Looking to secure a loan but unsure about documenting your collateral? You're not aloneâmany individuals find the process a bit overwhelming. Thankfully, understanding how to properly outline the assets backing your loan can make all the difference in getting the approval you need. Dive in as we explore a simple letter template designed specifically for documenting loan collateral, and get ready to take the next step towards your financial goals!

Loan Agreement Details

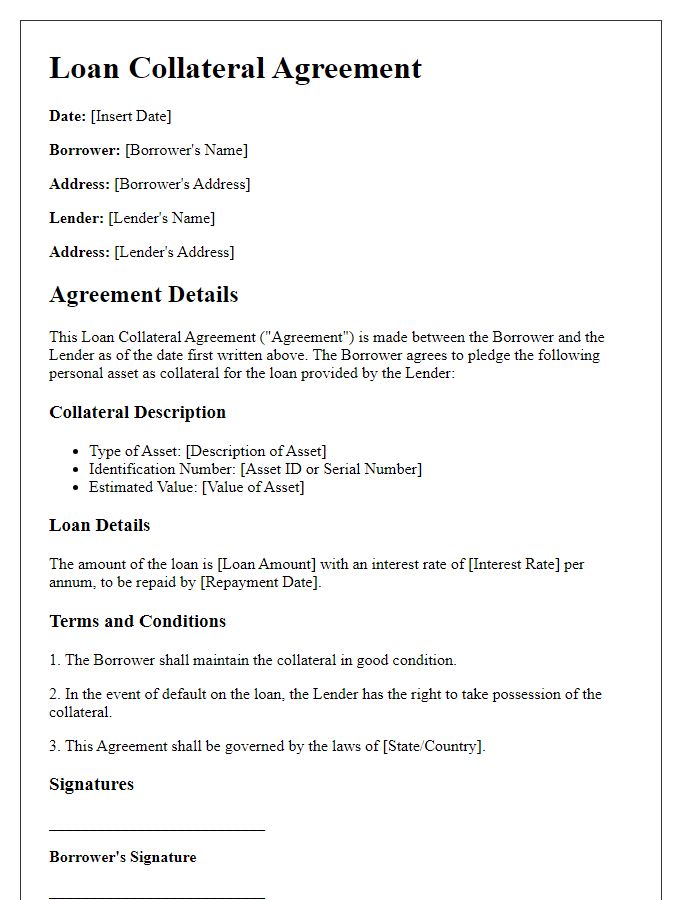

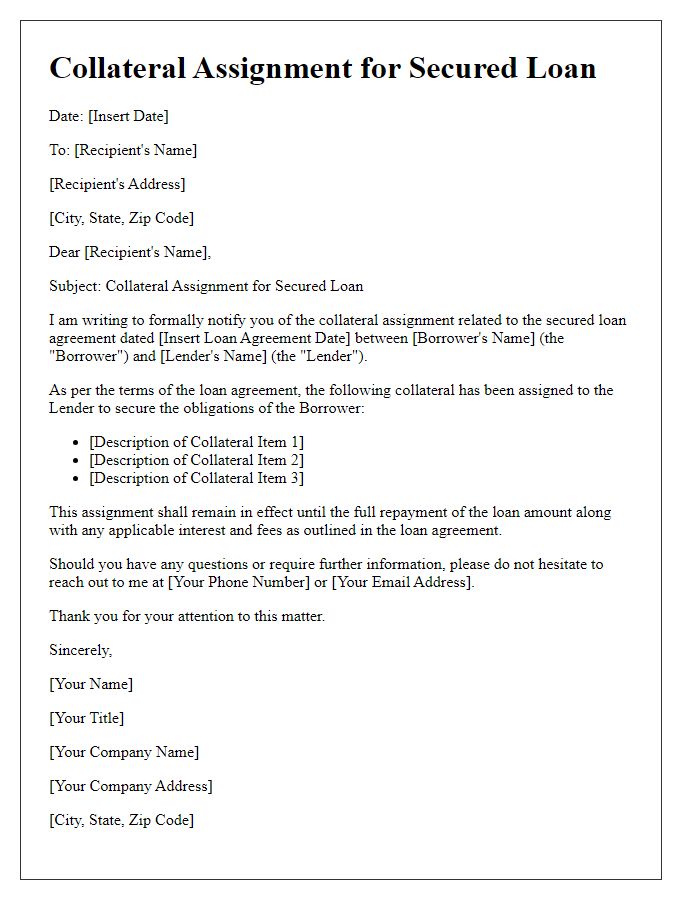

A loan agreement typically includes specific details regarding the collateral, ensuring both parties understand the terms and requirements. Collateral refers to the asset pledged by the borrower to secure the loan, which might include real estate properties like residential homes or commercial buildings, vehicles such as cars or trucks, or financial instruments like stocks or bonds. The documentation usually specifies the itemized description of the collateral, including its current market value, registration information, and condition. Additionally, the agreement outlines the lender's rights to the collateral in the event of default, including repossession procedures and potential legal actions. It's essential that the agreement is signed by both parties, often in the presence of a notary public, to ensure its legality and binding nature.

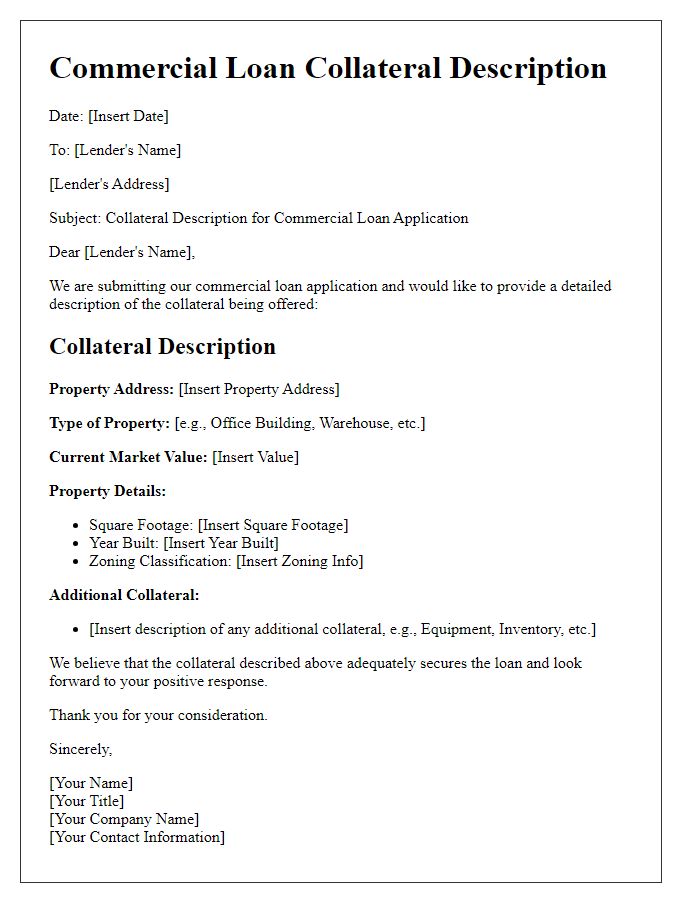

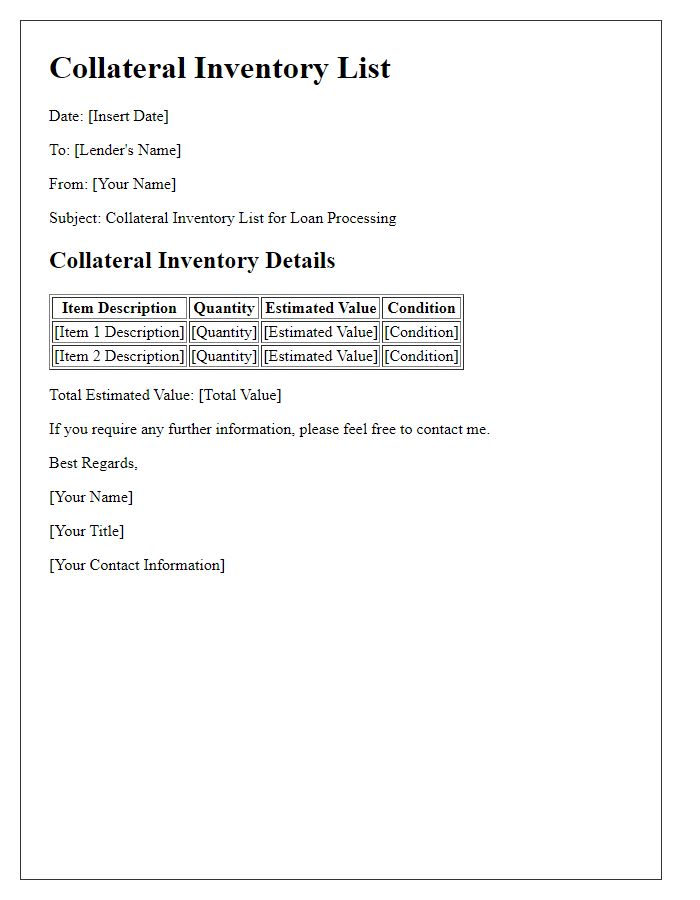

Collateral Description

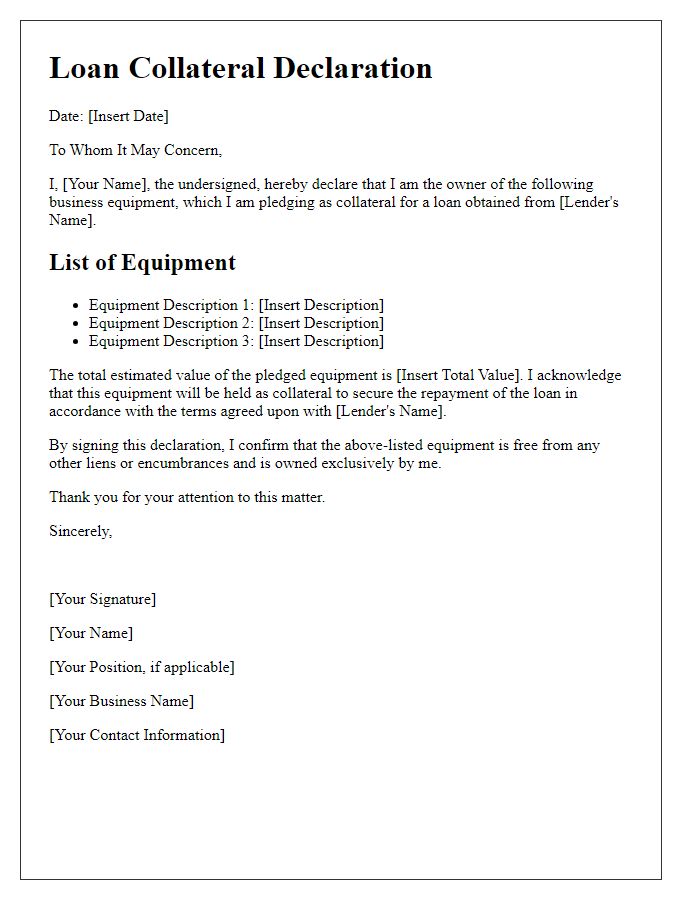

Collateral documentation requires a precise description to ensure clarity and security in lending agreements. The collateral itself, which can include various valuable assets such as real estate properties, vehicles, or equipment, must be detailed adequately. For example, a commercial property located at 123 Business Lane, Springfield, with an appraised value of $500,000 could serve as collateral. Additionally, items like a 2020 Ford F-150 truck with a market value of $35,000 or industrial machinery from XYZ Manufacturing valued at $150,000 may also be listed. Accurate descriptions including serial numbers, VINs (Vehicle Identification Numbers), and location details should be included. This thoroughness protects the lender's interests and provides a clear understanding of the asset's importance and value in the event of a default.

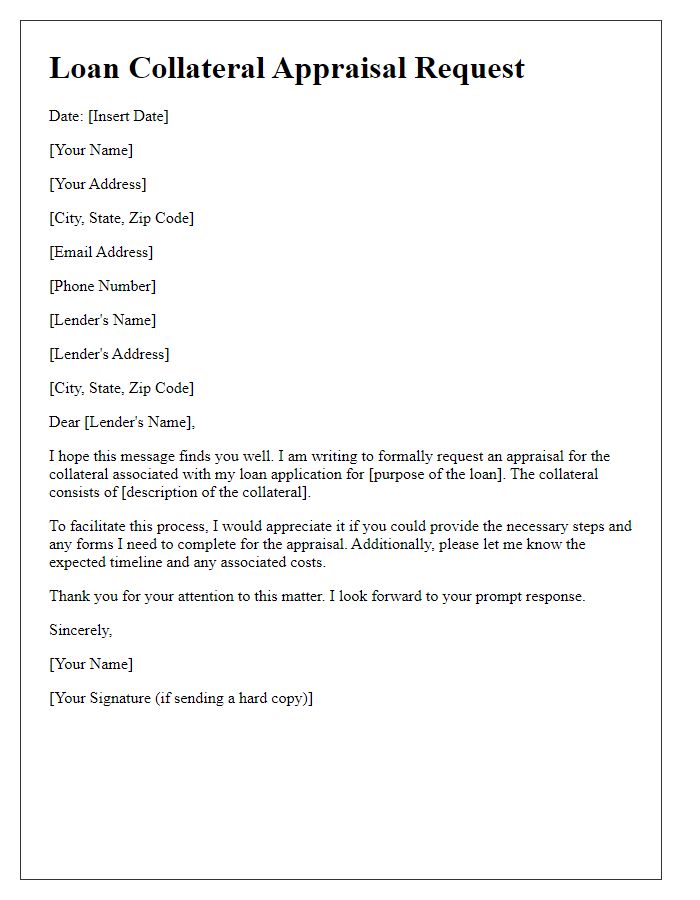

Valuation and Appraisal Information

Valuation and appraisal information is critical for determining the worth of collateral, especially in real estate transactions such as residential properties located in urban areas like New York City or commercial spaces in Chicago. Professional appraisers typically utilize the Uniform Standards of Professional Appraisal Practice (USPAP) guidelines to assess collateral value through methods like the Sales Comparison Approach, which compares similar properties sold within the last six months, or the Income Approach for investment properties generating rental income. Detailed reports usually include key metrics such as the square footage, number of bedrooms or commercial units, property condition, and market trends, ensuring an accurate and fair valuation process that satisfies lenders and borrowers alike. Accurate appraisals are essential for maintaining risk management standards in loan underwriting, potentially influencing interest rates based on collateral risk.

Lender and Borrower Identification

Lender identification is crucial in loan agreements, typically involving financial institutions like banks or credit unions, which provide monetary resources. Borrower identification entails personal data or business details, including full name, address, and social security number for individuals, or business registration number and address for companies. Loan collateral serves as an asset (such as real estate, vehicles, or stocks) that secures the loan, protecting lenders against default. Accurate documentation of both parties is essential for legal validity, ensuring clarity concerning rights and responsibilities throughout the loan term.

Legal Compliance and Terms

Documenting loan collateral serves as a critical component of legal compliance and ensures clarity in terms between parties involved. The collateral, such as real estate properties (like residential homes or commercial buildings), vehicles (including cars and trucks), or financial securities (stocks or bonds), must be clearly defined in the loan agreement to protect the lender's interests. Appraisal values for movable assets, including machinery and inventory, should be meticulously recorded, often requiring professionals to establish fair market value. Borrowers must understand their obligations regarding these items, including maintenance, insurance coverage, and conditions under which collateral can be seized in case of default. Proper documentation must also comply with local laws and regulations, ensuring that lien filings are accurately processed in relevant jurisdictions, like state or federal records, to affirm legal rights over the collateralized assets.

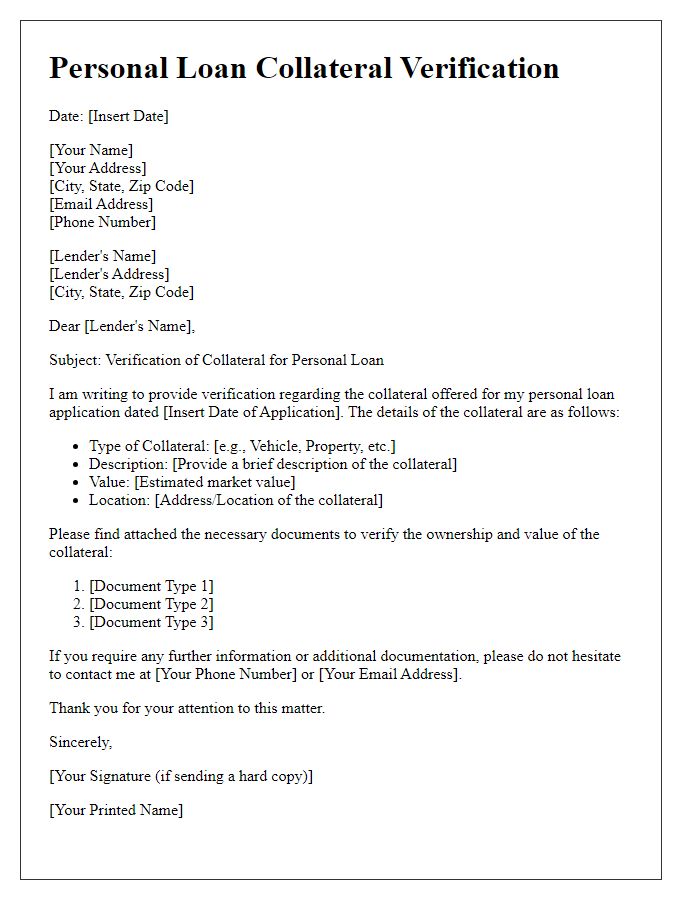

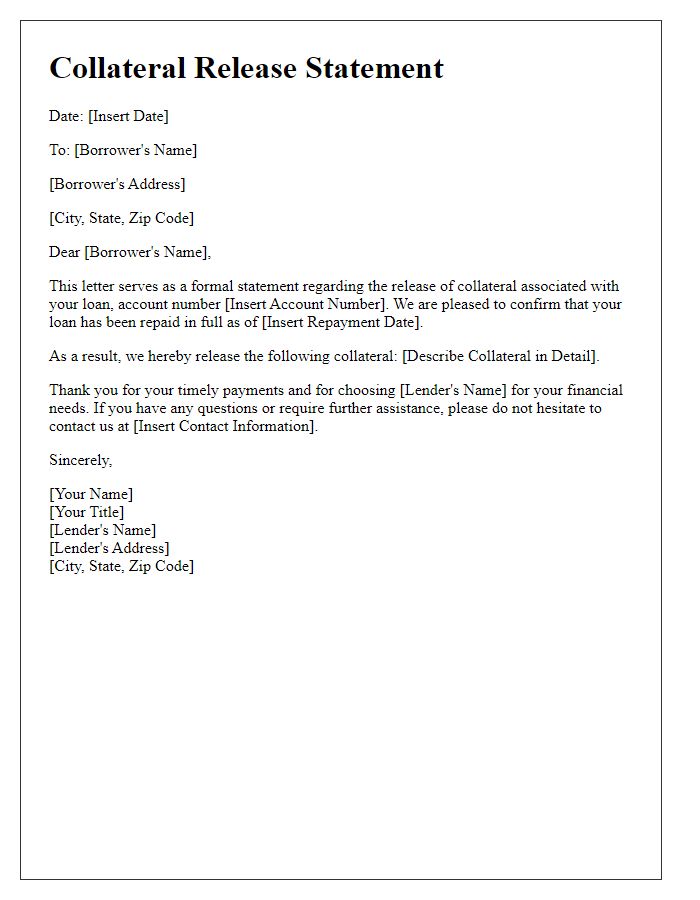

Letter Template For Documenting Loan Collateral Samples

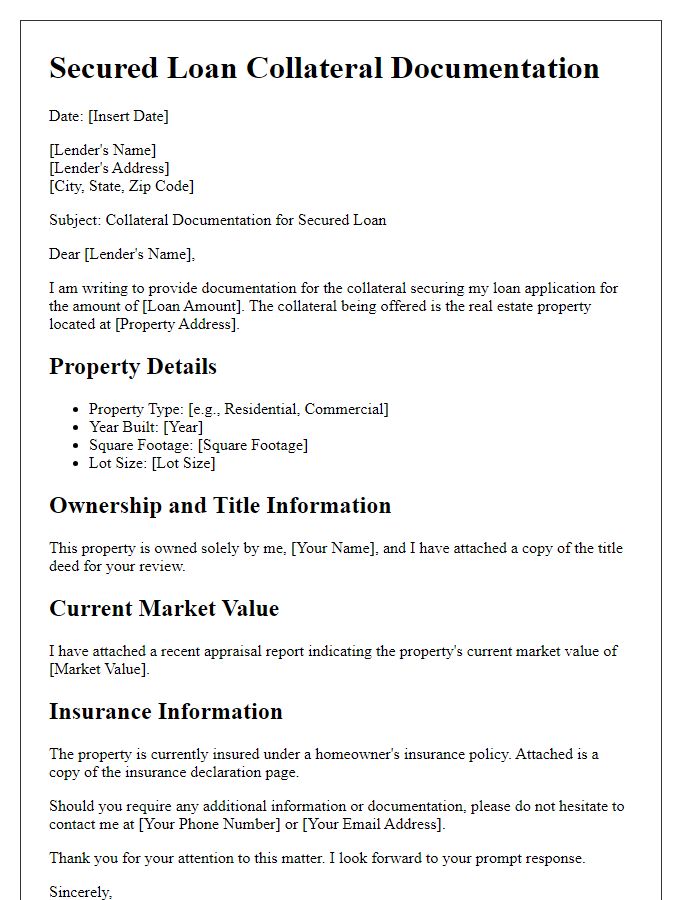

Letter template of secured loan collateral documentation for real estate.

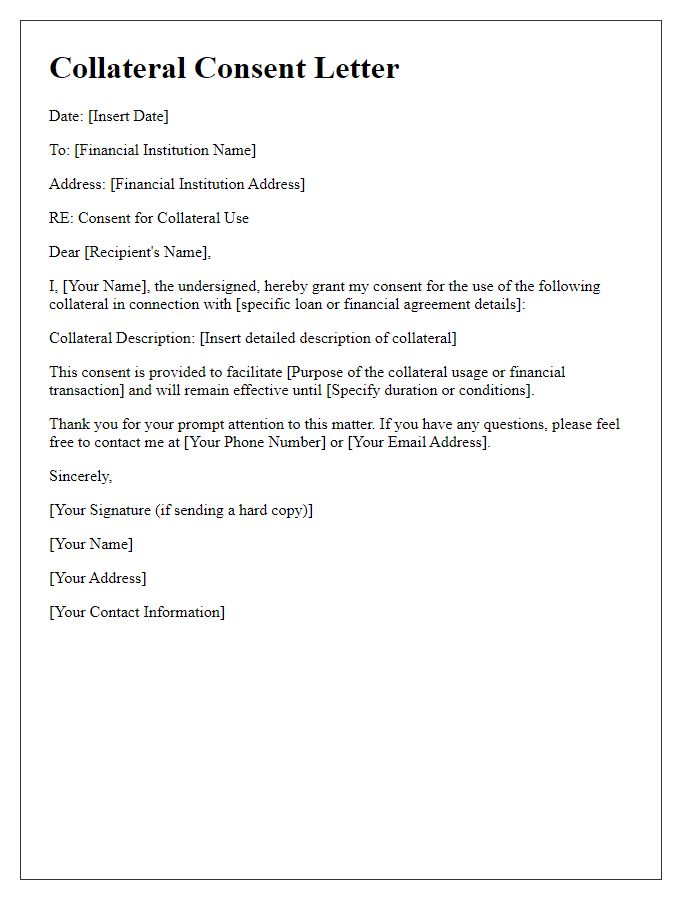

Letter template of collateral consent letter for financial institutions.

Comments