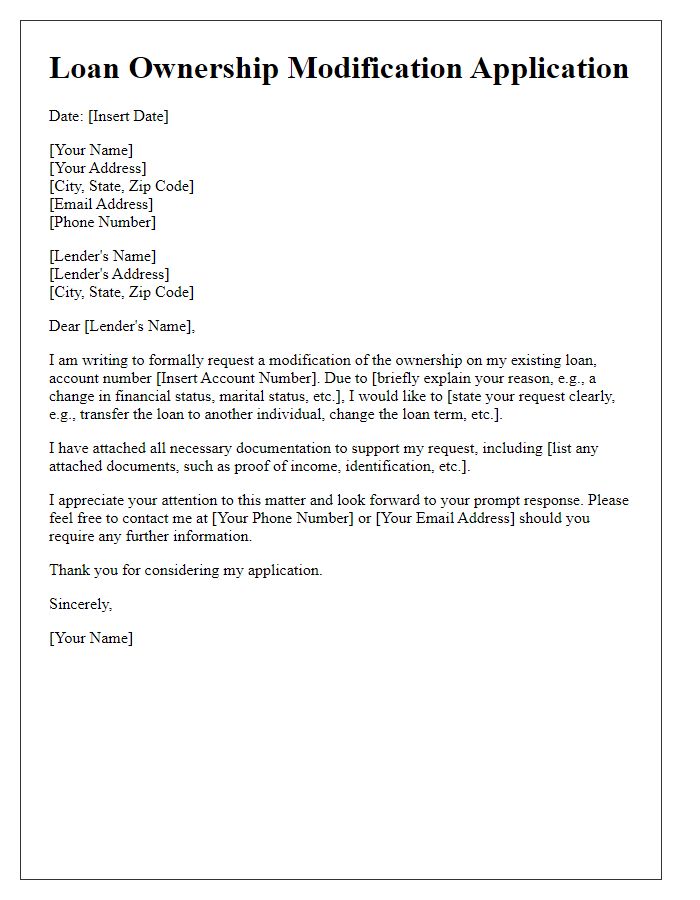

Are you considering a change in loan ownership and unsure where to begin? Navigating this process can feel overwhelming, but it doesn't have to be. In this article, we'll break down the essential steps and provide a comprehensive letter template to make your transition smooth and hassle-free. Ready to dive in and learn how to streamline your loan ownership change?

Borrower's information and current loan details

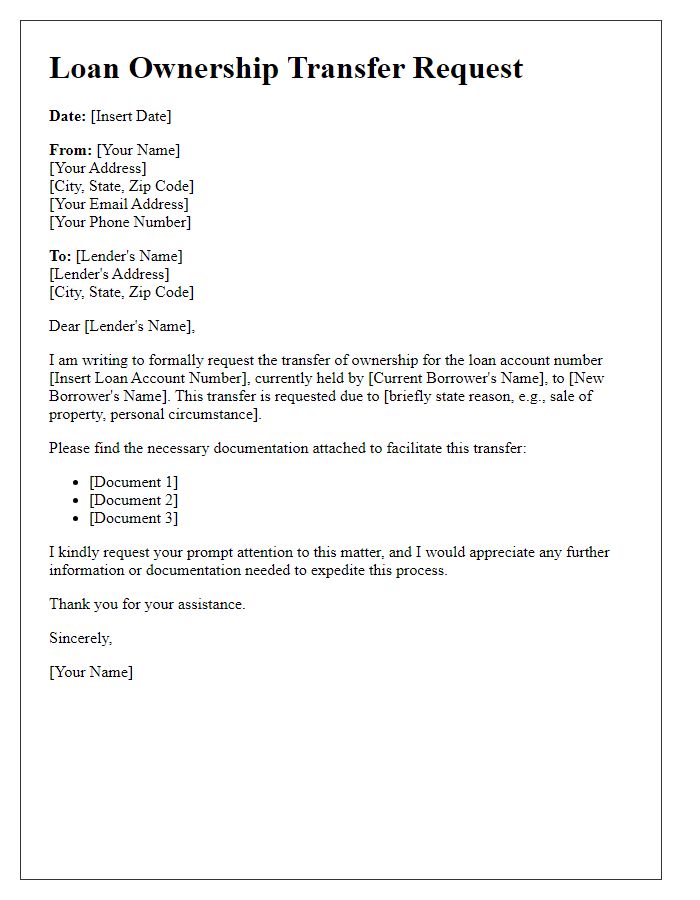

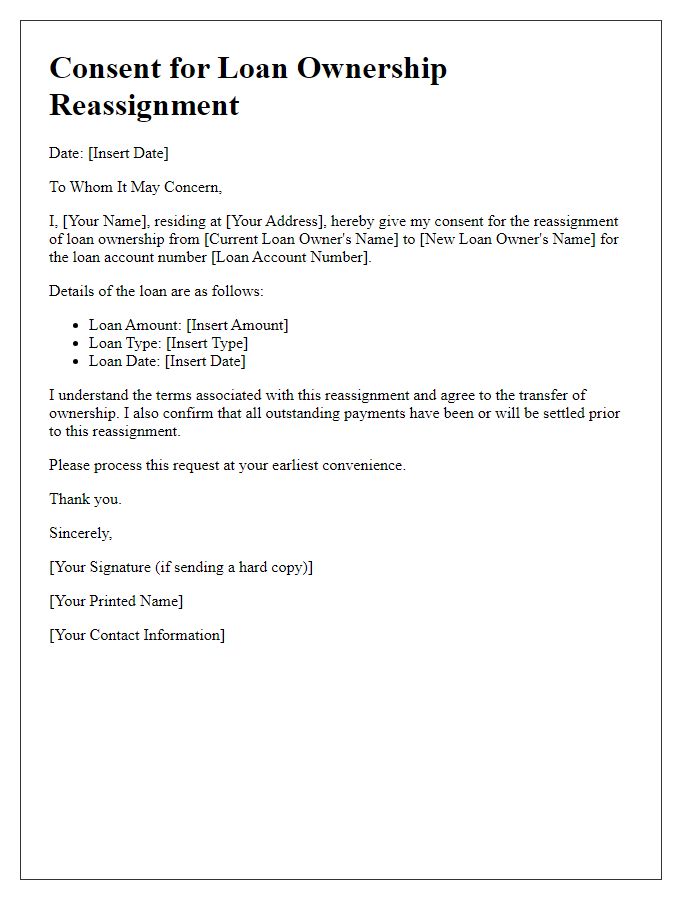

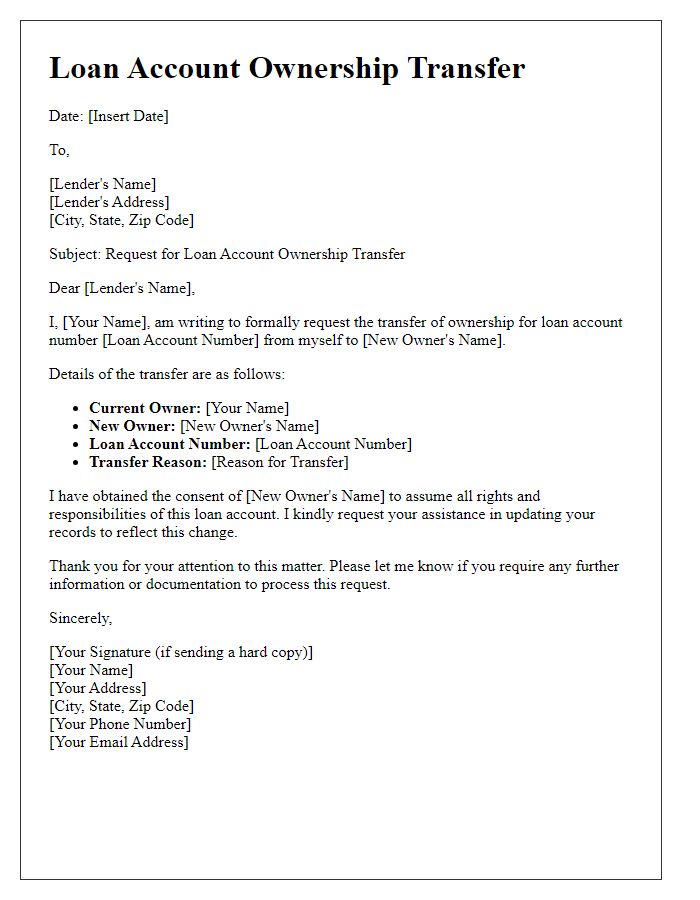

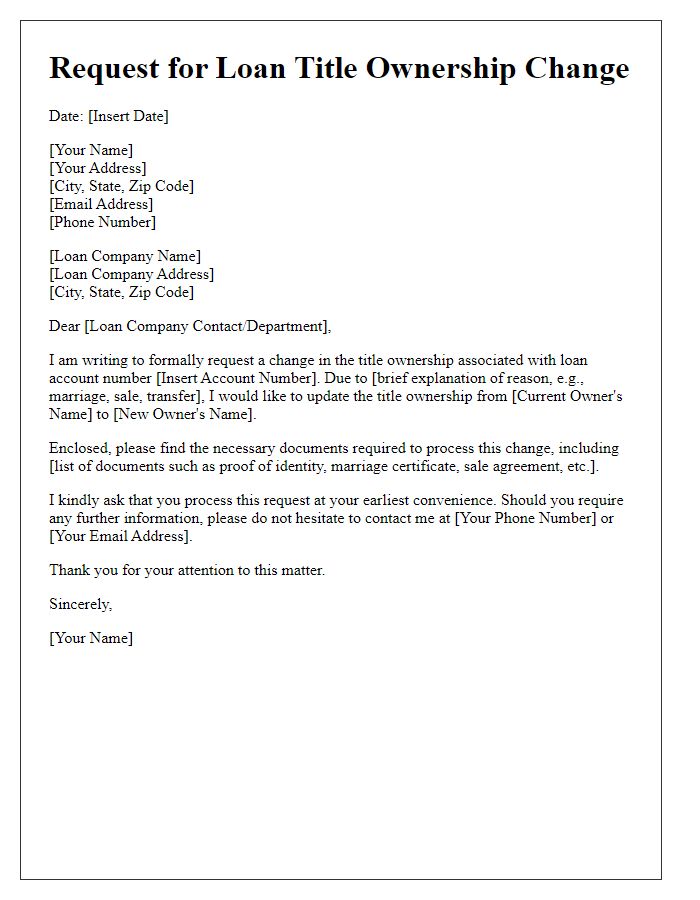

The transfer of loan ownership involves the borrower's information, including full name, contact details, and social security number for identification purposes. Current loan details reflect the original loan amount, outstanding balance (e.g., $50,000), interest rate percentage (such as 5.5%), term duration (e.g., 30 years), and monthly payment amount (like $500). These elements are crucial for processing the transfer and ensuring both parties have clear agreement on the obligations and rights associated with the loan. The lender's information should also be captured, noting the name of the financial institution, contact details, and any pertinent account numbers for efficient transaction processing.

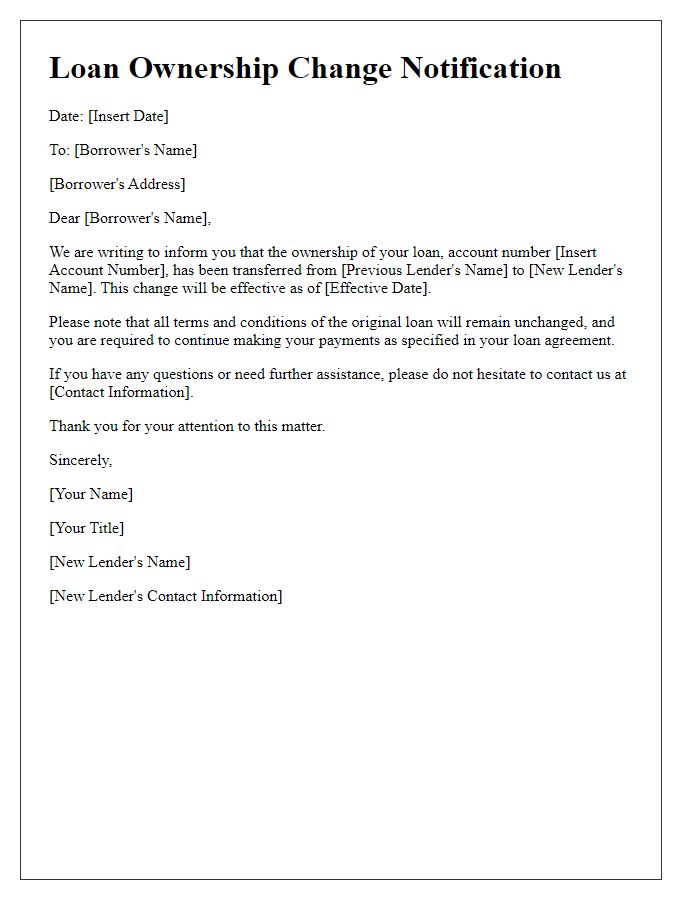

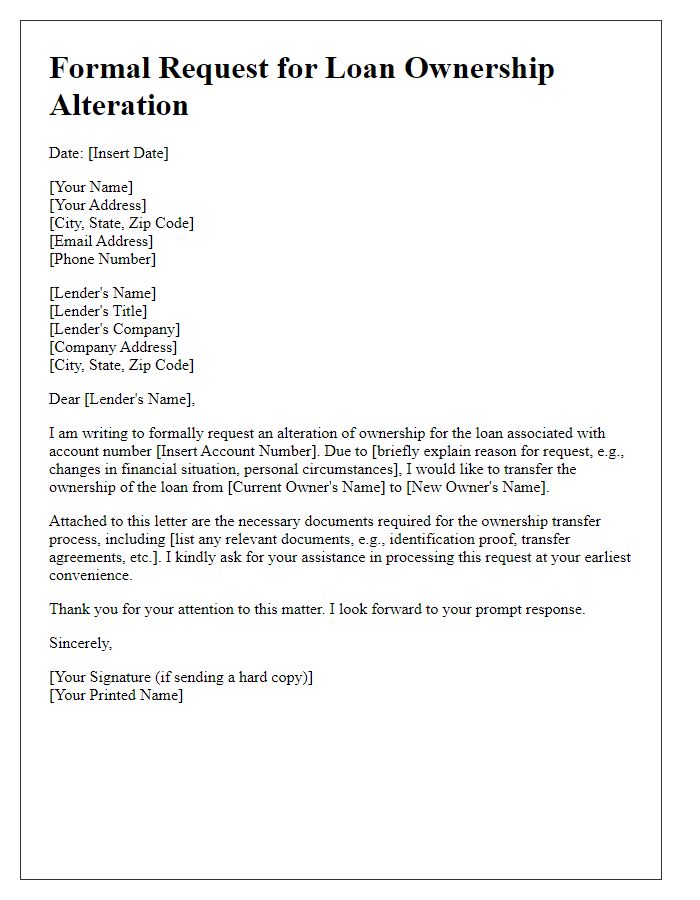

New lender's information and contact details

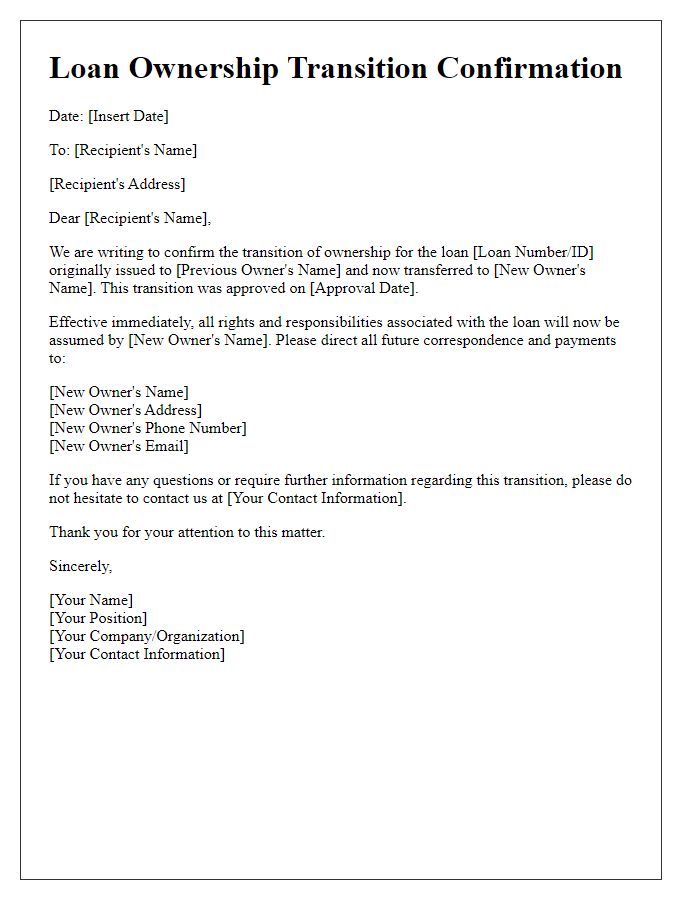

Lenders often issue loan ownership transfers to update the assigned financial institution handling the loan account. The new lender's name, such as First National Bank, needs to be clearly stated, along with their contact information, including the address of the nearest branch located at 123 Main Street, Cityville, State, Zip Code. Additionally, the new lender's phone number, like (555) 123-4567, should be included for any inquiries. Including the new lender's email, such as support@firstnationalbank.com, ensures efficient communication. Addressing any specific loan identifier, such as the account number or loan type (e.g., personal loan or mortgage), can streamline the process of updating records and facilitate a smooth transition for funding responsibilities.

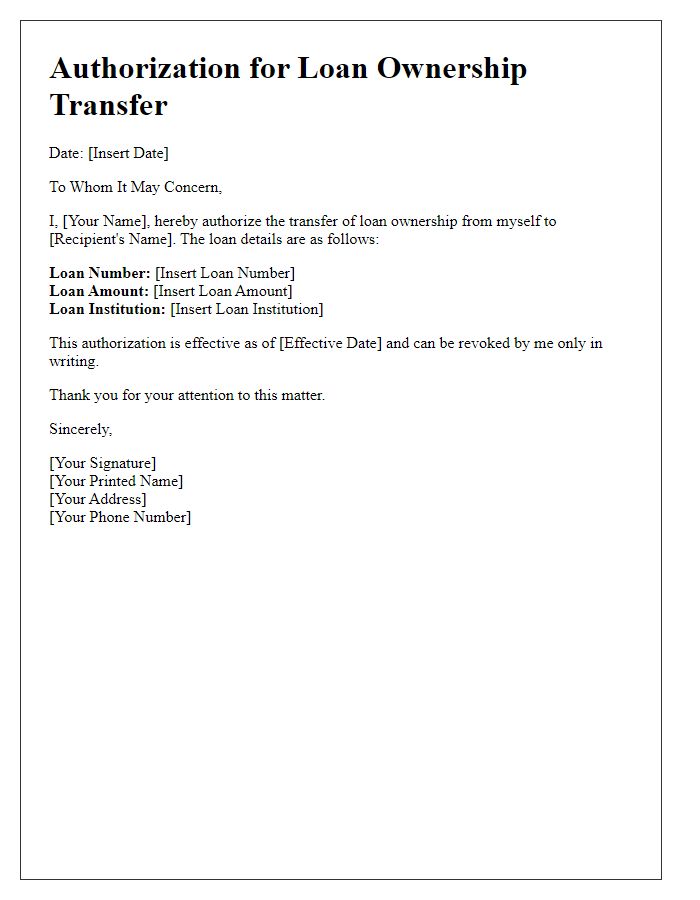

Effective date of loan ownership transfer

The transfer of loan ownership can impact various aspects of borrowing, especially concerning personal loans or mortgages. The effective date of the loan ownership transfer, typically specified in the loan documentation, marks when the new lender assumes responsibility for the loan. This date is crucial, as it affects interest calculations, payment schedules, and borrower obligations applicable under the original loan agreement. For instance, a mortgage loan amounting to $250,000 at a 4% interest rate can undergo changes in terms under the new owner, depending on the transfer's stipulations. Parties involved must be aware of their rights and responsibilities from the effective date to ensure compliance with the revised terms. Understanding local regulations, such as those in specific states or territories, is also necessary to facilitate a smooth transition.

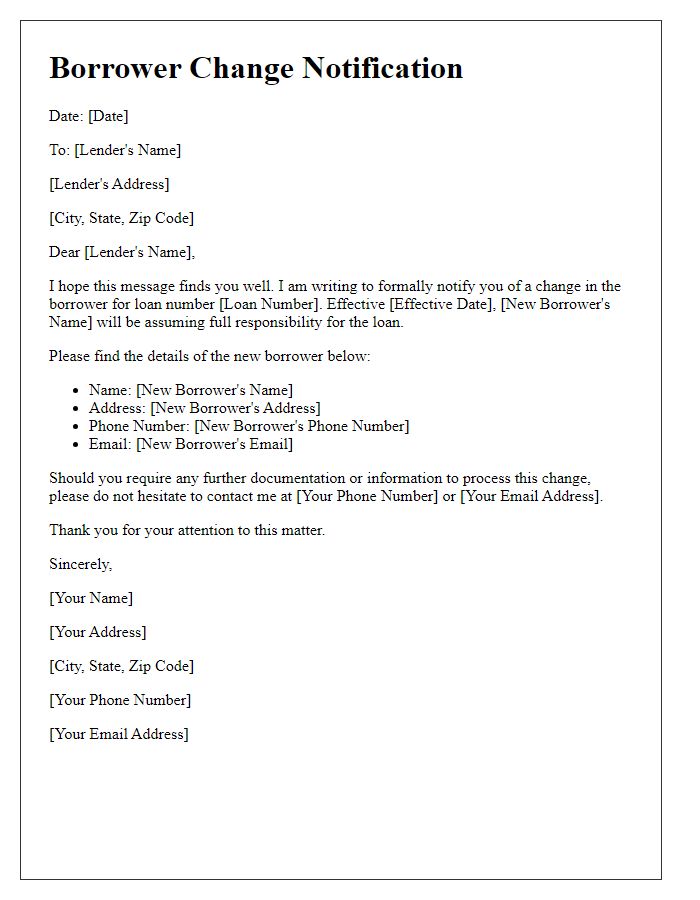

Instructions for payment and communication

Upon the transfer of loan ownership, all payment responsibilities will shift to the new loan holder, including the monthly repayment of principal and interest amounts. It is imperative for the new owner to set up their payment method promptly to avoid any late fees. Communication regarding the loan should be directed to the loan servicer, such as ABC Loans, at their customer service number (123) 456-7890. Important documents, such as the loan agreement and payment schedule, must be reviewed carefully to understand the terms. For any inquiries about the loan, both email and phone options for support are available Monday through Friday, 9 AM to 5 PM EST.

Authorization and signatures of involved parties

A change of loan ownership involves a formal process where the original borrower transfers their obligations under the loan to a new borrower. The authorization of both the original borrower and the new borrower is crucial to ensure the legal transfer of the loan. Signature verification serves as proof of consent from involved parties. Important elements include loan details (loan number, original amount), date of transfer, and identification of parties (full names, addresses, contact information). Additional documentation, such as credit reports or financial statements, may be needed to facilitate the approval process from the lender. Legal compliance ensures that the transfer aligns with applicable laws and lender guidelines, protecting all parties involved.

Comments