Are you considering applying for a joint loan but feeling overwhelmed by the process? You're not alone! Many individuals find themselves navigating the complexities of joint applications, especially when it comes to understanding credit scores, income verification, and responsibilities shared between borrowers. Join us as we break it all down, making the journey to securing your dream loan a breezeâread on to discover more!

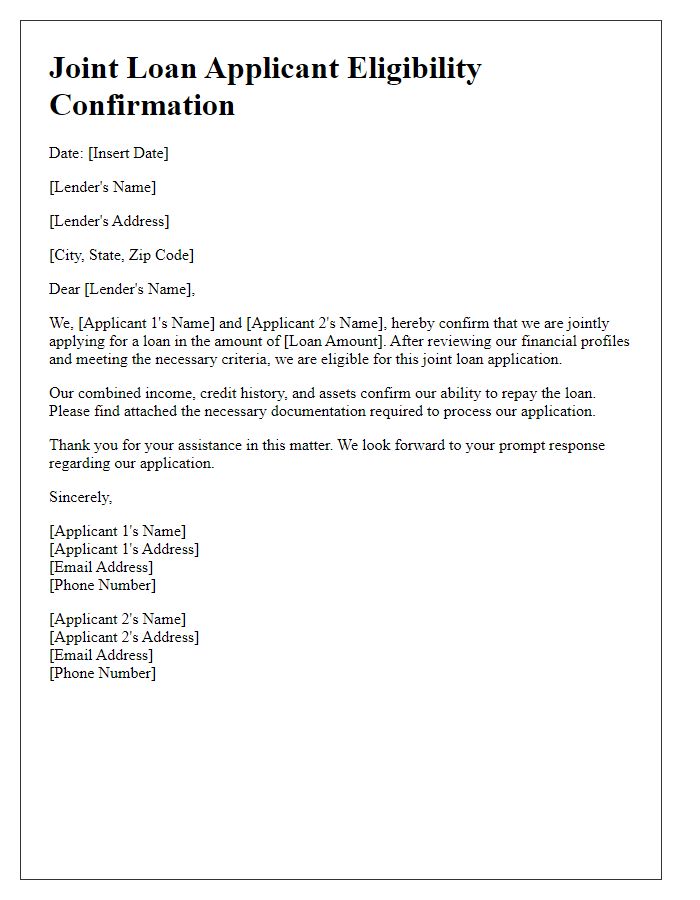

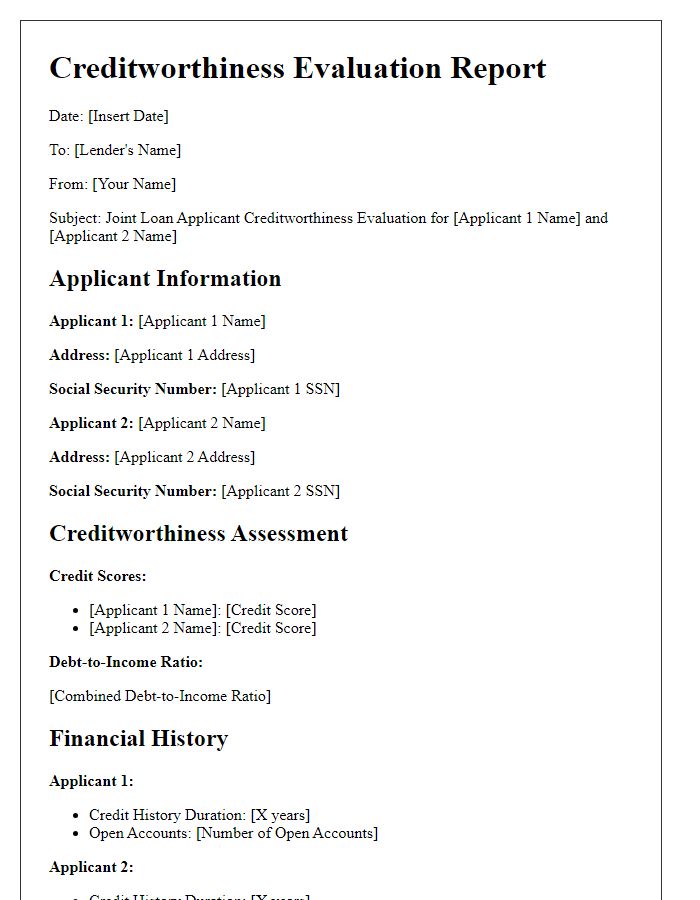

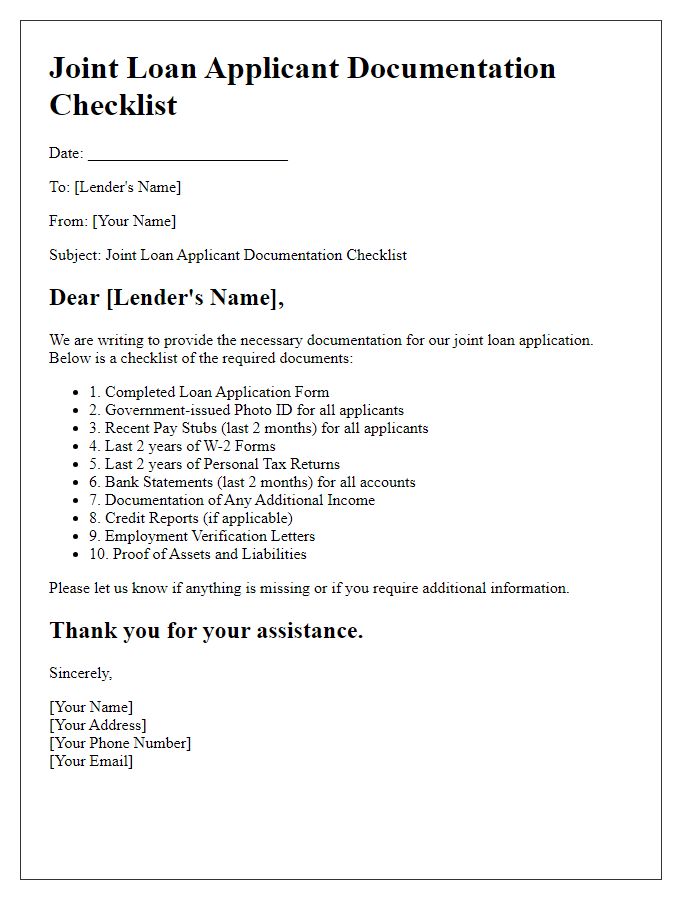

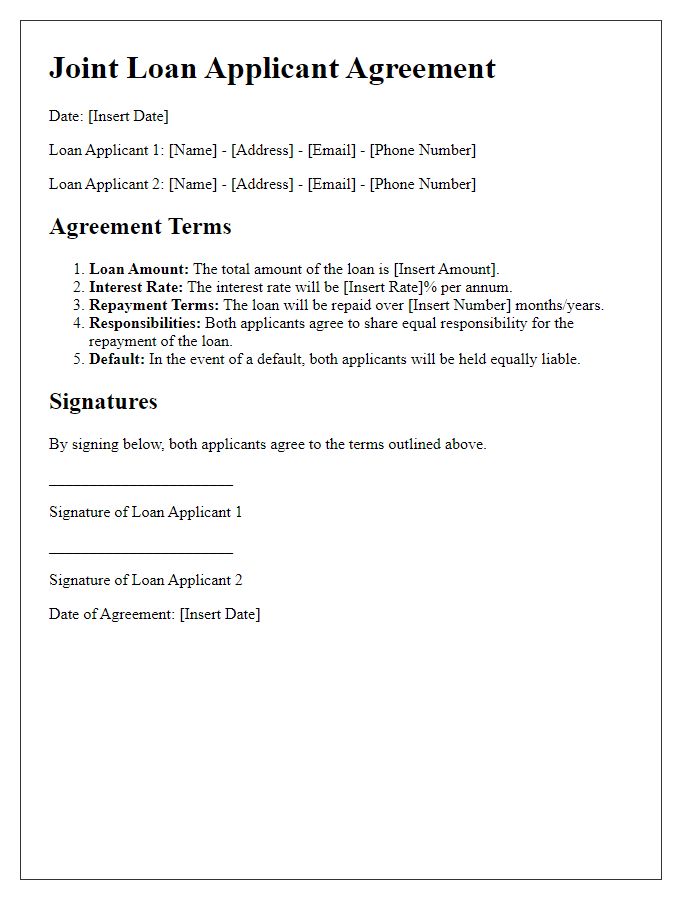

Applicant Information Verification

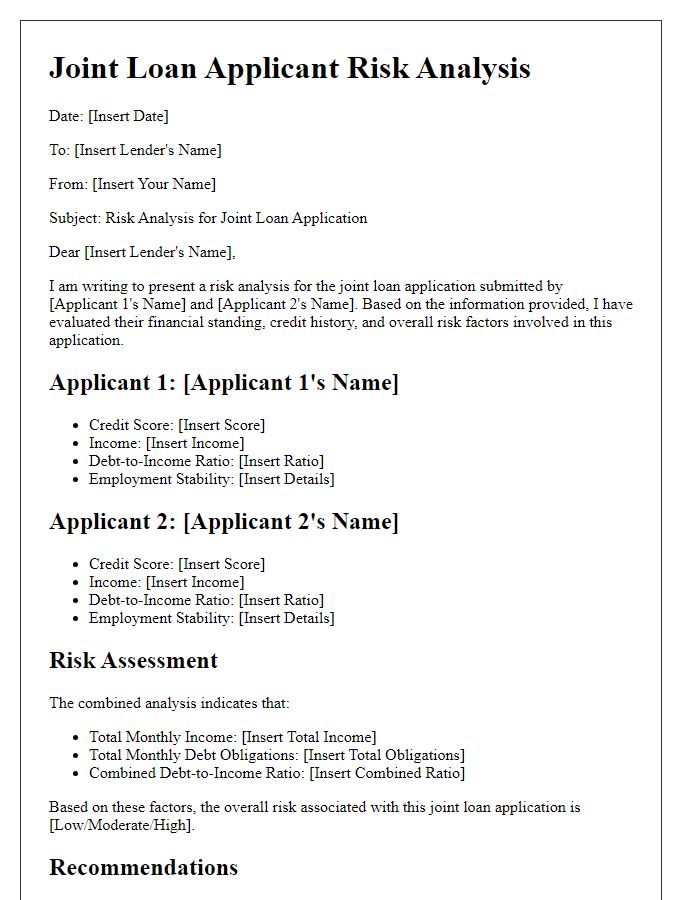

In the joint loan applicant review process, applicant information verification is critical for assessing creditworthiness and financial responsibility. Mortgage applicants submit financial documents such as W-2 forms (reporting wages and tax withholding) and bank statements (showing account balances and transaction history) for the previous three months. Credit scores are obtained from major credit bureaus, including Experian, TransUnion, and Equifax, with a minimum score requirement typically around 620 for conventional loans. Employment verification includes reaching out to current employers to confirm job status and income consistency. Additionally, debt-to-income ratios (ratio of total monthly debt payments to gross monthly income) must be calculated to determine the applicants' ability to manage monthly loan payments. Consistency across provided information ensures a thorough evaluation for the lending decision.

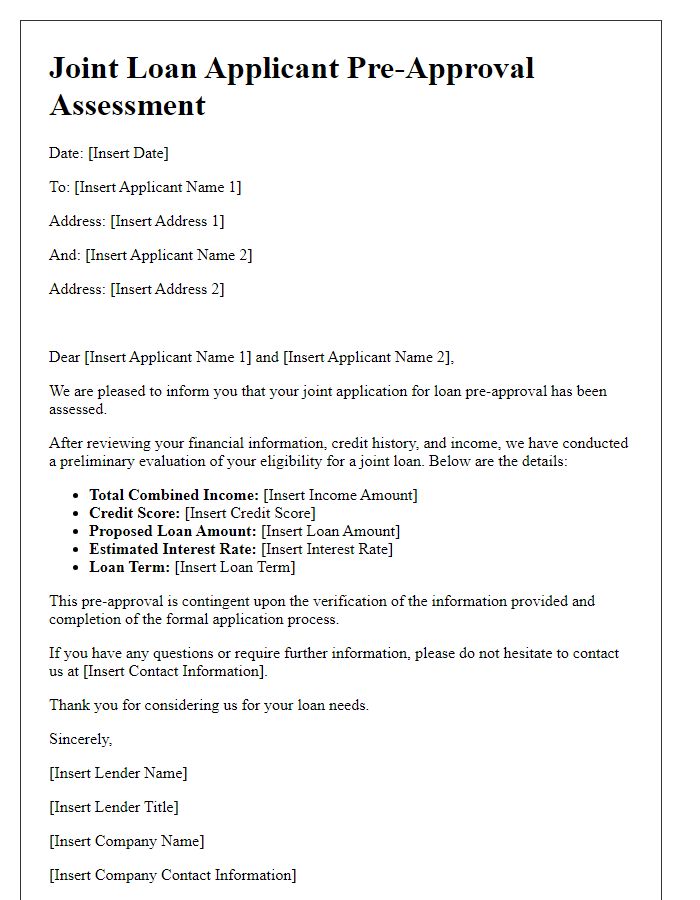

Credit Score Assessment

Credit score assessment plays a crucial role in determining the eligibility of joint loan applicants, particularly those seeking significant amounts for home mortgages or personal loans. Typically, credit scores range from 300 to 850, with higher scores representing lower risk for lenders like banks or credit unions. A joint assessment looks at combined scores, often averaging individual scores. Factors influencing these scores include payment history, credit utilization (ideally below 30%), length of credit history (accounts aged typically above ten years are favorable), types of credit used, and recent inquiries. A comprehensive analysis may also evaluate additional metrics such as debt-to-income ratios, which ideally should remain below 43% to avoid complications in loan approvals. Understanding these elements can greatly impact the loan process at institutions across various regions, influencing rates and terms offered to applicants.

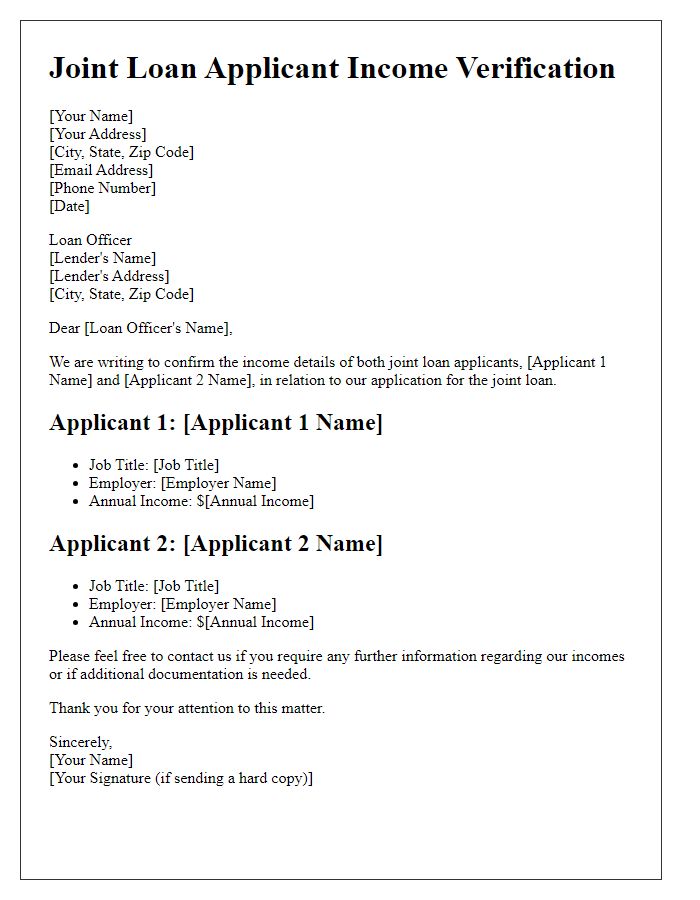

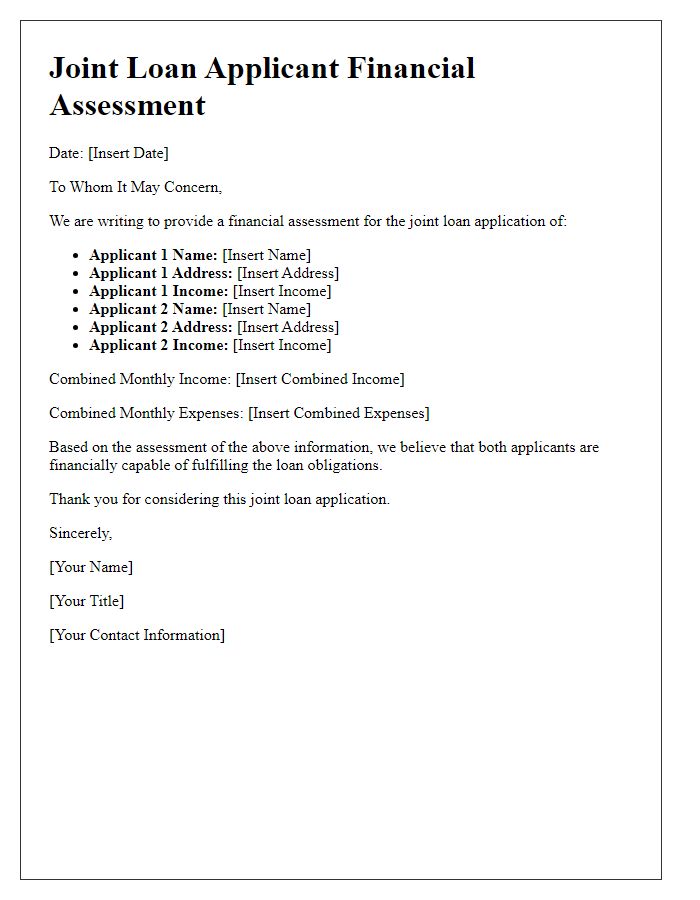

Income and Employment Status

The income and employment status of joint loan applicants play a critical role in assessing creditworthiness during a mortgage application process. Stable employment (defined as a consistent job history of at least two years) enables lenders to evaluate income reliability effectively. Income sources, such as salaries, bonuses, or commissions, are meticulously analyzed, particularly how they contribute to the applicants' debt-to-income ratio, which ideally should remain below 43 percent for most loan types. Employment information including job title, company name, and duration provides lenders insight into financial stability and potential future earning capacity, especially in fields with upward mobility, like technology or healthcare. Moreover, self-employed applicants must provide additional documentation, such as tax returns from the past two years, to verify income levels. Overall, a thorough review of income and employment status is essential for a comprehensive risk assessment in joint loan approvals.

Existing Debts and Financial Obligations

A joint loan applicant review highlights existing debts and financial obligations impacting loan approval. Existing debts may include personal loans, credit cards, mortgages, and student loans, each with varying interest rates. Financial obligations encompass monthly payments, such as rent or utility bills, typically exceeding 30% of gross monthly income. Credit scores, which range from 300 to 850, also play a crucial role in determining eligibility. Lenders assess debt-to-income (DTI) ratios, ideally below 36%, to evaluate repayment capability. Additionally, joint applicants must disclose any co-signed loans or shared financial commitments, as these can affect overall financial health and borrowing capacity.

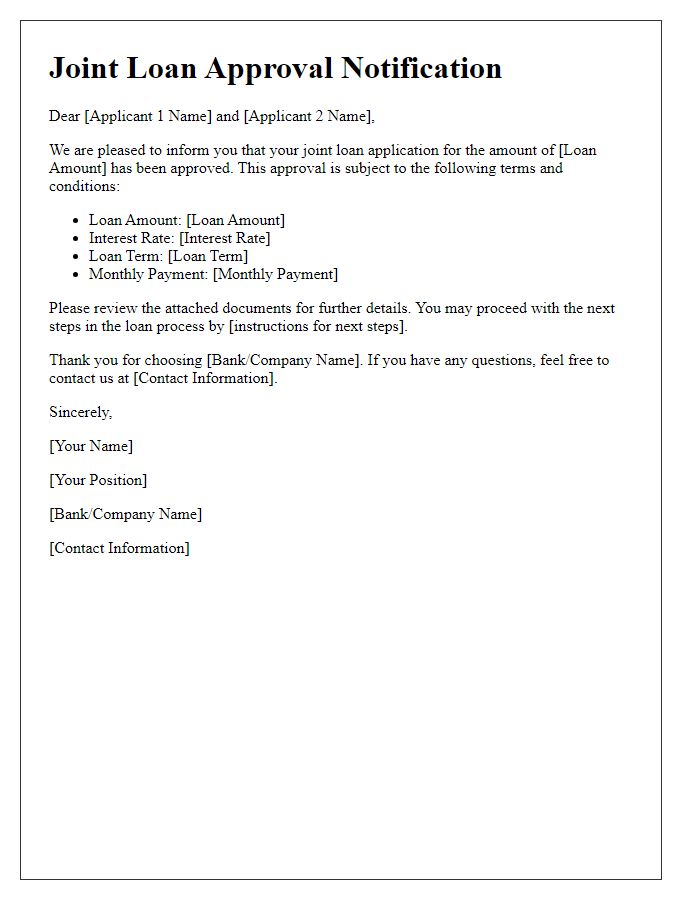

Loan Purpose and Amount Requested

An application for a joint loan may detail purposes such as home buying, vehicle financing, or debt consolidation. The specified loan amount is crucial for processing; it often ranges from $5,000 to $500,000 depending on the purpose. For instance, purchasing a home in cities like San Francisco may require loans averaging $1 million. Loan applicants must clearly articulate intended uses, like a 30-year mortgage for real estate, or a 7-year term for personal loans, impacting interest rates and repayment strategies. Providing this information helps lenders evaluate financial stability and creditworthiness effectively.

Comments