Are you a self-employed individual looking to secure a loan but unsure how to approach the application process? Crafting a compelling letter can significantly increase your chances of approval, as it showcases your unique business circumstances and highlights your financial responsibility. In this article, we'll walk you through a handy template that makes writing your own self-employed loan application letter seamless and effective. So, let's dive in and empower you to take the next step towards your financial goals!

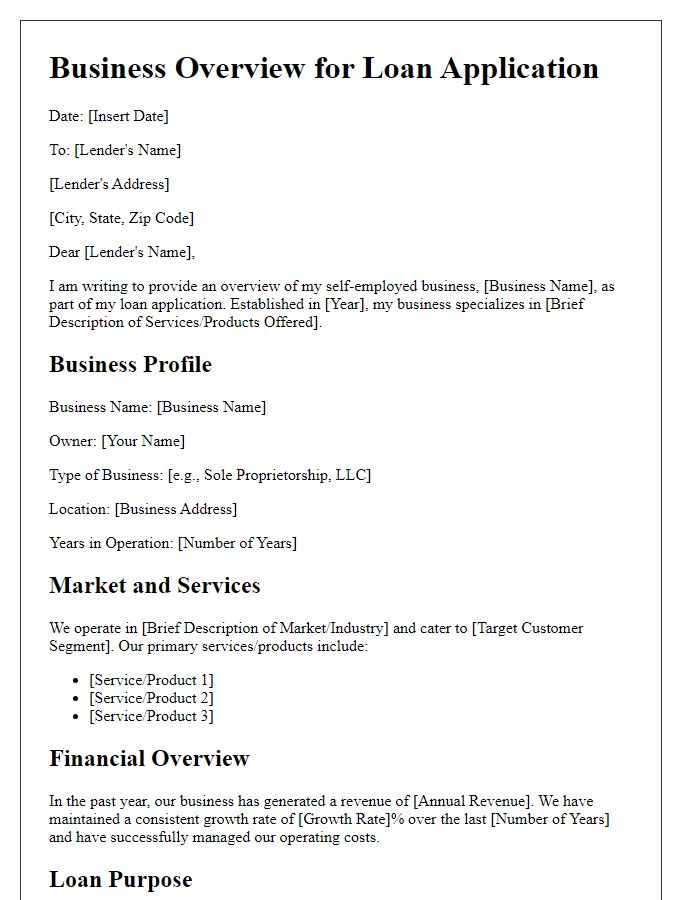

Business Overview

Self-employed individuals often face unique challenges when applying for loans, particularly in showcasing business viability. A comprehensive business overview should include critical details such as annual revenue figures (for instance, $75,000 in 2022), the nature of services or products offered (for example, digital marketing solutions), and target demographic insights (e.g., small businesses and startups within specific industries). Detailing the market trends, such as the 20% increase in demand for online services post-COVID-19, can bolster the application. Moreover, including operational expenses (like $30,000 yearly) and net profit margins (approximately 40% on average) reinforces the business's financial soundness. Highlighting client testimonials and case studies from recognized brands (e.g., XYZ Corporation) can further validate credibility and attract lender interest.

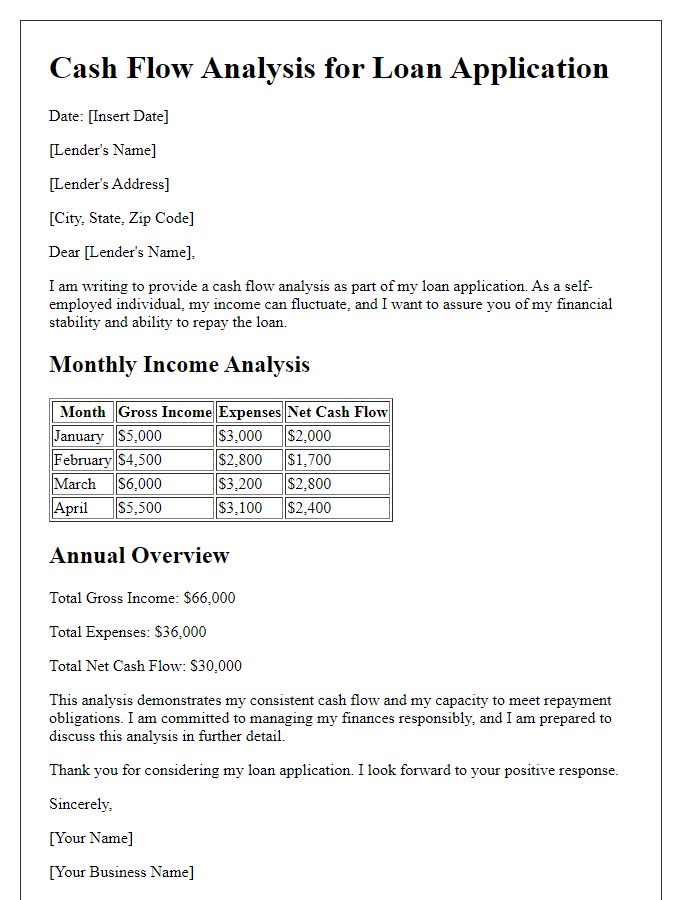

Financial Statements

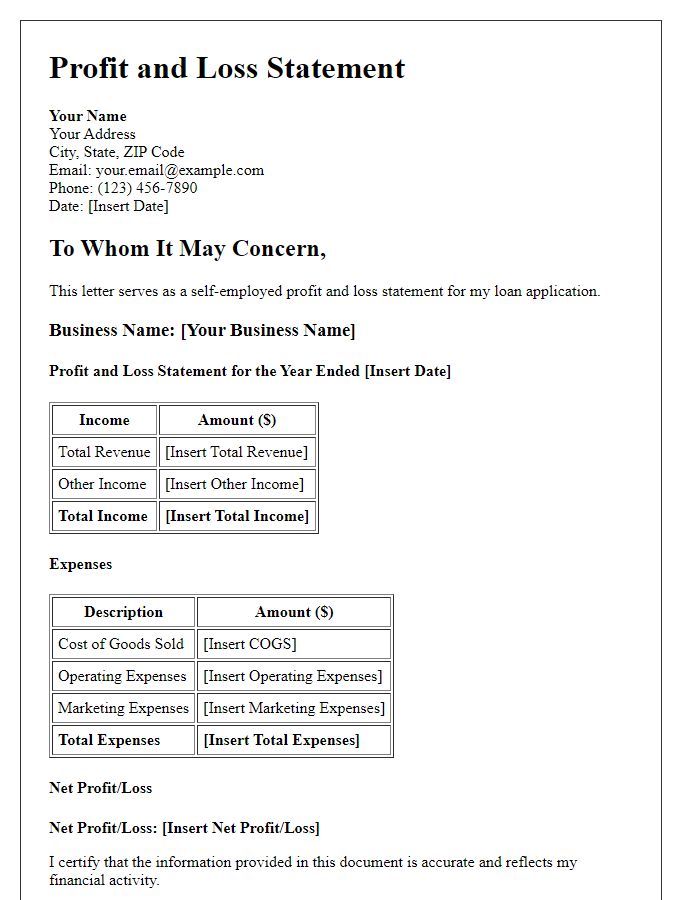

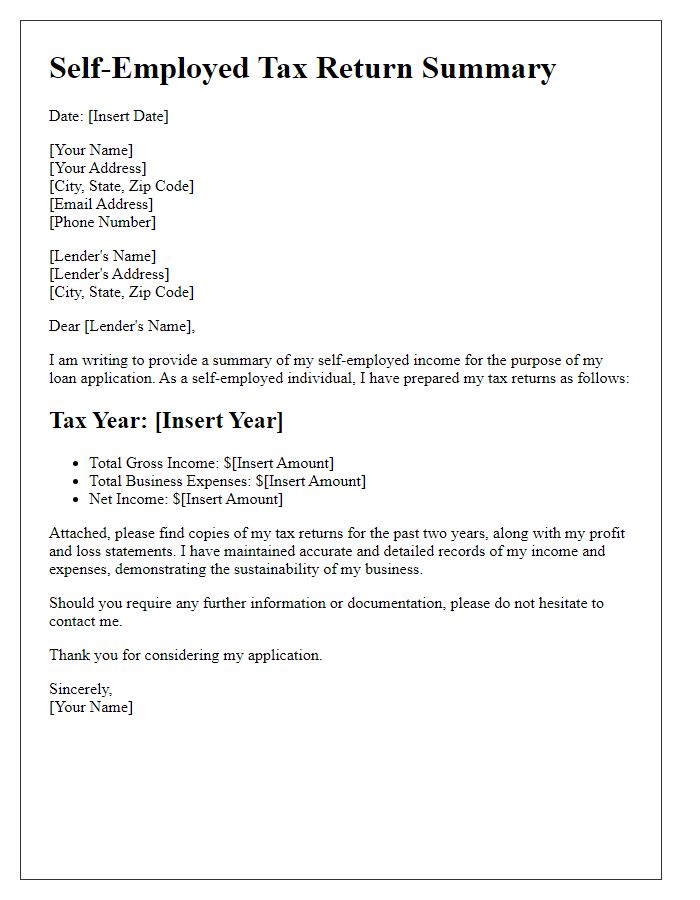

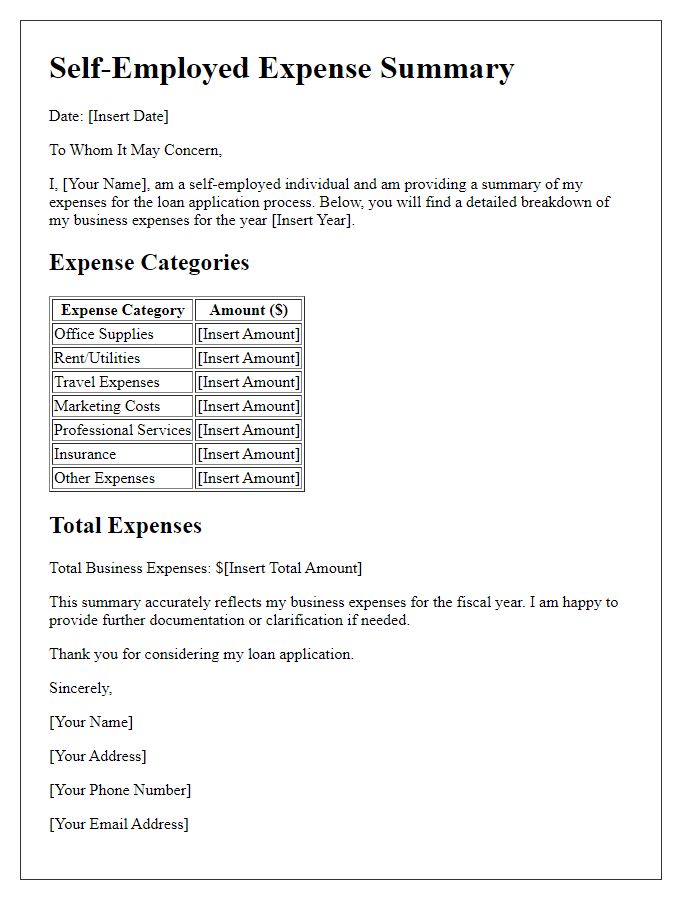

Self-employed individuals often need to present accurate financial statements to support loan applications. Important documents include profit and loss statements, which reflect net income over a specific period, usually the past year. Balance sheets provide a snapshot of assets, liabilities, and equity, essential for understanding financial health at a specific date. Cash flow statements show how cash moves in and out of the business, detailing operational liquidity. Tax returns for the previous two years are crucial, providing verification of income declared. Bank statements also play a significant role, offering evidence of cash reserves and transaction history. When these financial documents are well-organized and comprehensive, lenders can more easily assess the business's viability for approving loans.

Loan Purpose

Self-employed individuals often seek loans to finance various business needs, such as purchasing equipment, expanding operations, or managing cash flow. In 2023, many self-employed individuals face challenges due to fluctuating income and increased market competition. A loan purpose might include acquiring advanced machinery (like a computer for design work worth $2,500) to improve productivity. Another purpose could be investing in marketing campaigns (estimated cost around $1,000) that target specific demographics in local areas, leading to increased clientele. Additionally, working capital loans can assist in covering essential operational expenses (usually $3,000 to $5,000), like rent and utilities, ensuring seamless business continuity.

Repayment Plan

A well-structured repayment plan outlines the strategy for repaying the loan, emphasizing financial stability and management skills. Key elements include income projections, detailing expected earnings from self-employment ventures, such as freelance graphic design or consulting services. Monthly expenses, including fixed costs like rent (average $1,200 in urban areas) and variable costs related to business operations, should be clearly itemized to showcase budget allocation. The repayment timeline must specify the duration (typically ranging from 12 to 60 months), with fixed monthly payments calculated based on loan terms (for instance, a $10,000 loan at 6% interest). Contingency plans must also be in place, addressing potential income fluctuations due to seasonal demand changes or unforeseen market downturns. Additionally, highlighting any previous successful loan repayment experiences can instill confidence in lenders regarding the borrower's commitment and capability to fulfill obligations on time.

Supporting Documents

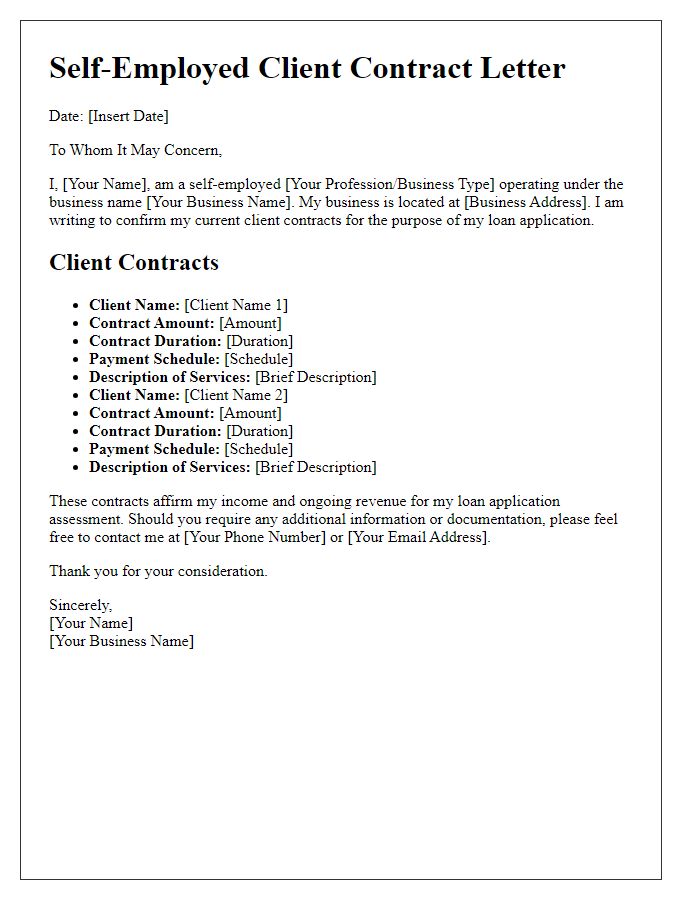

For a self-employed loan application, including supporting documents is crucial to demonstrate financial stability and business viability. Key documents include recent tax returns (individual and business), ideally for the last two years, as they provide evidence of income and business growth. Profit and loss statements, prepared quarterly or monthly, showcase the company's financial health and cash flow management. Additional documentation such as bank statements from the past three to six months may be required to verify the consistency of earnings. Furthermore, a business license or registration certificate confirms legitimacy, while any existing contracts or agreements can illustrate the potential for ongoing revenue. Lastly, a detailed business plan can offer insight into future projections and strategic direction.

Letter Template For Self-Employed Loan Application Samples

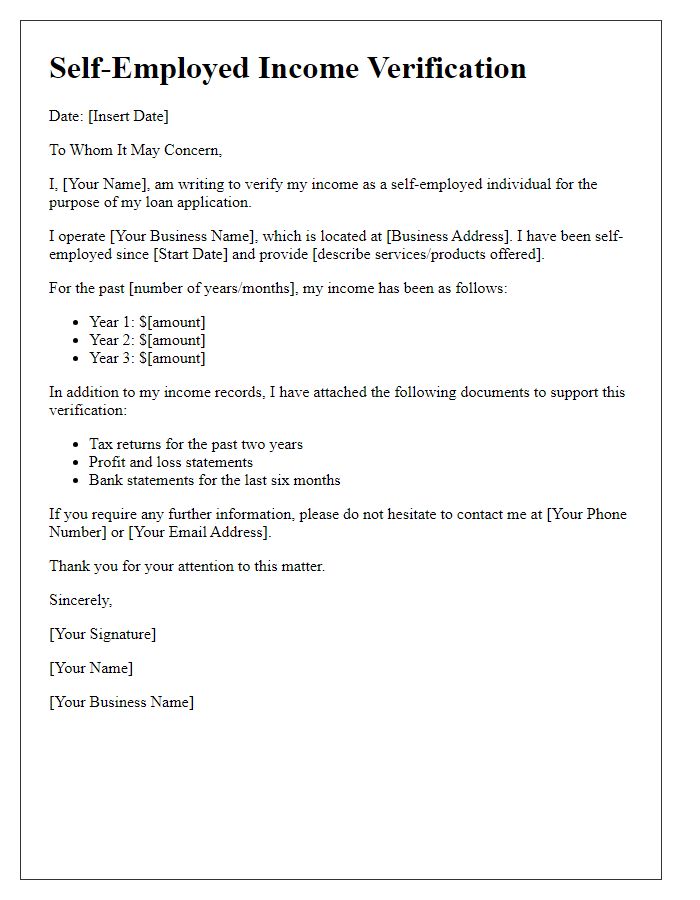

Letter template of self-employed income verification for loan application

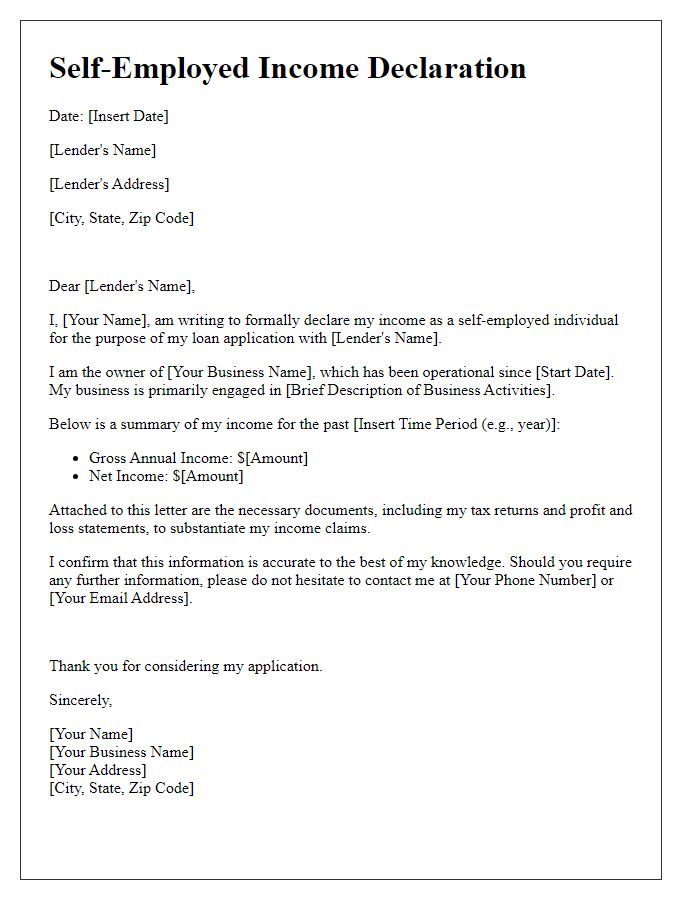

Letter template of self-employed business income declaration for loan application

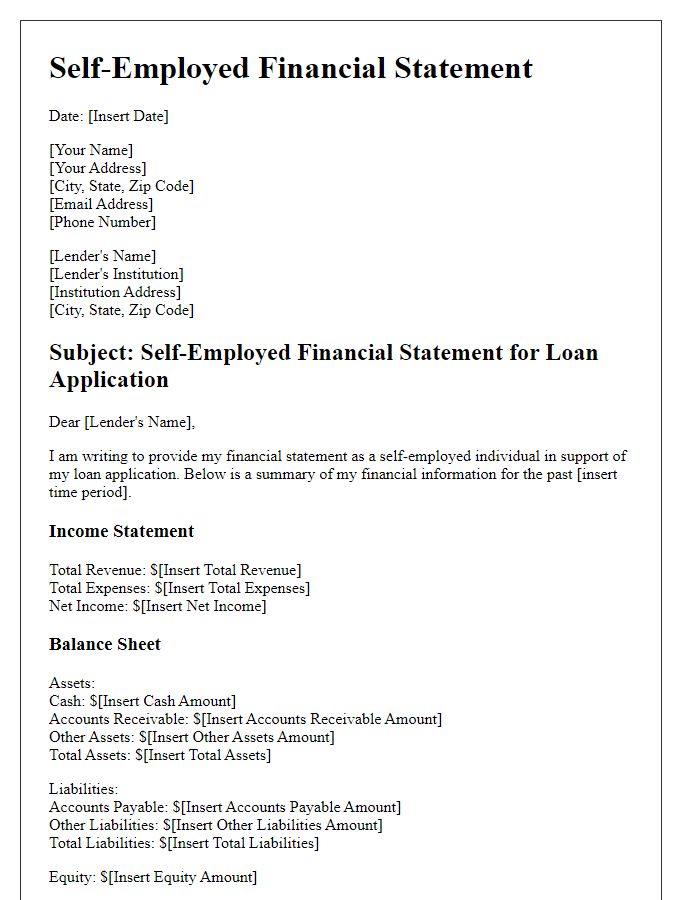

Letter template of self-employed financial statement for loan application

Letter template of self-employed profit and loss statement for loan application

Letter template of self-employed revenue confirmation for loan application

Letter template of self-employed tax return summary for loan application

Comments