Are you wondering if you might qualify for down payment assistance? Navigating the world of home buying can be overwhelming, especially with understanding the various assistance programs available. The good news is that many potential homeowners may be eligible for financial help that can ease the burden of a down payment. If you're curious about how these programs work and what criteria you need to meet, keep reading to explore the specifics!

Applicant Information

Down payment assistance programs can significantly aid potential homebuyers in navigating the financial challenges of purchasing real estate. Applicants, typically first-time buyers, may need to provide detailed personal information, including income levels, credit scores, and employment history, to determine eligibility for various programs. Financial institutions or local government agencies often oversee these programs, such as the Federal Housing Administration (FHA) or state housing finance agencies. These agencies assess applicants' financial situations based on metrics like debt-to-income ratios, which should ideally be below 43%. Additionally, geographic restrictions may apply, with certain assistance programs available only in specific areas, such as urban development zones or regions with high cost-of-living indices. Understanding these criteria is essential for applicants seeking to leverage down payment assistance effectively.

Program Eligibility Criteria

Down payment assistance programs, such as those offered by the Federal Housing Administration (FHA), provide critical support to first-time homebuyers seeking to purchase a home in areas like Los Angeles, California. Eligibility criteria typically include a minimum credit score of 620, a debt-to-income (DTI) ratio not exceeding 43%, and completion of a homebuyer education course. Income limits, often set at 80-120% of the area median income (AMI), vary based on local market conditions and family size. Applicants must also demonstrate residency or intent to purchase within specific neighborhoods designated for revitalization. Understanding these specific benchmarks ensures prospective homeowners can navigate these programs effectively.

Financial Documentation Requirements

Down payment assistance programs often require specific financial documentation to determine eligibility for homebuyers. Applicants must provide proof of income, including recent pay stubs (typically last two months) and W-2 forms from the past two years, to demonstrate stable earnings. Additionally, bank statements for the last two to three months should be submitted, detailing savings and checking accounts, to assess available funds. Applicants may also need to provide a credit report reflecting their credit history and score, with many programs expecting a minimum score of around 620. Furthermore, tax returns from the previous two years may be necessary to give a complete financial picture, especially for self-employed individuals. Documenting household size and associated income can also impact eligibility, as many programs aim to assist low to moderate-income families.

Approval Process and Timeline

Down payment assistance programs provide crucial financial support to homebuyers, particularly in high-cost markets like San Francisco and New York. These programs typically involve an application process including documentation such as income verification, credit scores, and information on the property being purchased. Approval timelines can vary significantly based on the specific program; for instance, state programs may take approximately 4 to 6 weeks, while local initiatives could expedite this to 2 to 3 weeks. Key elements influencing eligibility include the buyer's income, often capped at 80% of the area median income, and completion of homebuyer education courses. Overall, understanding these factors is vital for prospective buyers aiming to secure the necessary funding to facilitate their home purchasing journey.

Contact Information for Assistance

In the realm of housing affordability, down payment assistance programs provide essential financial support for potential homeowners. Among these programs, the Federal Housing Administration (FHA) guidelines stipulate that eligible candidates can receive aid facilitating their journey towards homeownership. Local government initiatives often cater to low-income families, with specific income thresholds varying by state or city, for instance, California's income cap at 80% of the area median income (AMI). Additionally, nonprofit organizations, such as Habitat for Humanity, also extend down payment assistance alongside counseling services to educate first-time buyers. Interested individuals can reach out to local housing authorities or community development offices for personalized information regarding available resources and eligibility requirements, primarily aimed at increasing access to affordable housing.

Letter Template For Down Payment Assistance Eligibility Samples

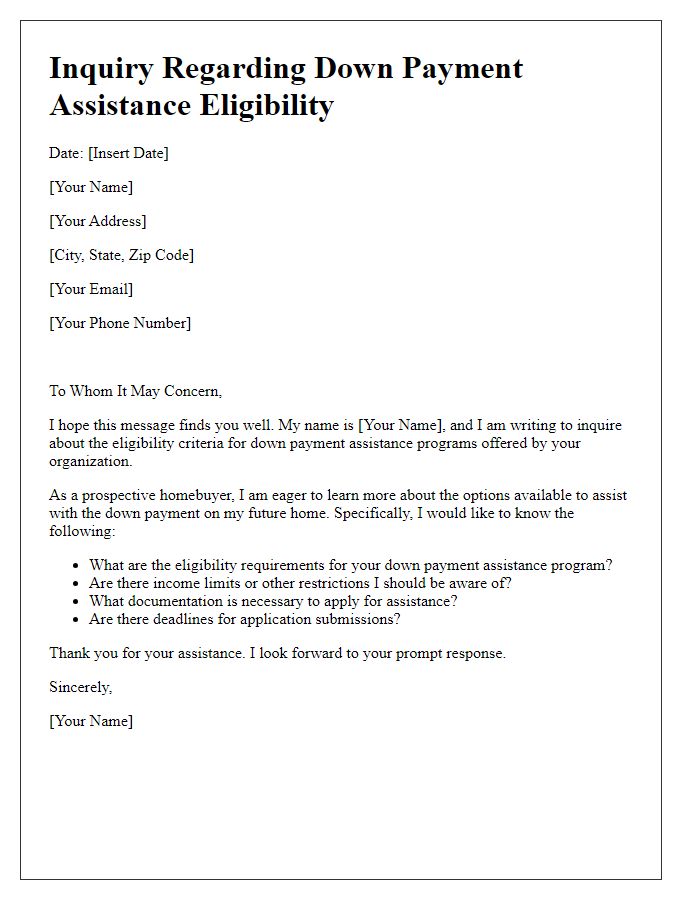

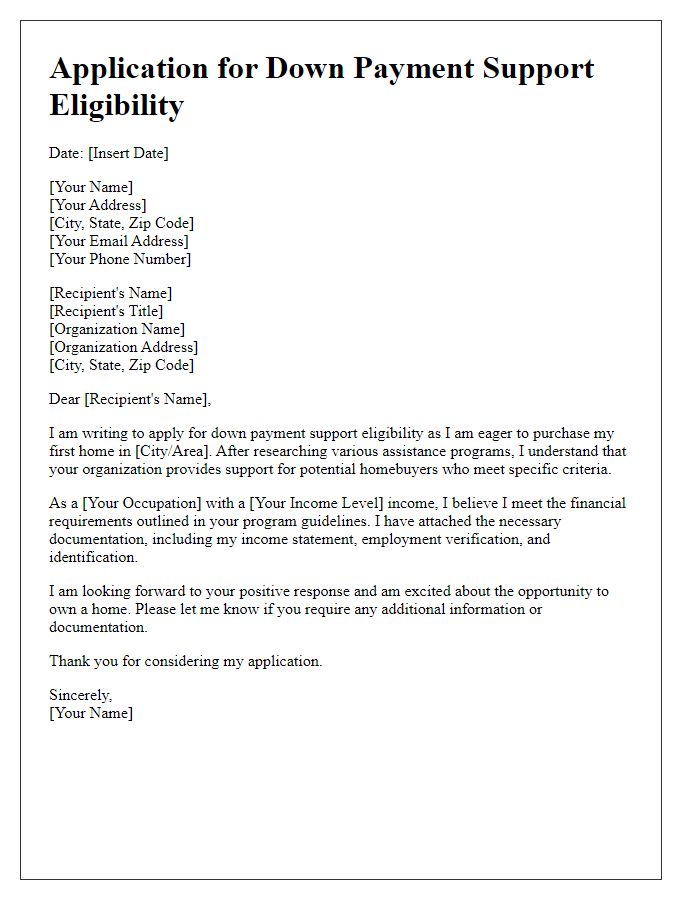

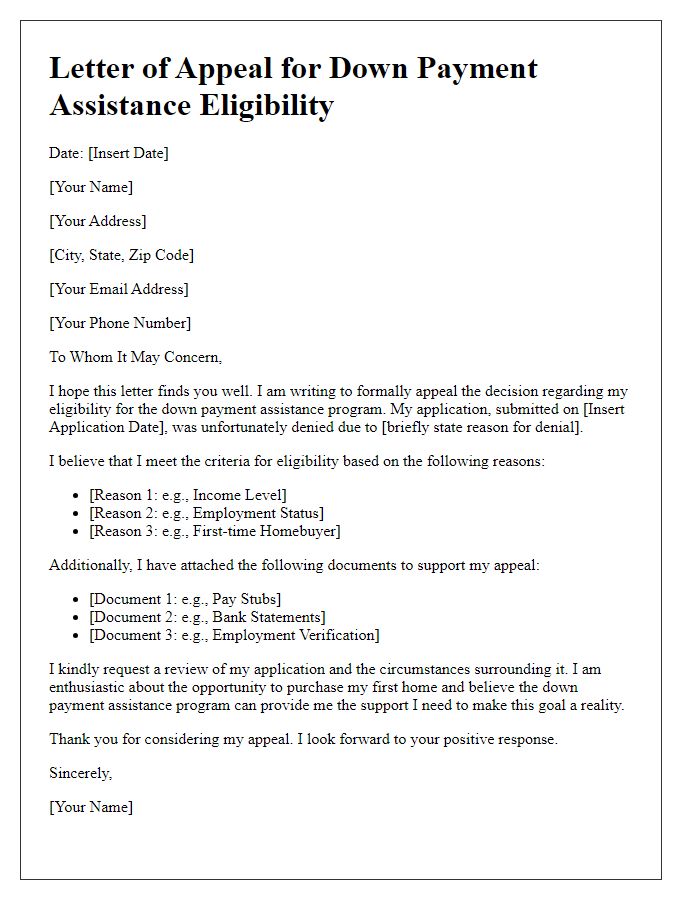

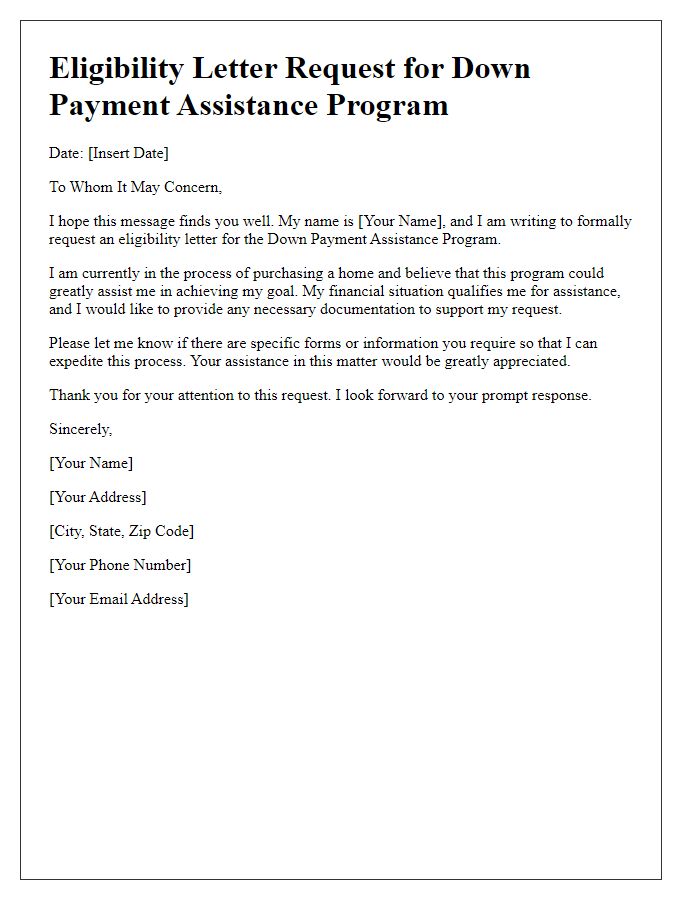

Letter template of inquiry regarding down payment assistance eligibility.

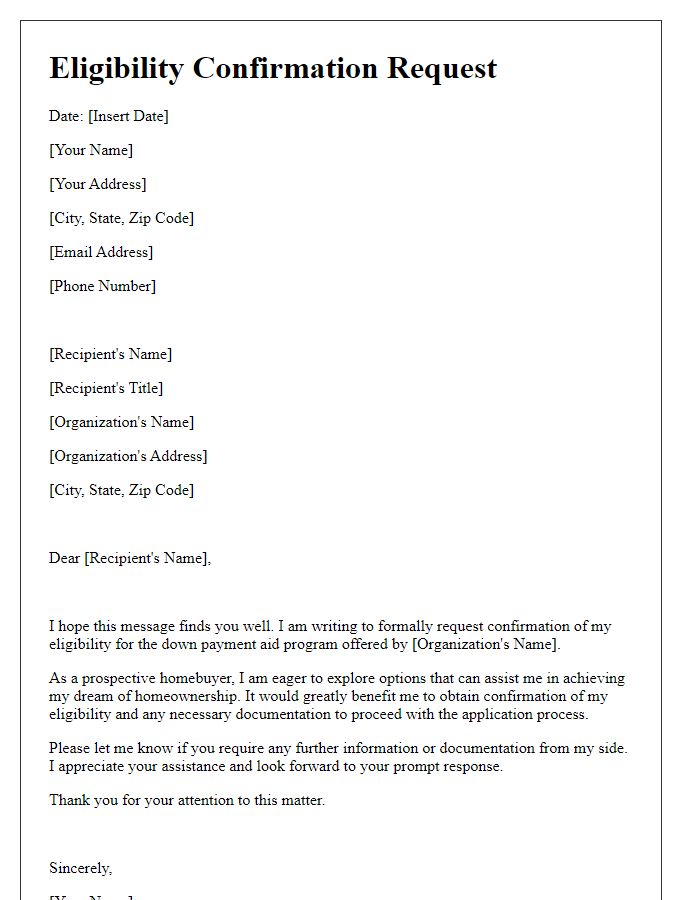

Letter template of eligibility confirmation request for down payment aid.

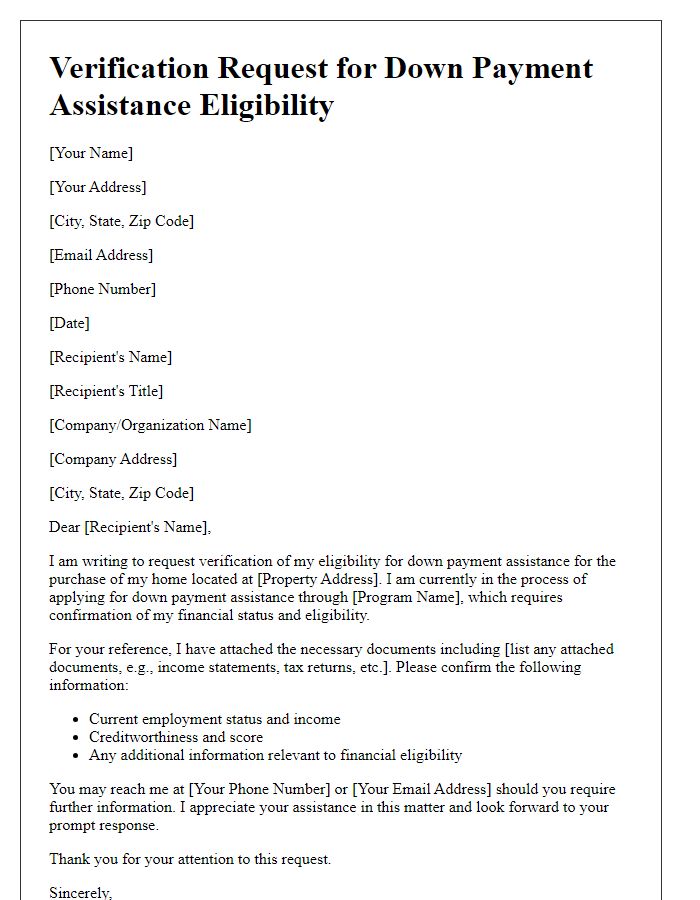

Letter template of verification request for down payment assistance eligibility.

Letter template of inquiry for eligibility requirements for down payment aid.

Letter template of eligibility assessment request for down payment assistance.

Letter template of consultation request about down payment assistance eligibility.

Comments