Are you eager to understand the intricacies of a loan disbursement schedule? In this article, we'll break down everything you need to know, from key terms to timelines, ensuring you're well-informed for your financial planning. A clear grasp of this schedule can not only help you manage your repayments but also empower you to make better financial decisions moving forward. So, let's dive in and explore the essential elements of a loan disbursement schedule together!

Loan Amount and Purpose

The loan amount of $50,000 for home renovation projects is scheduled for disbursement in three phases. The first phase of $20,000 will be allocated upon initial approval on January 15, 2024, designated for foundational repairs and structural enhancements. The second phase of $15,000 is set for release on April 1, 2024, aimed at kitchen upgrades and bathroom renovations. The final phase of $15,000 will be disbursed on July 1, 2024, intended for aesthetic improvements such as painting and landscaping. All disbursements will be contingent on project progress, verified through periodic site inspections by assigned loan officers.

Disbursement Timeline and Schedule

Loan disbursement schedules outline the specific timeline and terms for the distribution of funds, serving as crucial documentation for borrowers. Typical timelines may span weeks to months, depending on loan types, such as personal loans or mortgages from financial institutions like Wells Fargo or Bank of America. Each disbursement phase is often tied to milestones, such as project approvals or construction completion dates, with clear amounts designated for each release. Borrowers must be aware of conditions that could affect disbursement timelines, including credit checks and necessary documentation like income statements or collateral evaluations. Understanding the full scope of this schedule ensures borrowers can manage expectations regarding access to funds during critical periods, impacting significant purchases or investments.

Interest Rate and Repayment Terms

A loan disbursement schedule is crucial for understanding the financial obligations associated with a borrowed amount, especially concerning interest rates and repayment terms. For example, a typical personal loan of $10,000 might come with an interest rate of 5% annually. Monthly payments would be structured over a period of five years (60 months), leading to total repayments of approximately $11,500. Key dates related to the payment schedule, such as the commencement date (usually the loan disbursement date), must be outlined clearly. This information helps borrowers manage their finances effectively, ensuring they can meet their scheduled payments while also considering potential additional charges such as late fees or prepayment penalties. Understanding these terms is vital for financial planning and maintaining good credit.

Borrower's Obligations and Conditions

The loan disbursement schedule for borrowers outlines essential obligations and conditions that must be adhered to throughout the loan period. Borrowers, identified by their unique social security numbers, must ensure timely repayments according to the agreed-upon terms in the loan agreement. Each installment, typically due monthly, is calculated based on the total loan amount of $50,000 at a 5% interest rate, resulting in a total repayment period of five years. Failure to meet repayment deadlines can result in late fees, accumulation of interest, and potential damage to credit ratings. Additionally, borrowers are required to maintain adequate insurance on the financed assets, ensuring coverage against damages or loss, thereby protecting both parties' interests. Regular income verification every six months is mandated to assess continued ability to repay, fostering transparent communication between the lender and the borrower throughout the loan's duration.

Contact Information for Queries and Support

Loan disbursement schedules often provide crucial details regarding timelines and payment amounts. Comprehensive schedules typically include the lender's contact information, including a phone number, email address, and office hours, allowing borrowers to seek assistance for queries or concerns. For example, borrowers can reach the support team via a dedicated hotline, such as 1-800-555-0199, available Monday through Friday from 9 AM to 5 PM. Email support might offer a response within 24 hours, utilizing an address like support@loanprovider.com. This accessibility ensures that borrowers receive the necessary guidance throughout the loan process, thereby facilitating a smoother financial experience.

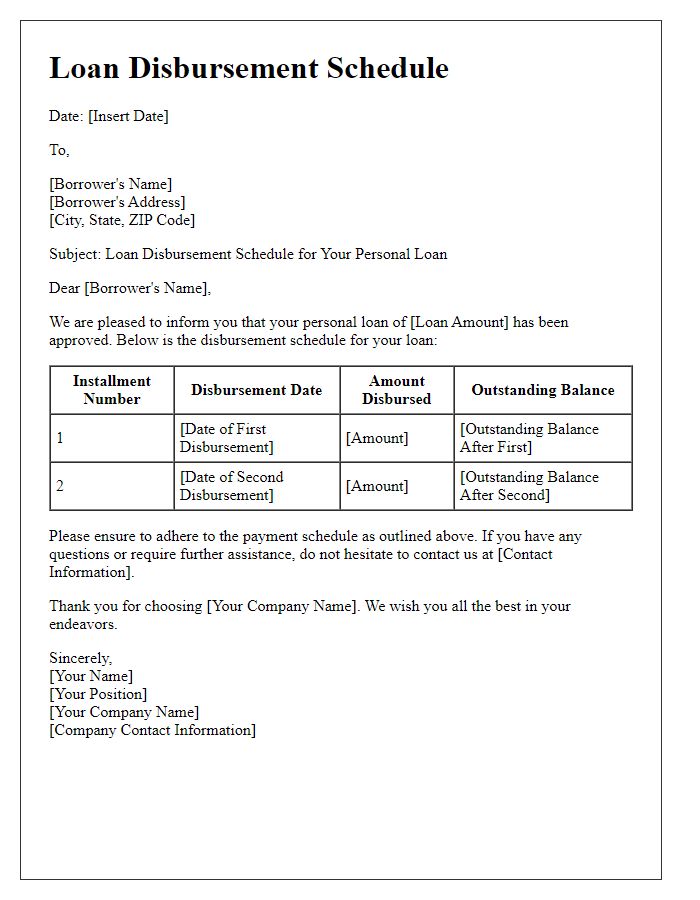

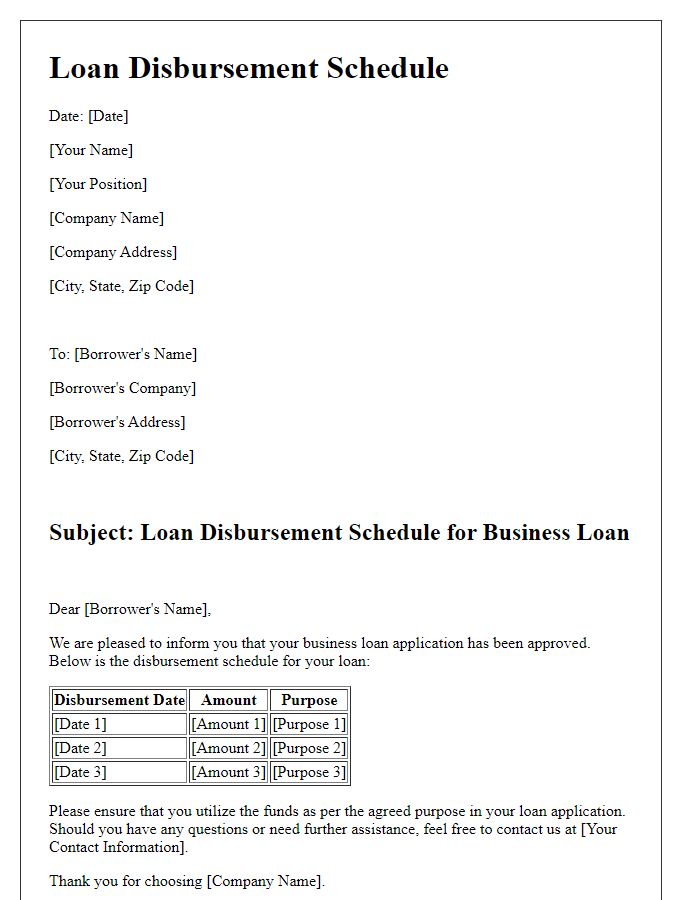

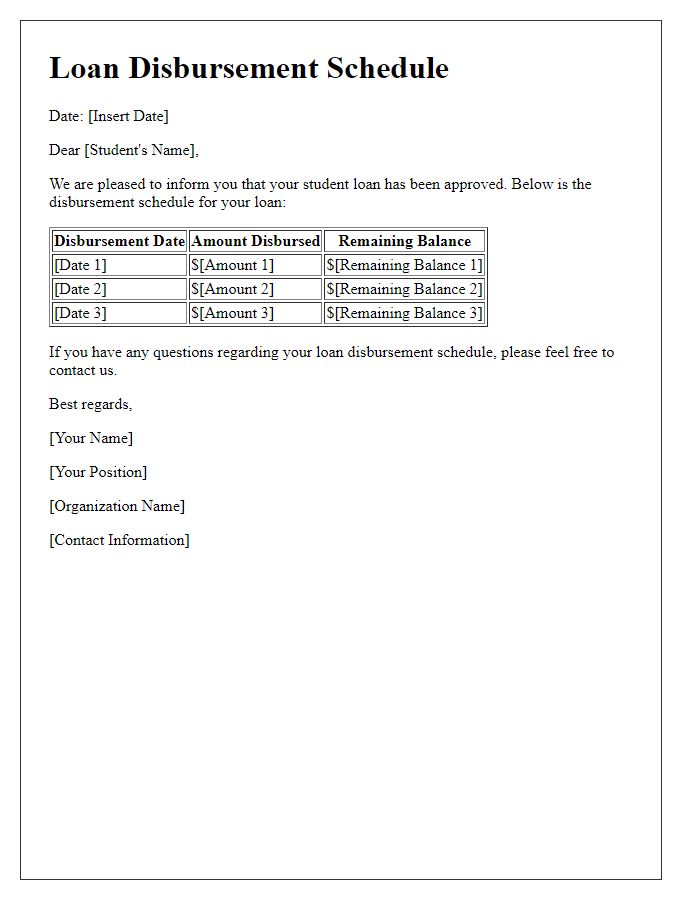

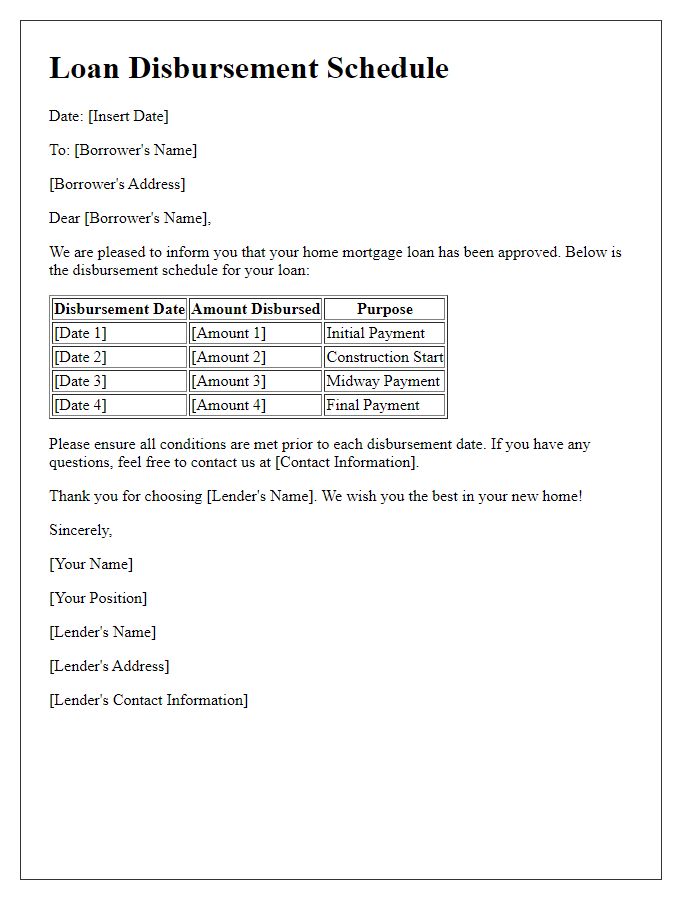

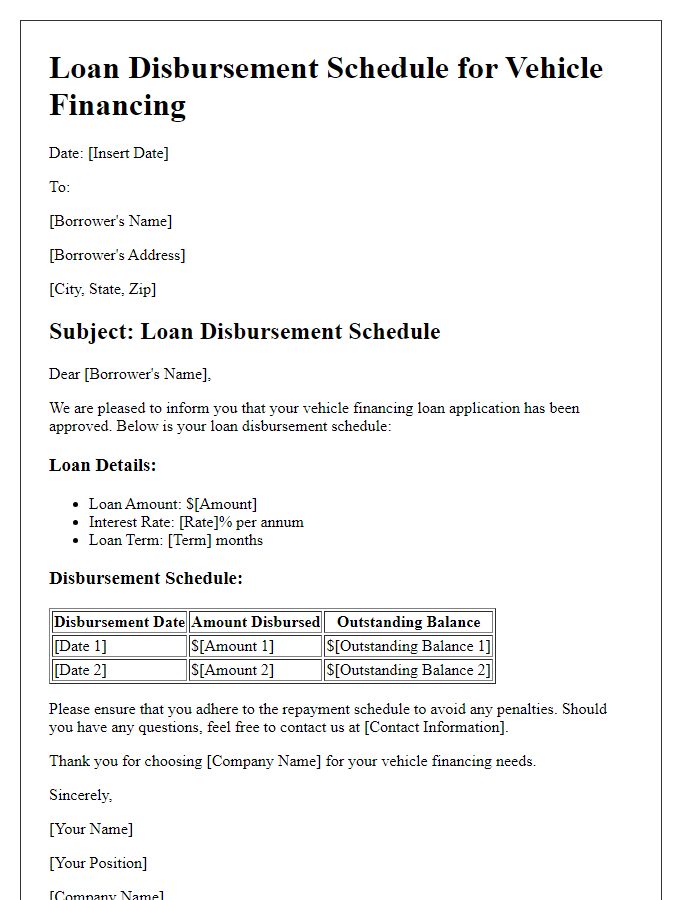

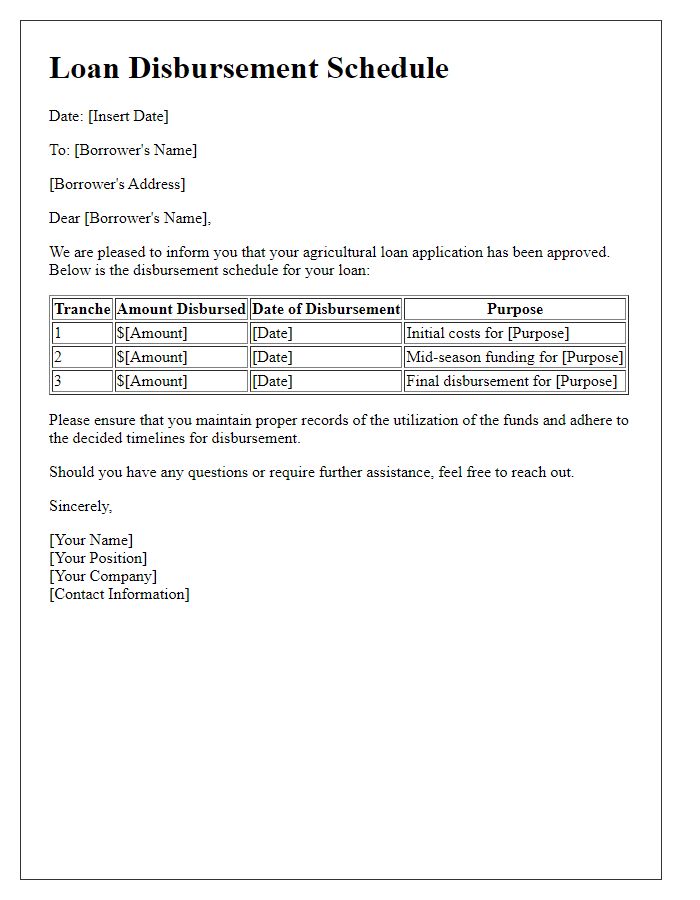

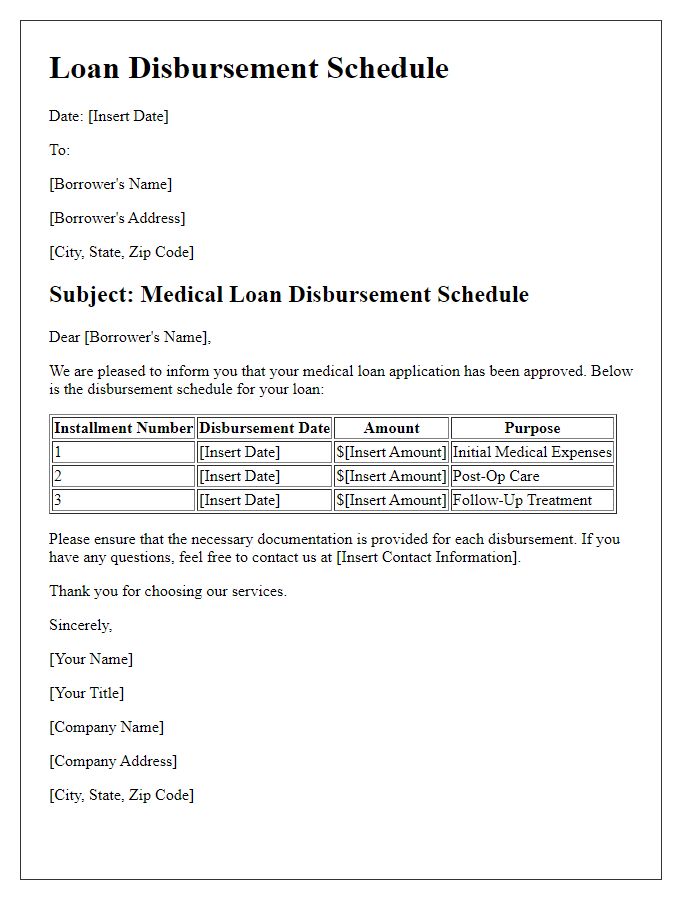

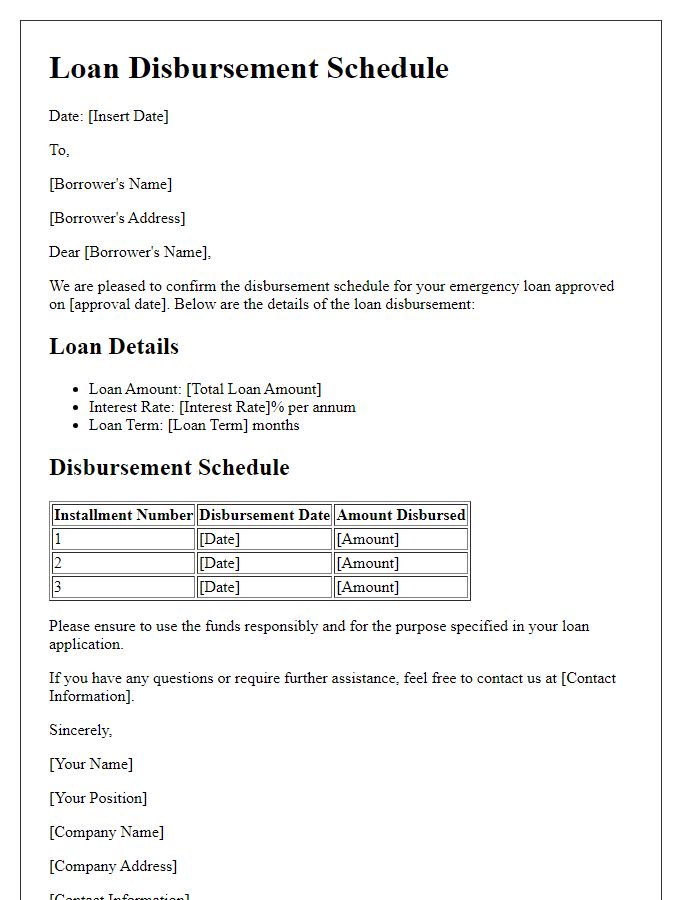

Letter Template For Loan Disbursement Schedule Samples

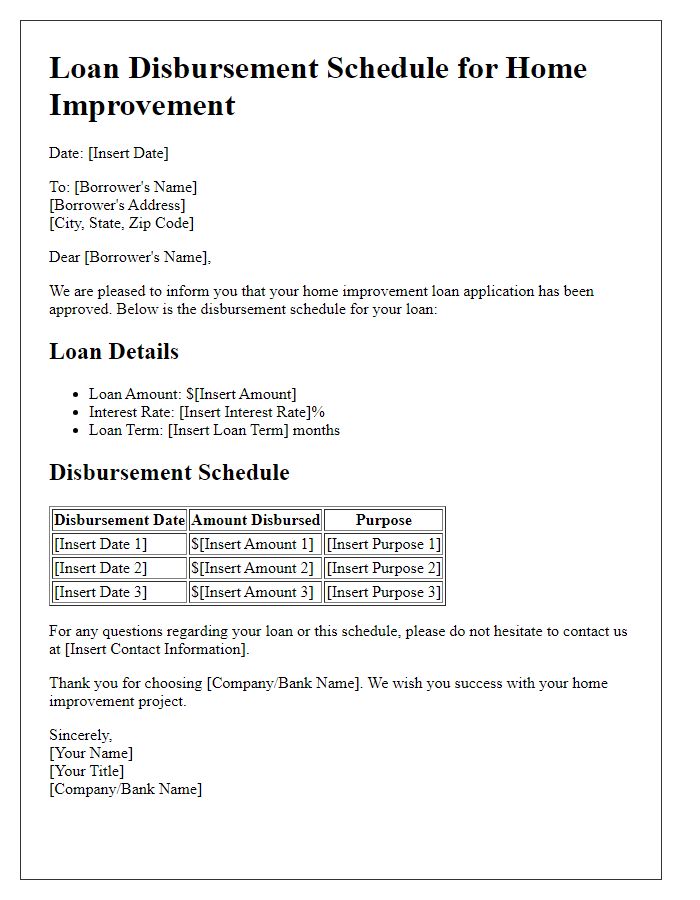

Letter template of loan disbursement schedule for home improvement loans

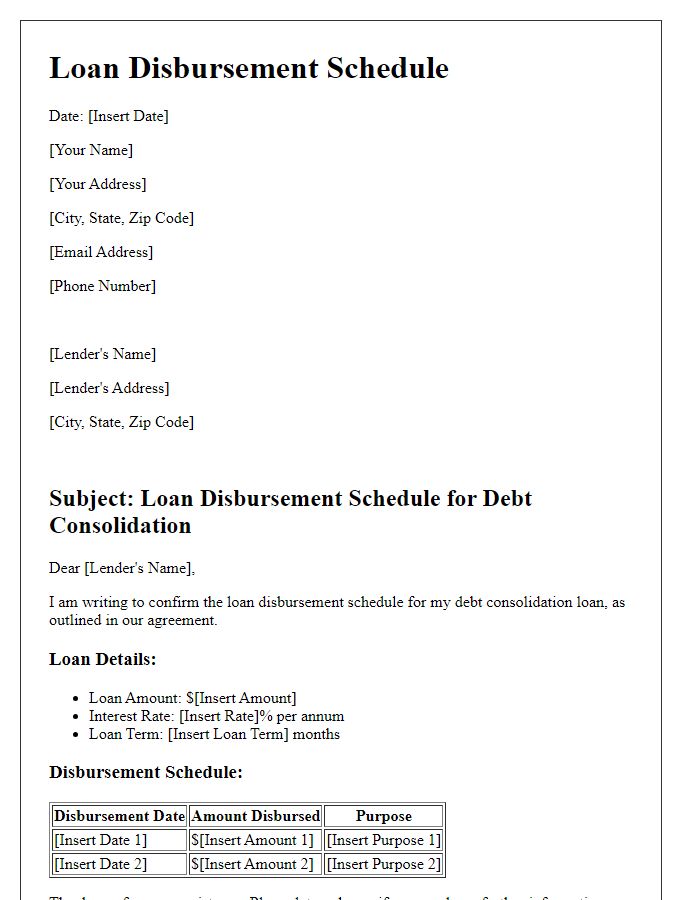

Letter template of loan disbursement schedule for debt consolidation loans

Comments