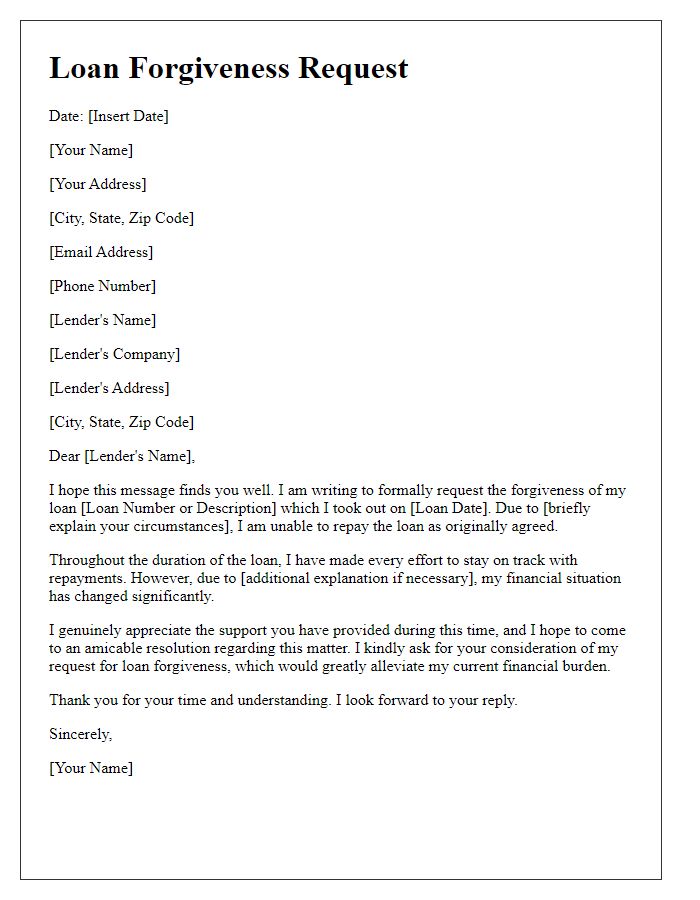

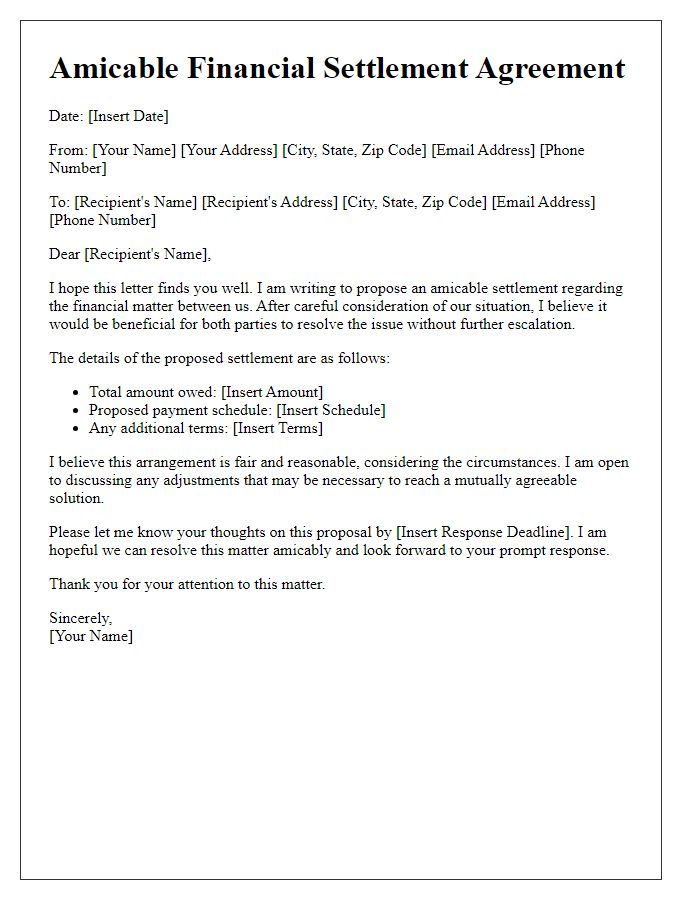

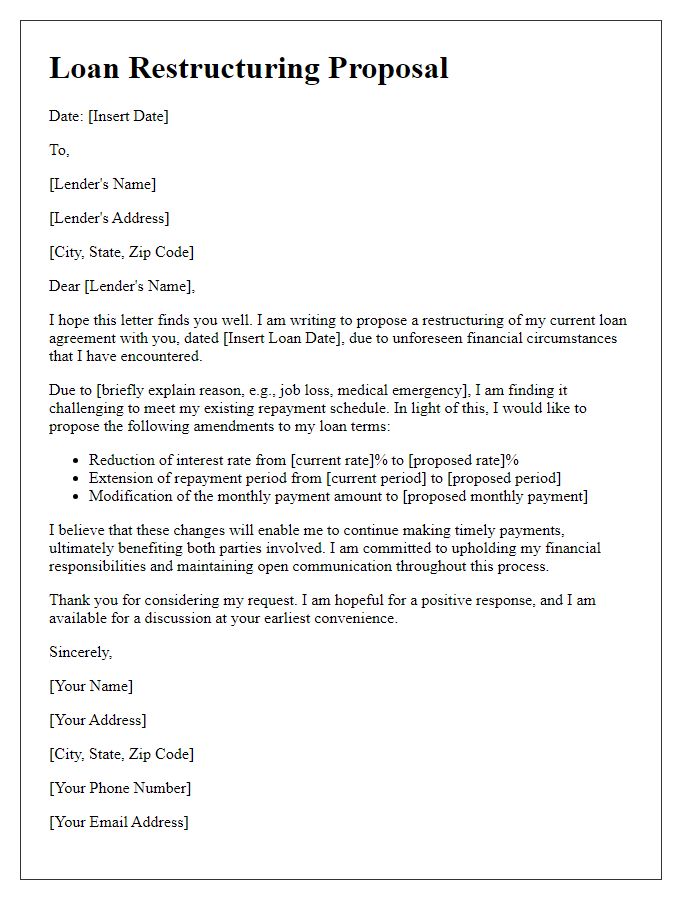

When life throws financial challenges your way, finding a way to settle debts amicably can feel like a daunting task. But don't worryânavigating that path can be straightforward and stress-free with the right approach. In this article, we'll guide you through crafting a thoughtful letter that paves the way for a positive resolution. So, if you're ready to take the first step towards financial peace, keep reading!

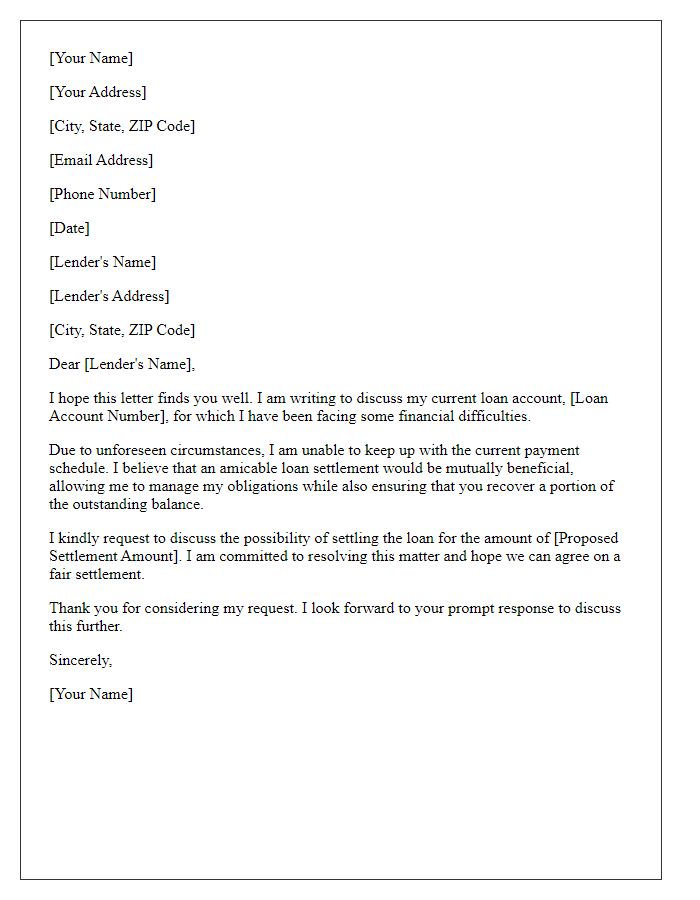

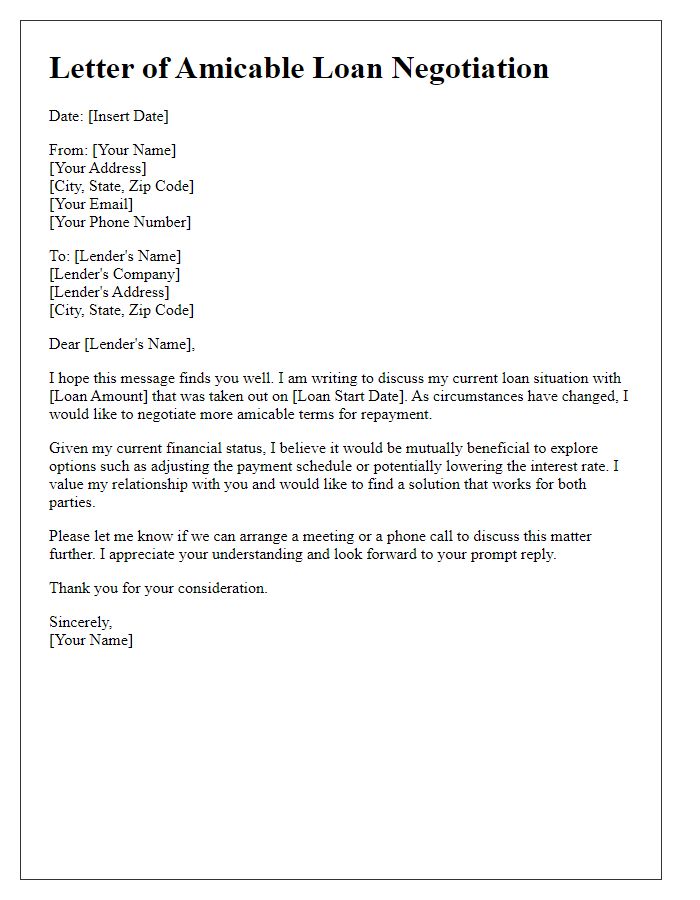

Clear Identification of Parties

In the amicable resolution of a loan settlement, accurate identification of parties is paramount. The Borrower, [Borrower Name], residing at [Borrower Address], and the Lender, [Lender Name], located at [Lender Address], must be clearly defined. This clarity ensures accountability and prevents any disputes concerning identities during the settlement process. Alongside personal details, including contact information and identification numbers (such as Social Security Number or Tax Identification Number), will reaffirm the legitimacy of both parties involved. Such diligence creates a transparent framework for the negotiation and agreement stages of the loan settlement process, fostering a smooth resolution of financial obligations.

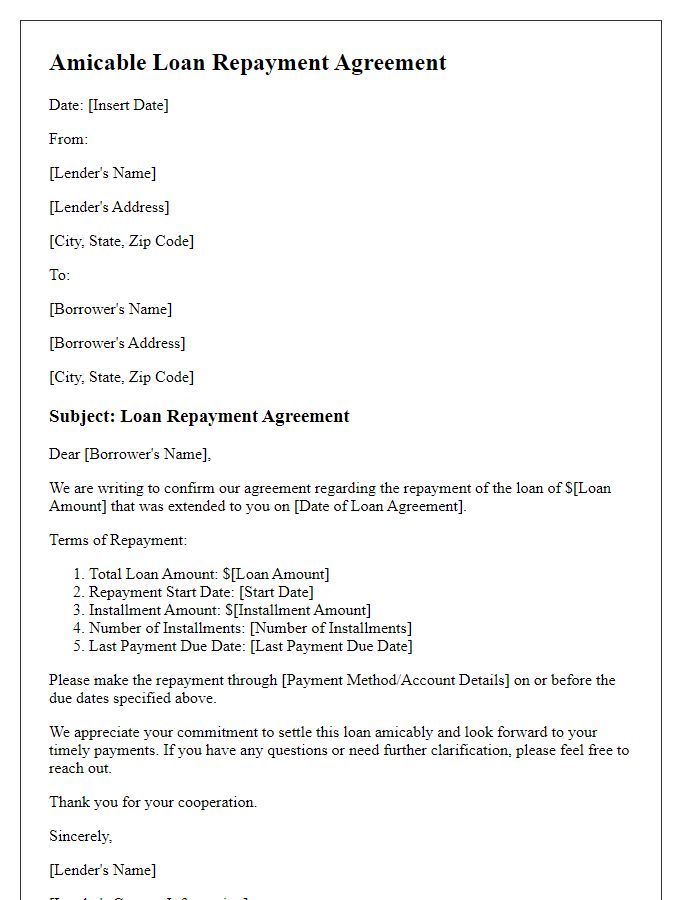

Terms of Settlement Agreement

A Terms of Settlement Agreement outlines the conditions under which a loan disagreement will be resolved amicably between parties involved, such as borrowers and lenders. This legally binding document specifies the outstanding loan amount, typically in figures, like $10,000, along with any interest accrued, and the repayment timeline, which could span 6 months to 3 years. Key dates may include the first payment due date and final settlement date, often located in a neutral location, like a local courthouse or mediation center. Additionally, it must clarify the consequences of failure to comply with the agreement, such as potential legal action or increased fees. Signatures of both parties are essential to finalize the document, establishing a mutual understanding for future relations.

Payment Plan and Amount

Amicable loan settlements involve reaching an agreement between lender and borrower to repay a loan under modified terms. Creating a payment plan is essential in ensuring clarity. A structured plan can specify total owed amount, possible adjustments to interest rates, duration of repayment (often months to years), and monthly installment values. For instance, if the original loan was $10,000 with a fixed interest of 5% over three years, the borrower might propose a new plan of $8,000 at 3% interest, paid over 24 months. Noteworthy deadlines should also be included, accounting for both the lender's flexibility and the borrower's circumstances. Clear communication fosters mutual agreement and maintains positive relations.

Waiver of Claims and Liabilities

A comprehensive loan settlement agreement outlines the terms under which a borrower and lender resolve a financial obligation amicably. The agreement includes a Waiver of Claims and Liabilities clause, ensuring that both parties relinquish any future claims related to the loan amount, including any interest or fees that may have accrued. The date of the agreement is crucial, as it formalizes the resolution process, typically situated within a jurisdiction known for its clear contract laws, such as California. This document also specifies the repayment terms, which might include a lump sum payment of $5,000, reducing the principal loan of $10,000, and any conditions tied to the payment method, such as through wire transfer or certified check. Additionally, a confidentiality clause may be included to protect the privacy of financial details discussed, enhancing the comfort level of both parties involved in the settlement process.

Signatures and Contact Information

An amicable loan settlement involves parties reaching an agreement to resolve outstanding financial obligations. This usually includes detailed information, such as the names of the debtor and creditor, the original loan amount (which could be thousands of dollars), and the settlement terms. For example, the settlement amount might be 50% of the total debt, with a payment plan extending over three months. Contact information must be clearly stated, including phone numbers, email addresses, and mailing addresses, ensuring both parties can communicate effectively throughout the settlement process. Signatures from both the debtor and creditor are crucial as they signify mutual agreement and understanding of the terms, safeguarding each party's interests legally.

Comments