Are you considering a shared equity loan as a way to step into homeownership without the burden of traditional financing? This innovative approach allows you to team up with investors or housing organizations to buy a home, making it more accessible for those facing financial barriers. Not only does it help you manage upfront costs, but it can also ease your monthly mortgage payments. Curious to learn how a shared equity loan could work for you? Keep reading to discover the ins and outs!

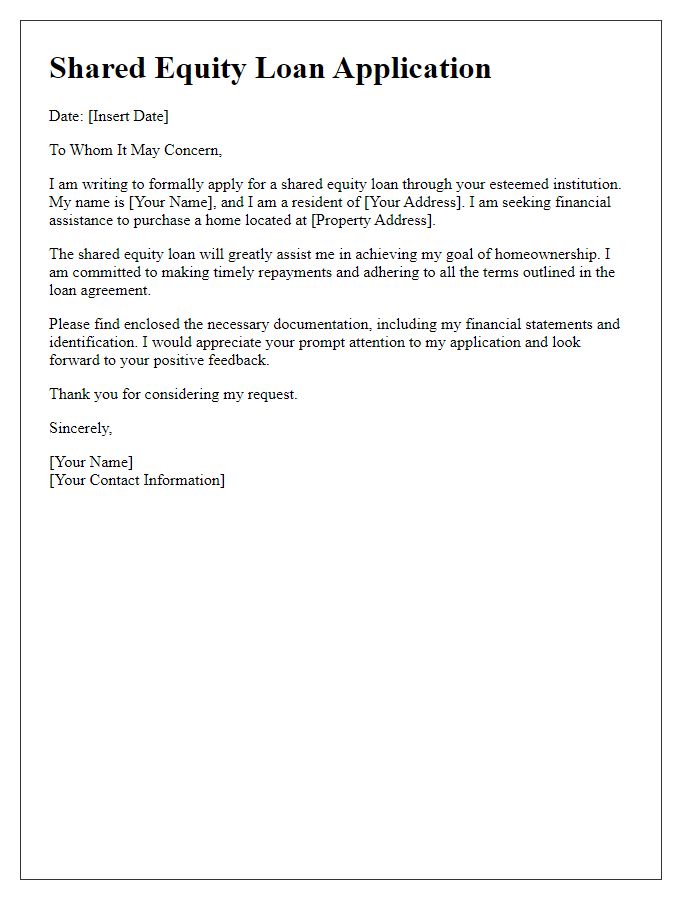

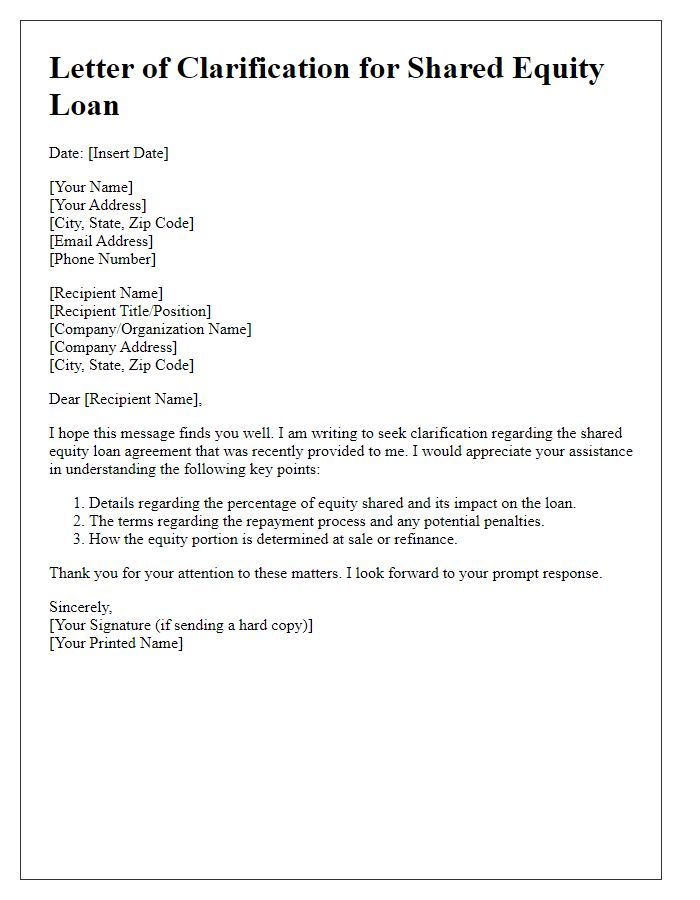

Personalized Recipient Details

A shared equity loan option offers potential homebuyers a unique financial pathway, often provided by government programs or private lenders. This loan arrangement typically allows individuals to purchase a property by covering a portion of the purchase price, while a co-investor, like the government or a housing association, finances the remaining share. For instance, in Australia, the First Home Loan Deposit Scheme can help first-time buyers secure a home with as little as a 5% deposit on properties valued up to $700,000 in metropolitan areas. The co-investor's stake in the property can range from 25% to 50%, depending on the program. Homebuyers contribute monthly mortgage payments on the loan and eventual payouts to their co-investors when they sell or refinance the property, helping to alleviate financial burdens while encouraging homeownership.

Clear Explanation of Shared Equity Loan

A shared equity loan represents a financial arrangement allowing homebuyers to co-invest with a lender, typically a government entity or private organization, in a property purchase. This system enables buyers to acquire homes with lower initial deposits, often around 5% to 10%, while the lender retains a proportional ownership stake, ranging from 10% to 40%. Upon sale, the lender's share is returned based on the property's current market value, creating an equitable situation. This approach is particularly beneficial in high-cost housing markets, where property prices can reach over $500,000. Shared equity loans often come with low-interest rates and flexible repayment options, making it an attractive alternative for first-time buyers facing financial hurdles in affording home ownership. Additionally, various programs exist across regions, such as the First Home Owner Grant in Australia or the Shared Equity Scheme in Scotland, which further support buyers in navigating the complexities of entering the housing market.

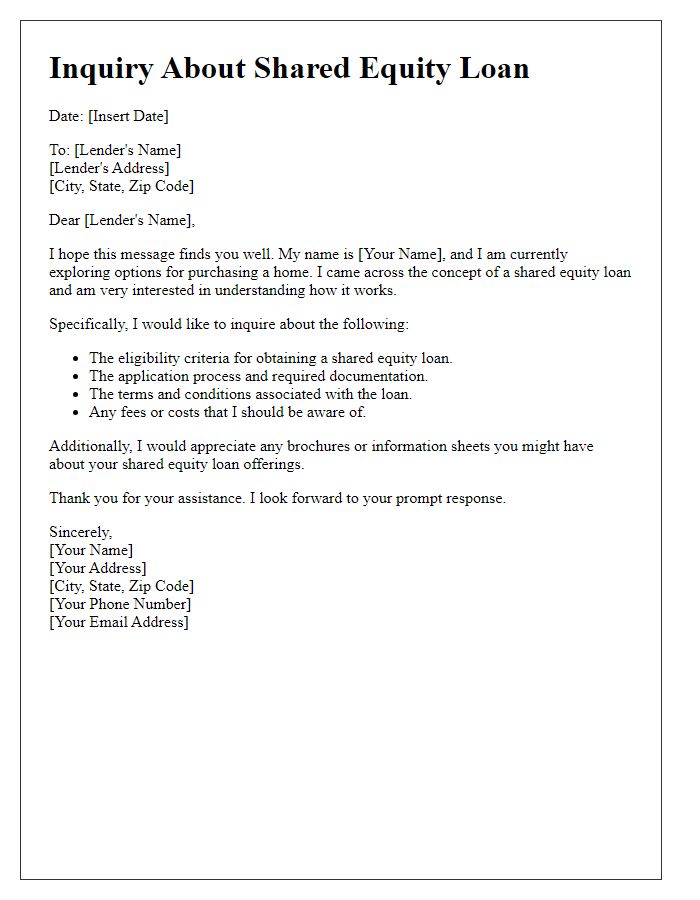

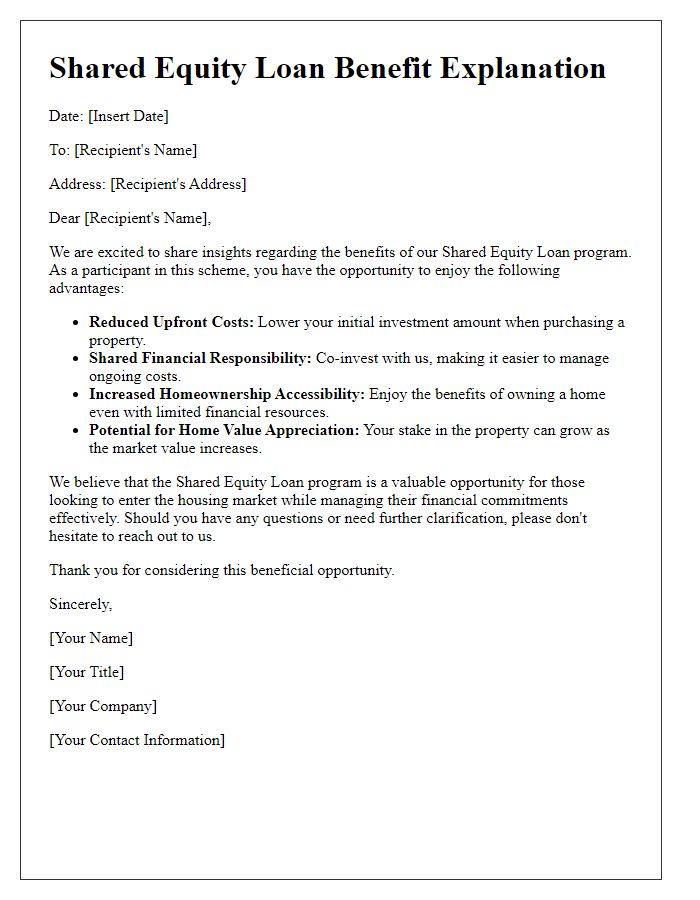

Benefits and Unique Features

The shared equity loan option offers a unique financial solution for homebuyers, particularly first-time buyers navigating the competitive property market. This innovative arrangement allows buyers to own a percentage of the property while a financial institution or government entity retains equity in the remaining portion. Typically, these loans require lower upfront deposits, often as low as 5% of the property's value, significantly reducing the initial financial burden. Unique features of this program may include no repayment on the shared equity portion until the property is sold or refinanced, appealing to those needing to manage monthly budgets effectively. Additionally, many shared equity loans provide access to lower interest rates compared to traditional mortgages, translating to further savings over time. This model encourages homeownership and fosters community growth by making housing more accessible, particularly in metropolitan areas where property prices exceed the average income.

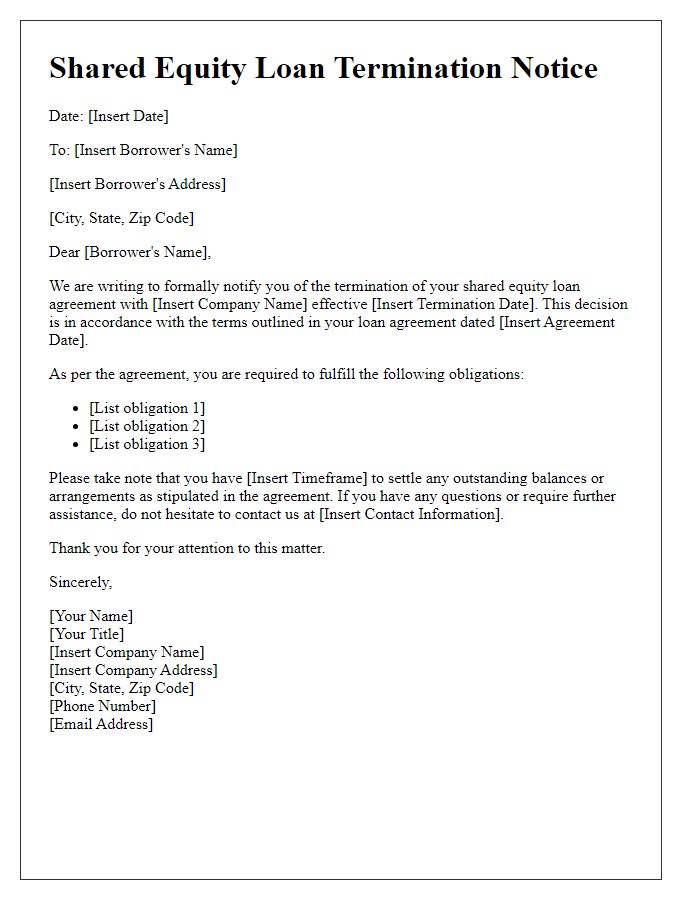

Eligibility and Requirements

Shared equity loan options provide a financial pathway for homebuyers seeking assistance in purchasing property, particularly in high-cost areas like San Francisco or New York City. Eligibility criteria often include income thresholds, typically capped at 80% of the area median income (AMI), and residency requirements within the state. Potential applicants may need to demonstrate a minimum credit score of 620, showcasing their financial reliability. Additionally, a down payment of at least 3% may be necessary, although some programs offer grants for this expense. Documentation such as tax returns, pay stubs, and bank statements is usually required for thorough financial assessment. Local housing authorities, like the California Department of Housing and Community Development, frequently oversee these programs, ensuring that buyers receive guidance throughout the application process.

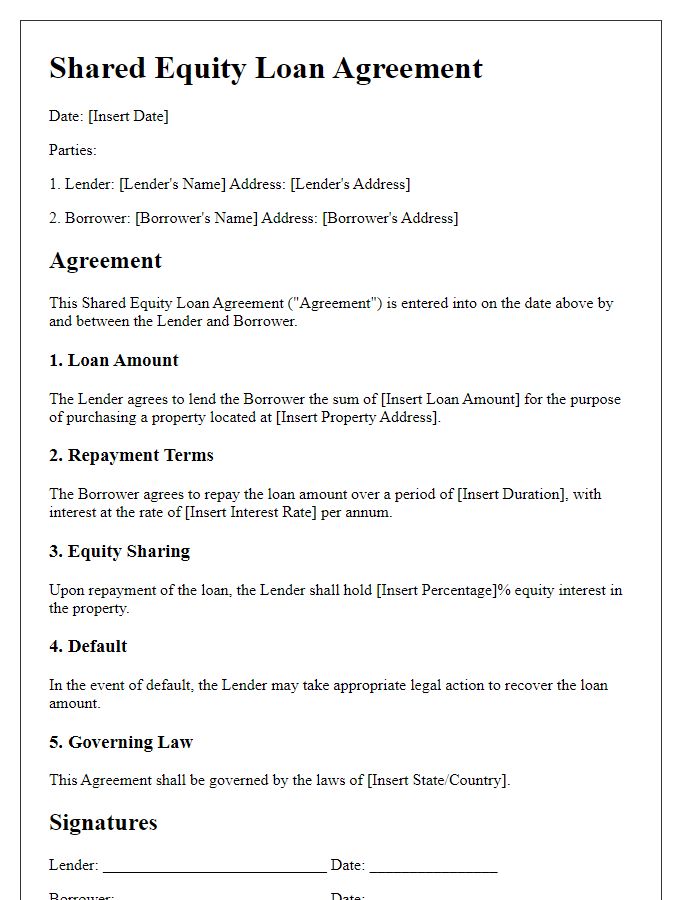

Contact Information for Further Assistance

Shared equity loan options provide potential homeowners a unique pathway to property ownership by allowing them to co-invest with a housing authority or private organization. This financial arrangement typically involves a percentage of ownership shared between the buyer and the lender, often covering high-demand areas like urban centers with escalating property prices, such as San Francisco or New York City. Eligibility requirements often include income limits, credit assessments, and the potential for providing lower down payments, making homeownership accessible to first-time buyers and lower-income families. It is crucial for interested individuals to consult their local housing authority or financial advisor to understand the specific terms and conditions associated with such loans, thus ensuring informed decision-making amidst the complexities of the real estate market.

Comments