Are you considering a loan but unsure of your affordability? It's crucial to have a clear understanding of your financial situation before making any commitments. In this article, we'll discuss how to effectively document your loan affordability and provide you with a simple template to guide you through the process. Stay tuned to learn how you can make informed decisions about your borrowing options!

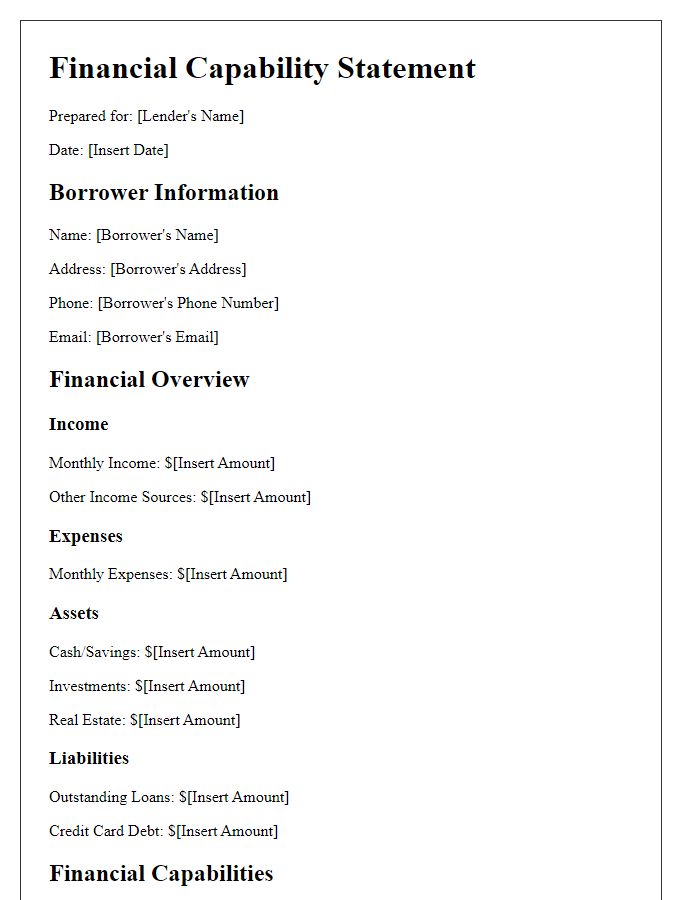

Borrower's financial details

A comprehensive overview of a borrower's financial profile entails their income, expenses, assets, and liabilities, crucial for assessing loan affordability. Net monthly income, typically derived from salaries or business profits, must exceed national living wage benchmarks, often around $1,200 to $2,000 in the U.S., depending on location. Fixed monthly expenses, including housing costs (mortgages or rents averaging around $1,500 in urban areas), utility bills (approximately $300), and transportation costs ($200), should be detailed. Outstanding liabilities, such as credit card debt, student loans averaging $30,000, and auto loans, need careful consideration. Real estate assets, retirement accounts, and savings should also be documented to provide a full picture of the borrower's financial health, supporting loan applications for amounts commonly reaching $250,000 or more, especially for home purchases.

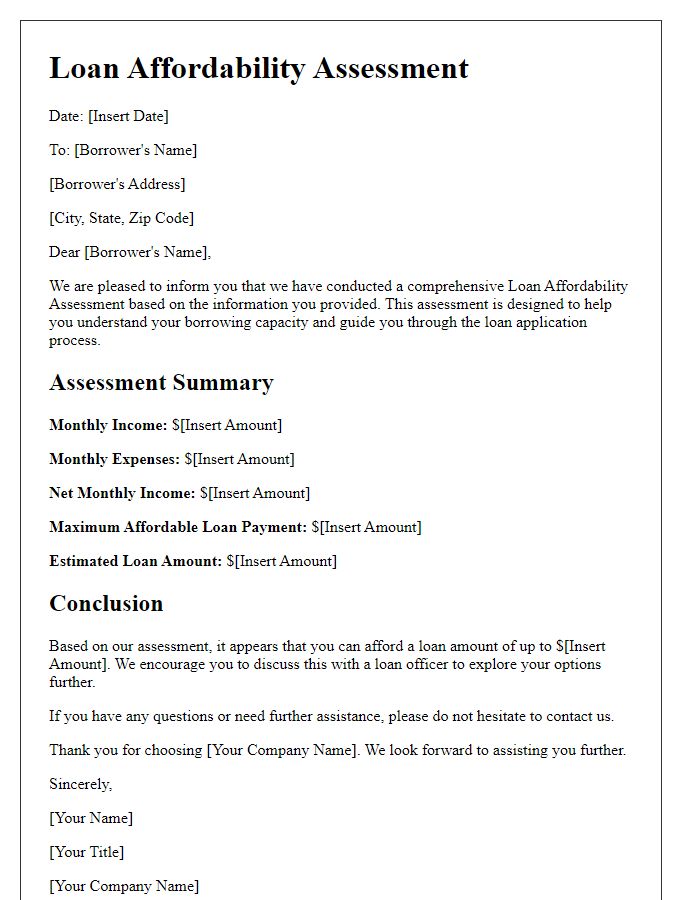

Loan terms and conditions

Loan affordability assessments are critical for determining the capacity of borrowers to meet their repayment obligations. Key factors include loan amount, typically ranging from $5,000 to $500,000, interest rates varying from 3% to 15%, and repayment terms extending from 1 to 30 years. Monthly installment calculations take into account the total loan amount (principal) plus interest, ensuring that borrowers maintain a debt-to-income ratio below 43%. Employment verification and credit score evaluations, often requiring a minimum score of 620, play significant roles in assessing financial health. Documenting these elements contributes to a thorough understanding of the borrower's financial landscape, ensuring responsible lending practices and mitigating the risk of default.

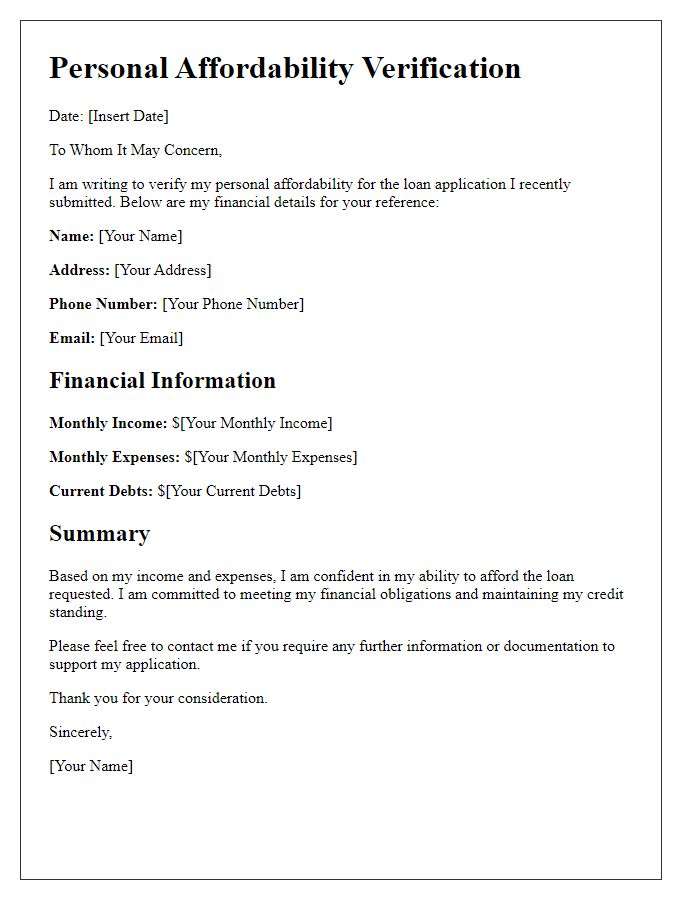

Income stability and sources

Documenting loan affordability requires a detailed overview of income stability and sources. Monthly income, including salary from employment, bonuses, and overtime should be outlined. If applicable, additional income streams such as rental income from properties or dividends from investments must be included. Consistency is crucial; job tenure exceeding two years indicates stability, while contracts or freelance work should demonstrate consistent earnings over at least 12 months. Income documentation should also include bank statements and tax returns, showcasing reliable cash flow. Understanding total debt-to-income ratio, ideally below 43%, allows lenders to assess borrowing capacity accurately, ensuring overall financial health in loan approval scenarios.

Debt-to-income ratio

A debt-to-income (DTI) ratio is a critical measure for assessing loan affordability, typically calculated by dividing total monthly debt payments by gross monthly income. For instance, a person with a monthly income of $5,000 and total debts of $1,500 has a DTI ratio of 30% ($1,500 / $5,000). Financial analysts recommend that a DTI ratio below 36% is ideal for most conventional loans, including mortgages, as it indicates a good balance between debt and income. Lenders in markets such as the United States often view DTI ratios above 43% as red flags, possibly leading to loan denial. Monitoring this ratio regularly can help individuals manage financial health and maintain eligibility for future loans.

Repayment capacity analysis

Loan affordability assessment involves a detailed analysis of an individual's repayment capacity, which typically encompasses factors such as income, expenses, credit score, and existing debt obligations. The evaluation process generally begins with an examination of the gross monthly income, which may include salaries, bonuses, rental income, and other revenue streams. Next, an assessment of monthly expenses, including essential costs like housing, utilities, and food is crucial in determining disposable income available for loan repayments. Additionally, credit scores, ranging from 300 to 850, play a significant role in influencing interest rates and loan terms, with higher scores generally leading to more favorable conditions. Furthermore, the debt-to-income ratio, calculated by dividing total monthly debt payments by gross monthly income, should ideally remain below 36% to indicate a healthy financial state conducive to taking on new loan commitments.

Comments