Have you ever missed a payment and faced the hassle of late fees? Sending an automatic payment reminder can make life much easier, both for you and your recipients. A well-crafted reminder letter can help ensure everyone is on the same page regarding payment due dates. If you'd like to learn more about how to effectively create these reminders, keep reading!

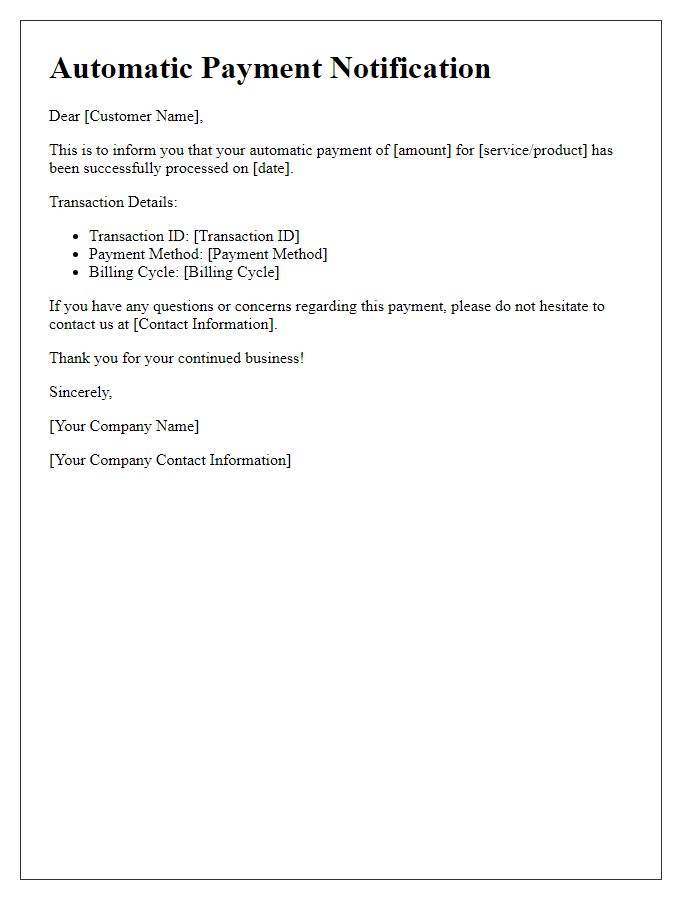

Subject Line

Automatic payment reminders help ensure timely transactions for services or subscriptions. For businesses, an effective reminder email subject line must be clear, concise, and engaging. Examples include "Friendly Reminder: Upcoming Payment Due on [date]" or "Payment Reminder: Don't Miss Your Due Date!" This direct approach fosters prompt attention, reduces potential late fees, and enhances customer satisfaction by providing clear notification of obligations.

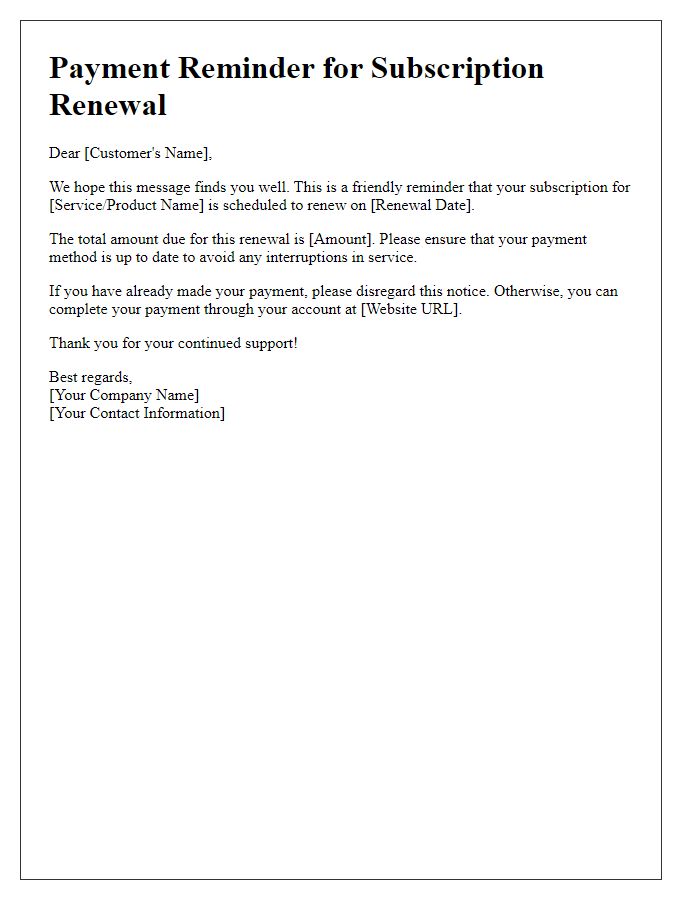

Greeting

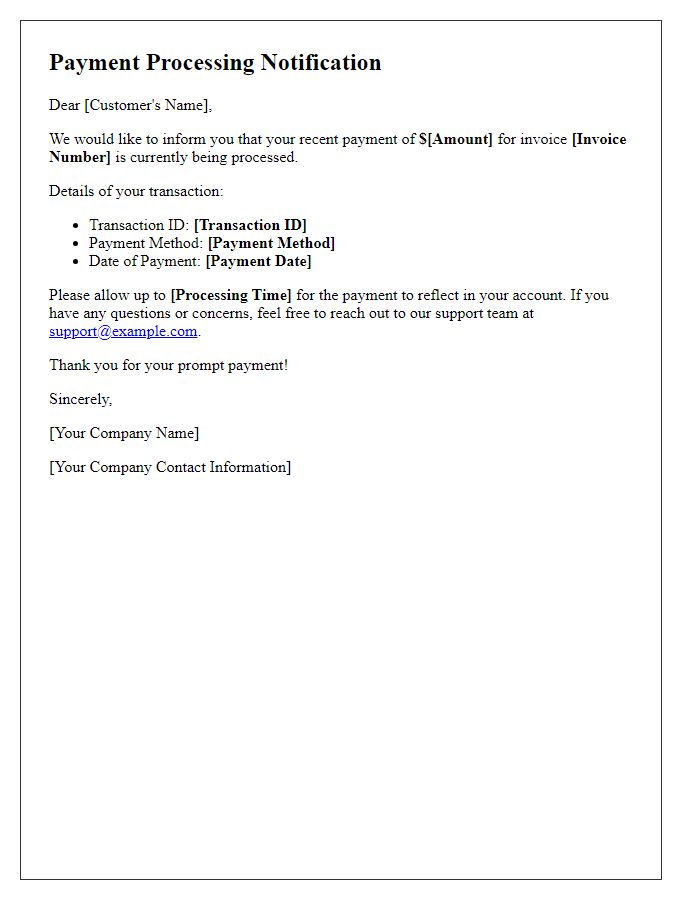

Automatic payment reminders play a crucial role in maintaining timely financial transactions. These reminders notify individuals or businesses of upcoming payments, ensuring that bills or subscriptions remain current. For example, a monthly subscription for a streaming service like Netflix, costing approximately $15, may trigger a reminder a few days before the due date to prompt the user. Additionally, reminding clients about automatic payments, such as mortgage installments, which can exceed thousands of dollars, is essential to avoid late fees and maintain good credit standings. Implementing these reminders not only enhances financial management but also fosters positive customer relationships, ensuring services remain uninterrupted.

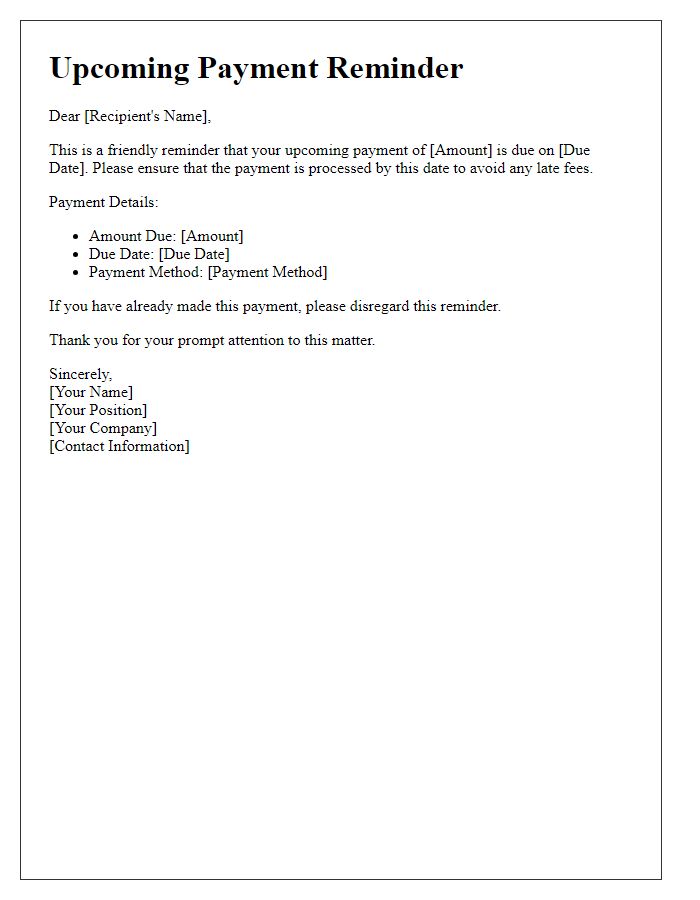

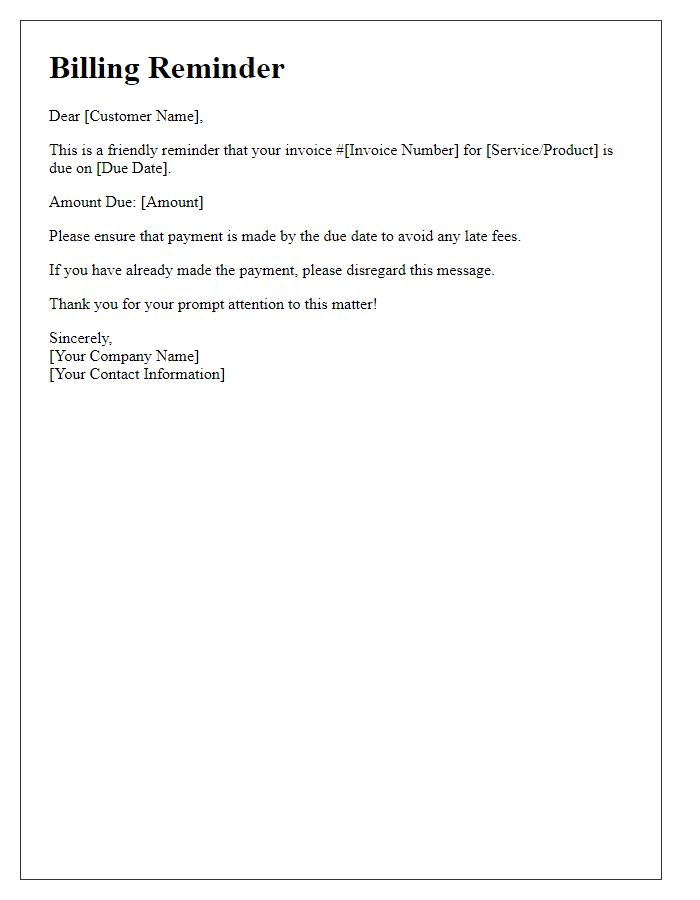

Payment Details

Automatic payment reminders help ensure timely bill settlement, which is crucial for maintaining good standing with service providers. These notifications typically include payment details like the due amount, which might range from $10 to $500, depending on the service, and the due date, often set at the end of the month (for example, January 31 or February 28). Payment methods such as credit card, bank transfer, or mobile wallet are commonly supported. Additional information, including account numbers for identification and references to past payments or service periods, enhances clarity. Regular reminders prevent late fees and service interruptions, particularly for essential services like utilities or subscriptions.

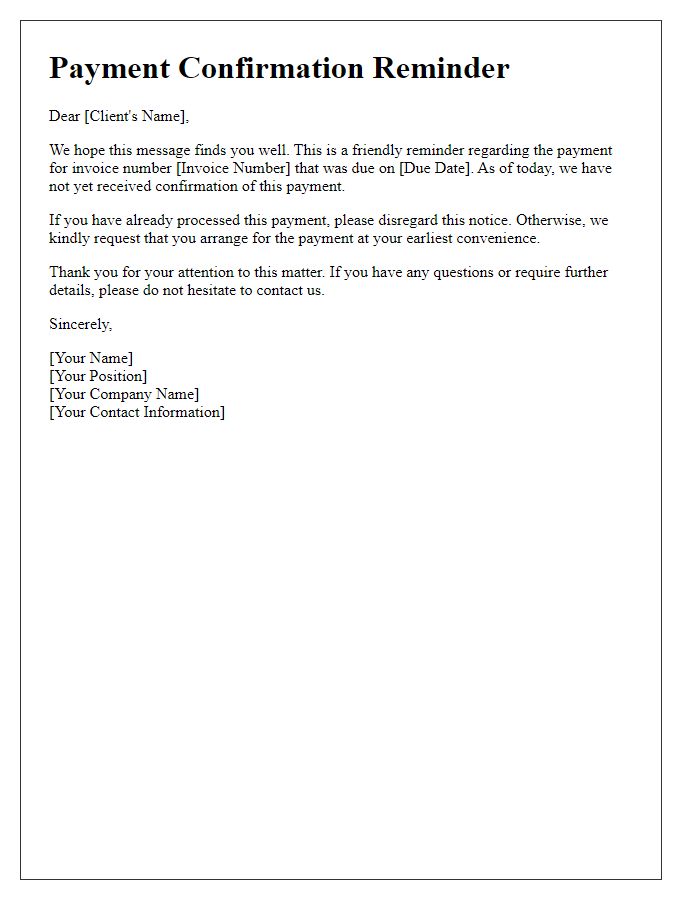

Reminder Message

Automatic payment reminders are crucial for maintaining timely financial transactions. These reminders often pertain to recurring bills, such as utility services (electricity, water, gas) or subscription services (streaming platforms, software licenses). Services like PayPal or bank apps typically send notifications ahead of the due date (often 5-7 days prior) to avoid late fees. Clear communication of payment amounts, due dates, and potential consequences (like service interruptions or late charges, which can be up to 20% of the bill in some cases) enhances user compliance. Ensuring that reminders are timely and informative helps maintain a strong financial relationship between service providers and customers.

Contact Information

Automatic payment reminders serve to ensure timely transactions related to services or bills, maintaining financial management. Organizations typically utilize this system for billing cycles, such as monthly subscriptions or annual fees. Contact information, including email addresses, phone numbers, and mailing addresses, enables seamless communication between service providers and customers. Details, such as payment due dates and amounts, are crucial; missing deadlines can lead to late fees or service interruptions. Implementing reminders via automation enhances efficiency, facilitates on-time payments, and improves customer satisfaction, minimizing the stress associated with manual process tracking.

Comments