Are you considering applying for a loan but need a little extra support? If so, a cosigner can be a fantastic solution to help strengthen your application and increase your chances of approval. In this article, we'll explore the key elements of a cosigner loan application letter, ensuring you present your case in the best light possible. So, grab a cup of coffee, get comfortable, and let's dive into the essential tips and templates for creating an effective cosigner loan application letter!

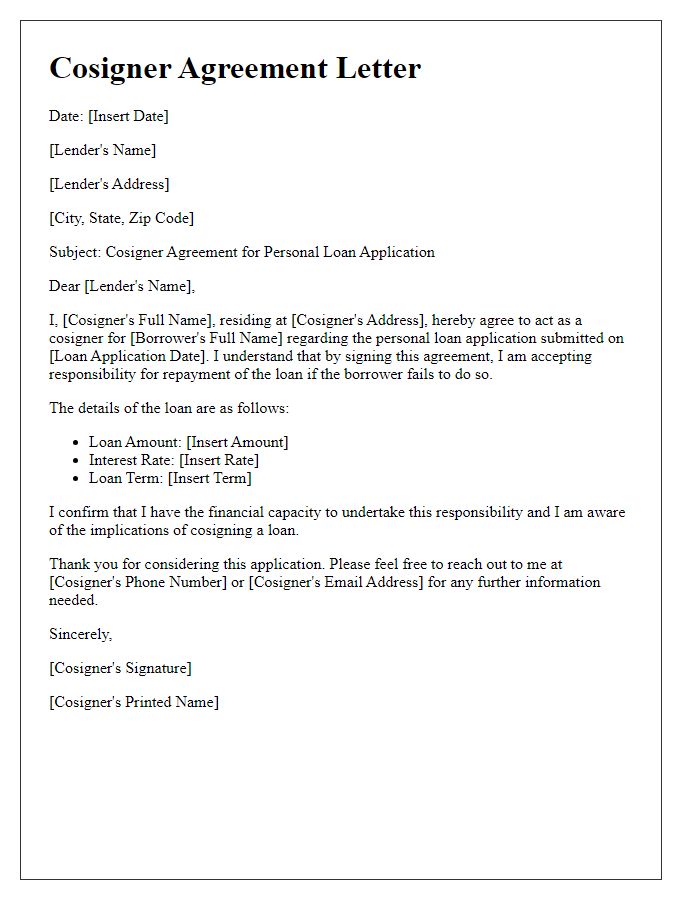

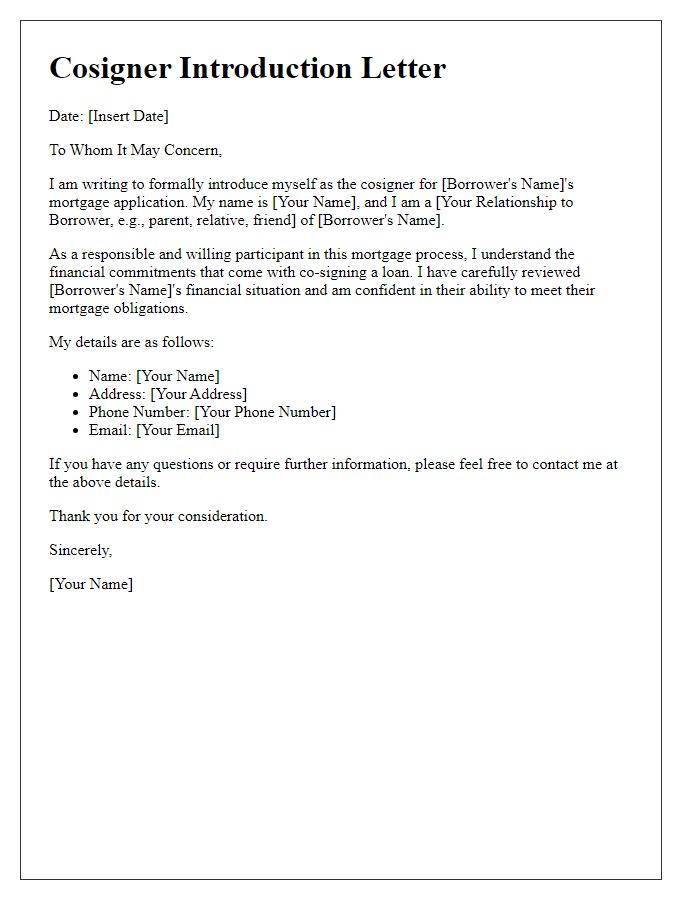

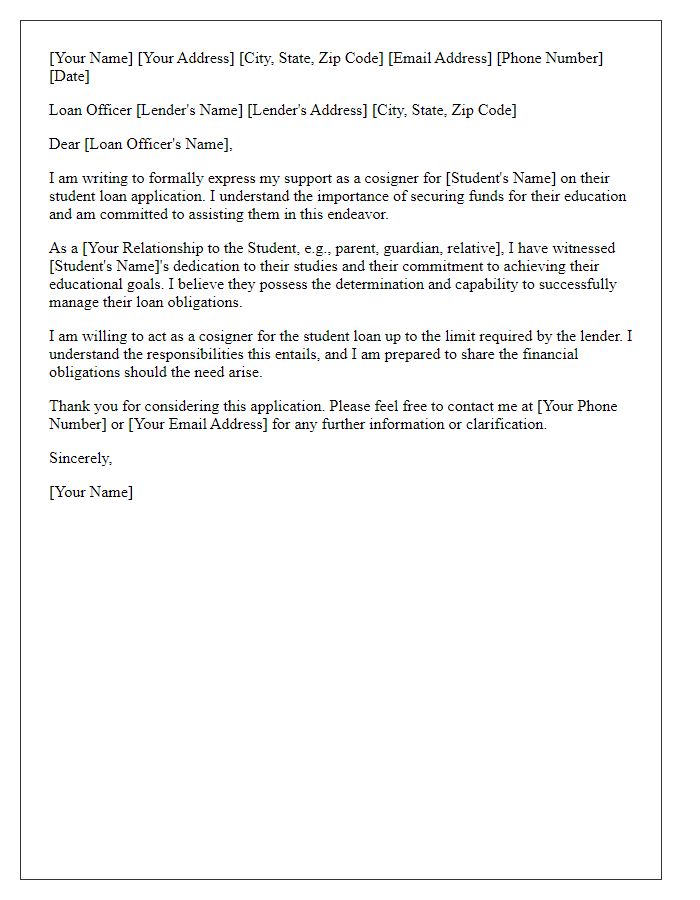

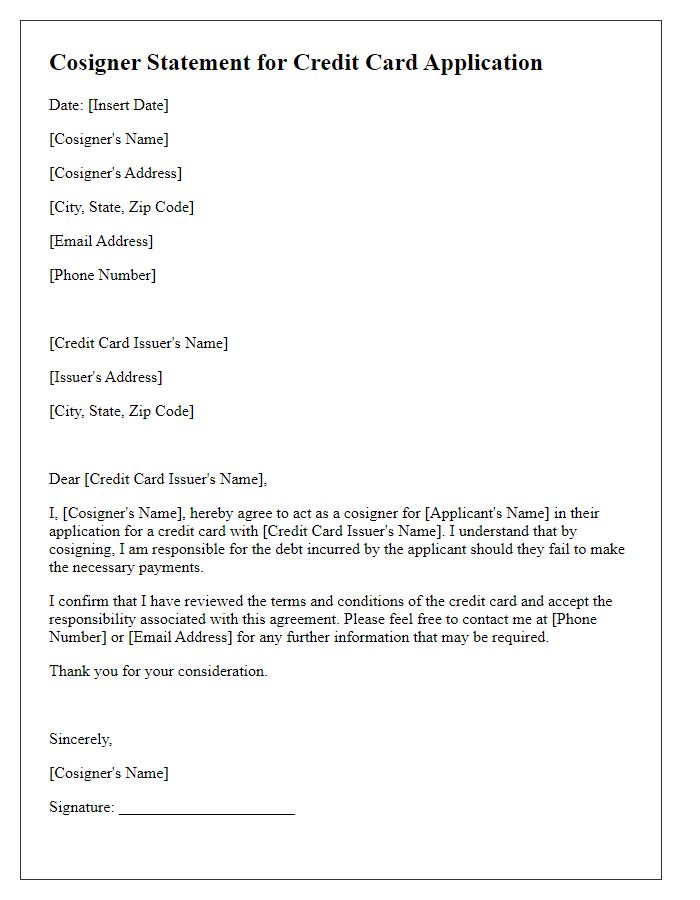

Personal Information: Name, address, contact details.

A cosigner loan application requires detailed personal information to assess the financial responsibility and reliability of the cosigner. Full name should include middle name, ensuring clarity. Residential address must contain street number, street name, city, state, and ZIP code for accurate identification. Contact details are crucial, comprising a mobile number and an email address for effective communication. Additional demographic details such as date of birth and social security number may be necessary for credit evaluation. The application may also request employment information, including current employer name, job title, and duration of employment to ensure financial stability. Properly compiling this information streamlines the application process and increases the chances of loan approval.

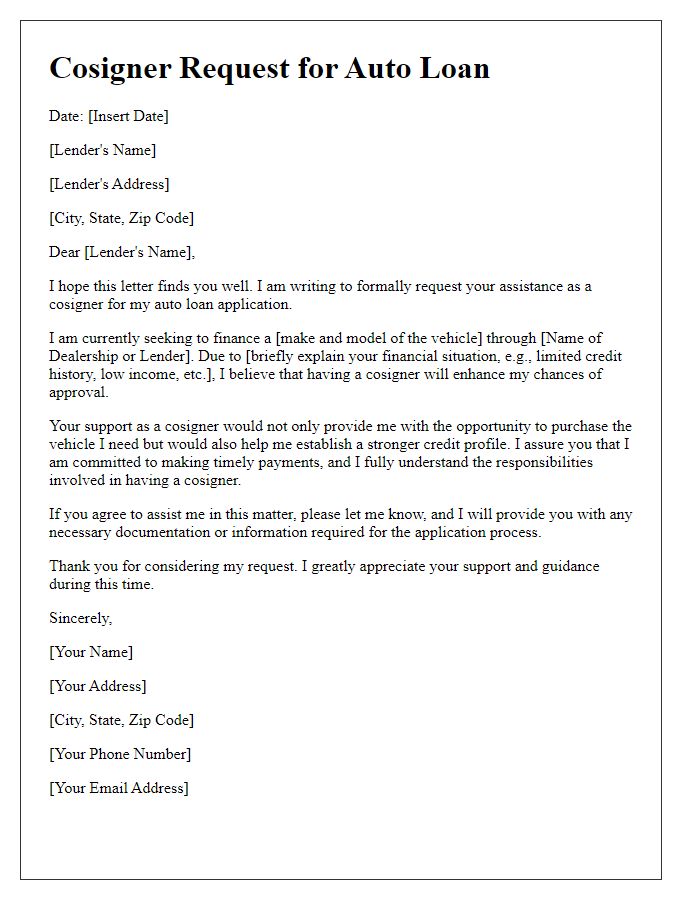

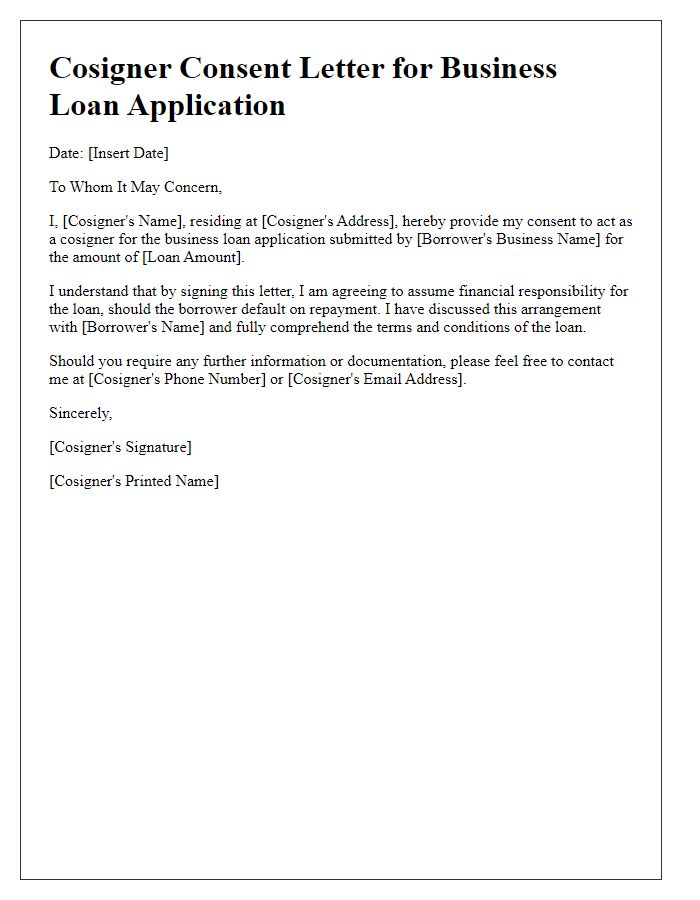

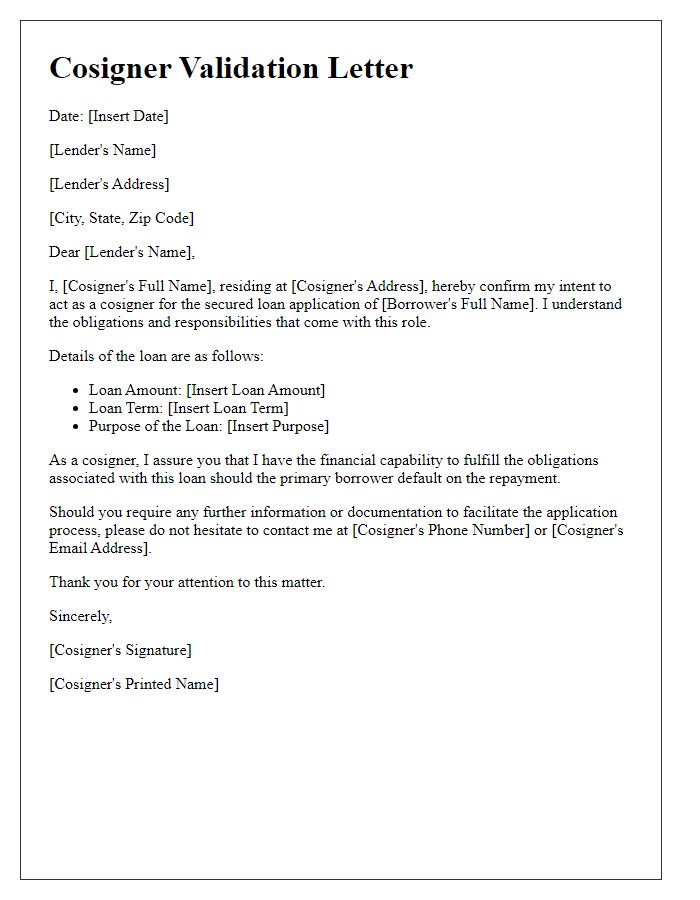

Loan Details: Loan amount, purpose, terms.

A cosigner loan application typically involves several key details regarding the loan itself. The loan amount, which could range significantly depending on the financial need, serves as the total sum requested from the lender. For instance, a common figure may be $20,000 to cover expenses such as home improvements or educational costs. The purpose of the loan specifies these intended uses, which can include purchasing a vehicle, consolidating debt, or financing a major purchase like medical expenses. Additionally, the terms outline the repayment conditions, often expressed as a monthly payment plan over several years, commonly spanning from three to five years, with interest rates varying based on the borrower's creditworthiness. All these factors contribute to the overall understanding of the loan's structure and objectives within the framework of a cosigned agreement, enhancing the likelihood of approval by mitigating the risk perceived by financial institutions.

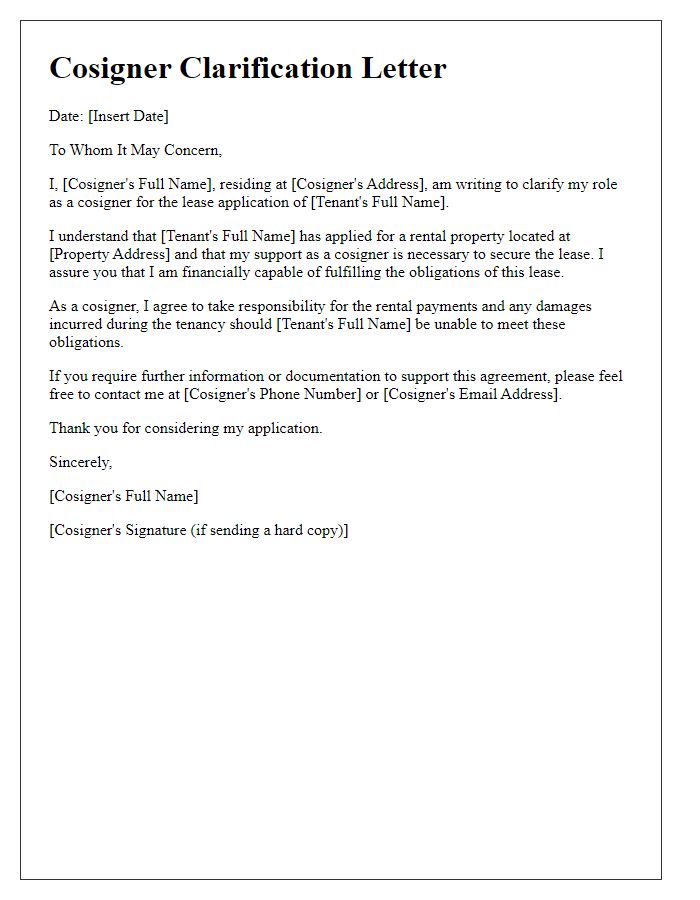

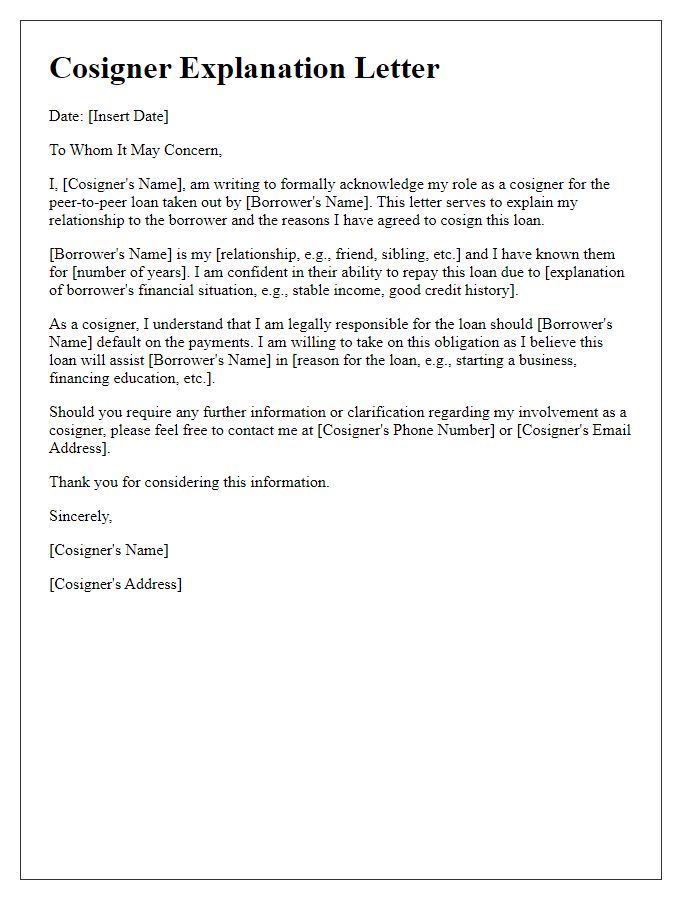

Relationship: Connection to primary borrower.

A cosigner loan application typically requires a statement explaining the relationship between the cosigner and the primary borrower. The connection may include familial ties, such as being a parent or sibling, or it could involve long-term friendships or business relationships. These connections are vital as they provide context about the trust and loyalty in the arrangement. For instance, a parent might cosign for a child's first car loan, emphasizing their support for financial responsibility. In a different scenario, a close friend might cosign for a student loan, showcasing their belief in the borrower's future potential. Establishing this relationship can strengthen the loan application, demonstrating the commitment of both parties to fulfill the loan agreement.

Financial Stability: Income, employment, credit score.

Financial stability plays a crucial role in the cosigner loan application process, emphasizing three key factors: income, employment, and credit score. Reliable income, such as a stable monthly salary (typically over $3,000), demonstrates the ability to support loan repayments. Consistent employment history, ideally spanning at least two years in the same industry, indicates job security and reduces the risk for lenders. A strong credit score, generally above 700, reflects responsible financial behavior and signifies reliability to lenders, minimizing the perceived credit risk associated with the loan. These elements collectively enhance the strength of the loan application, increasing the likelihood of approval.

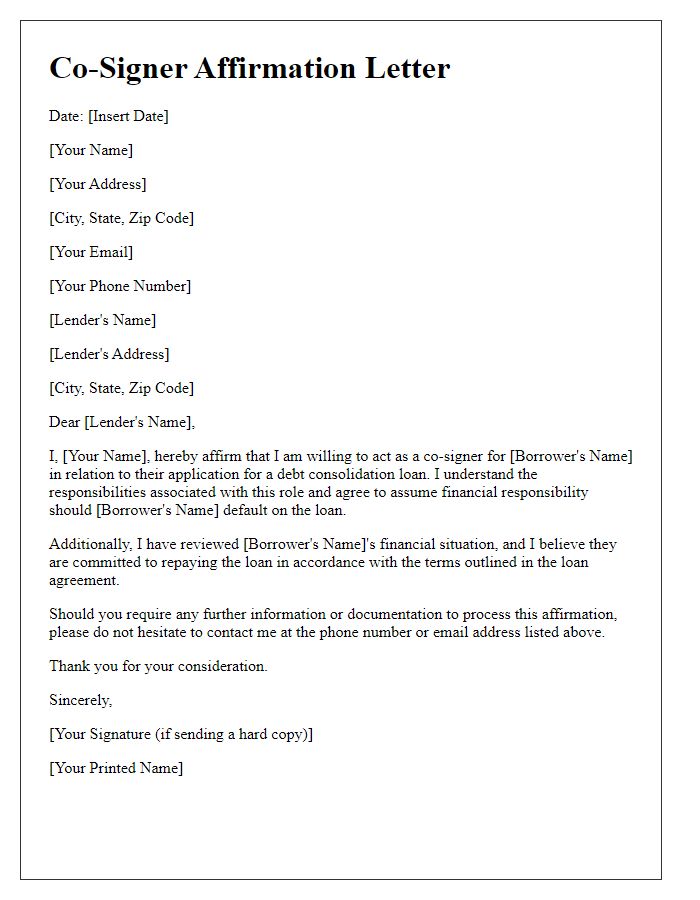

Legal Obligations: Responsibilities, risks, consent.

Cosigning a loan involves significant legal obligations and responsibilities. As a cosigner, individuals agree to share liability for the entire loan amount, which can range into thousands of dollars depending on the loan type, such as personal loans, mortgages, or auto financing. Should the borrower default on payments, the cosigner is legally required to fulfill the repayment, impacting their credit score negatively with potential late payment entries reported to credit bureaus. Risks include the possibility of a substantial financial burden if the borrower struggles to make payments. Furthermore, consent to cosign implies an understanding of these consequences, including the potential loss of personal assets or diminished creditworthiness due to the borrower's financial decisions. Those considering this role should fully assess their financial situation and discuss responsibilities with the borrower to mitigate misunderstandings and safeguard personal finances.

Comments