Are you feeling overwhelmed by financial obligations and unsure if you qualify for payment forgiveness? You're not aloneâmany people are in similar situations and are discovering options they never knew existed. The good news is that there are programs designed to alleviate some of that stress, allowing individuals to regain their financial footing. Curious about how you can take advantage of these opportunities? Read on to learn more!

Applicant's Financial Hardship Explanation

To qualify for payment forgiveness, applicants must provide a detailed explanation of their financial hardship. Financial hardships may stem from various factors, such as job loss, medical expenses, or unexpected emergencies. It is essential to outline specific circumstances, including the date of job loss (e.g., January 2023), medical bills incurred (e.g., $15,000 for surgery), or other relevant events that have significantly impacted the financial situation. Include information about monthly income changes, reduction in hours worked, or any dependents that increase financial responsibilities. Additionally, incorporating any relevant documentation, like termination letters or medical invoices, strengthens the application, creating a clearer picture of the financial strain faced by the applicant. Providing an honest and comprehensive account of these hardships is crucial to increase eligibility for forgiveness programs.

Documentation of Income or Employment Changes

Documenting income or employment changes is crucial for payment forgiveness qualification. Recent pay stubs reflecting a 20% decrease in income can illustrate financial hardship. Additional documentation, such as a termination letter from an employer, helps establish loss of income due to job loss. If applicable, unemployment benefit statements can showcase eligibility for assistance programs, further solidifying the claim for payment forgiveness. Utilizing tax return forms (Form 1040) from the past year provides a comprehensive view of financial status. Gathering these documents enhances the credibility of the request, potentially accelerating the review process for forgiveness qualification.

Proof of Essential Living Expenses

Essential living expenses include costs necessary for basic survival, such as housing, utility bills, groceries, healthcare (like monthly insurance premiums), and transportation. Detailed documentation, including recent bank statements, invoices, or receipts, must be provided to illustrate these monthly commitments. For example, the average rent in urban areas like New York City can exceed $3,000 monthly, while utility costs, including electricity and water, may add another $200. Food expenses for a family of four typically average around $800 weekly. Healthcare expenses can include costs such as a $200 monthly insurance premium or unexpected medical bills. Transportation costs may range from vehicle maintenance to public transit fares, averaging $150 monthly in some metropolitan areas. This proof is crucial for evaluating qualification for payment forgiveness programs that consider individual financial hardship.

Justification for Payment Forgiveness Request

In recent economic challenges, many individuals, including those affected by the COVID-19 pandemic, face significant financial hardships. A payment forgiveness request often stems from these unforeseen circumstances, such as job loss, reduced income, or unexpected medical expenses, which have made meeting regular payment obligations increasingly difficult. For instance, the unemployment rate skyrocketed to 14.7% in April 2020 in the United States, dramatically impacting households. Additionally, medical expenses associated with COVID-19 hospitalizations can exceed $150,000 for uninsured patients, causing overwhelming debt. A thorough review of financial documentation, including income statements and bills, highlights the genuine need for relief, ensuring that individuals can stabilize their finances and prioritize essential living costs, such as rent or groceries, while pursuing a path towards recovery.

Contact Information and Authorization to Discuss Financial Matters

To qualify for payment forgiveness, individuals must provide accurate contact information, including full name, address, email, and phone number, which facilitates communication regarding financial matters. Authorization to discuss financial situations with designated representatives, such as financial institutions or nonprofit organizations, is essential. Additionally, this authorization allows the processing of sensitive data, including income levels and outstanding debts, which are necessary for a thorough evaluation of eligibility for forgiveness programs. Maintaining up-to-date records ensures adherence to legal requirements and supports transparent communication with all parties involved in the financial assessment.

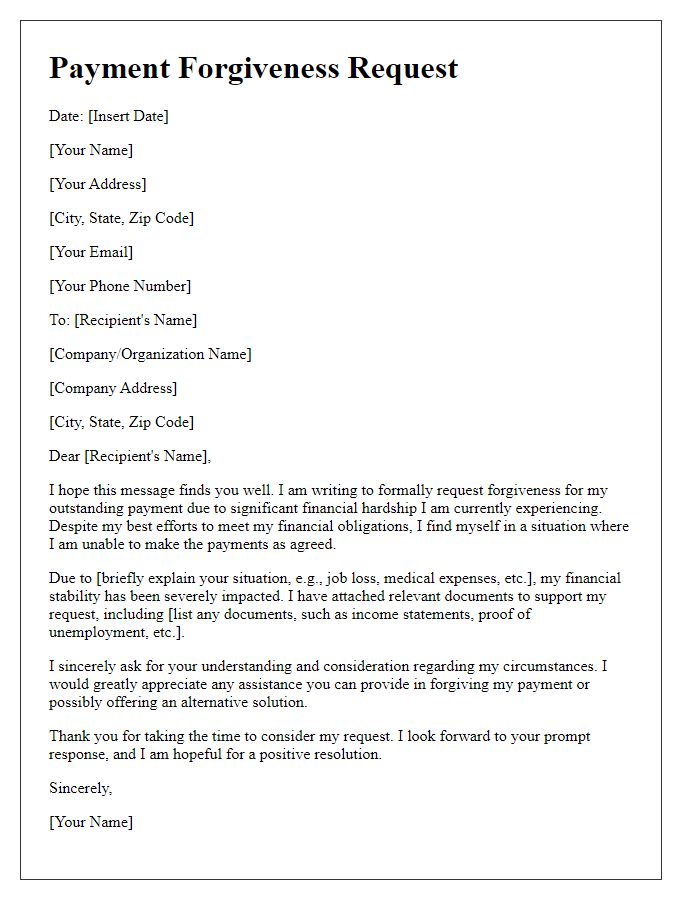

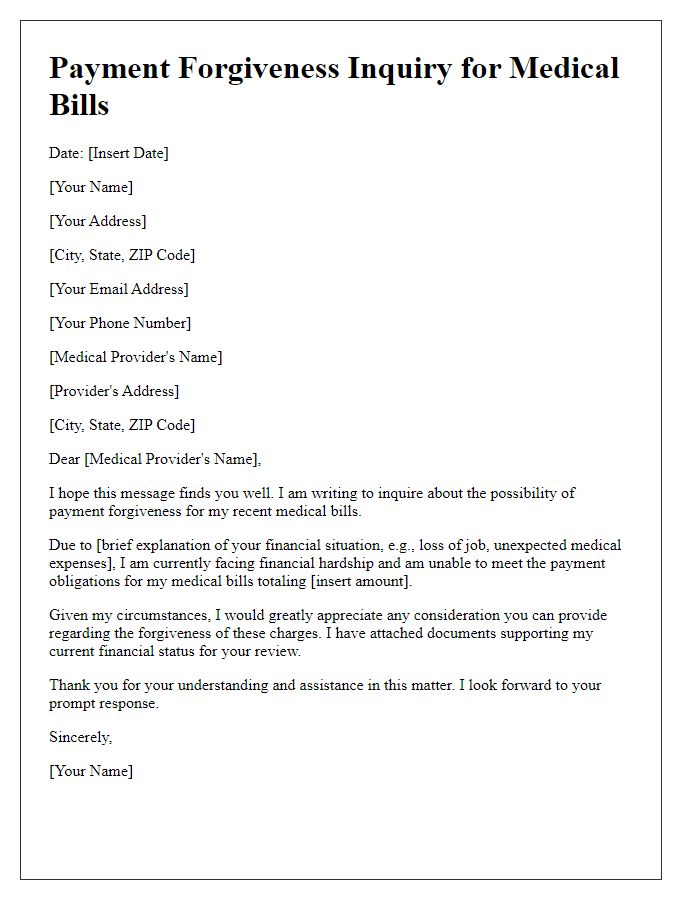

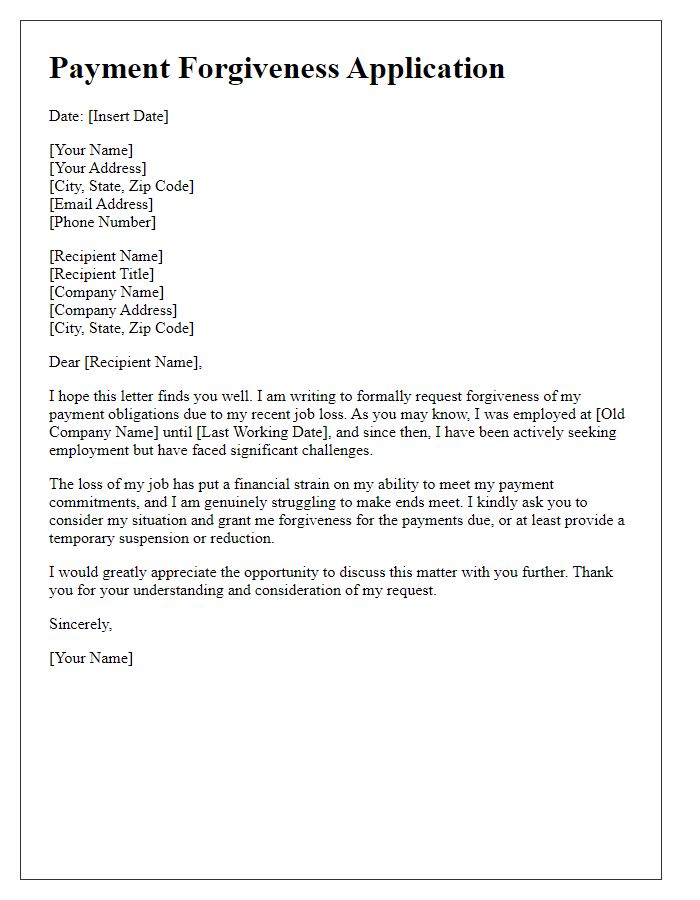

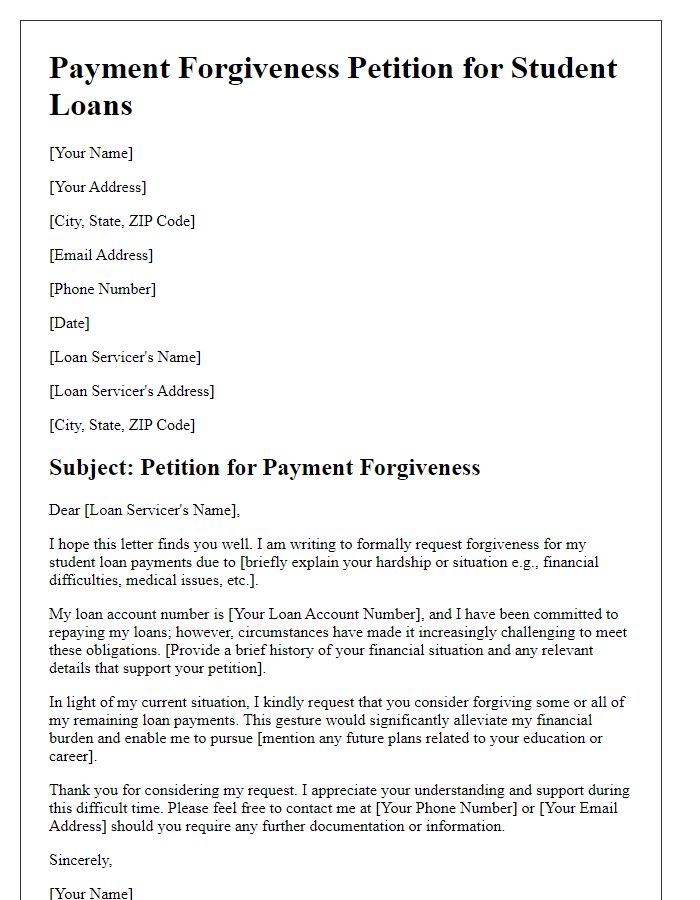

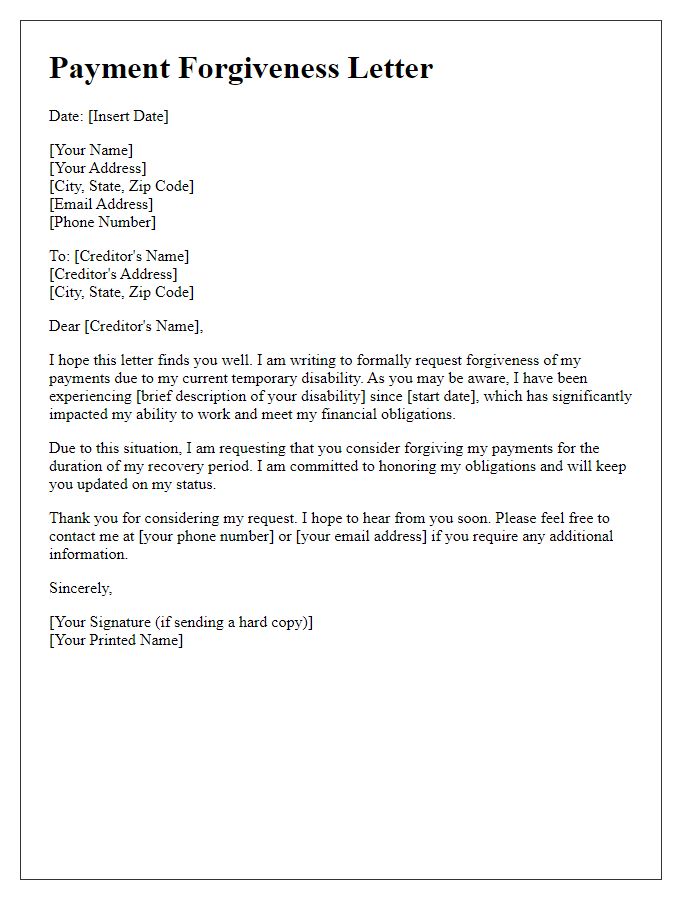

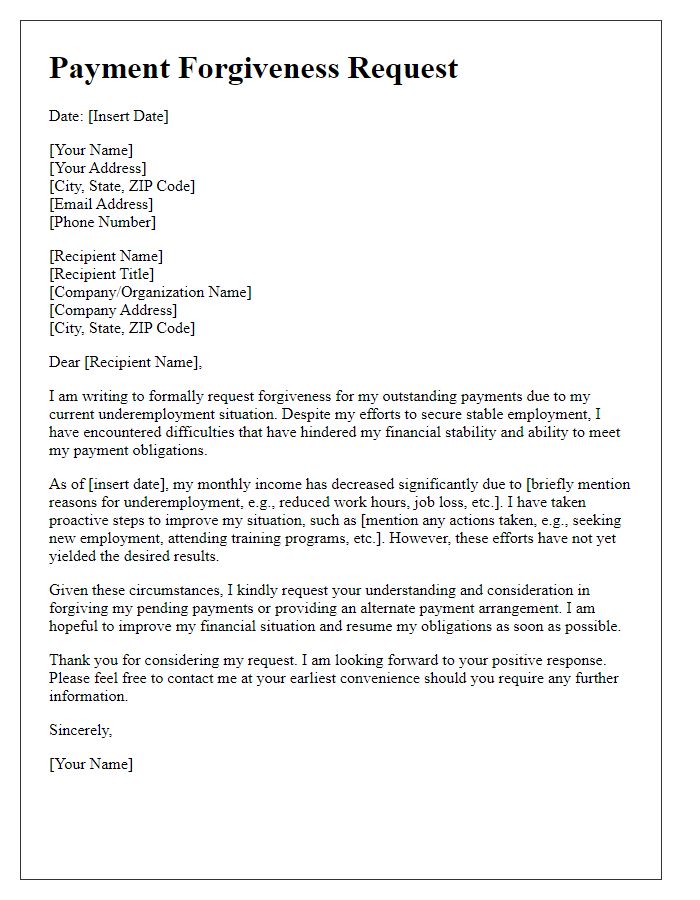

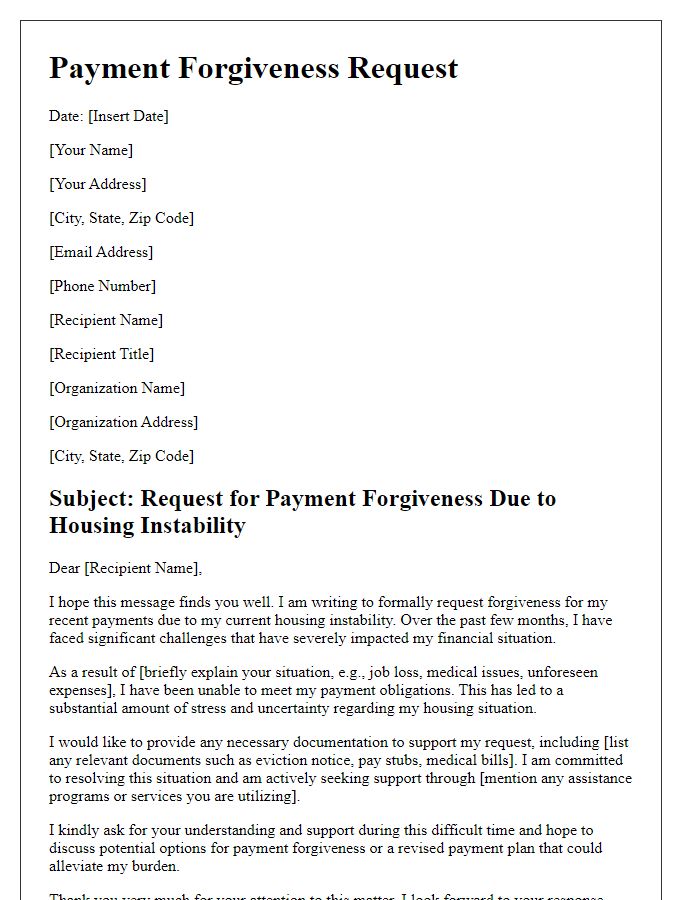

Letter Template For Payment Forgiveness Qualification Samples

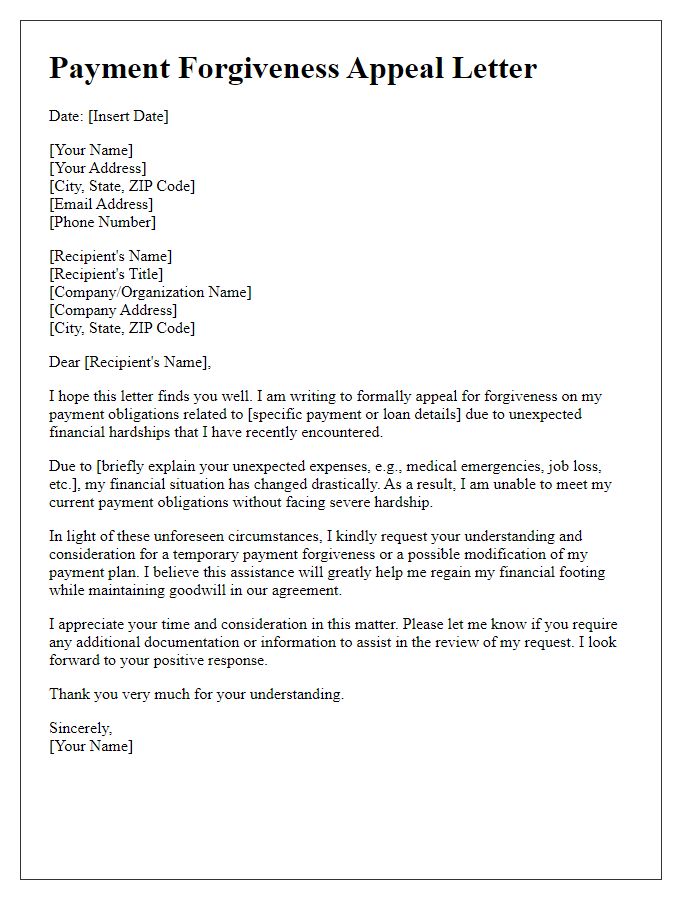

Letter template of payment forgiveness appeal due to unexpected expenses.

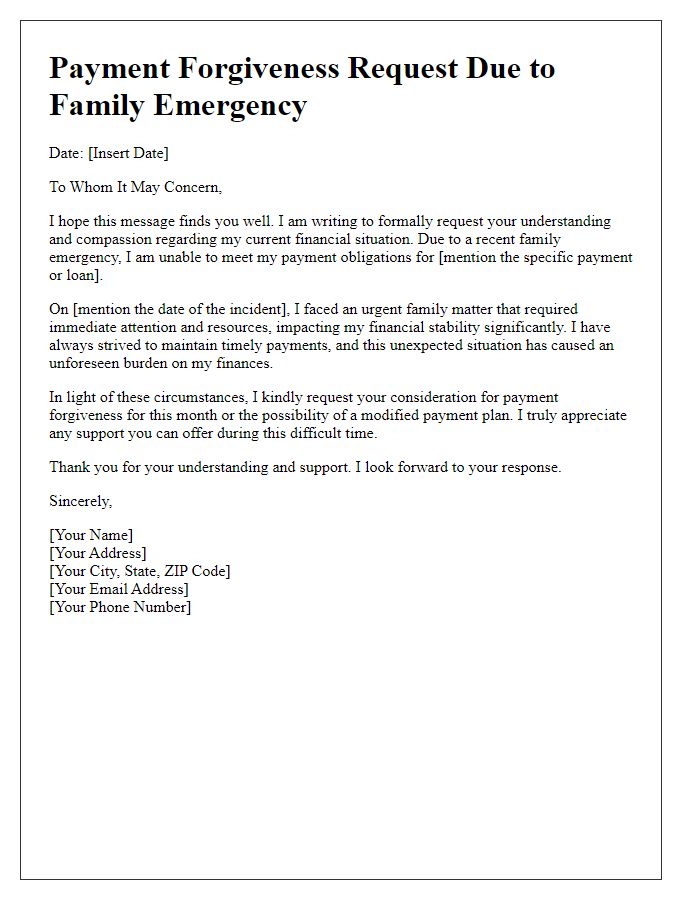

Letter template of payment forgiveness explanation for family emergencies.

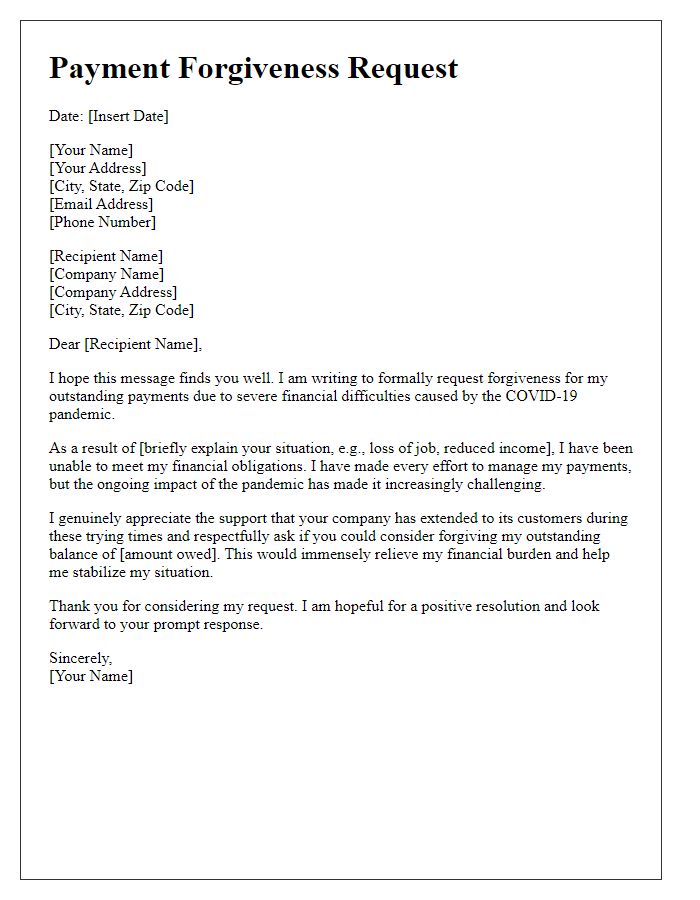

Letter template of payment forgiveness request for pandemic-related issues.

Comments