Have you ever faced the disappointment of a loan rejection? It can feel frustrating and confusing, especially when you've invested time and hope into the application process. Understanding the reasons behind such decisions is key to navigating your financial journey effectively. Join us as we explore secured loan rejections and provide insights that might help you bounce back stronger.

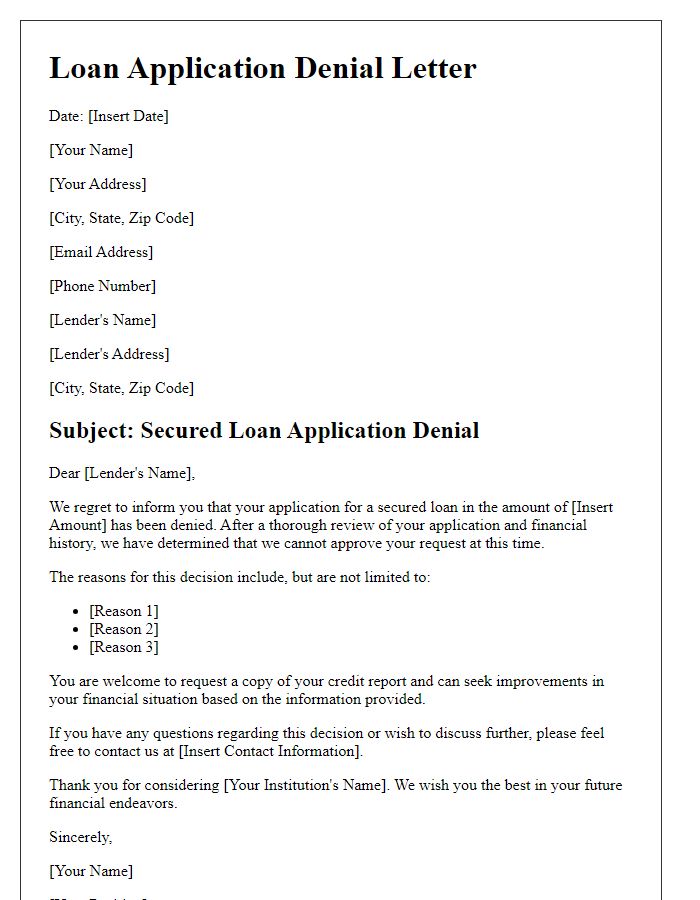

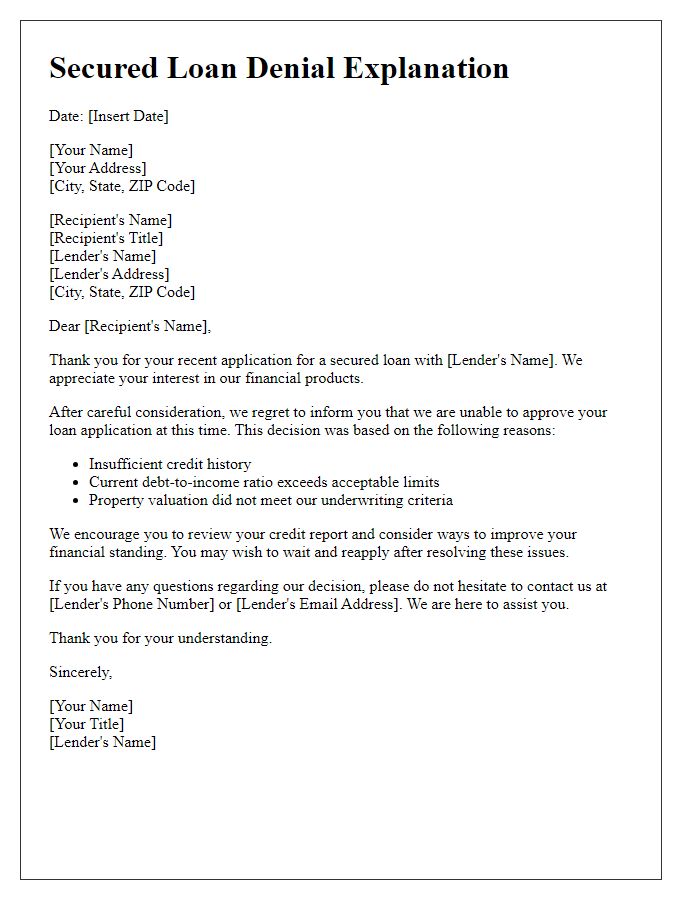

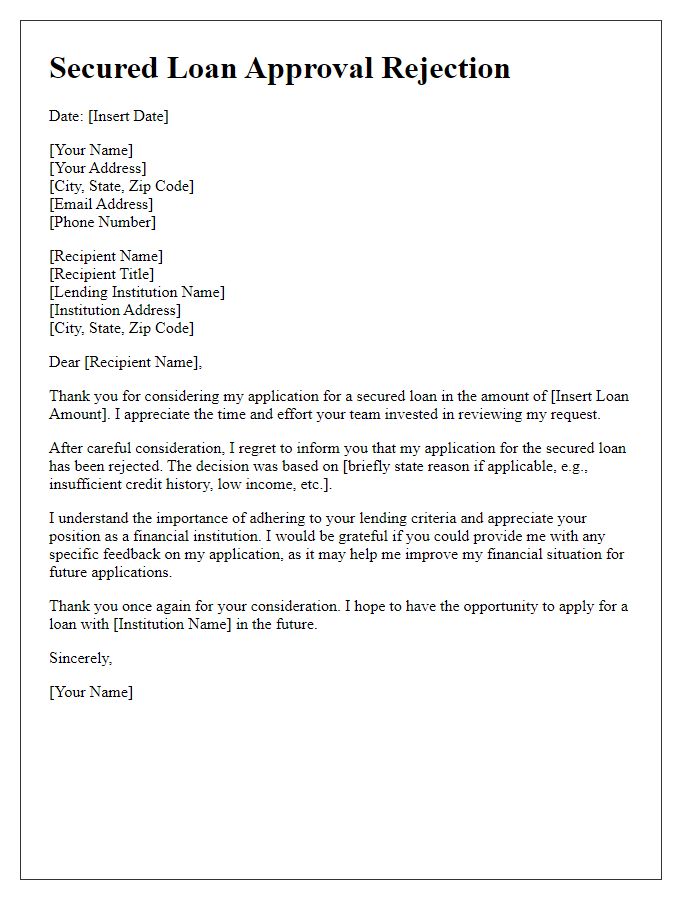

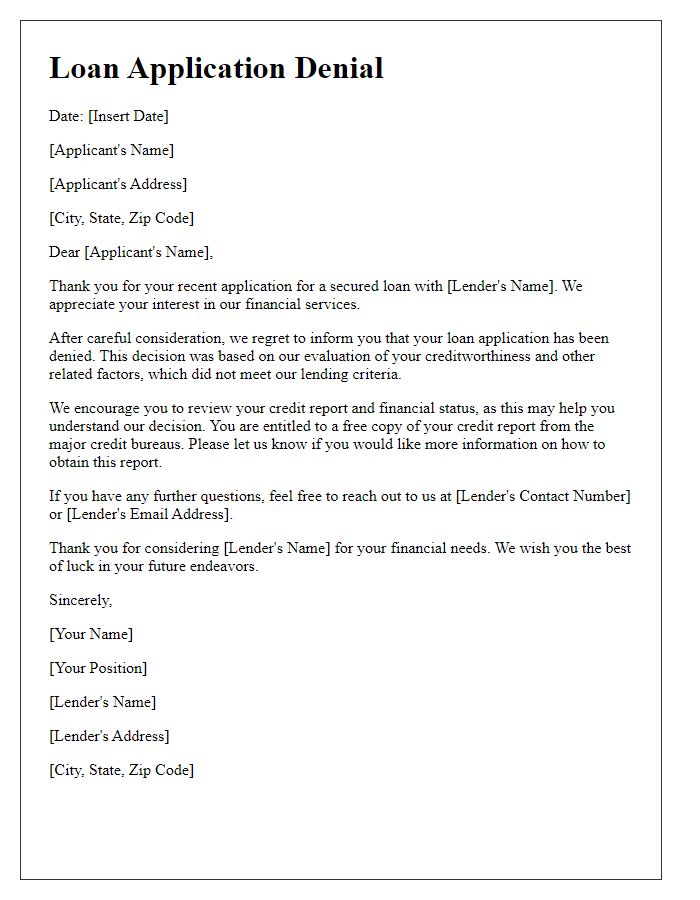

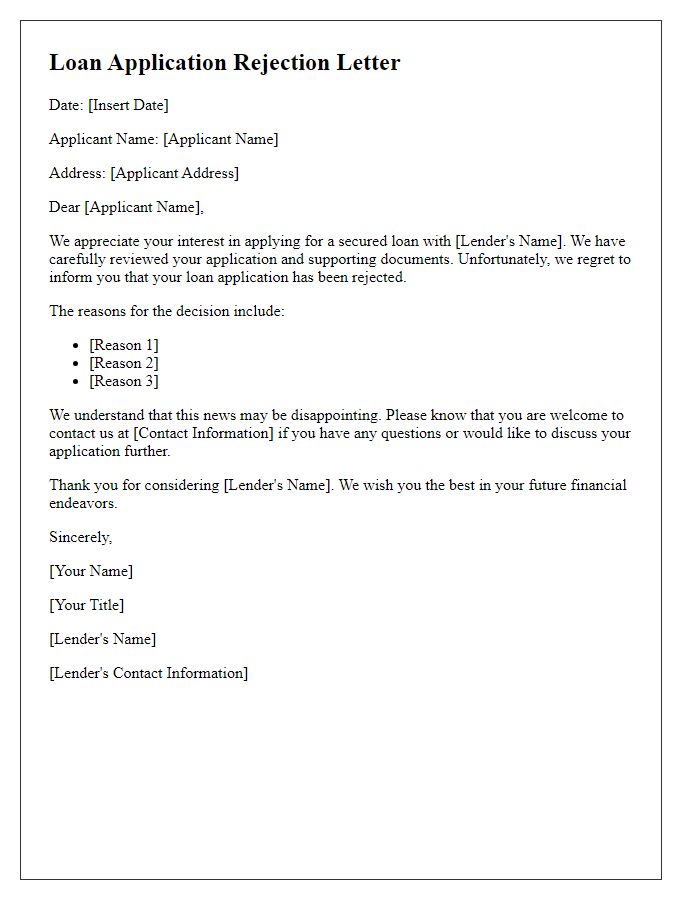

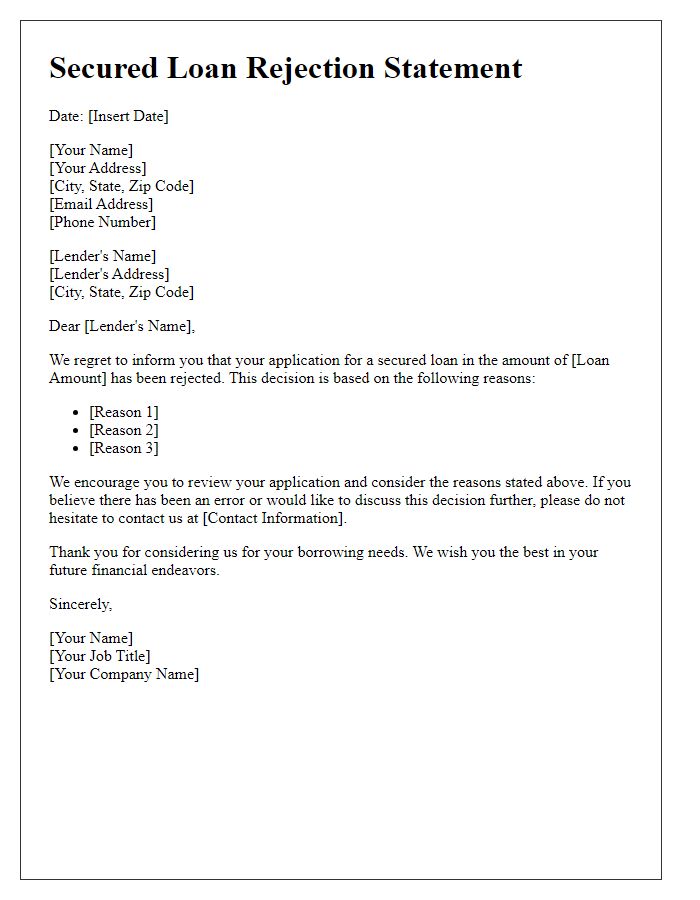

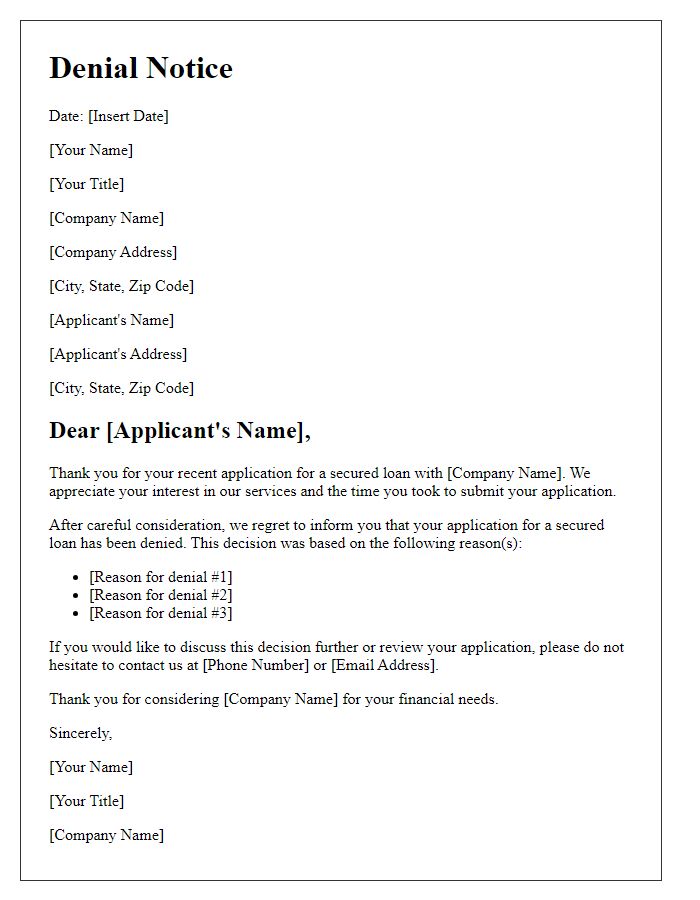

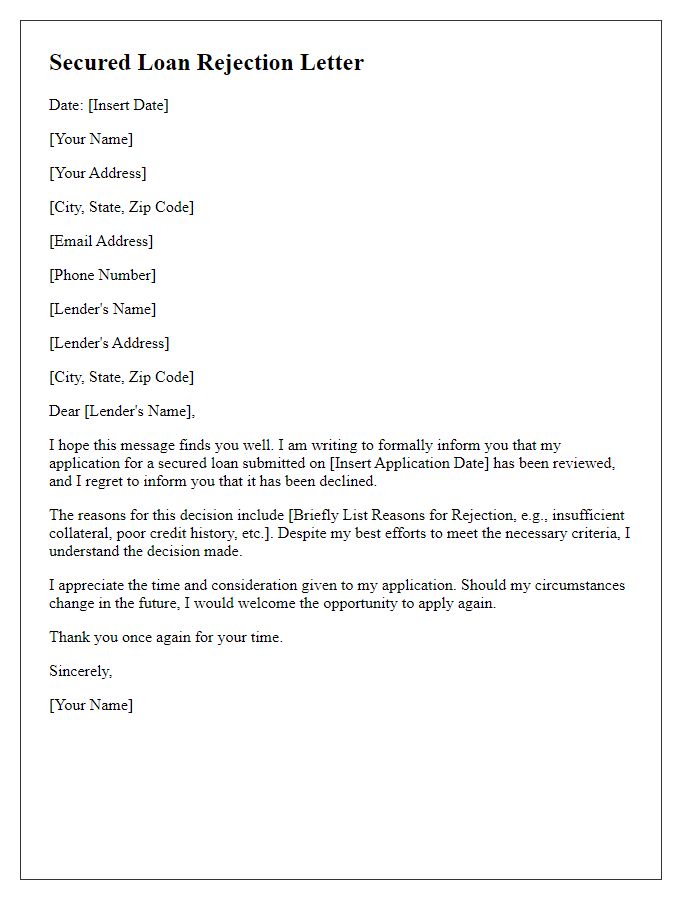

Clear Subject Line

Secured loans, often backed by collateral such as property or vehicles, may be rejected for various reasons impacting the borrower's financial profile. Credit score requirements typically demand a rating of at least 680 for favorable terms. Insufficient income verification, often owing to three months of pay stubs or tax returns, can lead to rejection. Additionally, high debt-to-income ratios exceeding 43% may signal financial strain to lenders. Property appraisals under the loan amount requested can cause lenders to withdraw approval, reflecting concerns about asset value. Ensuring a strong application with all necessary documentation can help mitigate the risk of rejection in future loan requests.

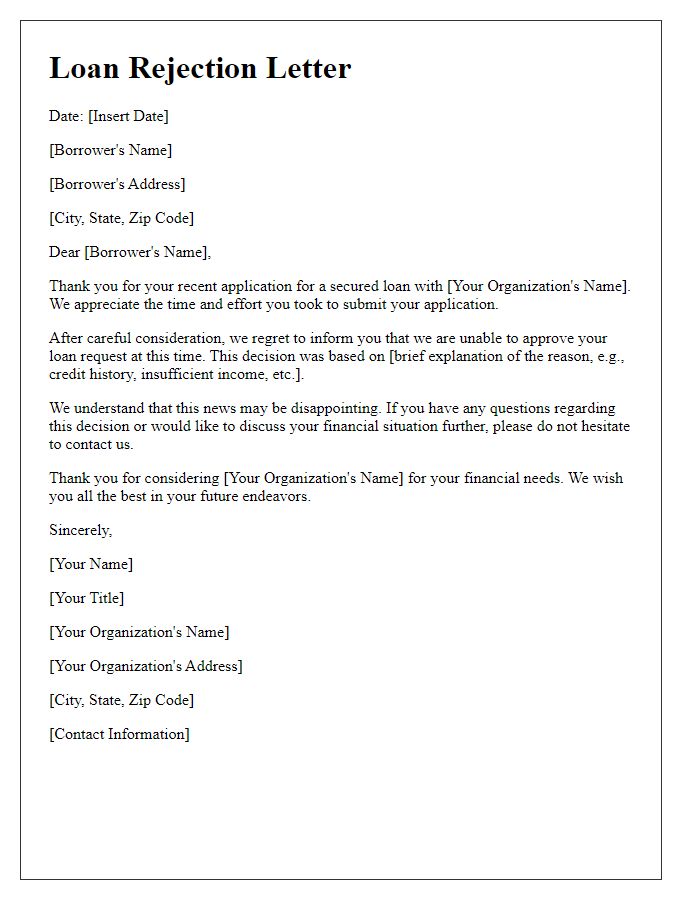

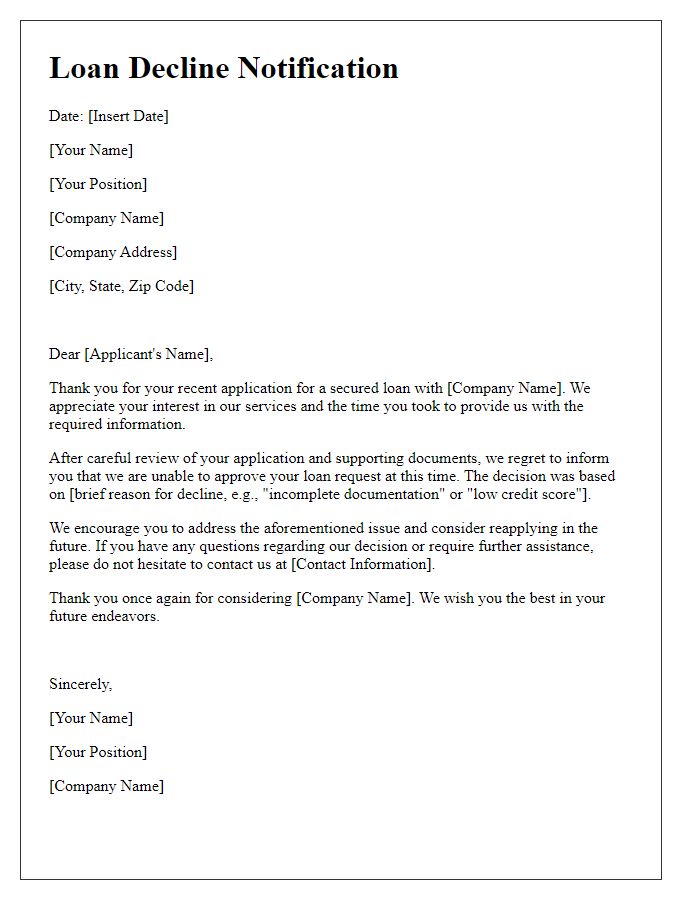

Polite Opening Statement

A secured loan rejection can be a disappointing experience for applicants. A letter addressing this matter needs to convey respect and professionalism while providing clear reasons for the decision. Many factors can influence a loan application's outcome, including credit scores, financial history, and the value of the collateral offered. A polite opening statement sets the tone for the letter, acknowledging the applicant's effort and expressing appreciation for their interest in securing a loan. This approach fosters understanding and maintains a positive relationship between the lender and the borrower.

Specific Reason for Rejection

Secured loans, such as home equity loans or auto loans, can be rejected for various reasons. Insufficient credit history can be a significant factor impacting the approval process. Lenders typically require a minimum credit score, often around 620, to qualify. Additionally, high debt-to-income ratios exceeding 43% may signal financial strain, making lenders hesitant to approve loans. Property appraisal values also play a critical role; if a home is appraised lower than the loan amount requested, the lender may reject the application. Furthermore, inconsistencies in provided documentation, like income verification or employment details, can raise red flags for lenders. Personal bankruptcy filings within the last seven years can also negatively influence the decision.

Encouragement for Future Applications

Secured loans, typically involving property or vehicle collateral, can sometimes be difficult to obtain. A rejection notification might highlight that even if the application was unsuccessful, factors such as credit history and income stability are crucial metrics that can be improved for future attempts. It may also suggest that applicants explore different lenders or loan products that align better with their financial situation. Seeking pre-approval or financial advice could empower borrowers, strengthening their chances of a successful application next time. Understanding the specific reasons for rejection can guide individuals in addressing gaps and enhancing their profiles for subsequent requests aimed at securing necessary funds.

Contact Information for Further Assistance

A secured loan rejection can cause confusion and disappointment for applicants, especially when seeking financial assistance for significant purchases like homes or cars. Loan rejection letters often include contact information for further assistance, which typically lists customer service numbers, dedicated loan officer emails, or online support chat options. These resources allow applicants to ask questions regarding their loan status or eligibility criteria. It's crucial to provide specific instructions on how to reach out, such as specifying business hours or any required documentation for follow-up inquiries. Understanding these options may help applicants navigate their financial journey more effectively.

Comments