When it comes to managing loans, understanding the intricacies of collateral substitution can be quite the challenge. It's crucial to have a solid letter template ready that clearly outlines your intentions and maintains a professional tone. This not only streamlines the process but also ensures that all parties are on the same page regarding the substitution details. If you're looking for expert insight and helpful tips on crafting the perfect letter for your collateral authorization, stick around to learn more!

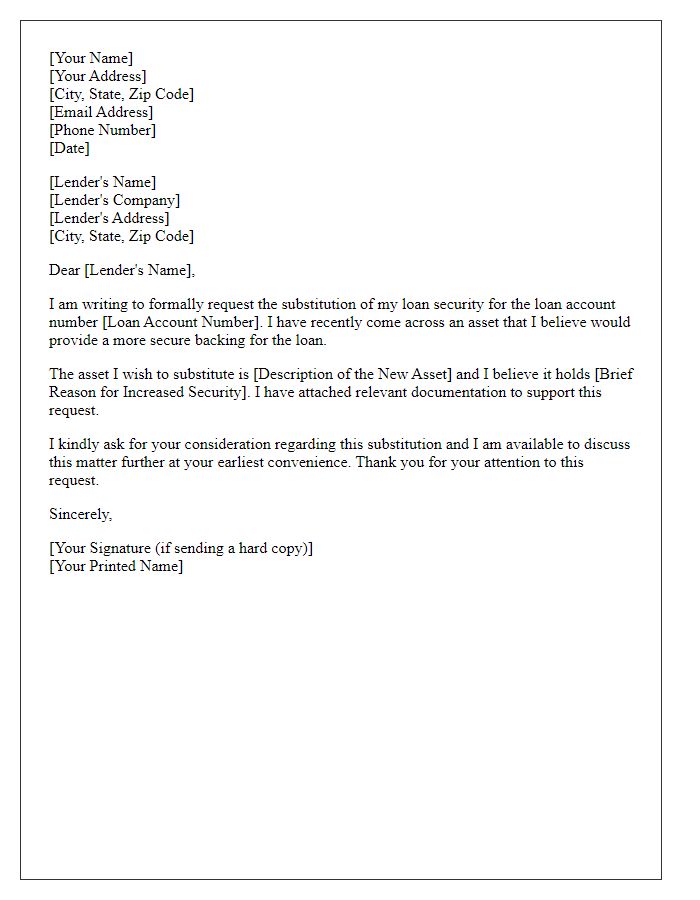

Borrower's details and contact information.

The Borrower's details include full name, residential address, and phone number. For instance, John Smith residing at 123 Maple Street, Springfield, can be an example. Contact information should also include email address, such as johnsmith@email.com. Clear documentation of these details ensures that communication regarding loan collateral substitution is streamlined and organized. Accurate identification of the Borrower enhances legal clarity and facilitates updates necessary for the authorization process, which is crucial for both parties involved. Properly formatted information aids in maintaining an efficient loan management system.

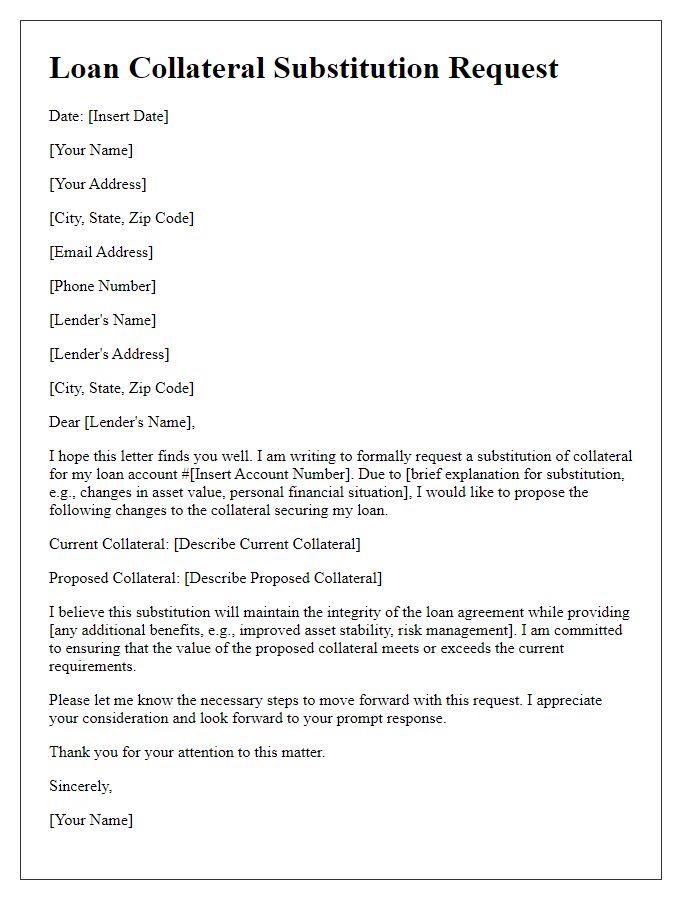

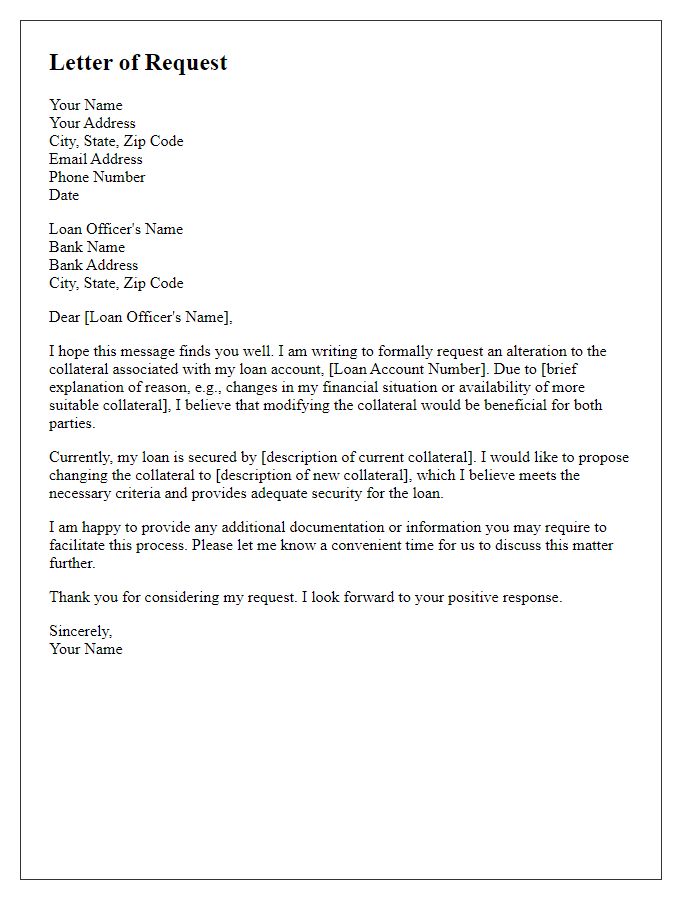

Loan account number and original collateral description.

Loan account number 23456789 serves as the identifier for the loan agreement associated with this request. The original collateral described as a 2018 Ford F-150 pickup truck, valued at approximately $25,000, was previously pledged as security against this loan. This vehicle, noted for its rugged durability and versatility, now requires substitution of collateral due to changes in financial circumstances. The new collateral proposed includes a residential property located at 123 Maple Street, Springfield, valued at $300,000, ensuring alignment with the lender's requirements for secured loans. All relevant documents demonstrating ownership, valuation, and compliance will be provided for formal approval of this substitution request.

Proposed new collateral description and valuation.

Loan collateral substitution involves the process of replacing existing collateral with new assets to secure a loan. This can include various forms of property such as real estate, vehicles, or financial instruments. An accurate valuation of the proposed new collateral is crucial to ensure it meets or exceeds the value of the original collateral, providing sufficient security for the lender. For instance, a residential property located in a high-demand area could have a valuation of $500,000, while a new vehicle might be valued at $30,000. It is essential to provide detailed descriptions of the assets, including identification numbers, physical condition, and current market conditions to facilitate the substitution process effectively.

Reason for collateral substitution request.

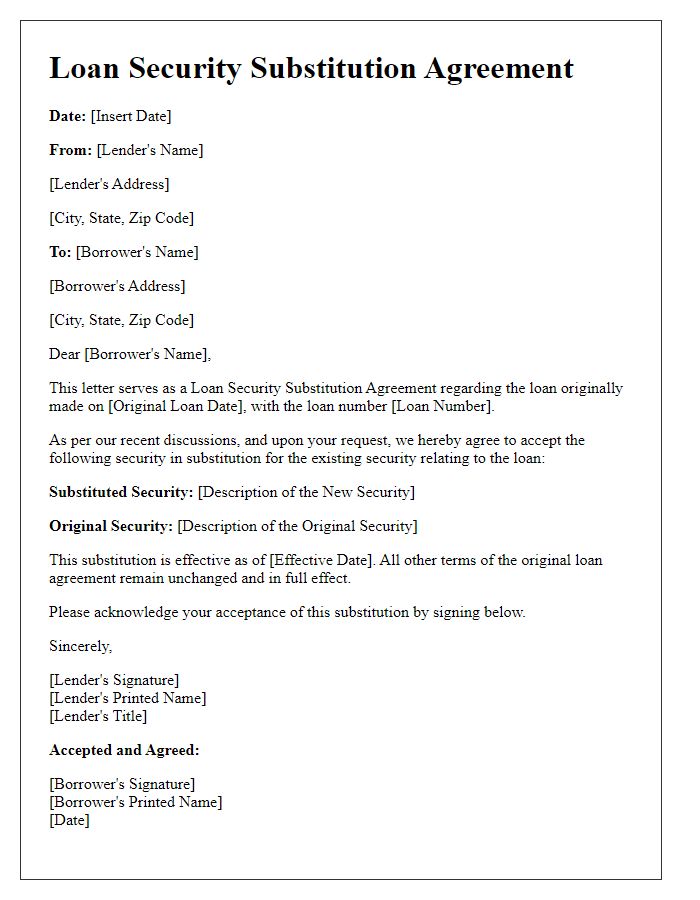

Collateral substitution requests often stem from changes in business needs or financial circumstances. For instance, a business may want to replace existing collateral, such as real estate or equipment, with a more liquid asset, like cash or marketable securities, to improve cash flow or reduce risk. Financial institutions typically require detailed documentation, including appraisals of the new collateral to ensure sufficient value is maintained. This process may also involve a formal assessment of the risk profile associated with the newly proposed collateral and verification of ownership to protect both parties involved in the loan agreement. Documentation must explicitly outline the reason for the substitution, detailing any shifts in asset value and strategic objectives guiding the request.

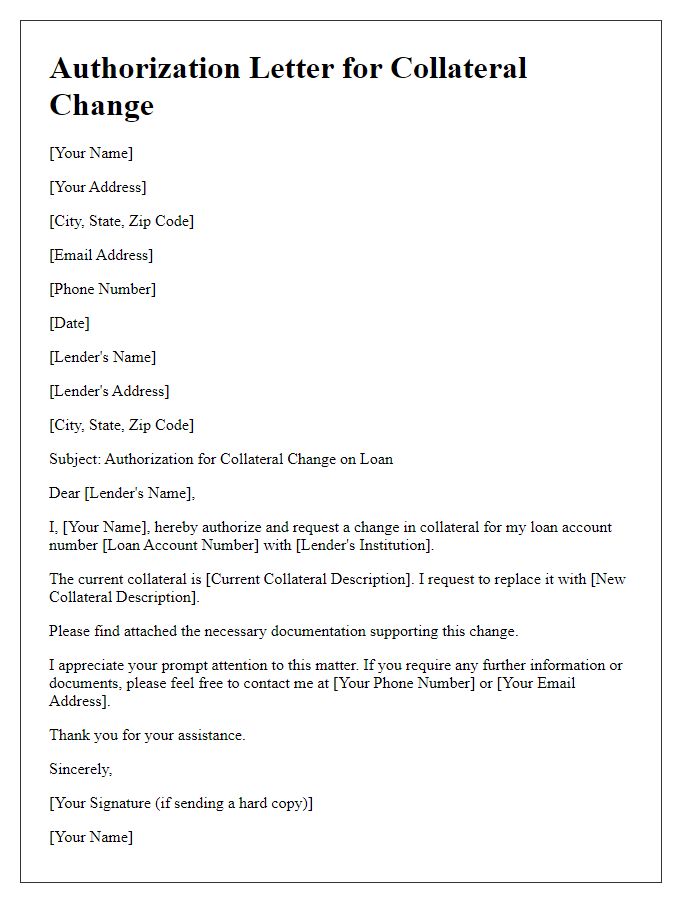

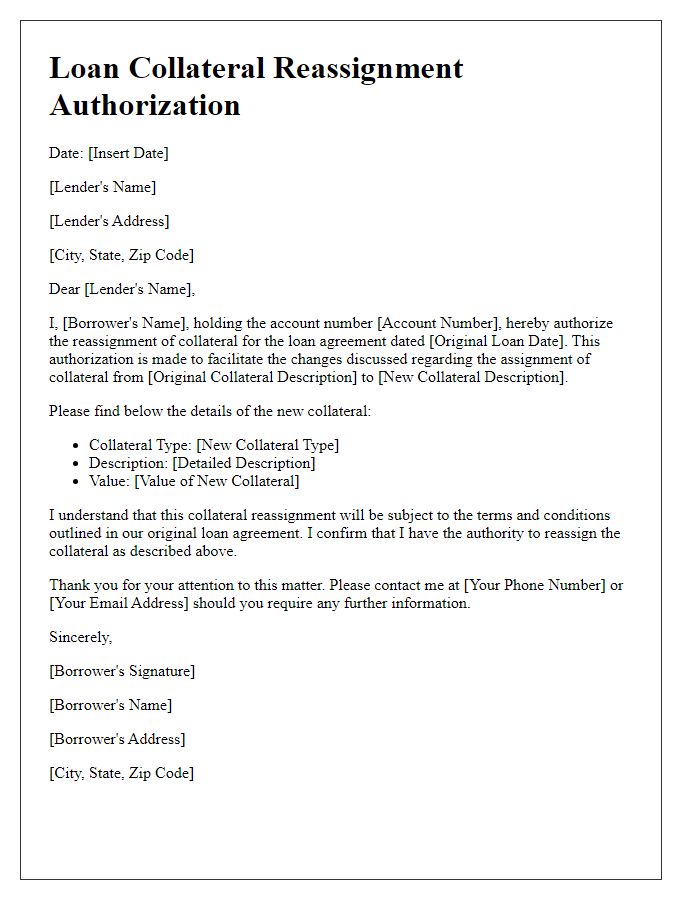

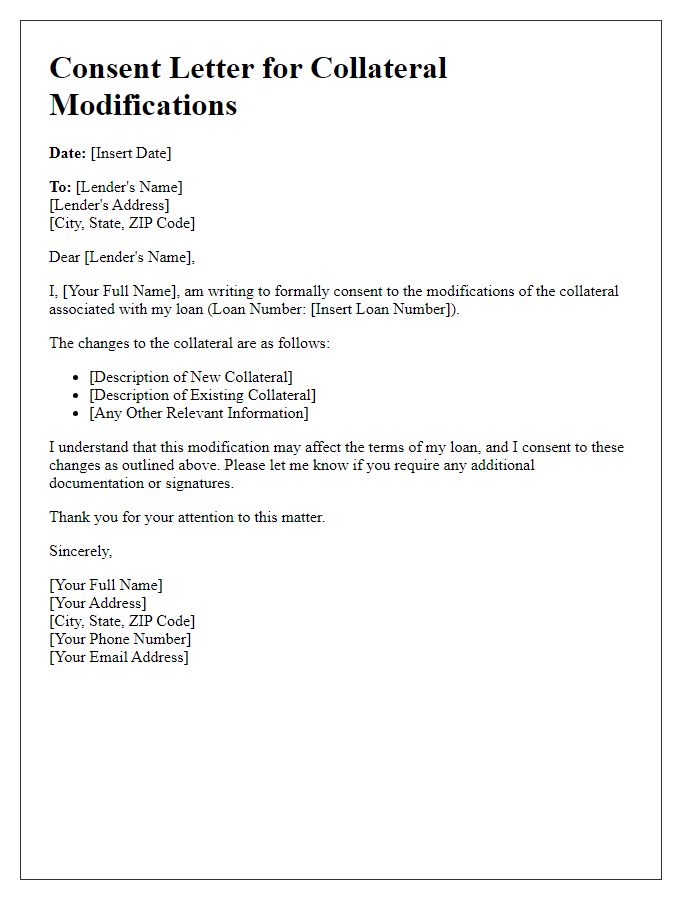

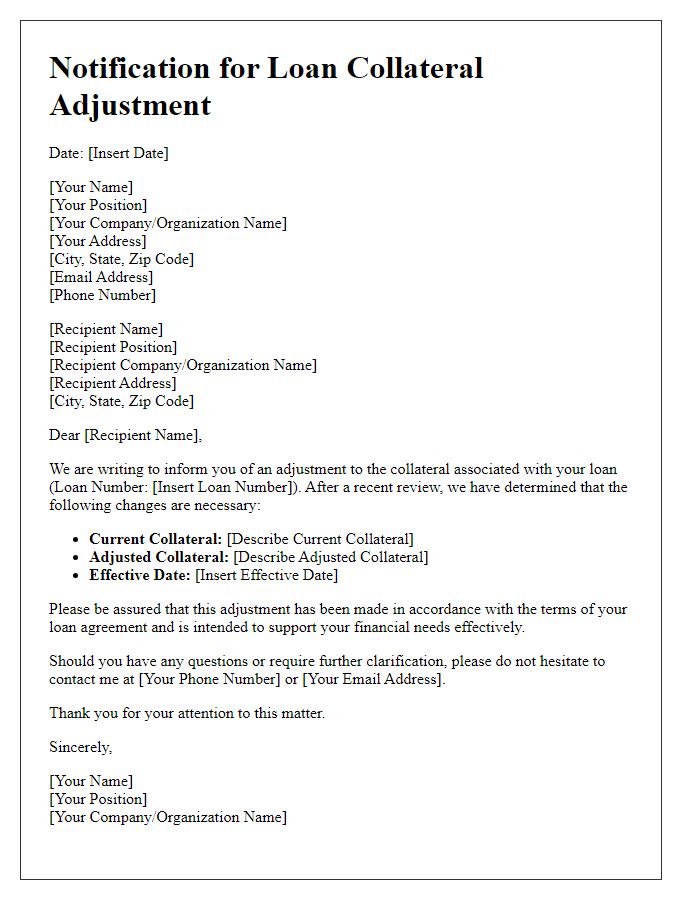

Authorization and consent statement.

Authorization for loan collateral substitution allows borrowers to replace existing collateral with alternative assets. This process usually involves signing a consent statement that outlines the terms. Key elements include detailed identification of the original collateral, such as real estate (with property description and valuation), and the new collateral, which could be other assets like vehicles or financial securities. The bank or lending institution must authenticate the transaction, often requiring notarized signatures from all parties involved to ensure legal compliance. Furthermore, a precise timeline for the substitution process must be established to protect both lender and borrower interests.

Letter Template For Loan Collateral Substitution Authorization Samples

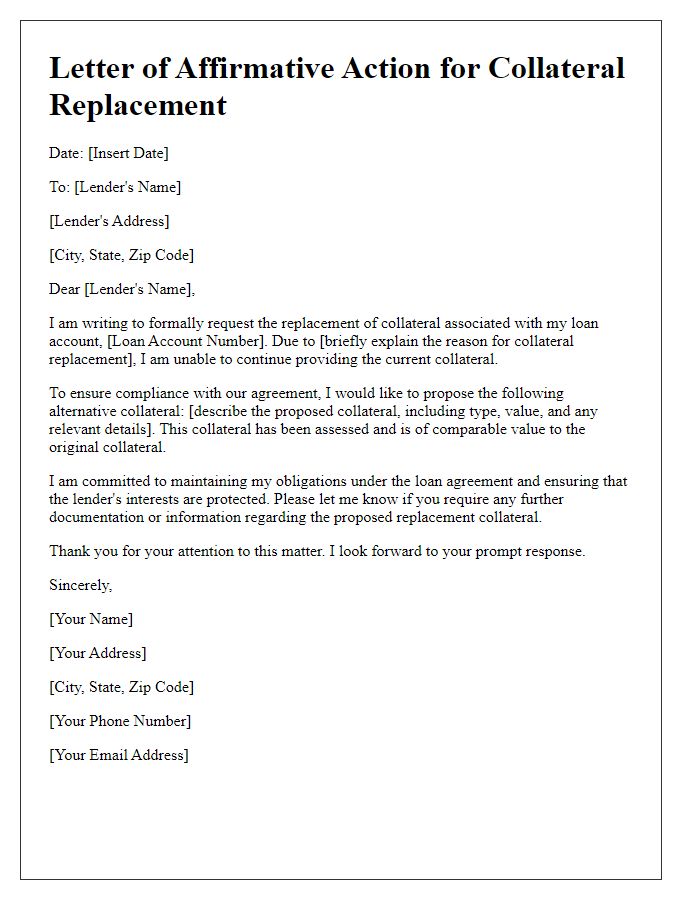

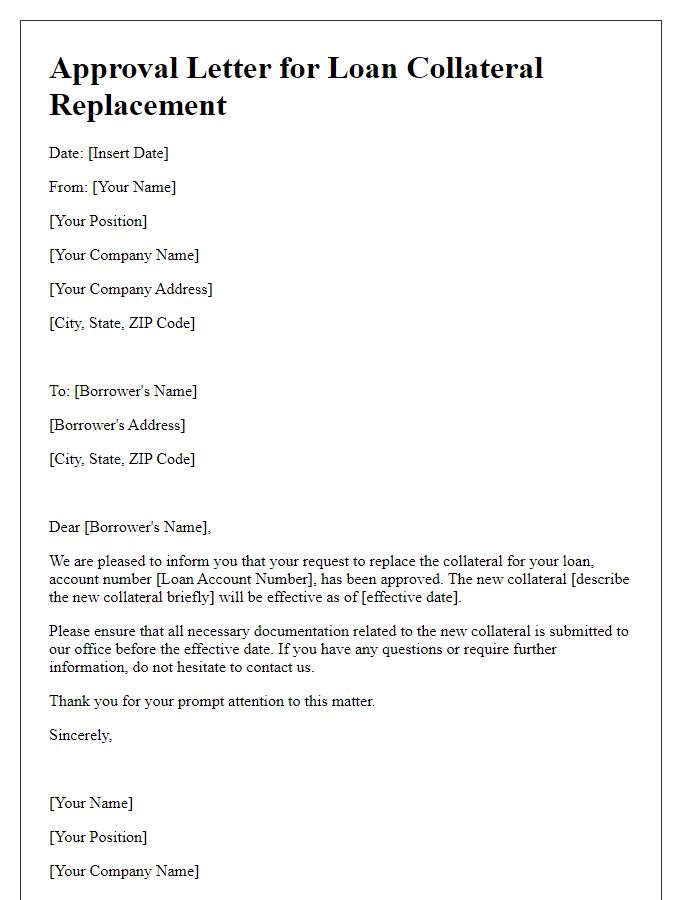

Letter template of affirmative action for collateral replacement on loan.

Comments