When it comes to managing your finances, keeping a clear record of your loan history is crucial. Not only does it help you stay organized, but it can also provide insight into your financial habits and responsibilities. Whether you're applying for a new loan or simply assessing your current standing, documenting your loan history can make a significant difference. Let's explore how to effectively create a loan history template that simplifies this process and keeps you on trackâread on to discover more!

Borrower's Information

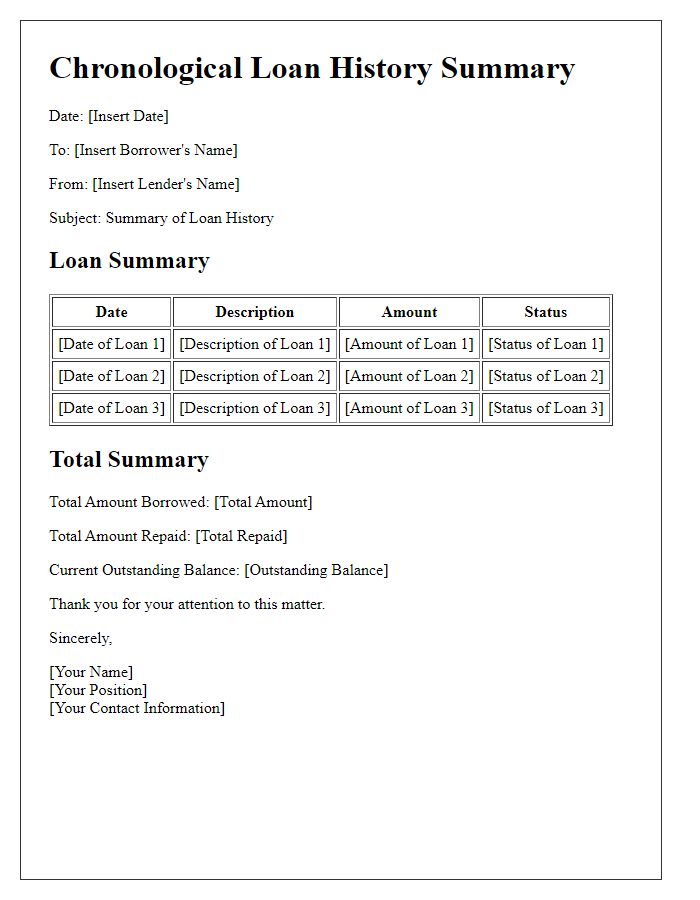

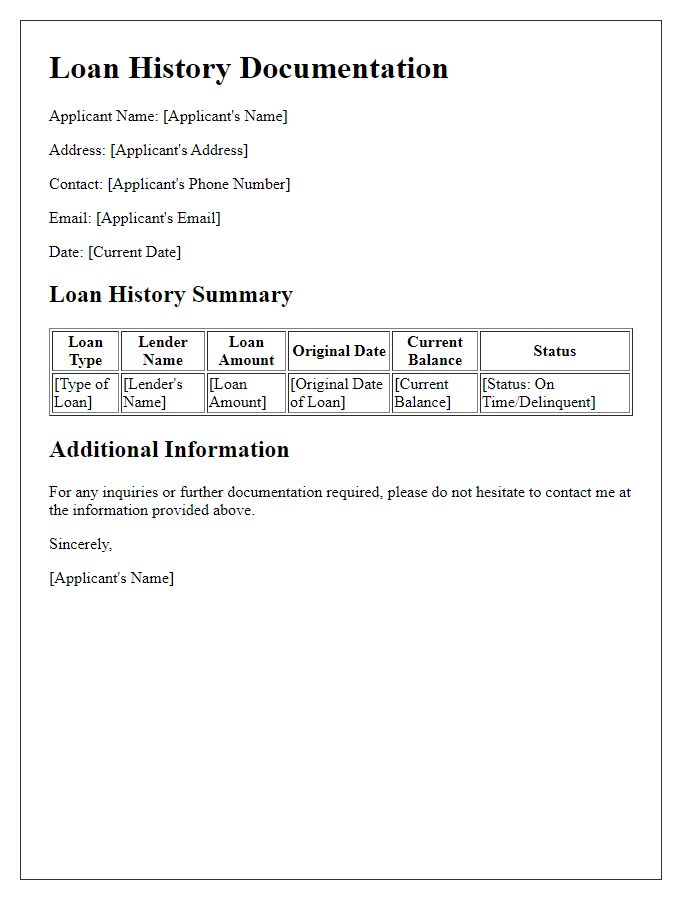

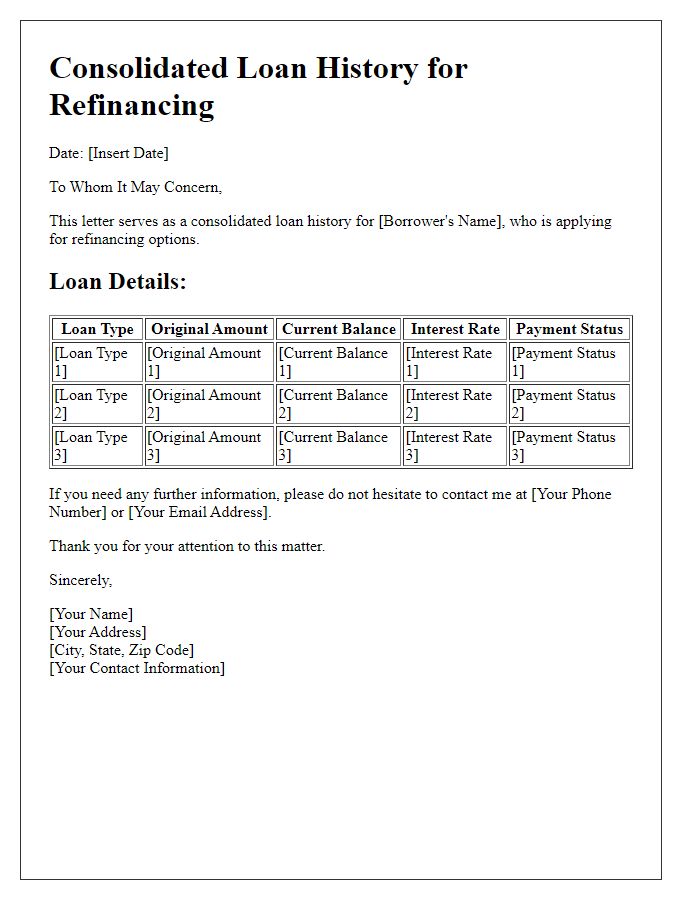

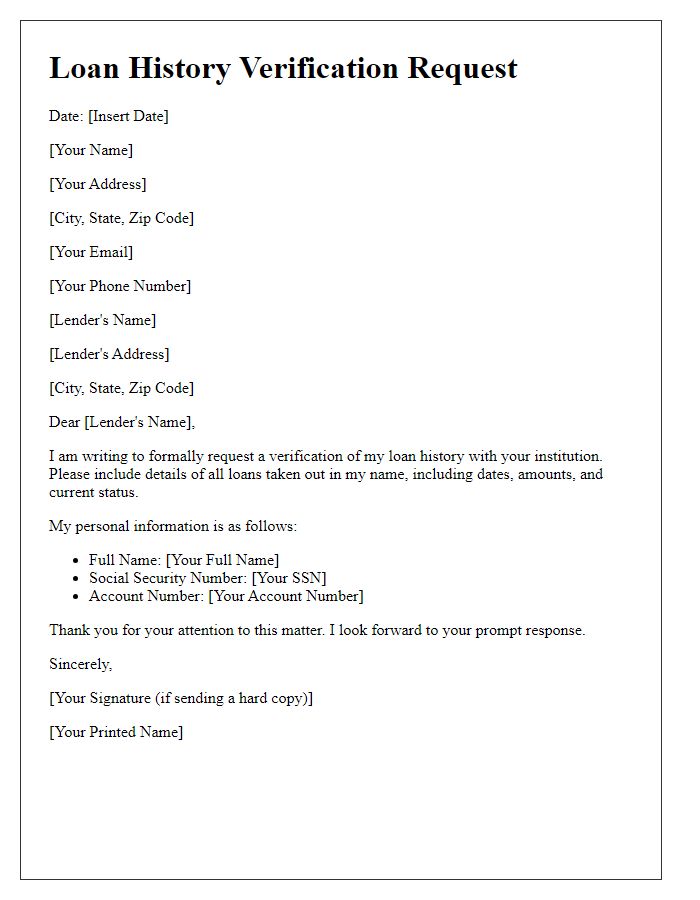

Borrowers typically need to present a detailed overview of their loan history to potential lenders or financial institutions, which includes key information such as full names, addresses, social security numbers, and contact information. Loan types, such as personal loans, student loans, and mortgages, must be clearly categorized, alongside their respective amounts, interest rates, and terms. It's crucial to indicate loan origination dates, payment history, and any default occurrences, as this data reflects borrower reliability. Additionally, documentation should include the names of creditors and any co-signer details to provide a comprehensive financial profile, ensuring transparency in the borrowing process.

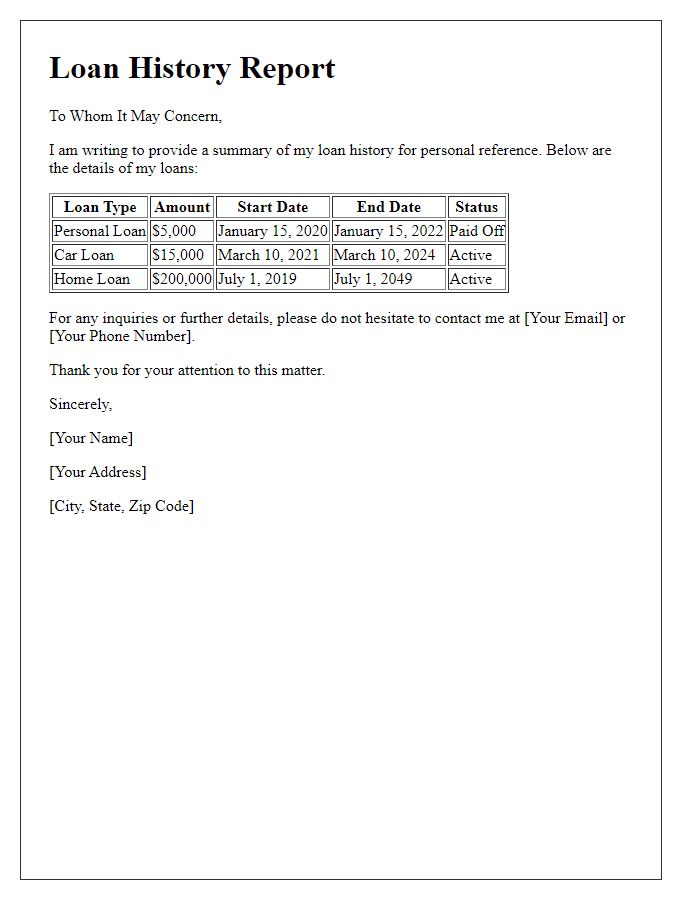

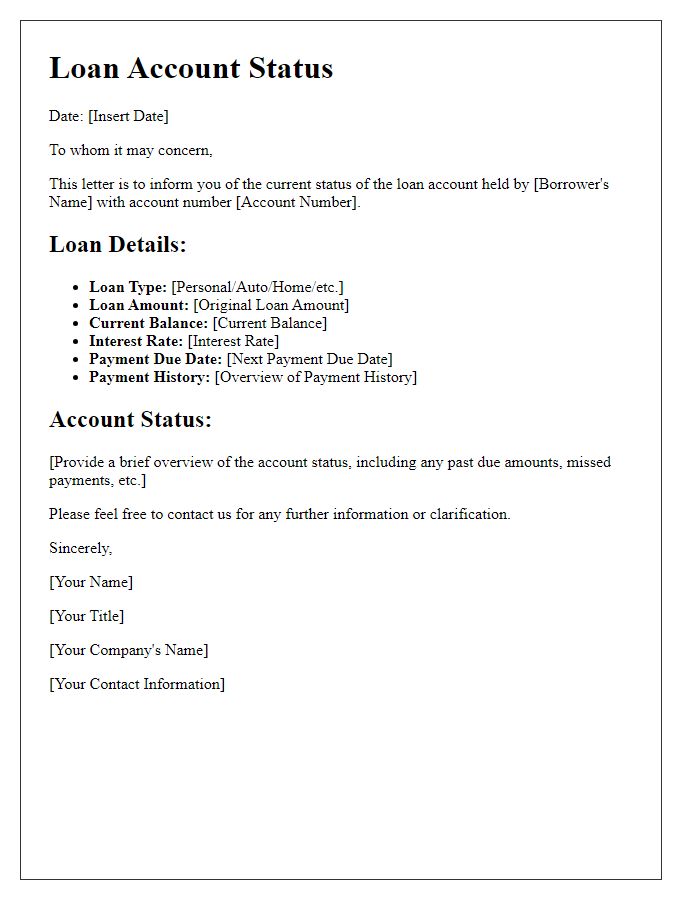

Loan Account Details

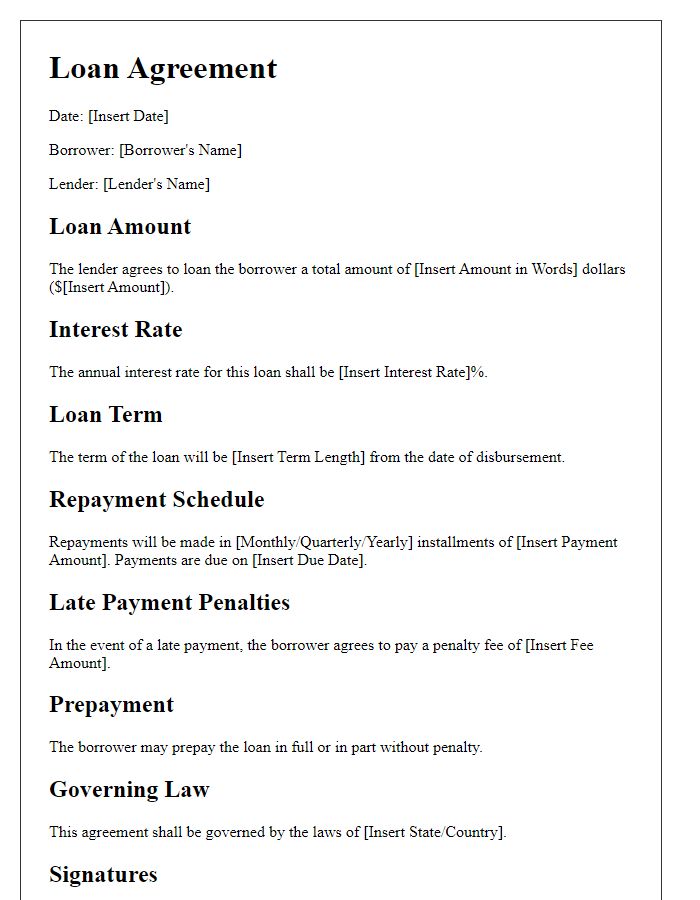

Loan account details play a critical role in understanding financial obligations and responsibilities. Each loan can be associated with a specific loan number, such as 123456789, which uniquely identifies the borrowing agreement. The loan type could be categorized as a personal loan, mortgage, or auto loan, influencing interest rates and repayment terms. The initial loan amount, for example, $15,000, serves as the foundation for calculations related to interest accrued over the tenure of the loan, typically spanning five years or 60 months. Important events in the loan's lifecycle include the disbursement date, often set as January 1, 2023, and significant milestones like payment due dates and remaining balances. Payments, whether monthly or bi-weekly, must be documented, reflecting the principal reduction and interest accumulated. Additionally, documenting any defaults or late payments in this history can provide insights into the borrower's creditworthiness and financial management skills. Accurate and detailed loan account documentation is essential for lenders and borrowers alike, ensuring transparency and facilitating future borrowing decisions.

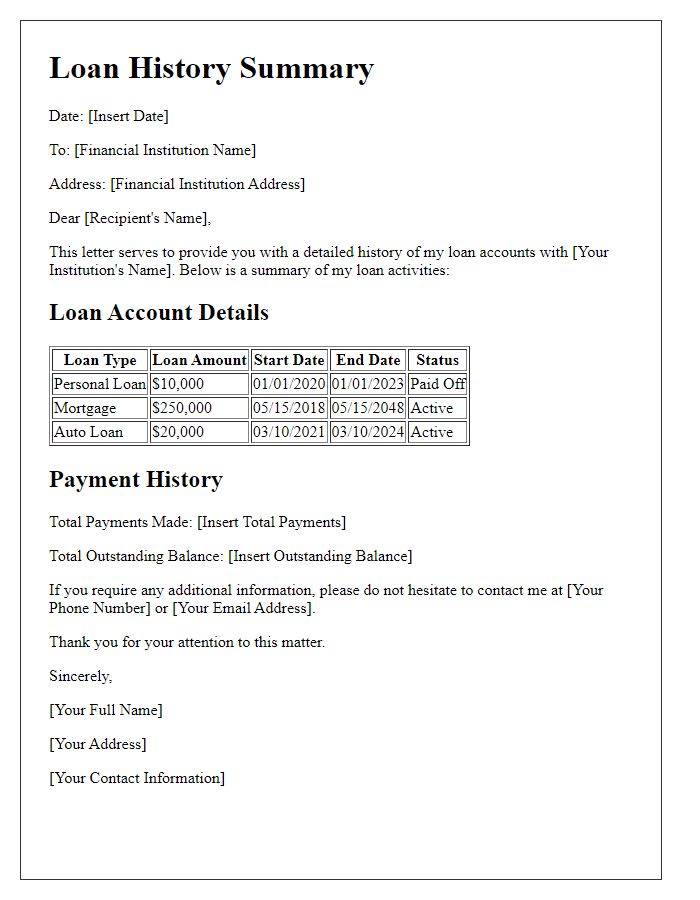

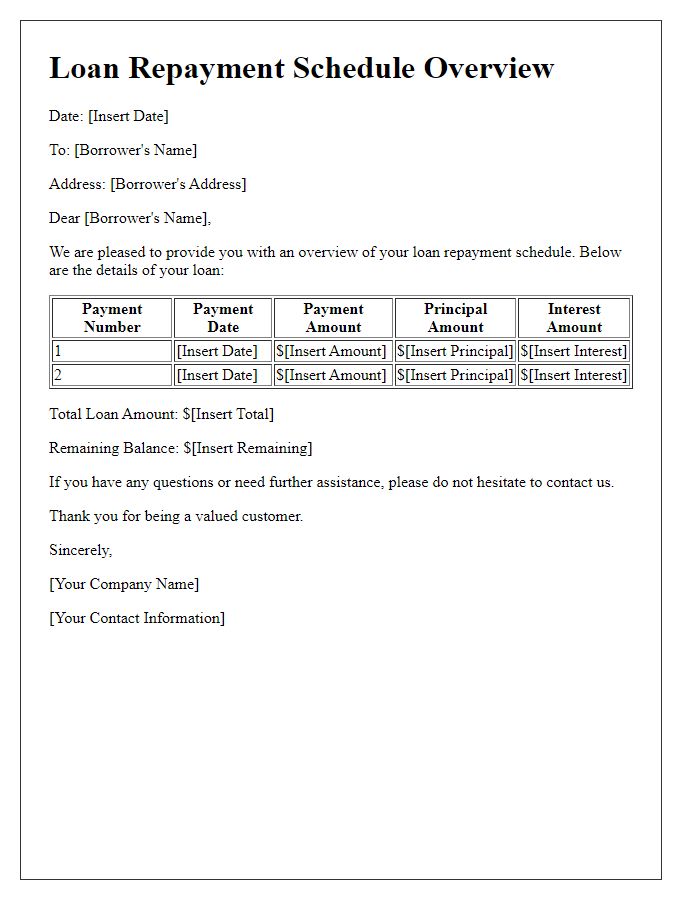

Payment History

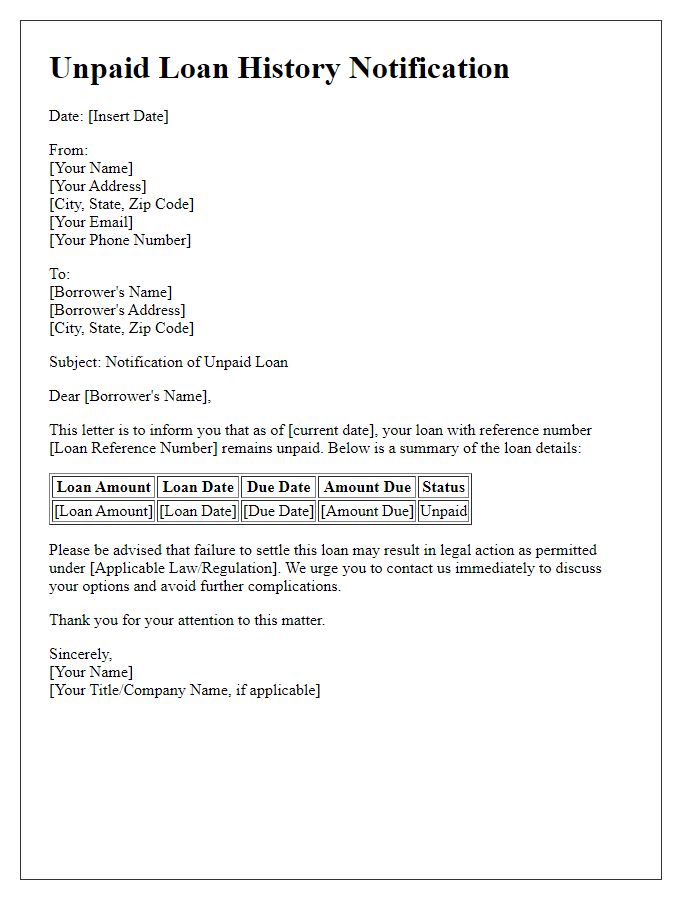

Documenting the payment history of loans is essential for tracking financial obligations over time. A detailed loan payment history includes critical details such as loan amount (for instance, $50,000), interest rate (averaging 5% annually), and payment frequency (monthly). Each entry should record payment dates, typically on the first of every month, and amounts paid (e.g., $1,000) to provide an accurate reflection of the borrower's commitment. Notable events, such as late payments or missed payments (which can affect credit scores significantly), should also be carefully documented along with any accrued fees (possibly $50 per occurrence). This record helps borrowers manage their outstanding balances and anticipate future financial obligations effectively.

Outstanding Balance

Outstanding balance on loans is a crucial aspect of personal finance, representing the remaining amount owed to lenders such as banks or credit unions. For example, an individual may have a personal loan with a principal amount of $10,000 and, after several payments, an outstanding balance of $3,500. This balance influences the calculation of interest, often expressed as an annual percentage rate (APR), which could be as high as 18% for unsecured loans. Regular payments, typically made monthly, gradually reduce this outstanding balance, whereas missed payments can result in late fees and an increase in the overall amount due. Accurate documentation of the loan history, including the outstanding balance, ensures financial accountability and aids in financial planning.

Contact Information for Inquiries

Loan history documentation is crucial for maintaining accurate financial records. Essential elements include the borrower's name, loan amount, interest rate, loan terms, and payment history. For personal loans, details such as the lender's name (e.g., Bank of America), loan start date (e.g., January 1, 2021), and termination date (if applicable) are vital. Payment schedules, including due dates and whether payments were made on time, should be included. It is also important to document any late fees incurred and the total balance remaining. Additionally, include contact information for inquiries which may consist of the lender's customer service number (e.g., 1-800-432-1000), email support (e.g., support@lender.com), and office hours for further assistance. This detailed overview fosters transparency and assists in managing future credit decisions.

Comments