Are you trying to navigate the tricky waters of setting up a payment plan? You're not aloneâmany people find themselves in situations where a structured payment arrangement can provide much-needed relief and clarity. In this article, we'll walk you through the essential elements of a payment plan letter, ensuring that your communication is clear, respectful, and effective. So, let's dive in and explore how to craft a payment plan arrangement that works for you!

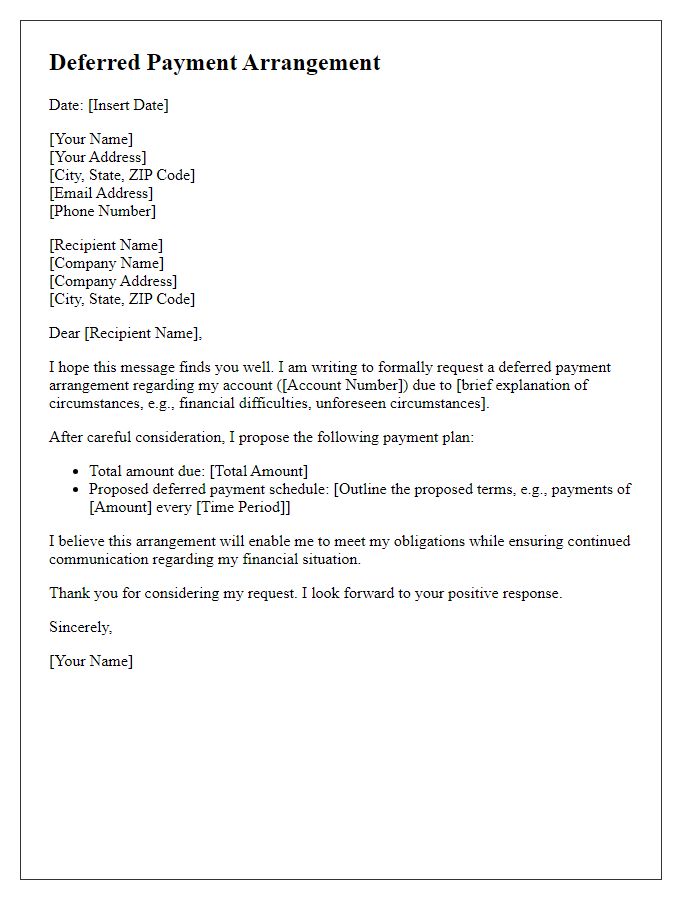

Clear identification of both parties

A payment plan arrangement requires precise identification of both parties involved in the agreement. The sender, representing a business, should include their company name, legal address, and contact information such as phone number and email. The recipient's information must be clearly stated as well, including their full name, residential or business address, and any relevant identification number or account reference tied to the transaction. Such details ensure clarity in communication and facilitate tracking of the arrangement. Accurate identification prevents confusion and establishes a formal record of the agreement between the two parties, which can be essential for future reference and potential dispute resolution.

Detailed description of debt and payment terms

The outstanding debt, amounting to $5,000, results from previous services rendered by XYZ Consulting, beginning in January 2023, with installments overdue since March 2023. Payment terms suggest a structured repayment plan over a period of 12 months, with monthly installments set at $416.67. Initial payment due date is February 1, 2024. Each subsequent payment will occur on the first of each month until the full balance is cleared by January 1, 2025. Late fees of $50 will apply if payments are not received within 5 days of the due date. Payment methods accepted include bank transfer, credit card, or check. Regular communication will be maintained to ensure adherence to this plan, allowing for any potential adjustments due to unforeseen circumstances affecting financial stability.

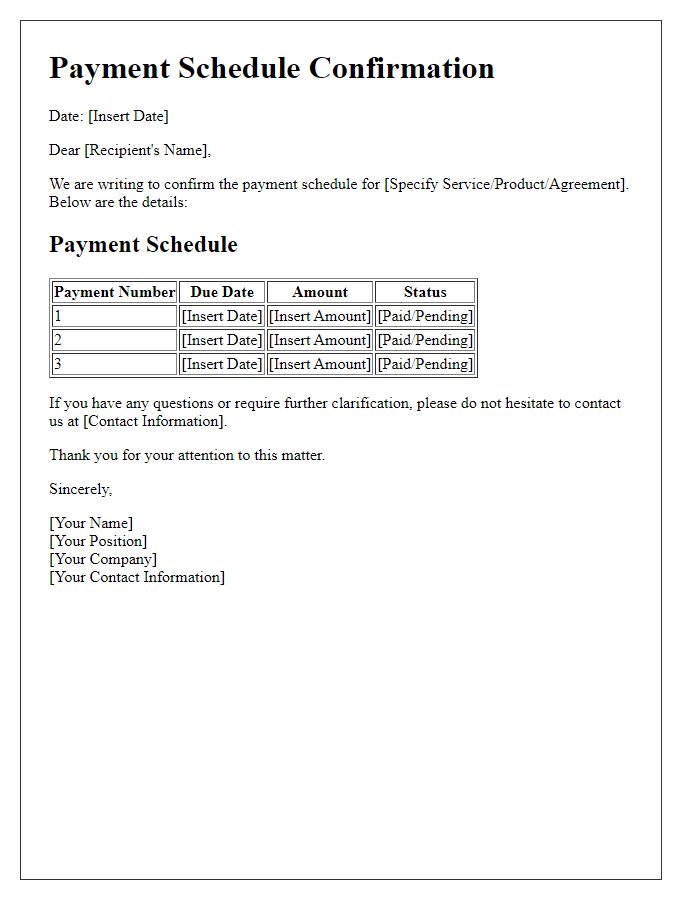

Schedule outlining payment dates and amounts

Establishing a structured payment plan is crucial for managing financial commitments effectively. Various options exist, depending on the total amount owed and the timeframe for repayment. For instance, a total debt of $2,000 might be divided into four equal payments of $500, due on the first of each month for four consecutive months. Alternatively, a longer schedule could extend monthly payments to $250 over eight months. Clear communication with debtors, such as specifying payment dates (e.g., March 1st, April 1st), ensures accountability and facilitates budgeting. Additionally, note any interest rates or fees associated with late payments, as these can significantly affect the total amount repaid. Documenting this plan in a formal agreement solidifies understanding and reduces potential misunderstandings.

Terms and conditions for default or late payments

A payment plan arrangement provides individuals with a structured method to settle outstanding debts over a specified timeframe, typically ranging from three to twelve months. Key terms include a grace period of 15 days for late payments, after which a late fee of 5% of the outstanding balance might apply. Defaulting on agreed payments can lead to consequences such as immediate accrual of interest rates (usually around 10% annually) or potential referral to collections agencies. It is crucial for individuals to maintain clear communication, ideally within 48 hours of a missed payment, to avoid complications. Additionally, both parties should document each installment payment, as failure to adhere to these terms can result in a legal dispute.

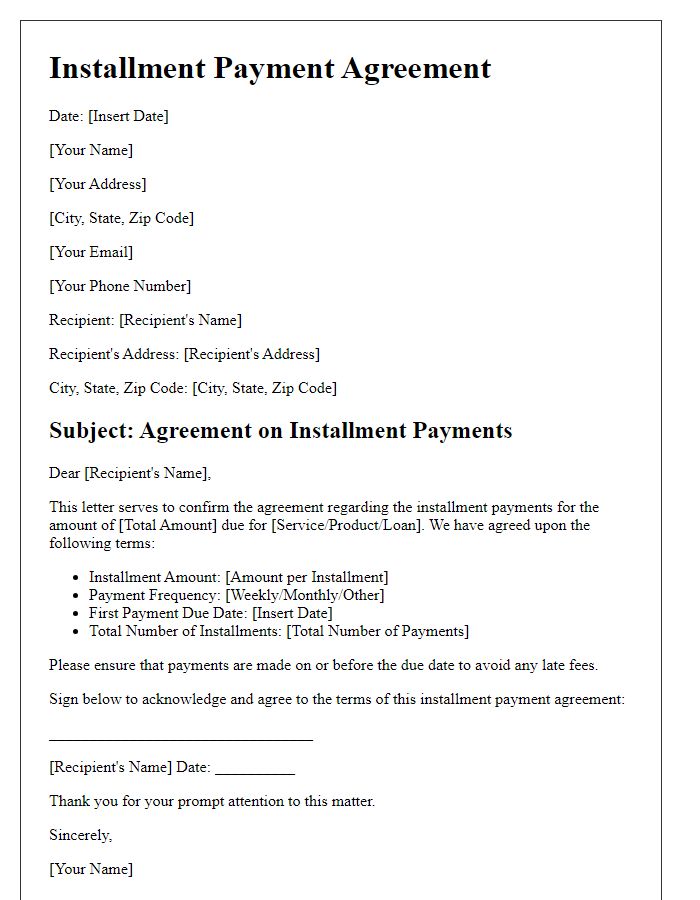

Signature and date sections for agreement confirmation

Payment plans can provide flexibility for managing financial obligations, allowing individuals or businesses to break down larger payments into manageable installments. This arrangement typically involves key terms such as total amount owed, interest rates, and specific payment dates across a set period, often outlined in a written agreement to ensure clarity. The final sections of the agreement often include signature lines for both parties, along with designated spaces for the date, confirming mutual agreement to the terms and conditions presented in the document. This legal acknowledgment plays a crucial role in ensuring accountability and adherence to the payment plan.

Comments