Are you considering a hybrid mortgage structure but feeling overwhelmed by the options? Don't worry; you're not alone! This flexible approach combines the stability of fixed rates with the adaptability of variable rates, offering homeowners a unique blend of security and potential savings. Join me as we delve deeper into the benefits and nuances of hybrid mortgages, and discover if this innovative solution is the right fit for your financial journey!

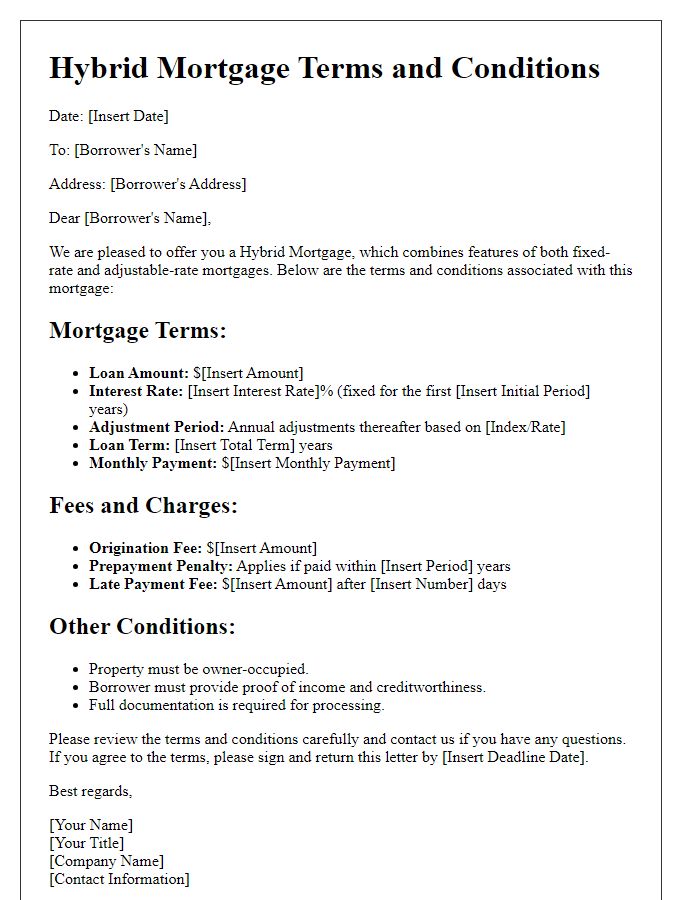

Clear terms and conditions

A hybrid mortgage structure offers a combination of fixed and adjustable interest rates that can provide borrowers with flexibility and potential cost savings over time. This type of mortgage typically features a fixed rate for an initial period, such as five, seven, or ten years, with rates generally ranging from 3% to 5%. After this fixed period, the interest rate may adjust annually based on a specified index, such as the LIBOR or the Treasury yield, plus a margin determined by the lender, often between 2% and 3%. Borrowers should be aware of potential rate caps, which limit how much the interest rate can increase or decrease at each adjustment and over the life of the loan. Additional terms may include the length of the loan, usually 15 or 30 years, prepayment penalties for early repayment, and requirements for maintaining homeowner's insurance. Clarity regarding payment schedules, potential interest fluctuations, and responsibilities regarding maintenance of the property are crucial for navigating the complexities of this mortgage type. Clear communication of these terms enhances understanding, enabling borrowers to make informed financial decisions.

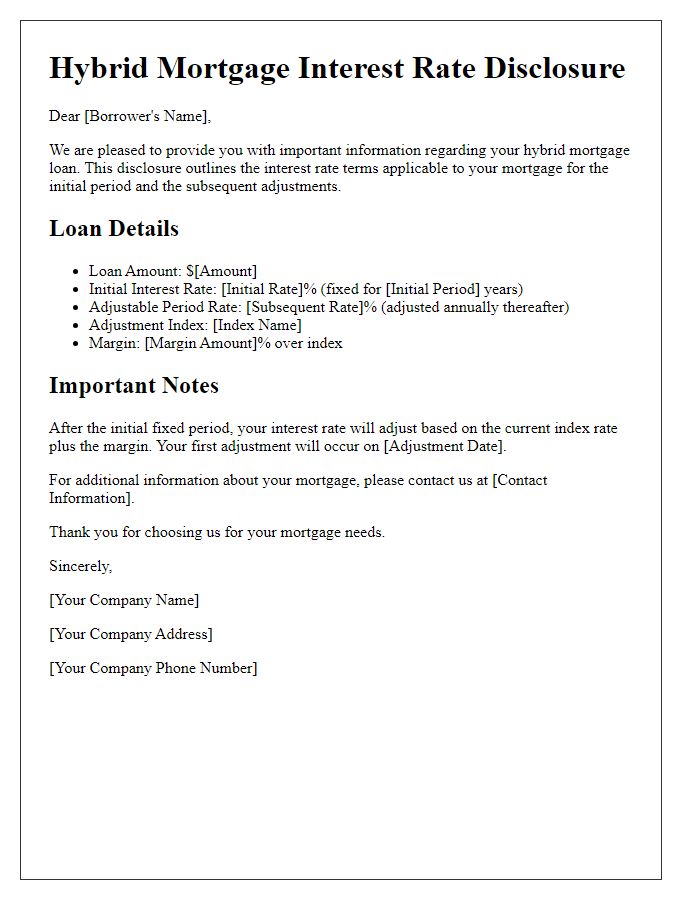

Interest rate details

Hybrid mortgage structures combine fixed and adjustable-rate components to provide flexibility to borrowers. Typically, the fixed rate applies for an initial period, often ranging from five to ten years, during which the interest rate remains stable. Following this fixed period, the mortgage transitions into an adjustable-rate mortgage (ARM) phase, where rates are subject to fluctuations based on market indices such as the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). Interest rate adjustments typically occur annually after the initial fixed period, influenced by economic indicators and prevailing market conditions. Borrowers should note that the margin added to the index rate can vary, impacting the overall cost of the loan over time. Understanding these details is crucial for adequately assessing financial commitments and potential future payments.

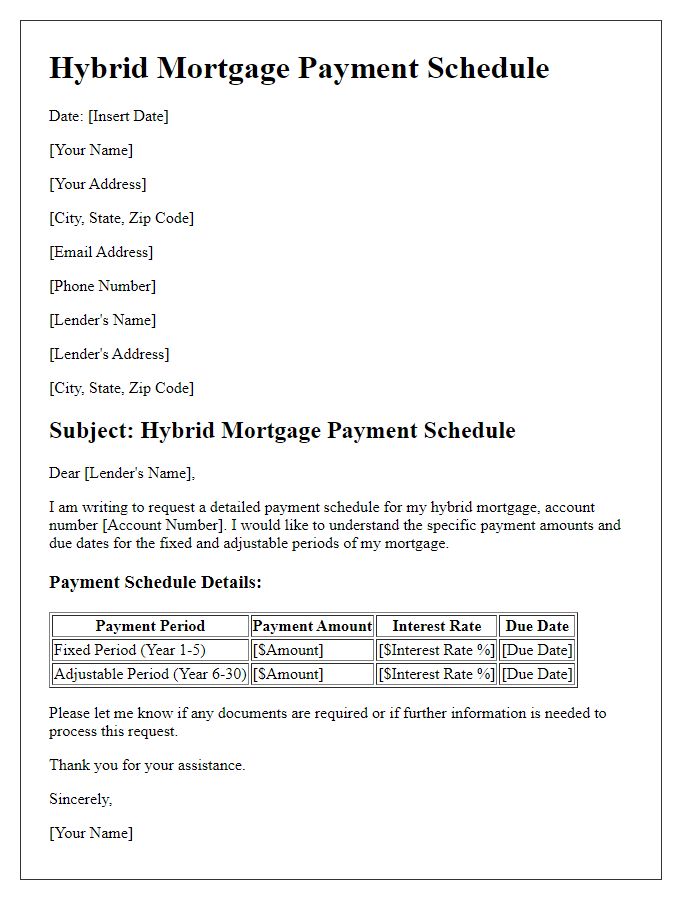

Repayment schedule

A hybrid mortgage structure blends features from both fixed-rate mortgages and adjustable-rate mortgages, providing flexibility in repayment schedules. The initial fixed-rate period typically lasts between 5 to 10 years, during which the interest rate remains stable, offering predictable monthly payments. Following this period, the mortgage transitions to an adjustable-rate format, where the interest rate fluctuates annually based on a specific index, such as the London Interbank Offered Rate (LIBOR) or the Constant Maturity Treasury (CMT). During the adjustable phase, borrower payment amounts may change, often influenced by market conditions. Importantly, hybrid mortgages frequently have payment caps, typically limiting increases to 1% or 2% annually, preventing drastic spikes in repayment amounts. Understanding the implications of this structure is crucial for managing long-term finances effectively, particularly in fluctuating interest rate environments.

Flexibility options

A hybrid mortgage structure offers flexibility options designed to adapt to varying financial needs and circumstances. This mortgage combines fixed-rate and adjustable-rate elements, allowing borrowers to benefit from stable payments initially while taking advantage of potential lower rates in later years. Key factors include an initial fixed-rate period, commonly ranging from 5 to 10 years, where borrowers can enjoy predictable payment schedules. After this term, the interest rate may adjust annually according to market conditions and indices such as the London Interbank Offered Rate (LIBOR), impacting monthly payments. Additionally, many hybrid mortgages provide options for early repayment without penalties, empowering homeowners to refinance or pay off their loan when financially advantageous.

Contact information

Hybrid mortgage structures combine features of both fixed-rate and adjustable-rate mortgages, providing borrowers with stability and flexibility. Typically, a hybrid mortgage may start with a fixed interest rate for an initial period, commonly between 3 to 10 years, before transitioning to an adjustable rate based on market conditions. For example, a 5/1 hybrid mortgage maintains a fixed rate for the first five years, then adjusts annually. Borrowers can benefit from lower initial rates compared to traditional fixed-rate mortgages, but they also face potential risks of increasing rates after the initial period. It is crucial for borrowers to evaluate their long-term plans and financial stability when considering this type of mortgage.

Comments