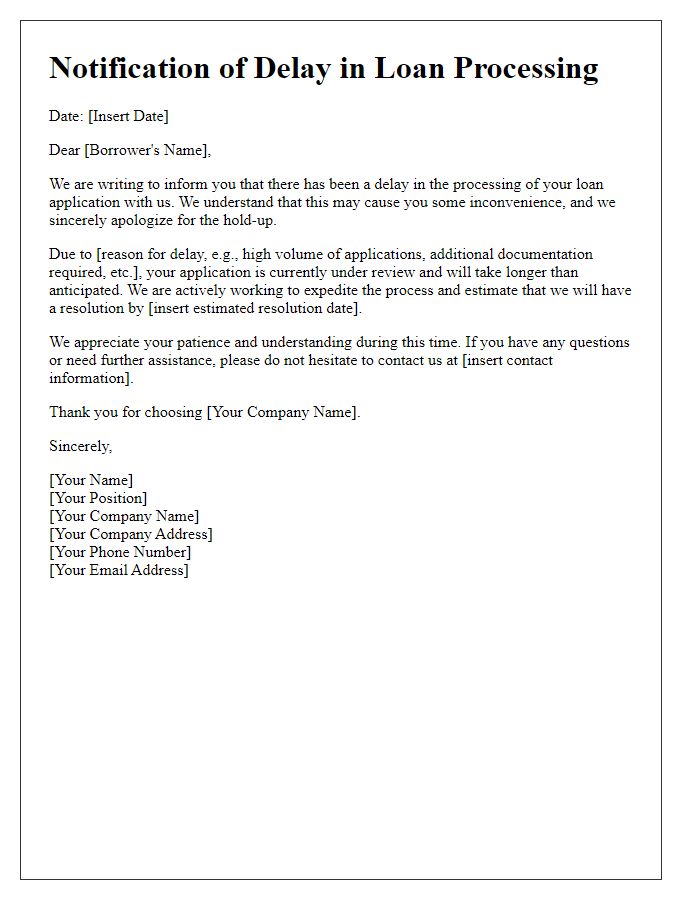

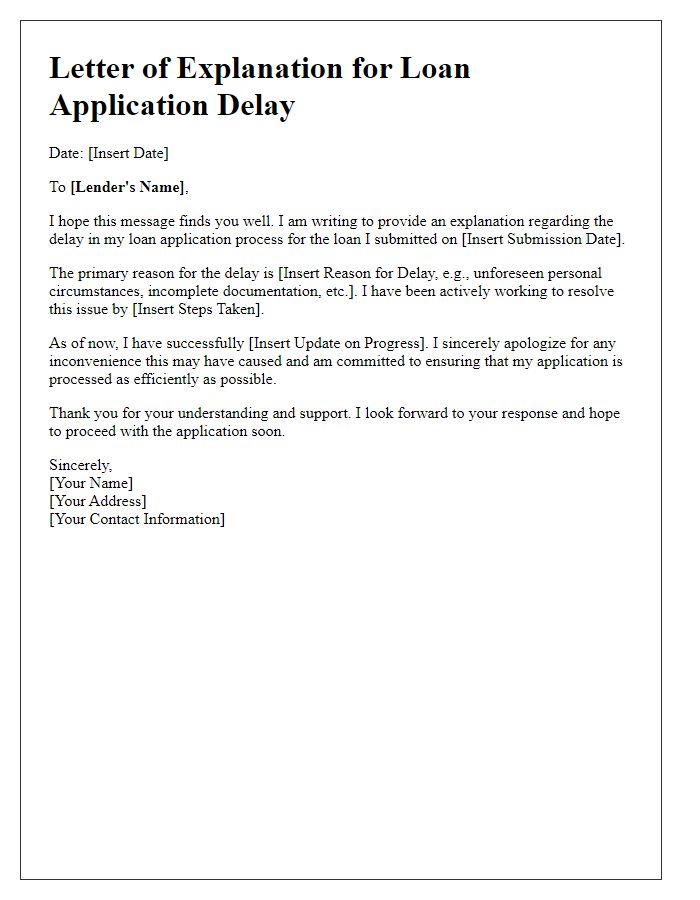

Hey there! If you've ever found yourself waiting on a loan approval, you know how frustrating it can be when the process takes longer than expected. Whether it's due to missing paperwork or backend verification issues, delays in loan proceedings can leave you anxious about your financial future. But don't worry, we've got your backâour letter template will help you communicate effectively with lenders about any delays. Ready to dive into the details? Read on to discover how to craft the perfect letter!

Reason for Delay

Significant delays in loan proceedings often arise due to various factors, including incomplete documentation, regulatory requirements, or changes in the applicant's financial status. For instance, missing tax returns or bank statements can halt the underwriting process until all necessary information is submitted. Additionally, stringent regulations imposed by bodies like the Consumer Financial Protection Bureau may require extra scrutiny, leading to extended processing times. Economic fluctuations or increased demand for loans may also impact the speed at which applications are reviewed and approved, resulting in longer wait times for borrowers. These factors collectively contribute to the overall delay in finalizing loan agreements.

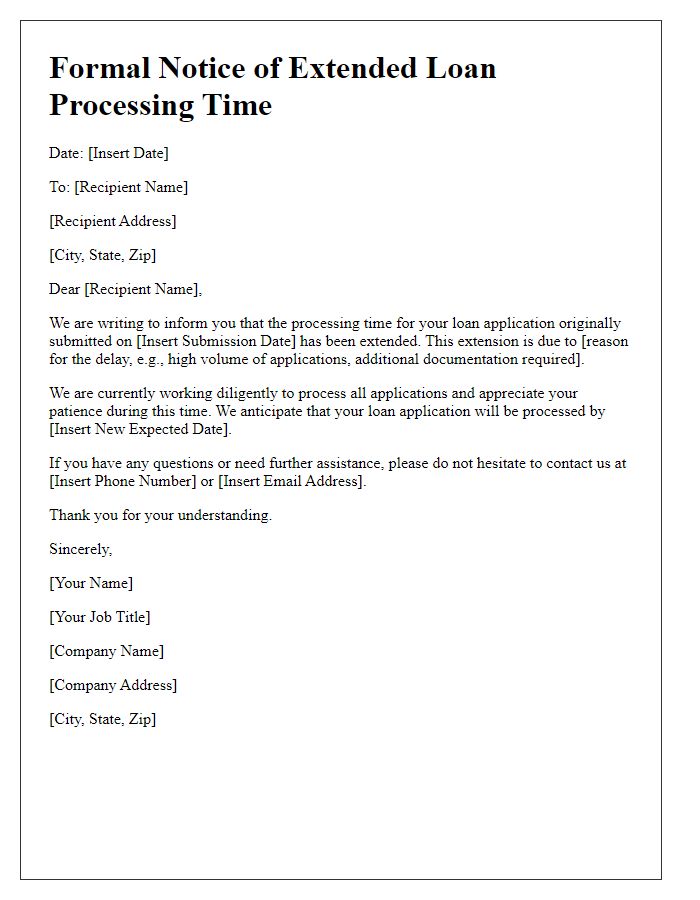

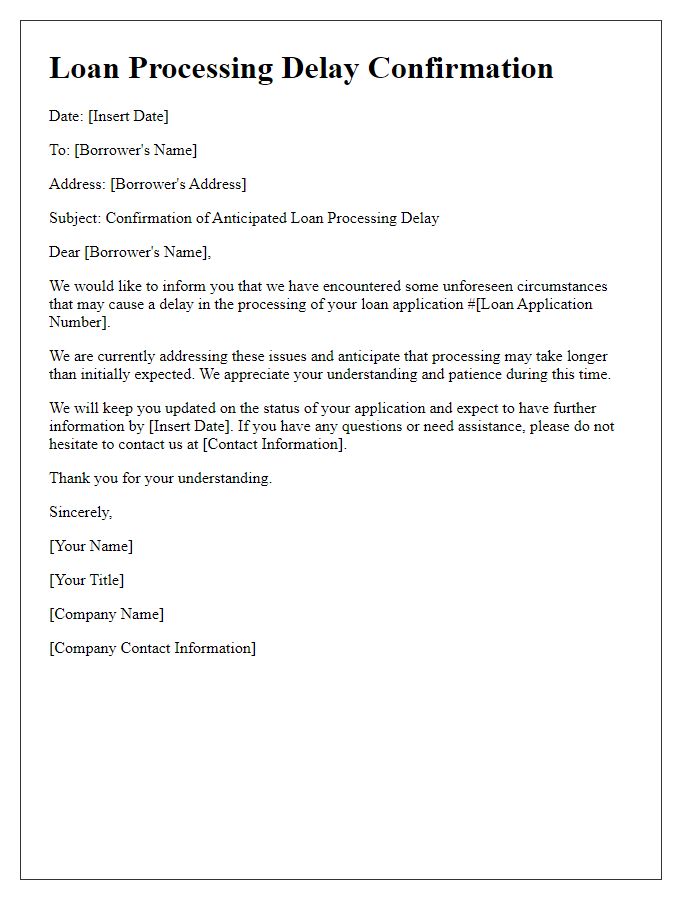

Revised Timeline

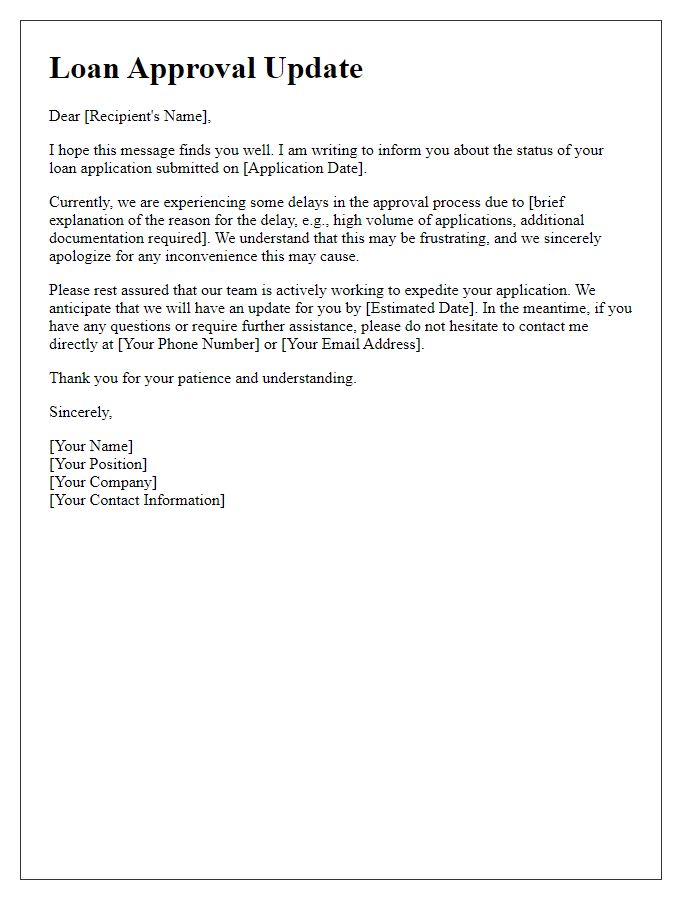

Due to unforeseen circumstances, the loan processing timeline has been affected, impacting applicants at various stages. Originally projected for completion within four to six weeks, the revised timeline now estimates an additional two to three weeks for final approvals and fund disbursement. Factors contributing to this delay include increased demand for loan applications, staff shortages, and regulatory reviews mandated by financial oversight entities. Applicants are encouraged to stay informed through regular updates from the financial institution, and additional support resources are available for inquiries about individual loan statuses during this extended period.

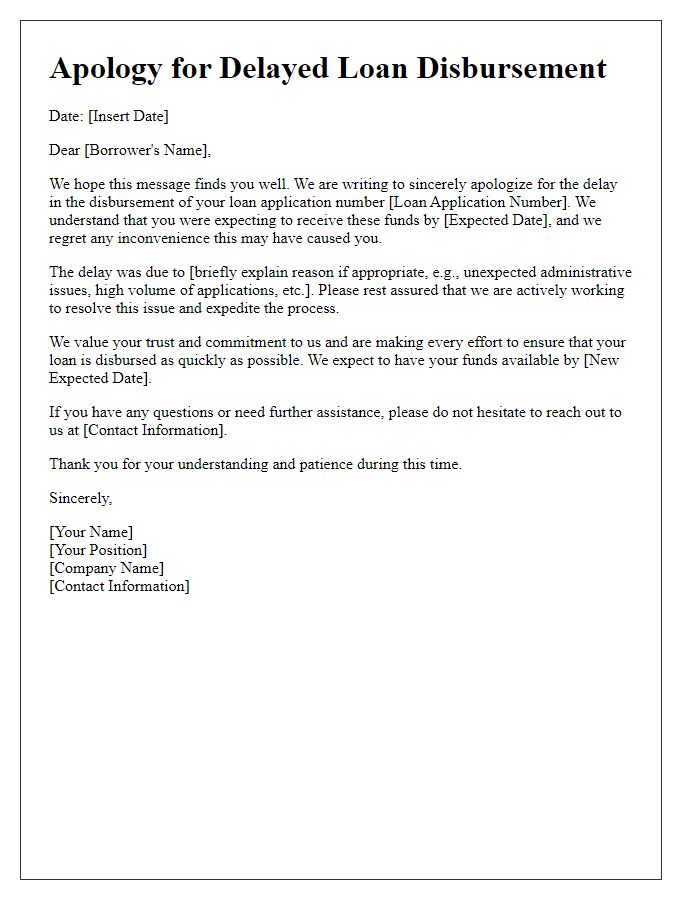

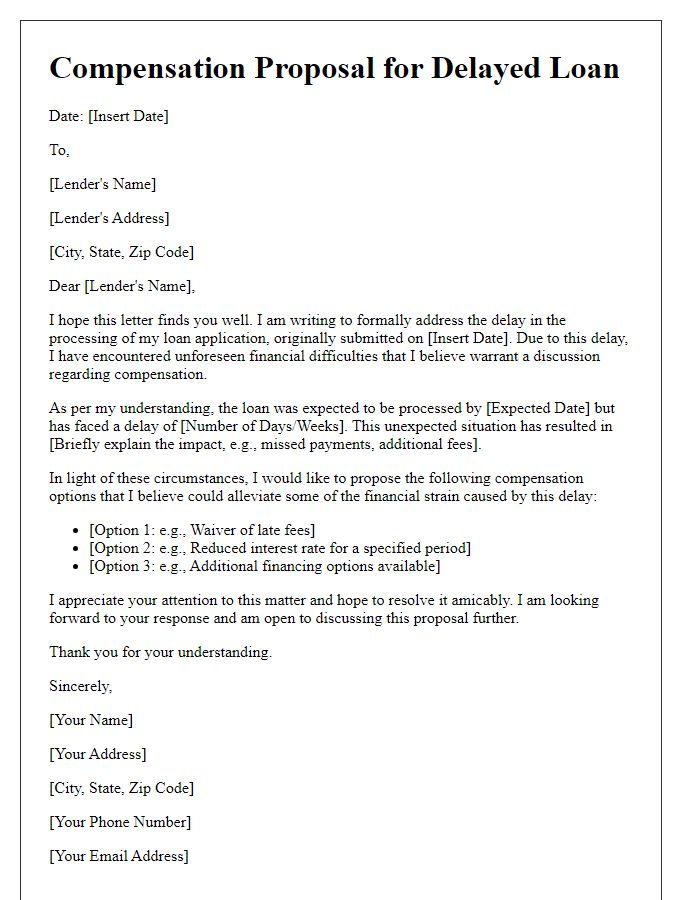

Apology and Acknowledgment

Delays in loan proceedings can significantly impact financial plans for individuals and businesses. The lending institution must acknowledge the situation and provide transparency regarding the timeline. Factors such as increased loan applications by 25% in the last quarter can result in longer processing times. Additionally, changes in regulatory compliance requirements set forth by government entities like the Consumer Financial Protection Bureau may prolong the review process. It is crucial to communicate clearly to affected borrowers about expected timelines and any additional documentation required to facilitate quicker approval. Maintaining open channels of communication helps build trust while navigating these procedural hurdles.

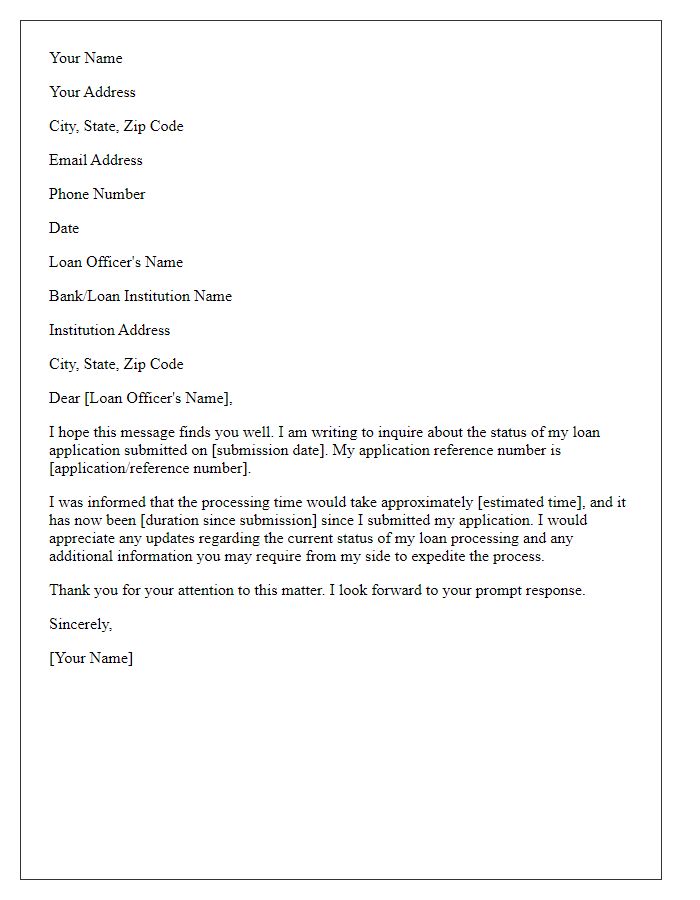

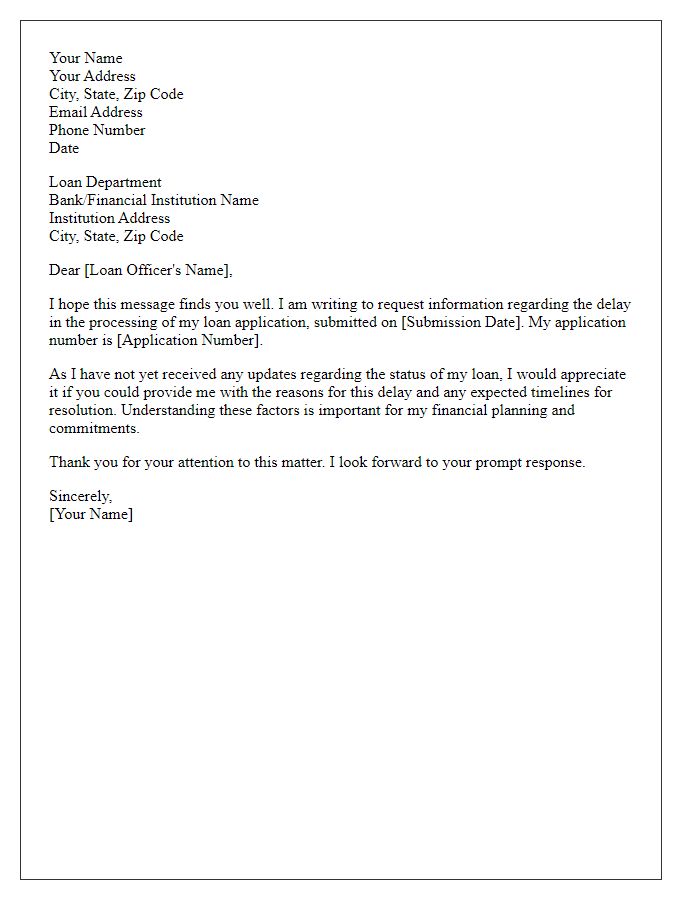

Contact Information

Loan delays can occur due to various factors such as regulatory requirements or incomplete documentation. Customers awaiting loan approval may experience anxiety, especially when financing major purchases like homes or vehicles. Mortgage applications often require extensive documentation, including proof of income, credit history, and detailed asset disclosures. In some regions, such as California, local regulations may further complicate timelines, potentially extending processing by several weeks. Keeping track of these variables is essential for both lenders and borrowers to manage expectations accurately. Communication regarding delays can significantly alleviate concerns, highlighting the importance of timely updates to all parties involved.

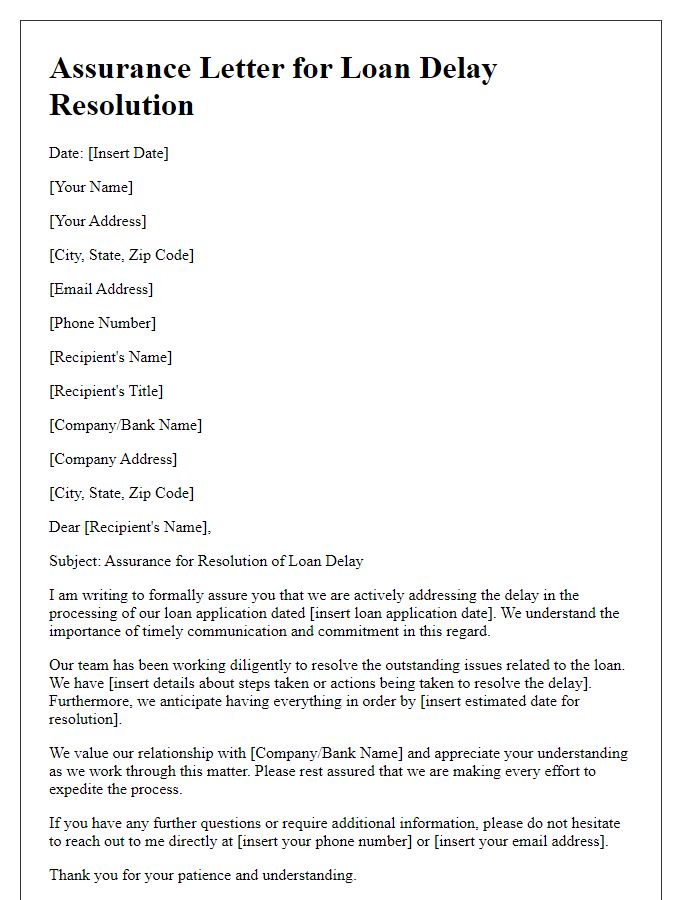

Assurance of Resolution

In the realm of financial transactions, delays in loan proceedings can arise from various factors, including extensive documentation reviews, credit checks, or regulatory compliance matters. A loan application might encounter a delay of several weeks, potentially affecting personal plans or business operations. Assurance of resolution, emphasized by communication from financial institutions, often includes a detailed timeline outlining steps taken to expedite the process. Clear updates regarding the status of the loan application, which might involve departments such as underwriting or risk management, can alleviate borrower concerns. A proactive approach from lenders demonstrates commitment to resolve outstanding issues and ensures borrowers remain informed during this critical waiting period.

Comments