Are you looking to navigate the process of a cosigner release request? Understanding the ins and outs can simplify what might seem like a daunting task. Essentially, a cosigner release is a formal request to remove a cosigner from a loan agreement, often involving a few key steps and documentation. Join us as we delve deeper into the process and provide tips to make your request as smooth as possible!

Cosigner's Personal Information

A cosigner release request involves various details that ensure clarity and facilitate processing. Important personal information for the cosigner includes full name (John Doe), contact number (555-123-4567), and email address (johndoe@email.com). Additionally, the cosigner's address (123 Elm Street, Springfield, IL 62704) is crucial for correspondence. The specific loan identification number (L123456789) relates directly to the financial agreement under review. Furthermore, the debt amount ($15,000) and the lender's name (XYZ Financial Services) play significant roles in the documentation process, ensuring the request's legitimacy and accuracy. Each detail helps expedite the review and approval of the cosigner release.

Borrower's Personal Information

In financial agreements, a co-signer release request involves specific borrower details, vital for identity verification and processing. The borrower's full name (John Doe), Social Security Number (123-45-6789), and current address (123 Oak Street, Springfield, IL 62704) form the basis of the request. Other essential identifiers include the loan account number (987654321) linked to a personal loan issued by ABC Bank on January 15, 2020. Contact information is also crucial; a valid email address (john.doe@email.com) and a phone number (555-123-4567) are necessary for communicating updates. Providing these details ensures an efficient review by the financial institution, expediting the co-signer release process.

Loan Details and Context

A cosigner release request typically involves the following loan details and context. This includes the original loan amount of $25,000 secured in March 2020, through ABC Bank, specifically intended for funding educational expenses at XYZ University. The loan has consistently been repaid on time over a three-year period, demonstrating responsible financial behavior. As of October 2023, the remaining balance stands at $10,000, with a history of no late payments. XYZ University, located in New York City, has seen the borrower graduate, leading to employment with a respectable salary. The request is aimed at releasing the cosigner, the borrower's parent, from any future obligations, emphasizing the significant improvements in the borrower's financial independence and creditworthiness since the loan's inception. This request must comply with the lender's policies, highlighting stability in income and ongoing successful payment track records.

Reason for Release Request

A cosigner release request is often made when the primary borrower has shown consistent, responsible repayment behavior. Factors influencing this request may include making timely payments for a predetermined duration, often 12 to 24 months, demonstrating improved creditworthiness as indicated by an increase in credit scores, and obtaining a stable income that affirms the borrower's ability to independently manage the loan. Financial institutions, such as major banks or credit unions, often require specific documentation such as proof of income, updated credit reports, and payment history to validate the request. A successful release can alleviate the financial burden on the cosigner, often a family member or close friend, thereby allowing them to pursue other credit opportunities without being tied to the existing obligation.

Supporting Documentation and Evidence

The process of requesting a cosigner release often requires substantial documentation to support the claim. Essential documents may include the original loan agreement outlining the responsibilities of all parties involved. Recent financial statements showcasing personal income, debts, and credit scores, particularly if they demonstrate the ability to manage payments independently, are crucial. Tax returns from the past two years help establish stable income sources. Letters of good standing from the lender indicate timely payments over a specified duration, usually 12 to 24 months, which can bolster the request for release. Additionally, personal identification documents, such as a driver's license or passport, verify identity throughout this formal process, reinforcing the case for the cosigner's release.

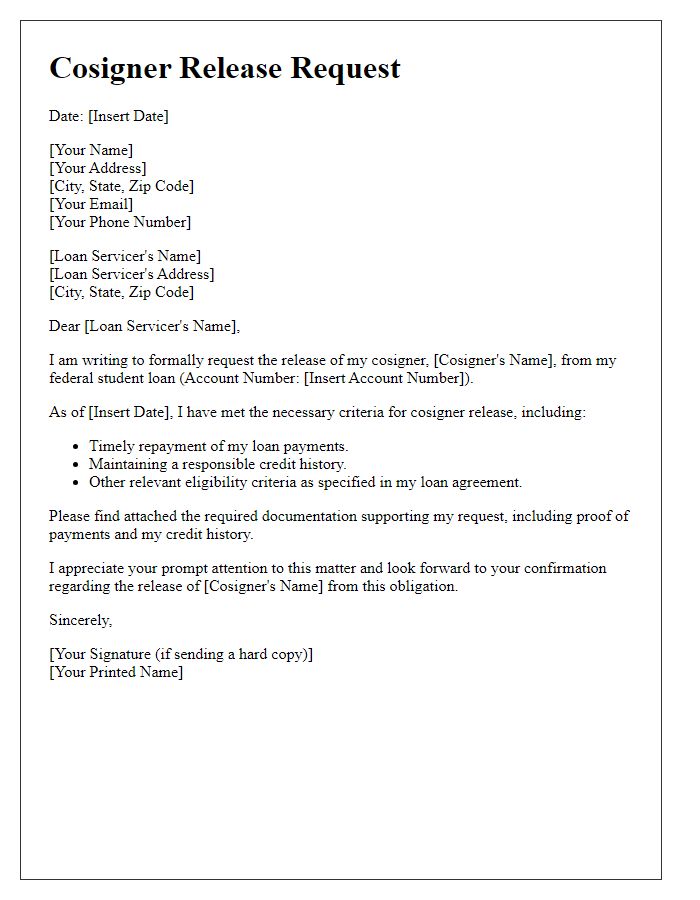

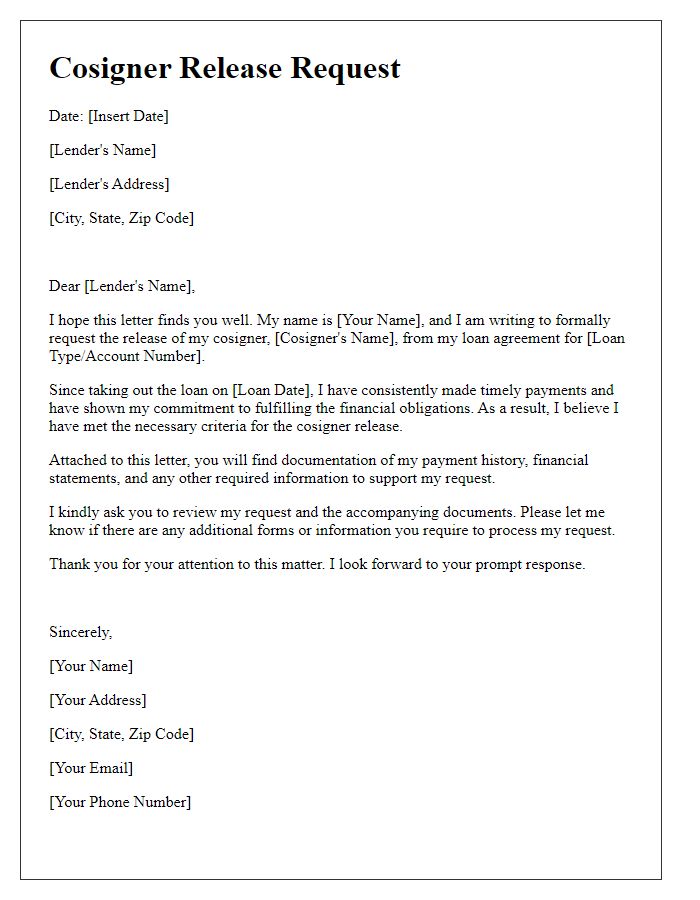

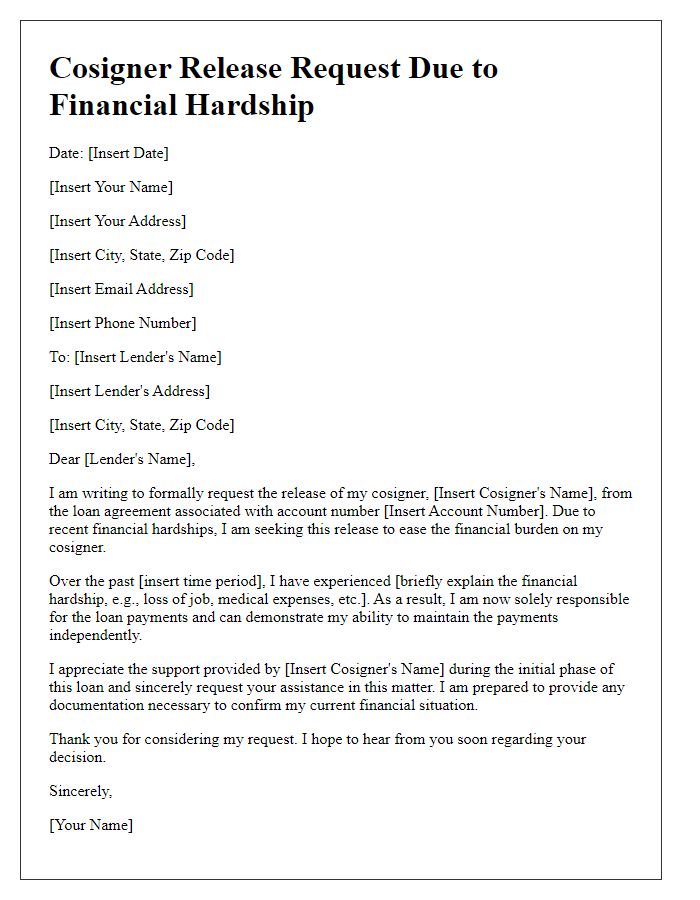

Letter Template For Cosigner Release Request Samples

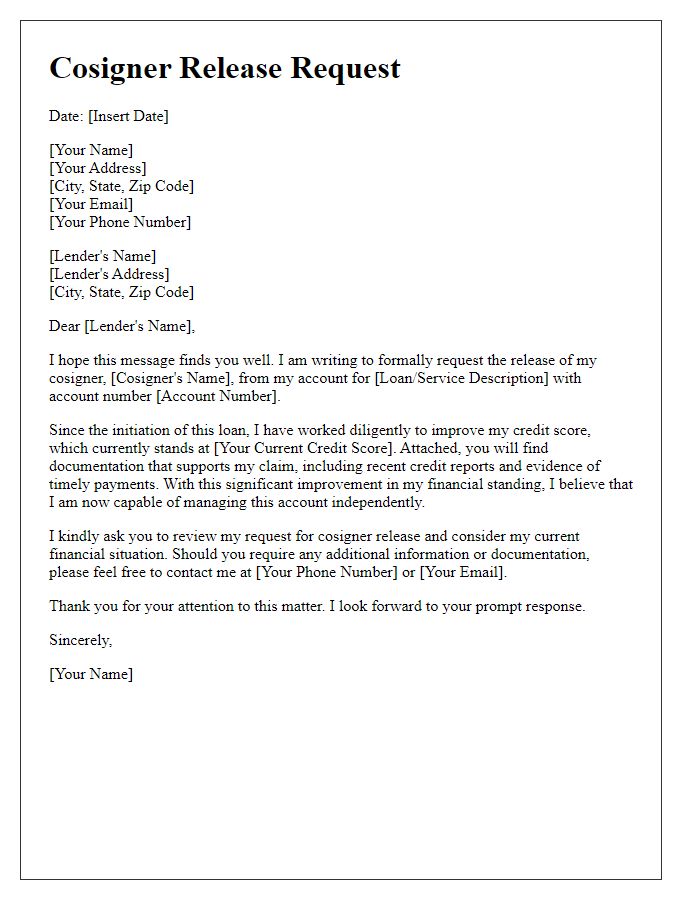

Letter template of cosigner release request due to improved credit score.

Comments