Are you looking to navigate the complex world of loan portfolios? Understanding the nuances of your loan options can be overwhelming, but it doesn't have to be. In this article, we'll break down what a detailed loan portfolio looks like and how it can benefit you in managing your financial assets. Join us as we explore the essential components that make up a successful loan portfolioâlet's dive in!

Borrower's Personal Information

Comprehensive borrower profiles encapsulate essential personal information vital for evaluating loan portfolios. Names, typically structured as first and last, provide clear identification. Dates of birth allow lenders to assess age and creditworthiness, with a focus on applicants between 25 to 40 years old, often seen as prime borrowers. Address details, including street name, city, and zip code, contribute valuable insights into geographical risk factors and local economic conditions. Contact numbers, primarily cell phones, facilitate direct communication, confirming borrower engagement. Employment history, showcasing job titles and duration, reveals income stability considerations, with steady employment over three years regarded favorably. Finally, marital status, such as single or married, significant for financial responsibilities, indicates potential joint income or shared debts impacting loan repayments.

Loan Details and Terms

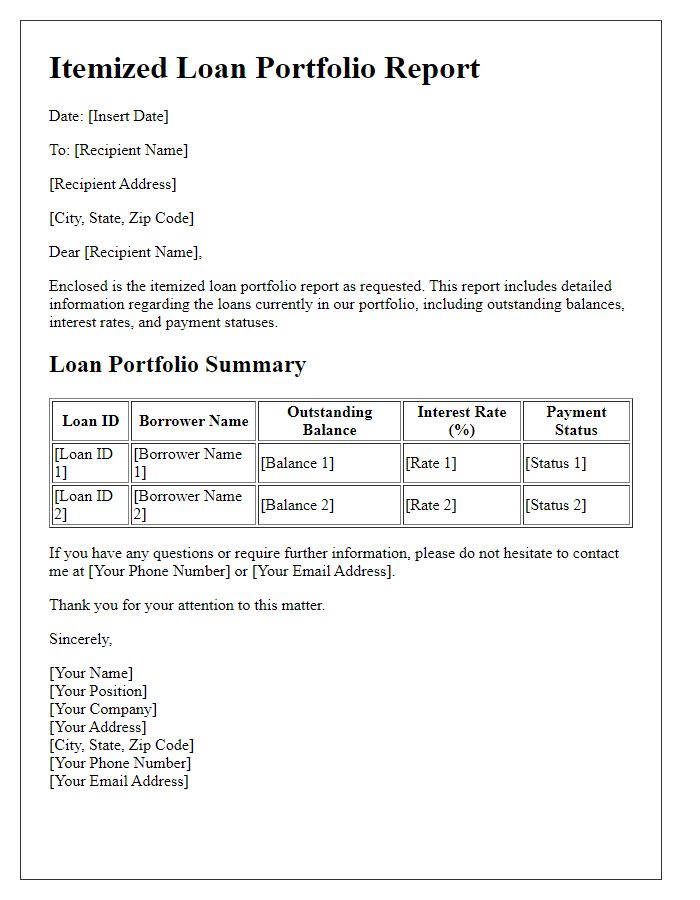

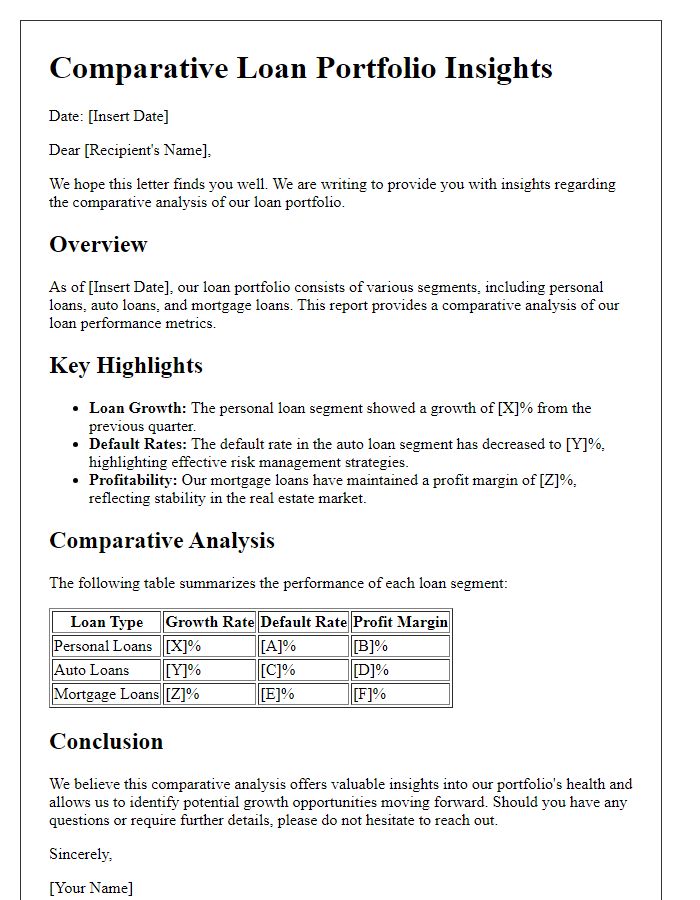

Comprehensive loan portfolios provide critical insights into individual loans and their performance metrics. Each loan entry includes essential loan details, such as the loan amount, usually ranging from $5,000 to $1 million, interest rate (typically between 3% to 10% annually), and loan term, generally spanning from 1 to 30 years. The portfolio also outlines borrower information, including credit scores (with averages hovering around 700 for approved loans) and income levels that influence approval rates. Additional terms may encompass prepayment penalties, which can vary significantly across lenders, and the loan purpose, such as home purchase, refinancing, or business expansion. Furthermore, performance indicators, including delinquency rates (estimated at around 2% for most portfolios) and default rates, are crucial for assessing the overall health of the loan portfolio. This detailed breakdown aids stakeholders in making informed decisions regarding investments and risk management strategies.

Collateral and Secured Assets

A detailed loan portfolio, particularly in the context of Collateral and Secured Assets, examines the specific items that lenders utilize to mitigate risk associated with lending. Collateral types may include real estate properties, vehicles, and equipment that are appraised for their market value; for instance, residential properties in metropolitan areas could average around $300,000, while commercial real estate might be valued in the millions depending on location and condition. Secured assets can also consist of financial instruments such as stocks and bonds; for example, a loan secured by stocks could be capped at 60% of the value of the assets, which might fluctuate in a volatile market. Furthermore, the terms of these secured loans often stipulate a loan-to-value (LTV) ratio, commonly set around 80% for mortgages, ensuring that sufficient equity exists to cover potential losses. The portfolio analysis may also include information on the borrower's creditworthiness, loan history, and debt-to-income ratio, which together provide a comprehensive view of financial health and the likelihood of repayment.

Repayment Schedule and History

A well-structured loan portfolio provides insight into the repayment schedule and history, essential for financial analysis. Each loan entry should include critical details such as the original loan amount, interest rate (typically ranging from 3% to 15%), the loan term (usually between 12 to 60 months), and the borrower's credit score (often between 300 to 850). Dates of payment history (monthly or quarterly) illustrate borrower behavior, such as on-time payments versus late payments. Total outstanding balance after each payment reflects the principal reduction over time. Further analysis can include default rates and delinquencies, emphasizing risk management in various segments, such as residential mortgages or personal loans. Additionally, geographic data relating to borrower locations, like urban versus rural areas, can provide valuable context regarding repayment tendencies influenced by local economic conditions.

Risk Assessment and Credit Score

A detailed loan portfolio requires thorough risk assessment and analysis of credit scores for each applicant. Credit scores, typically ranging from 300 to 850, determine the likelihood of repayment, impacting loan approval decisions made by institutions like banks or credit unions. Factors contributing to these scores include payment history (which accounts for 35% of the score), amounts owed (30%), length of credit history (15%), new credit inquiries (10%), and types of credit used (10%). Risk assessment includes evaluating economic conditions, such as unemployment rates in specific regions and industry stability, along with borrower-specific metrics like debt-to-income ratios and active loans. Monitoring compliance with regulatory requirements, including the Fair Lending Act, is crucial for maintaining an equitable lending process. A portfolio with diversified loans mitigates risks, ensuring stability against fluctuations in default rates.

Comments