Are you looking for a way to modify your repayment schedule? It's entirely normal to find yourself in a situation where adjustments are needed, whether due to unexpected expenses or a change in income. Crafting a well-structured letter can help facilitate this process smoothly and ensure clear communication with your lender. If you're interested in learning how to effectively write this letter, read on for useful tips and a sample template!

Clear identification of parties involved

A repayment schedule amendment requires a precise articulation of the parties involved, often including the lender, typically a financial institution or individual, and the borrower, an individual or business seeking to modify loan terms. The lender's official name, address, and contact details establish their identity, while the borrower's full legal name, address, and any relevant identifiers such as a Social Security Number (SSN) or Business Identification Number (BIN) strengthen clarity. Additionally, this document may include loan reference details, such as the loan number, date of origination, and original repayment terms, so that all parties can easily reference the specific agreement being amended. This clear identification ensures all parties are correctly acknowledged within the context of the proposed changes, preventing any misunderstandings or legal disputes.

Specific details of the original agreement

A repayment schedule amendment involves careful consideration of the original terms agreed upon in a financial contract. For instance, in a loan agreement dated March 15, 2022, a borrower committed to repay a total amount of $10,000 with a fixed interest rate of 5% over a period of two years, which included monthly installments of $500. The original agreement stipulated that payments would be due on the 1st of each month. Important details include the specific payment infrastructure outlined for automatic deductions from the borrower's bank account (Bank of America), which ensures timely payments. Any amendment must reference these original conditions to provide a clear basis for renegotiation.

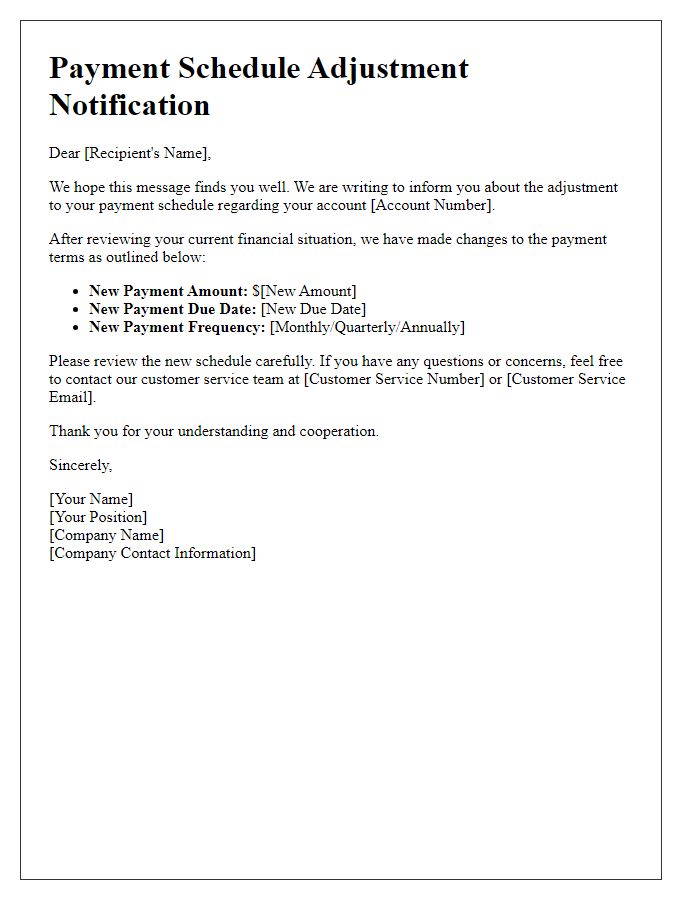

Proposed changes to repayment terms

Borrowers may seek modifications to repayment schedules for loans, particularly for small business loans from lenders such as banks or credit unions. Proposed changes might include extending the repayment period from three years to five years, resulting in lower monthly payments, perhaps decreasing from $1,000 to $700. Another option involves adjusting the interest rate, potentially lowering it from 6% to 4%, which would significantly decrease the total cost of the loan over time. Additionally, borrowers may request a temporary deferment of payments for six months, providing necessary relief during financial hardship without accumulating penalties. Such amendments must be documented formally and include specific terms, dates, and any applicable fees to ensure clarity and mutual agreement.

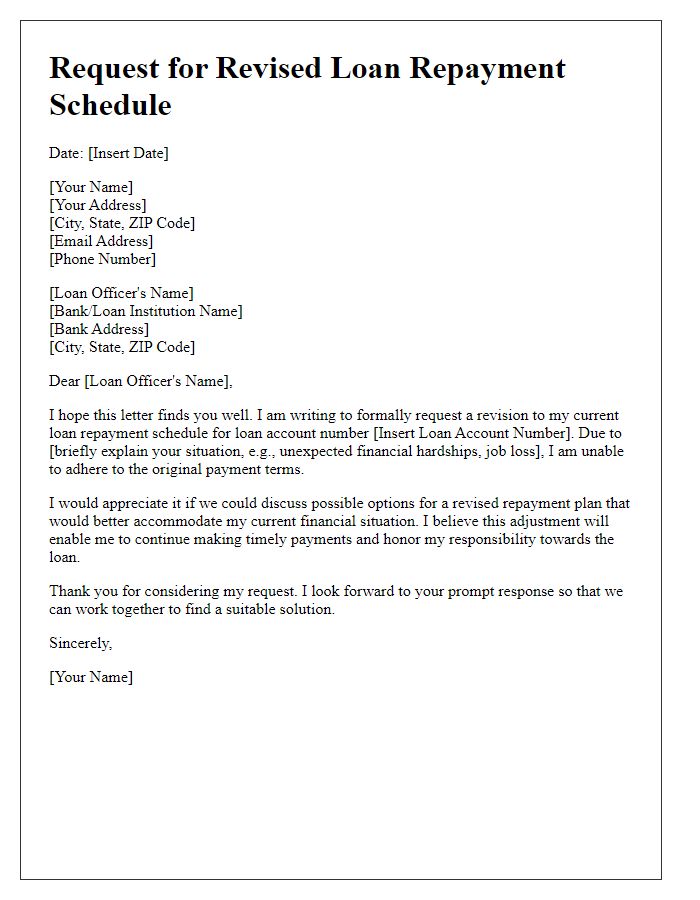

Rationale for amendment request

A request for a repayment schedule amendment can arise from several circumstances that impact financial stability. An unexpected health event, such as a major surgery requiring significant medical expenses, can result in temporary income loss. Job loss during economic downturns, approximately affecting 20 million individuals in recent years, often necessitates adjustments to repayment terms. Additionally, natural disasters like hurricanes (e.g., Hurricane Harvey) can disrupt livelihoods, prompting a request for revised payment timelines. Financial emergencies can strain budgets, making it difficult to adhere to original repayment schedules, which might have been set based on prior financial conditions significantly different from the current situation.

Contact information for further discussion

If a repayment schedule amendment is required, providing contact information is crucial for discussing terms in detail. Include your full name, a relevant reference number for the repayment arrangement, and the current date. Provide a phone number, including the country code for international calls, and an active email address for prompt communication. Specify preferred contact hours to facilitate timely responses. For businesses or organizations, include the company name, position, and additional relevant contact methods such as a fax number or mailing address if necessary.

Comments