Understanding your debt-to-income ratio is essential for managing your finances effectively. This ratio not only provides insight into your financial health but also plays a crucial role when you're applying for loans or mortgages. By evaluating the balance between your monthly debt payments and your income, you can make informed decisions that pave the way for a more secure financial future. So, let's dive deeper into how this ratio works and explore ways to improve itâread on for more valuable insights!

Personal identification details

Debt-to-income ratio (DTI) measures an individual's financial health, specifically the ratio of monthly debt payments to gross monthly income. This ratio, often expressed as a percentage, helps lenders assess repayment ability for loans or credit. A healthy DTI usually falls below 36%, with no more than 28% of that monthly income going towards housing expenses. For example, an annual income of $60,000 results in a gross monthly income of $5,000, and housing costs exceeding $1,400 could indicate potential risk for lenders. Understanding DTI calculations assists in making informed financial decisions, ultimately impacting creditworthiness and loan eligibility.

Current income sources and stability

Current income sources, such as employment, self-employment, and rental income, play crucial roles in evaluating financial stability. A full-time job with an annual salary of $70,000 provides a stable financial foundation, while a side business generating $15,000 annually adds to the overall income. Consistent monthly rental income from a property, averaging $1,200, further bolsters the income portfolio. Factors such as job tenure (5 years in the current position), industry stability (healthcare sector), and consistent payment history on debt obligations enhance credibility. This income stability significantly impacts the debt-to-income ratio, a critical metric for lenders assessing financial health and the ability to manage additional debt.

Existing debt obligations and terms

A debt-to-income (DTI) ratio is a critical financial metric that assesses an individual's ability to manage monthly debt payments relative to their gross monthly income. Existing debt obligations refer to any outstanding loans, such as mortgages, car loans, student loans, credit card debts, and personal loans, each carrying its own terms, including interest rates, repayment durations, and minimum monthly payments. For instance, a home mortgage may have a principal balance of $250,000 with a 4% interest rate and a 30-year repayment term, resulting in a monthly payment of approximately $1,200. In contrast, personal loans could have varying amounts; for example, a $15,000 loan at an interest rate of 10% may require a monthly payment of around $400 over five years. Understanding these existing debt obligations and their respective terms is essential for calculating the DTI ratio accurately, which lenders often require for loan approvals, helping determine an individual's overall financial health and loan eligibility.

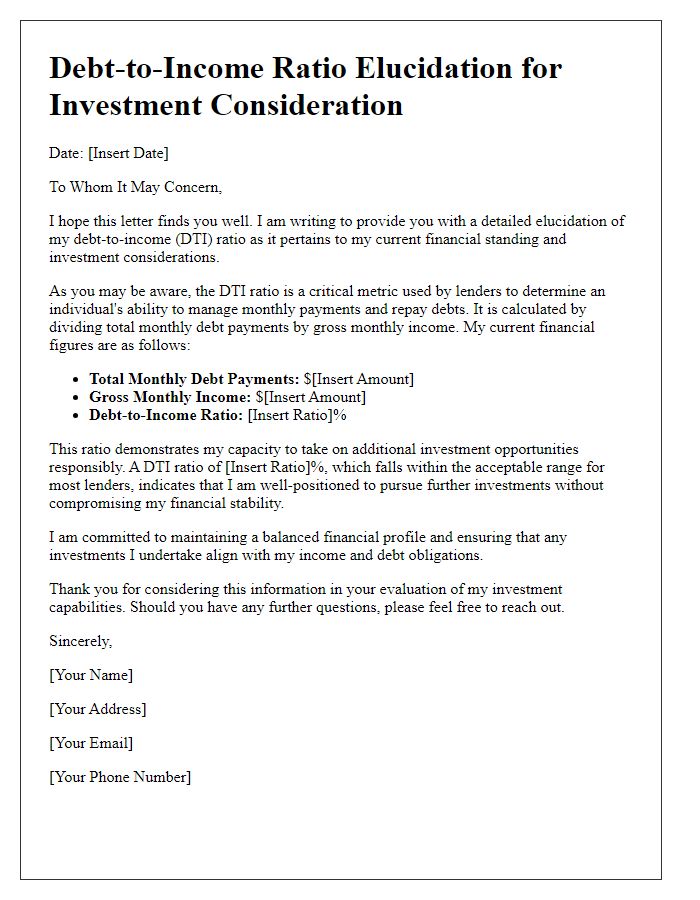

Financial goals and plans for repayment

A debt-to-income ratio (DTI) is a key financial metric that lenders use to assess an individual's ability to manage monthly payments and repay debts. A typical DTI under 36% is often considered favorable, ensuring that no more than 36% of gross monthly income is allocated towards debt obligations. Individuals aiming to improve their financial situation and repayment strategy may focus on increasing income sources, such as part-time work, and reducing discretionary expenditures. Establishing a structured repayment plan can further enhance financial stability; methods like the snowball approach--prioritizing smaller debts for motivation--can contribute to long-term financial goals. Regular budgeting and monitoring DTI changes facilitate informed decisions regarding additional loans or credit expansions, especially for significant purchases like home buying or investing in education. Implementing these strategies at key financial milestones can significantly impact overall financial health and future creditworthiness.

Additional supporting documents or evidence

A debt-to-income ratio (DTI) is a financial measure comparing an individual's total monthly debt payments to their gross monthly income, expressed as a percentage. Lenders, particularly in the mortgage industry, emphasize a DTI below 36% for favorable loan terms. Supporting documents can include recent pay stubs, bank statements, and tax returns. In specific circumstances, individuals may need to present proof of additional income sources like bonuses, alimony, or rental income. Essential evidence also encompasses monthly debt obligations, such as credit card bills, auto loans, and student loans, ensuring an accurate assessment of financial capability. Understanding DTI is crucial for individuals seeking loans or refinancing options, impacting their eligibility and interest rates.

Letter Template For Debt-To-Income Ratio Explanation Samples

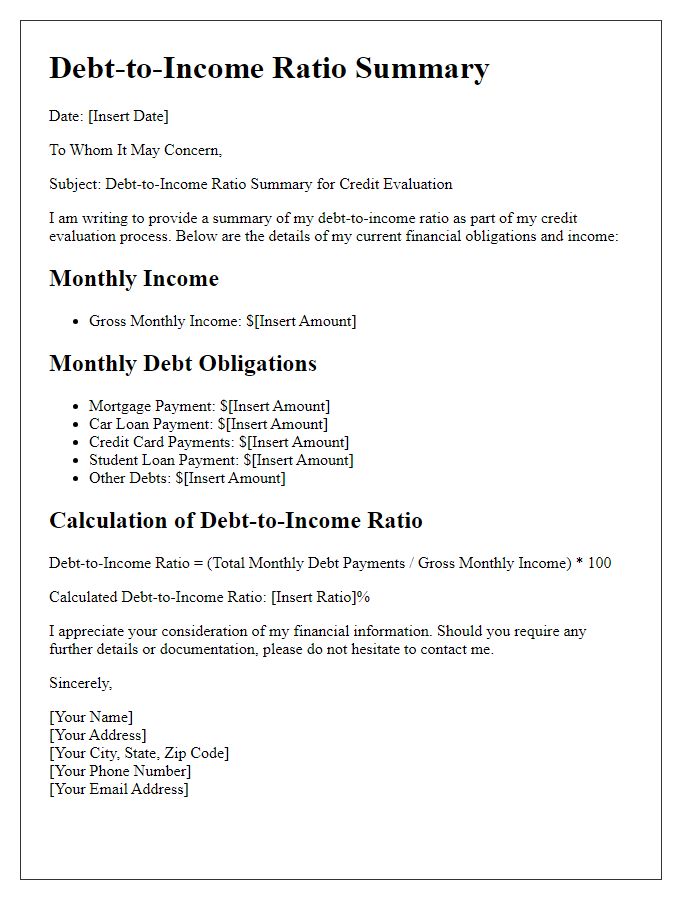

Letter template of debt-to-income ratio clarification for loan application.

Letter template of debt-to-income ratio disclosure for mortgage approval.

Letter template of debt-to-income ratio justification for financial assessment.

Letter template of debt-to-income ratio analysis for income verification.

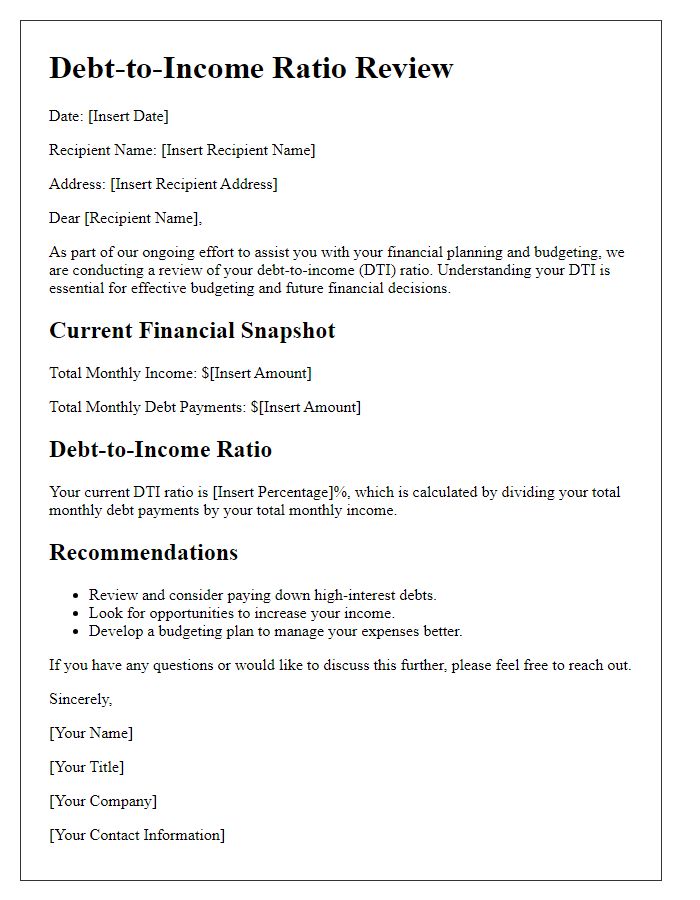

Letter template of debt-to-income ratio rationale for refinancing request.

Letter template of debt-to-income ratio explanation for rental application.

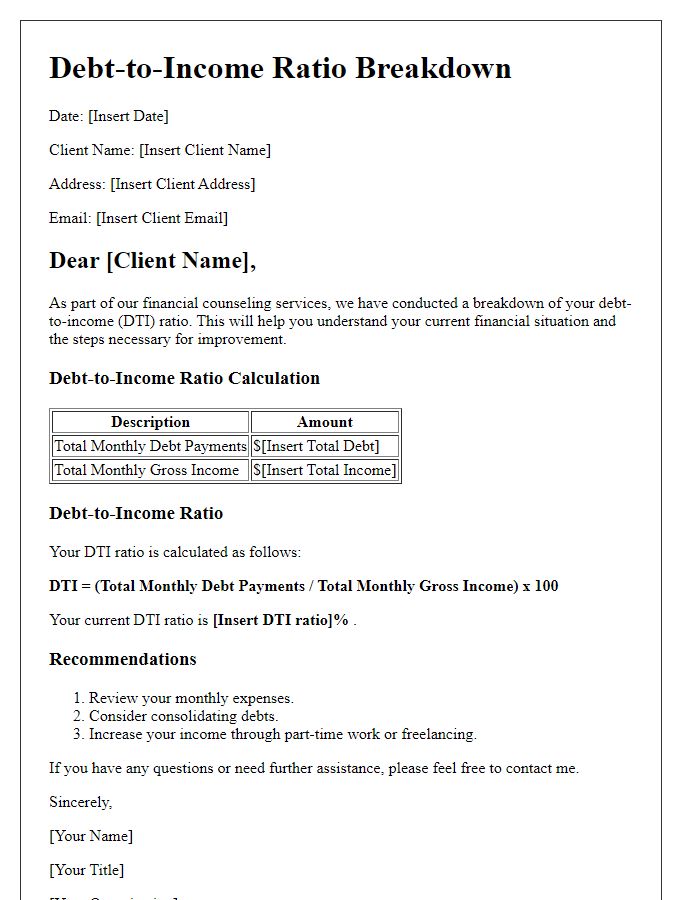

Letter template of debt-to-income ratio breakdown for financial counseling.

Comments