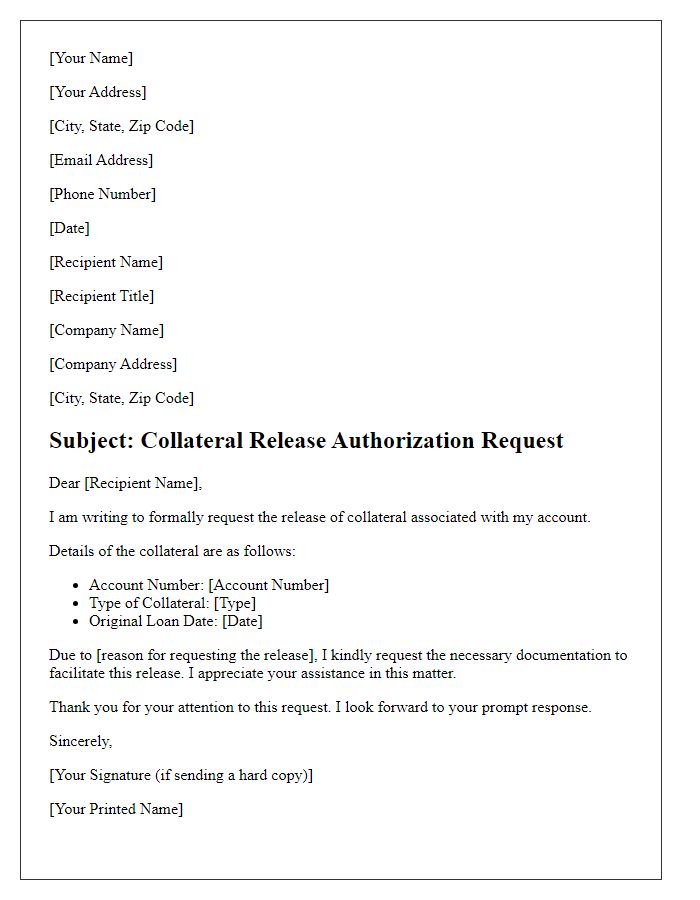

Are you grappling with the complexities of collateral release approvals? Navigating financial agreements can often feel overwhelming, especially when it comes to maintaining clear communication with all parties involved. In this article, we'll break down a straightforward letter template designed specifically for collateral release approval requests, ensuring that your correspondence is both effective and professional. So, let's dive in and streamline your processâread more to discover how you can simplify your next collateral release approval!

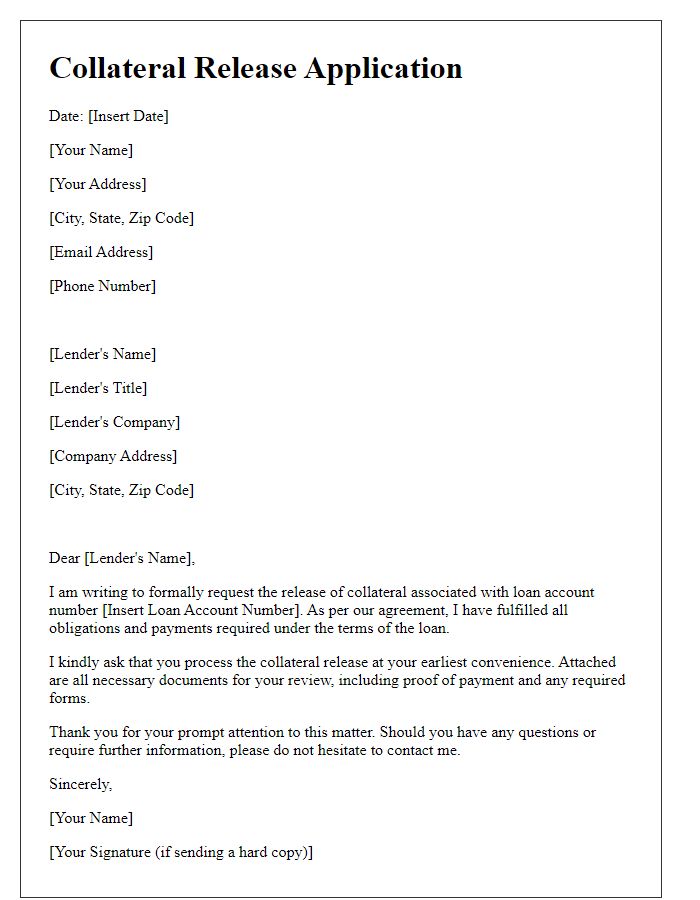

Borrower's Information

Collateral release approval involves evaluating a borrower's information, including personal and financial details. Key data points include the borrower's name, loan account number, collateral type (such as real estate or personal property), outstanding loan balance (e.g., $50,000), and payment history (e.g., on-time payments for the last 12 months). Evaluating the borrower's credit score (FICO score) is crucial, with scores over 680 generally considered favorable. Additional details may encompass the property's estimated market value (e.g., $75,000 for real estate), loan-to-value ratio, and any existing liens on the collateral. Accurate assessment of these elements is vital for making informed approval decisions.

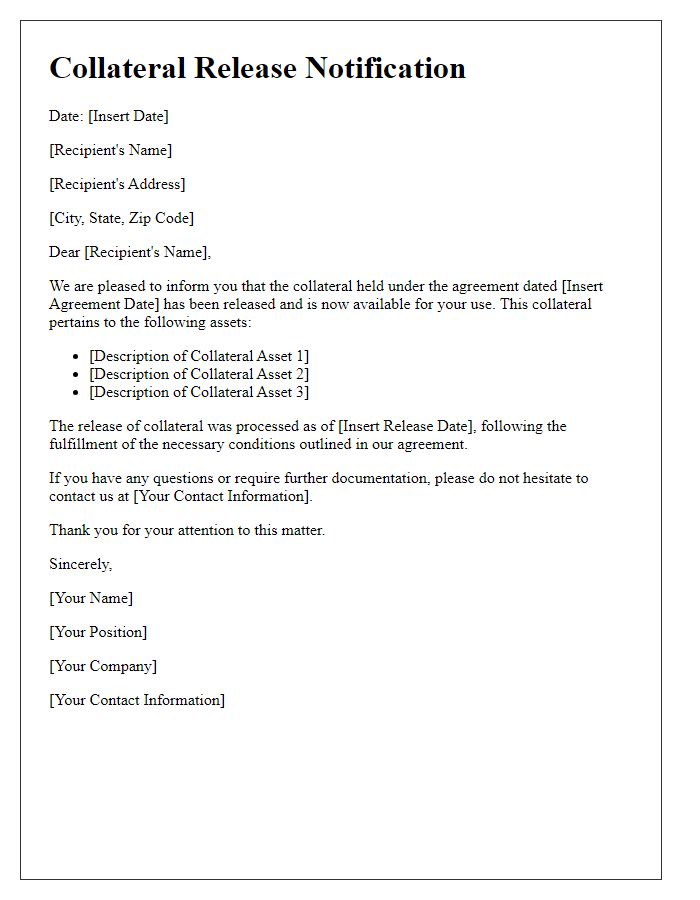

Loan Details

Collateral release requests in loan agreements often involve detailed specifications regarding the asset securing the loan. In cases like real estate transactions, properties (e.g., the residential home at 123 Maple Street, valued at $350,000) serve as collateral. Loan amounts (e.g., $250,000 at a 5% interest rate) are indicative of secured debts. The lending institution (e.g., First National Bank) requires accurate documentation, including borrower identification (e.g., Jane Doe, social security number 123-45-6789) and payment history. A formal approval process must follow due diligence, addressing any outstanding amounts, ensuring compliance with regulatory requirements, and confirming the completion of all legal paperwork necessary for the collateral release. The approval timeline often spans several days to weeks, dependent on the complexity of the loan conditions and collateral evaluation processes.

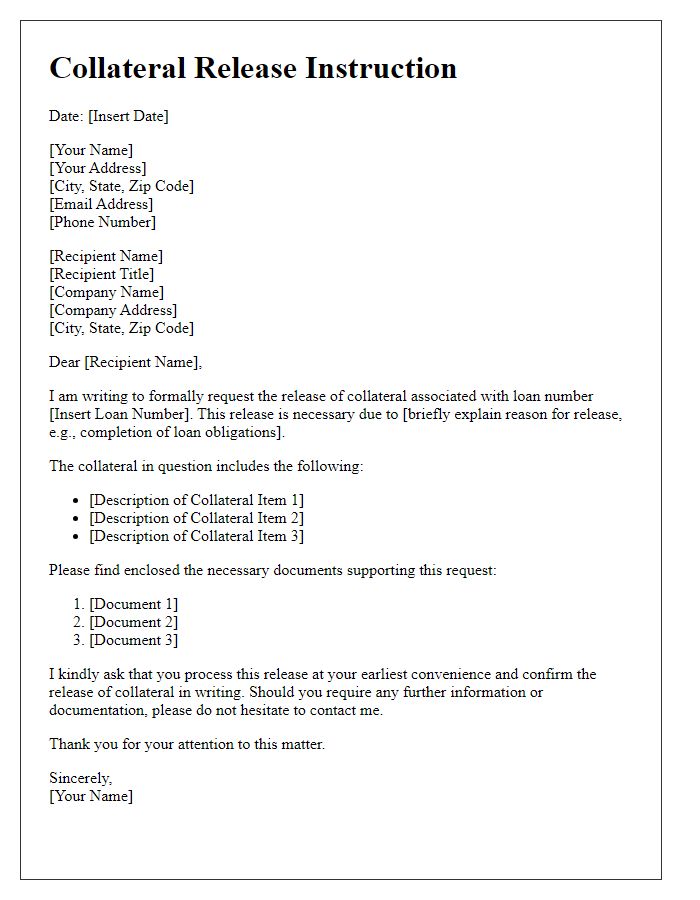

Collateral Description

The collateral release process involves the evaluation and approval of various assets, such as real estate or vehicles, which are pledged as security for loans. The collateral description should include specific details such as the asset type (e.g., residential property at 123 Maple Street, Springfield, valued at $250,000), asset identification numbers (e.g., VIN for vehicles), and relevant legal documentation (e.g., title deeds, appraisals). Proper documentation ensures transparency and helps mitigate risks for financial institutions during the asset release process. Parties involved include lenders, borrowers, and legal representatives. Completing this process promptly can facilitate smoother transactions and clear any obligations associated with the collateral.

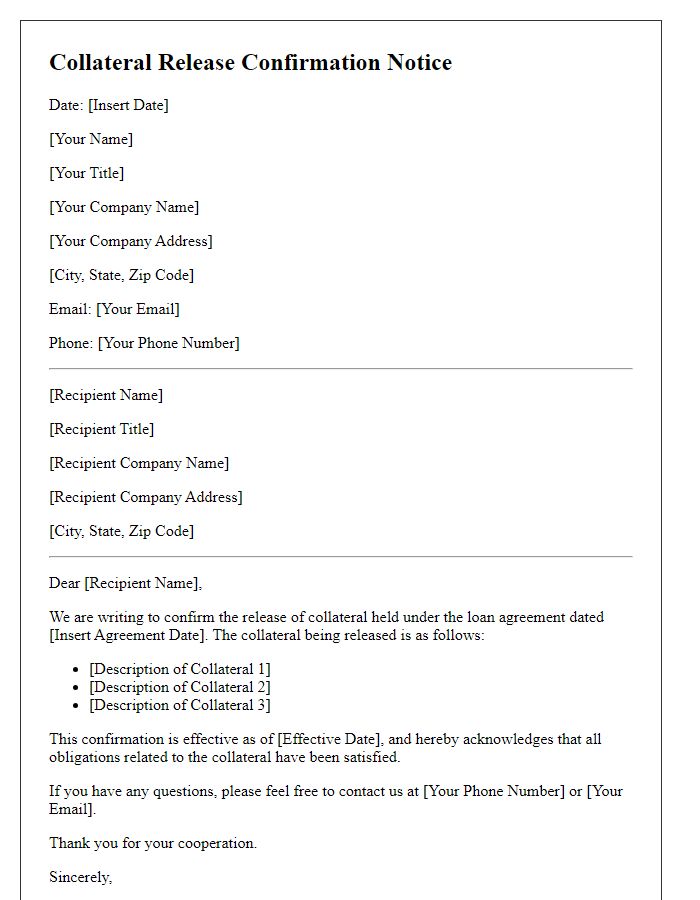

Terms and Conditions

Collaterals, such as stocks or real estate, require careful documentation and approval processes before release. The terms and conditions outline specific requirements needed for the collateral release, including full repayment of the loan amount, verification of legal ownership documents, and compliance with any outstanding obligations. Financial institutions often stipulate a minimal notice period, sometimes ranging from 7 to 30 days, before processing the release. Essential details such as loan identification numbers and stakeholder agreements must be specified to ensure clarity and prevent future disputes. All parties must adhere to regulatory guidelines, potentially involving legal review or notarization, to finalize the release and safeguard against any breaches.

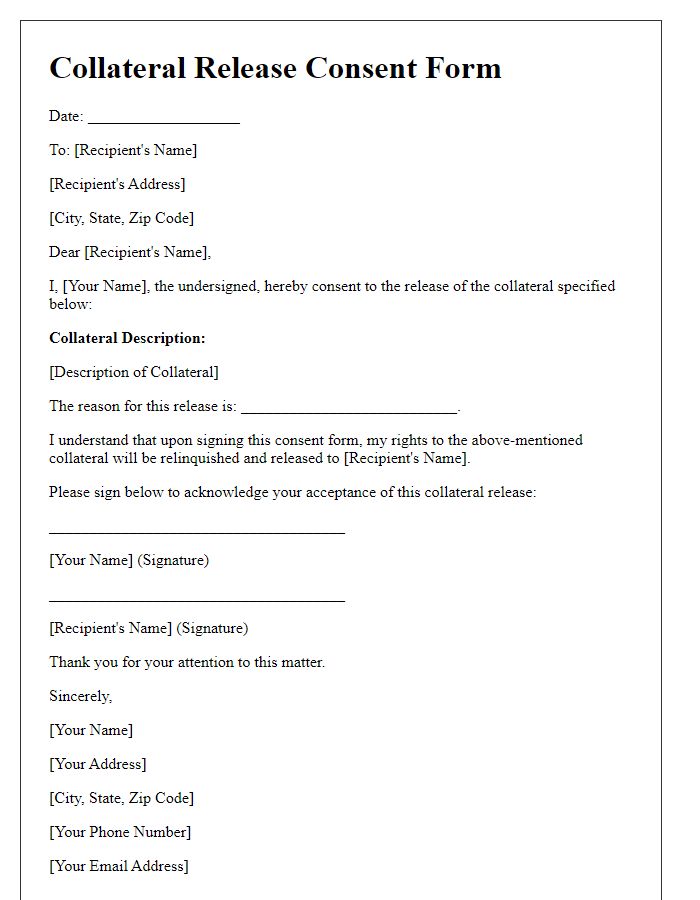

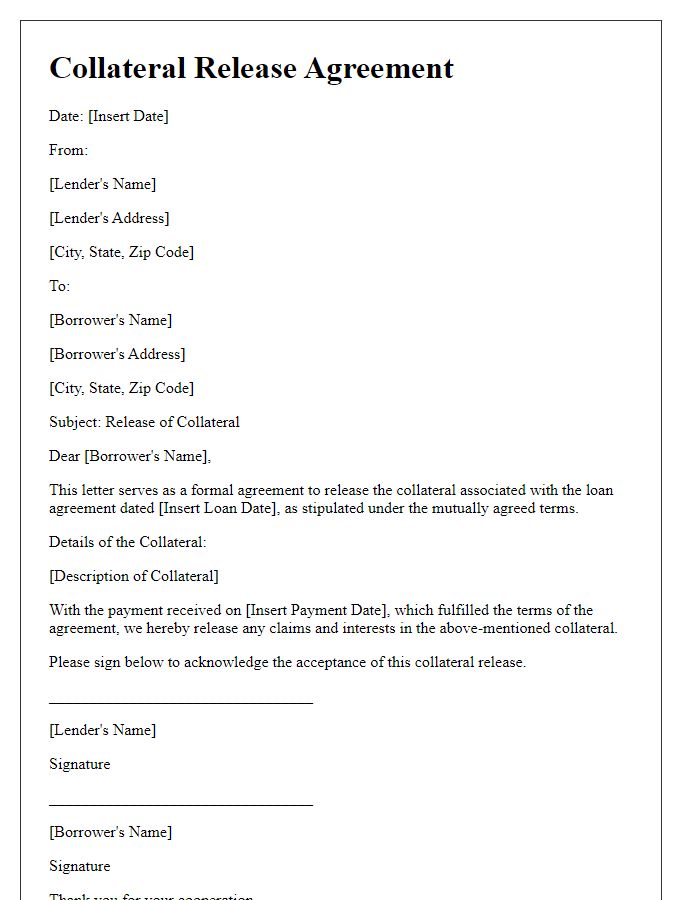

Authorization and Signatures

The collateral release process requires meticulous attention to authorization and signatures. Each financial institution, such as banks or credit unions, mandates detailed documentation to approve the release of collateral, typically secured against loans or credit lines. This documentation often includes forms that outline terms, conditions, and identities of parties involved, necessitating signatures from authorized representatives. For instance, banks may require the signature of the loan officer and the department head, while borrowers must also sign to acknowledge the release. Legal aspects might require witnesses or notarization, depending on jurisdictional regulations. Ensuring each signature is gathered diligently accelerates the release process, allowing funds or assets to be accessed promptly, usually within 5 to 10 business days after submission. Proper compliance with these procedures safeguards against future disputes and reinforces trust between lenders and borrowers, promoting smoother financial operations.

Comments