve operational efficiency. In addition, the loan may support hiring additional staff, aiming to create 20 new jobs within the local community, which would also contribute to the economic development of the region.

Repayment Plan

A formal loan request requires a detailed repayment plan to demonstrate financial responsibility and capacity. The repayment plan should include the loan amount (specific sum needed), interest rates (expressed as an annual percentage, e.g., 5%), loan duration (e.g., 36 months or 3 years), and monthly payment amounts (calculated based on the loan amount and interest). It is essential to outline the source of income (e.g., monthly salary from XYZ Corporation or freelance income), ensuring it covers the total monthly payments. Consideration of contingencies (such as emergency savings) adds reassurance regarding repayment stability. Additionally, providing a timeline for repayment milestones (initial installment due on a specific date) shows organization and commitment to timely payments.

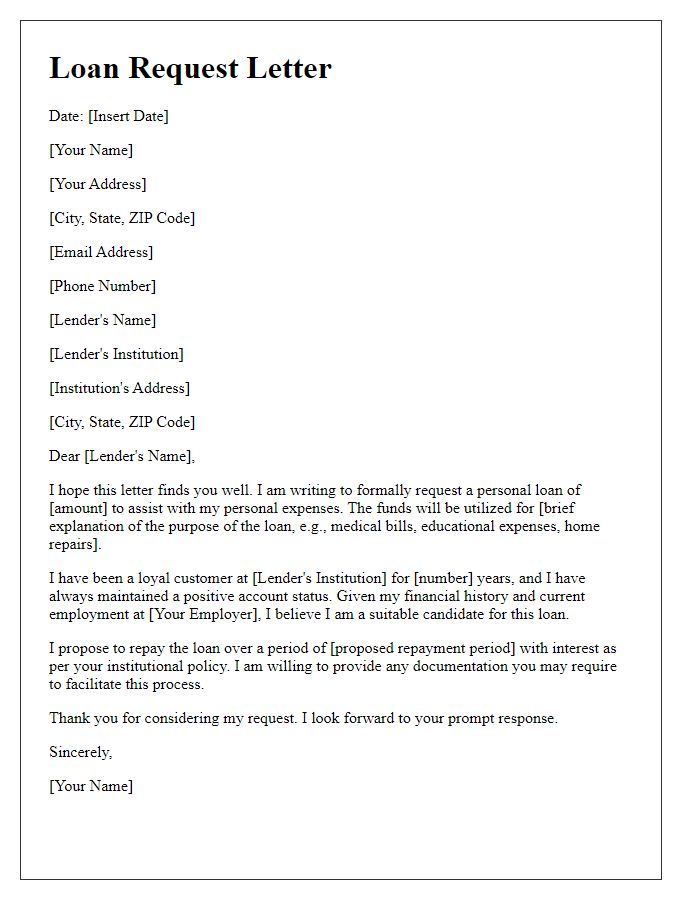

Financial Status and Creditworthiness

When assessing financial status and creditworthiness for a loan application, several key factors play a crucial role. Monthly income, which should include salary from employment and additional sources such as rental income or investment returns, must demonstrate a consistent and sufficient amount to cover monthly payments. Credit score, a numerical representation of an individual's credit history, typically ranging from 300 to 850, significantly impacts loan approval, with higher scores indicating better creditworthiness. Employment history, detailing years at current position and previous jobs, adds stability and reliability to the applicant's profile. Debt-to-income ratio, calculated by dividing total monthly debt payments by gross monthly income, ideally should be below 36%, showcasing the borrower's ability to manage existing debts along with new loan obligations. These elements collectively form a comprehensive picture of financial health and responsibility, essential for lenders in making informed decisions.

Comments