Navigating the world of loans can often feel overwhelming, especially when it comes to understanding the terms that govern your agreements. One critical aspect that borrowers frequently overlook is the prepayment penalty, a fee that lenders may impose if you pay off your loan early. This advisory aims to shed light on what prepayment penalties entail and why you should consider them before signing on the dotted line. Join us as we delve deeper into how these penalties can impact your financial decisions and what options you haveâread on to learn more!

Clear explanation of prepayment penalty terms

Prepayment penalties in loan agreements serve as fees imposed when a borrower pays off a loan early, often specified in mortgages or personal loans through service providers like banks or credit unions. Commonly expressed as a percentage of the remaining balance or as a set number of months' worth of interest, these penalties can vary significantly based on local laws and lender policies. For instance, a prepayment penalty might be applicable during the first five years of a 30-year fixed-rate mortgage and can range from 2% to 5%. This penalty exists to ensure lenders receive a return on their investment, as early repayment can reduce total interest collected. Borrowers should thoroughly review loan documents for specific terms regarding eligibility, duration, and calculation of penalties to avoid unexpected financial burdens. A detailed understanding can effectively inform financial planning and decision-making.

Details of the financial implications

Prepayment penalties can significantly impact the financial strategy of borrowers, especially in loan agreements such as mortgages. Typically structured as a percentage of the remaining principal balance, these penalties can range from 2% to 5% depending on the lender and loan terms. For example, a borrower with a $300,000 mortgage who pays off the loan early might incur a prepayment penalty of $6,000 at a rate of 2%. Events such as refinancing or selling the property can trigger these fees, hindering potential savings from lower interest rates or the proceeds of a sale. Awareness of contractual stipulations regarding prepayment penalties is crucial for financial planning and decision-making.

Options for prepayment without penalty

Prepayment penalties can significantly impact homeowners seeking to refinance or pay off their mortgage early. In many cases, lenders impose these penalties to recover lost interest income when borrowers choose to pay off their loans ahead of schedule. However, various alternatives exist that allow homeowners to make prepayments without incurring additional costs. For example, some mortgage agreements include provisions such as "no prepayment penalty" within the first few years or for granted certain conditions. Homeowners may also inquire about specific dates that allow penalty-free payments, or consider refinancing with lenders offering flexible prepayment options. Providing clarity on these details can empower borrowers to make informed decisions regarding their mortgage obligations.

Contact information for further clarification

Prepayment penalties can significantly impact loan agreements, particularly in mortgage contracts. Financial institutions often impose these fees to recover lost interest income when borrowers pay off loans before the scheduled term. Commonly, prepayment penalties can range from a few months of interest to up to 5% of the remaining loan balance. These fees typically apply during the initial years of the loan, commonly the first three to five years, depending on the lender's policies. Borrowers considering early repayments should carefully review their loan documents, particularly sections discussing prepayment clauses, and may benefit from consulting financial advisors for specific implications related to their contract and unique financial situation.

Personalized greeting and closing remarks

Prepayment penalties can pose significant financial implications for borrowers seeking to pay off loans early. Such fees, typically expressed as a percentage (ranging from 1% to 5%) of the outstanding loan balance, can deter borrowers from refinancing or making substantial payments beyond scheduled installments. Loan agreements, particularly in mortgage contracts from lenders in the United States, often outline these penalties with specific timeframes (usually within the first five to seven years of the loan term) when they are applicable. Understanding these penalties is crucial for borrowers considering early payment options; they should review loan terms closely to avoid unexpected costs that could negate financial benefits.

Letter Template For Prepayment Penalty Advisory Samples

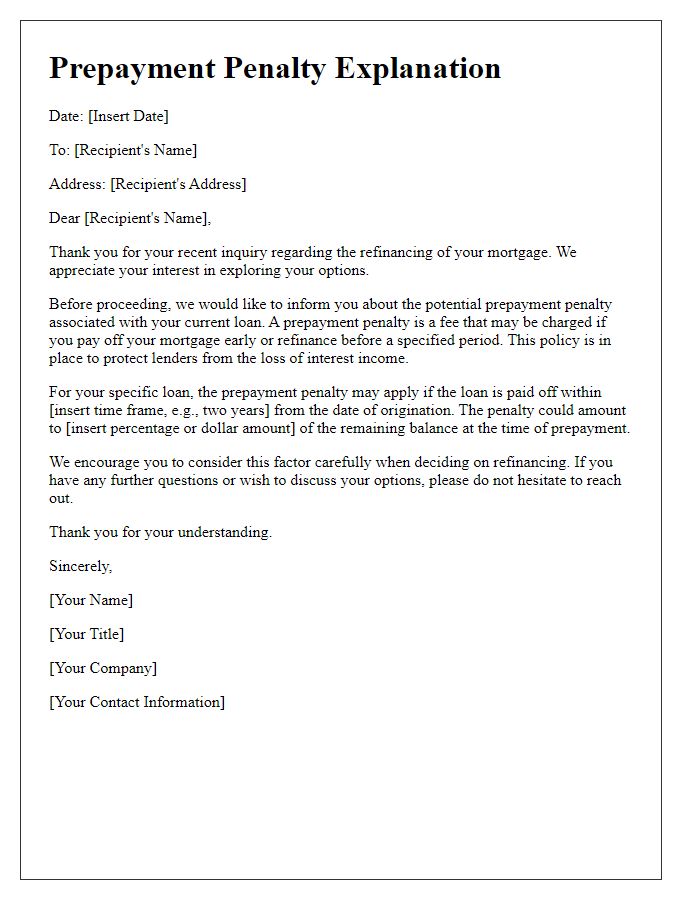

Letter template of prepayment penalty explanation for refinancing inquiries.

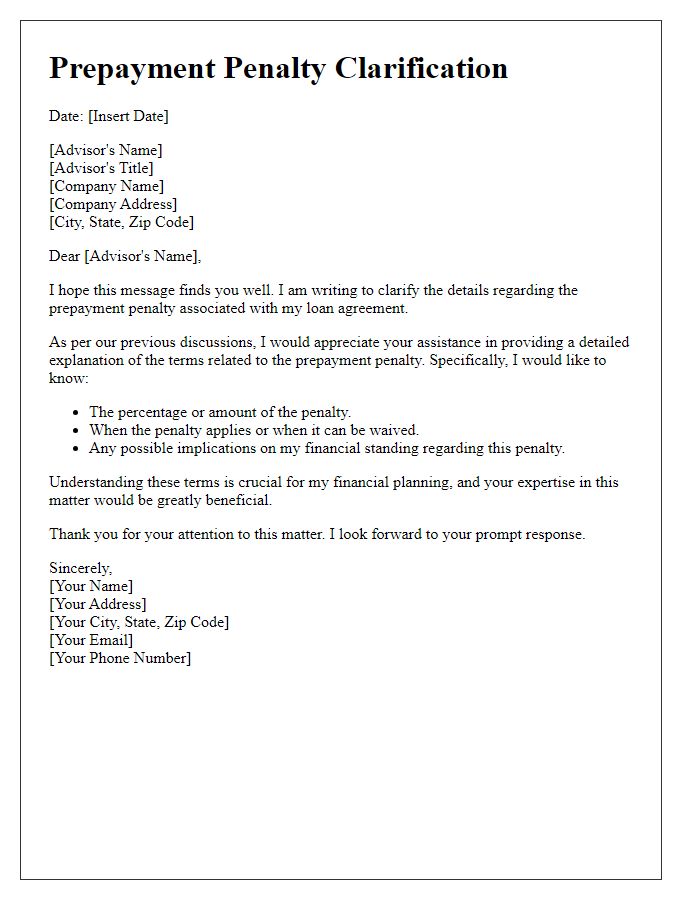

Letter template of prepayment penalty clarification for financial advisors.

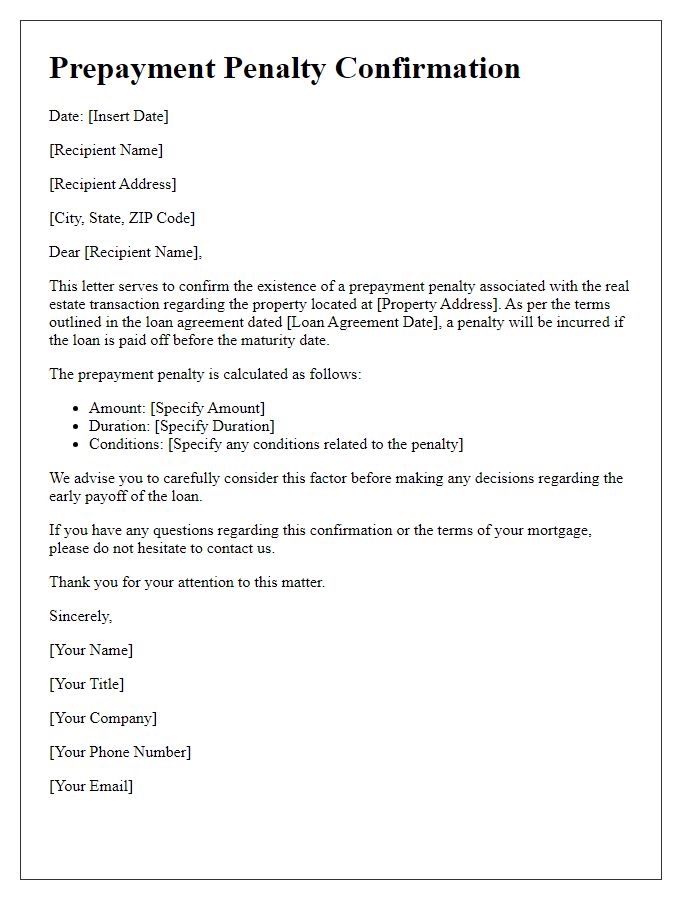

Letter template of prepayment penalty confirmation for real estate transactions.

Letter template of prepayment penalty acknowledgment for customer service.

Letter template of prepayment penalty waiver request for special circumstances.

Comments