Are you in need of a proof of income letter for a loan application? This simple yet essential document can greatly enhance your chances of securing the financing you need. In this article, we'll guide you through creating a professional proof of income letter that meets lender requirements while ensuring it's easy to understand. Ready to get started? Let's dive in!

Borrower's Basic Information

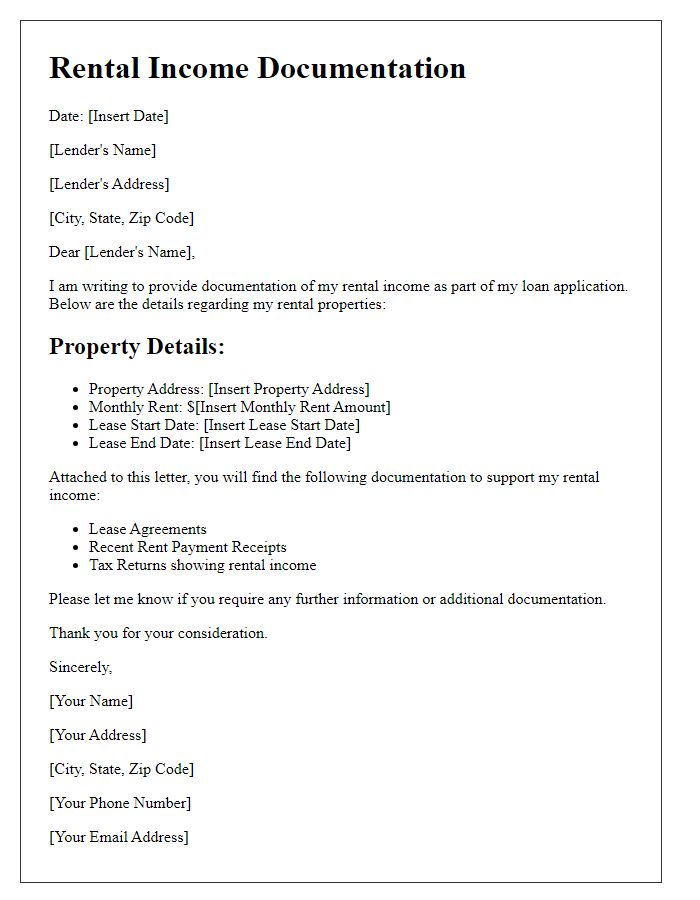

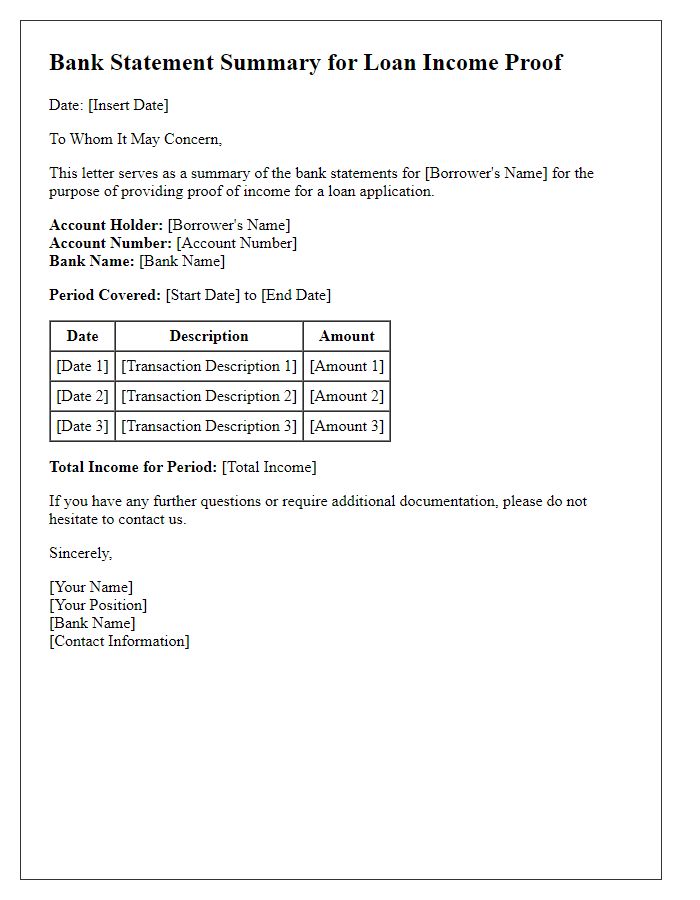

Borrower information including full name John Smith, current address 123 Elm Street, Springfield, state Illinois, zip code 62704, telephone number (555) 123-4567, and email address john.smith@example.com is crucial for verifying loan applications. Employment details such as job title Senior Software Engineer, employer name Tech Innovations Inc., and duration of employment five years should be provided. Gross monthly income $6,000 before taxes is essential to establish financial capability. Additional income sources, like rental income from property located at 456 Oak Avenue, Springfield, providing $1,200 monthly, contribute to overall financial stability. This detailed information assists lenders in assessing loan eligibility effectively.

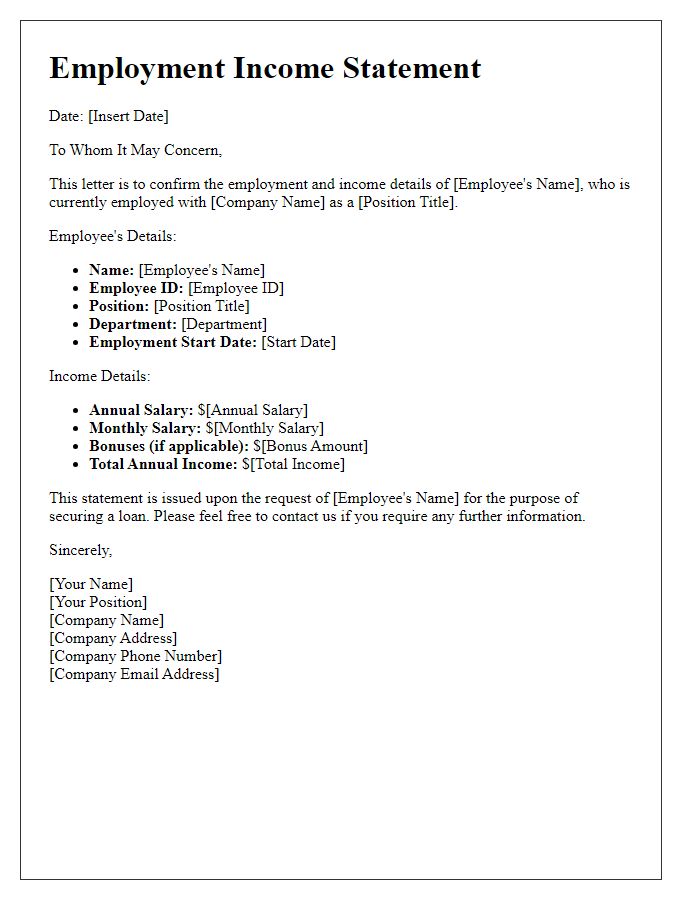

Employment and Income Details

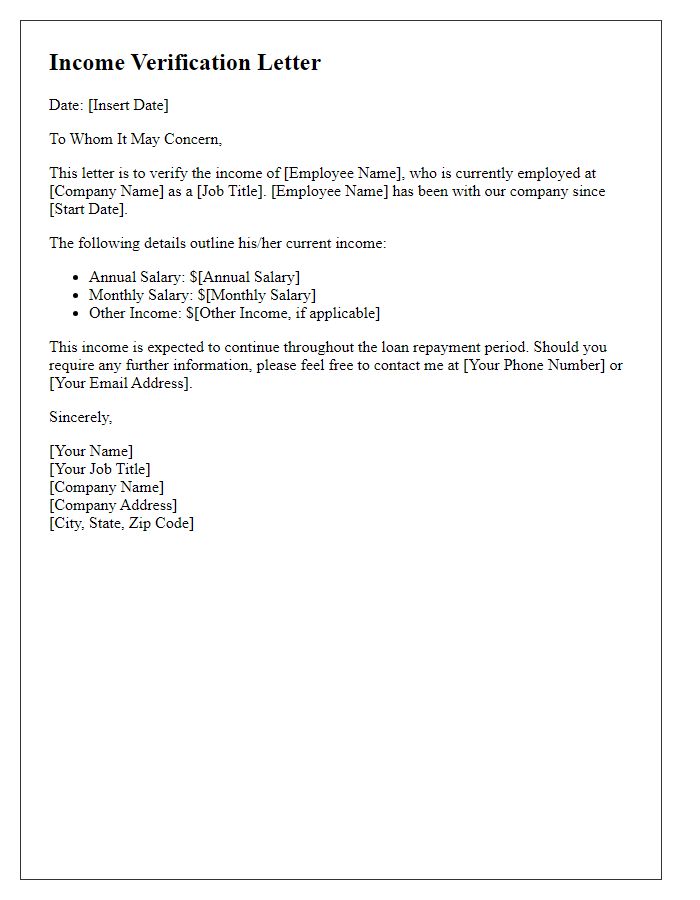

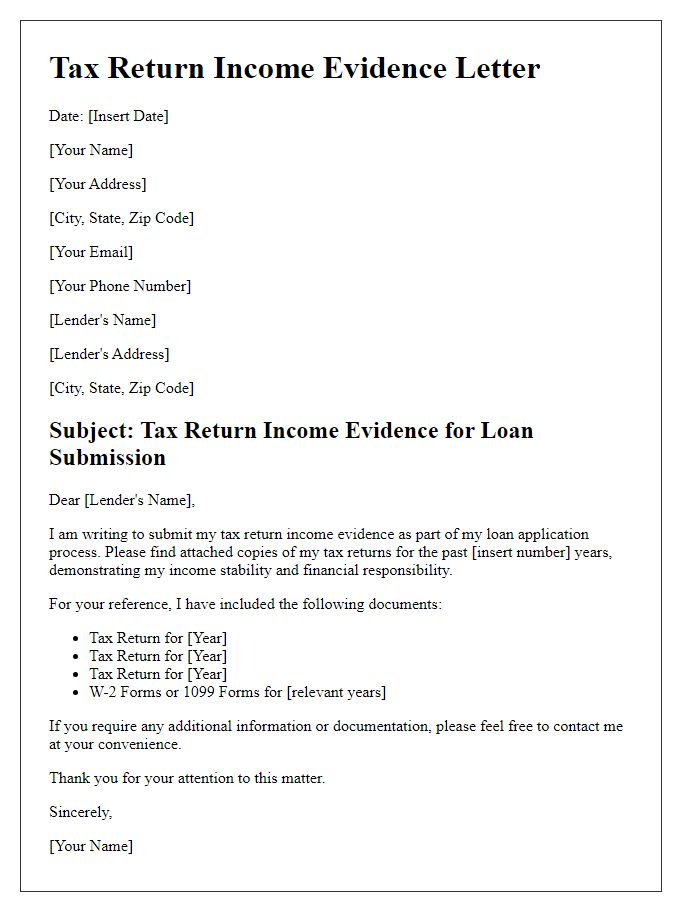

Employment verification serves as a critical component for proving income when applying for a loan. Essential figures include the borrower's annual salary, which may vary from $30,000 to $150,000, depending on the job title and industry. Employers often provide the employee's position and tenure, usually detailing start dates, and sometimes, current projects or responsibilities within the company, which can enhance the applicant's creditworthiness. Additionally, specific details are captured, such as bonuses, commissions, or overtime, reflecting potential income variations. The document typically features company information, including the name, address, and contact number, ensuring legitimacy and facilitating verification processes. This thorough overview helps lenders assess financial stability and repayment capacity effectively.

Duration of Employment

A verification of employment document typically outlines important details about an employee's work status and income for loan applications. For instance, the duration of employment can be crucial, especially for lenders evaluating stability. Employers must mention the start date (for instance, January 15, 2020) and the current date (such as October 5, 2023), indicating a total duration of approximately three years and nine months, which can reflect job reliability. Additional context about position, salary information (like annual gross income), and any promotions can further enhance the proof of income, demonstrating the employee's growth and ongoing contribution to the company's success. Accurate representation of these details helps streamline the loan approval process.

Employer Contact Information

When applying for a proof of income loan, provide detailed employer contact information to facilitate verification of income. Key elements include the employer's name, often a large corporation or small business, followed by the physical address, such as a specific street number and city, which can be critical for assessing the company's legitimacy. Include the telephone number formatted with the area code, enabling quick communication for income confirmation. Email addresses serve as an additional method of contact, often necessitating a professional format to ensure credibility. Including the name and position of the HR representative or direct supervisor can further streamline the verification process, adding an extra layer of assurance regarding the accuracy of the income statement presented to the lending institution.

Certification and Signature

Proof of income for loan applications typically requires official documentation detailing employment status, salary, and additional income sources. This can include a salary statement, employment verification letter, or recent pay stubs. Critical information includes the borrower's name, employer's name, job title, and the duration of employment. Signed certification by a supervisor or human resources officer may be required, affirming the accuracy of the provided information. Date of certification and contact information for verification must also be included to ensure the lender can confirm employment and income details efficiently.

Letter Template For Proof Of Income Loan Samples

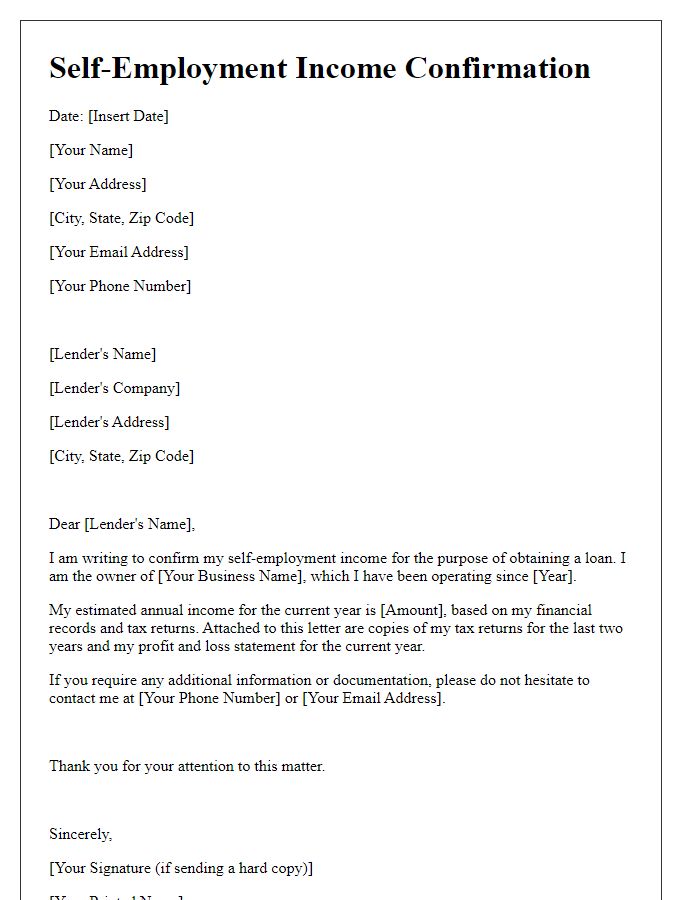

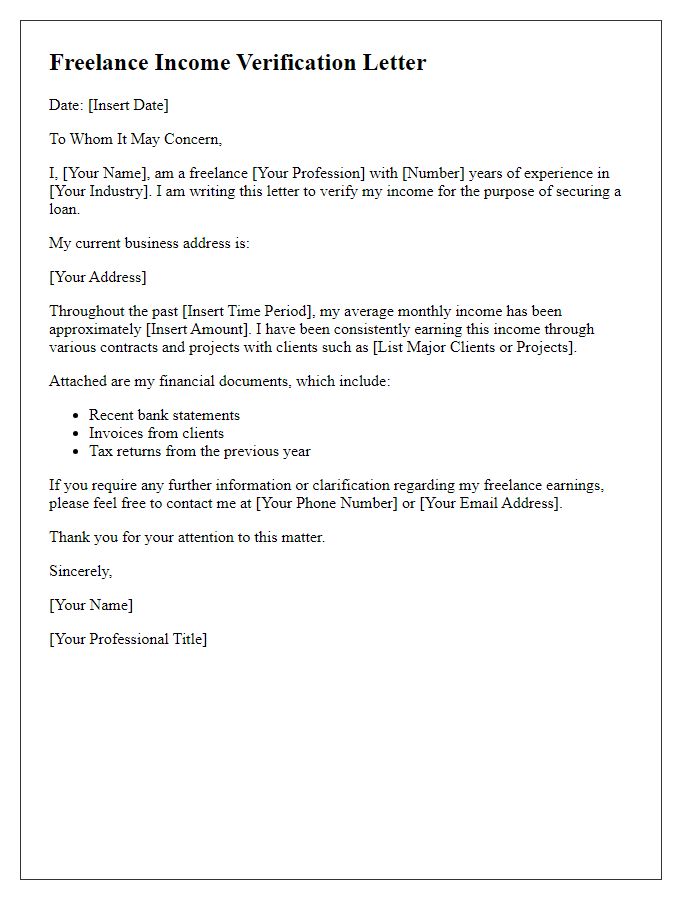

Letter template of self-employment income confirmation for loan purposes

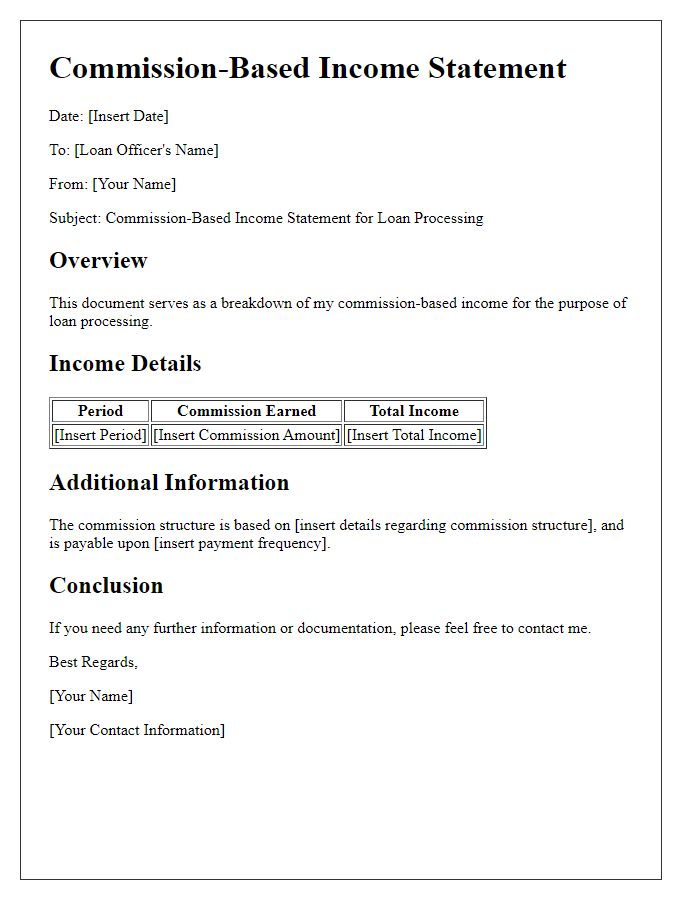

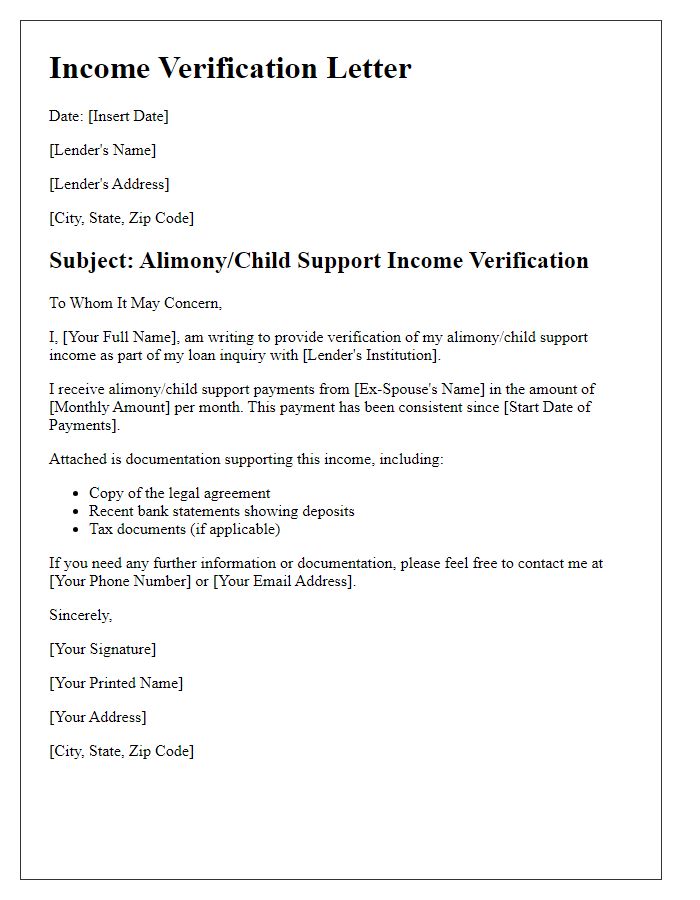

Letter template of commission-based income statement for loan processing

Comments