Are you considering participating in a guaranteed loan program but unsure where to start? Navigating the world of loans can be daunting, but with the right guidance, it does not have to be. In this article, we'll break down the essential steps to ensure you make the most of this opportunity and secure the funding you need. So, keep reading to discover how you can confidently embark on your financial journey!

Clear Purpose Statement

The Clear Purpose Statement for the Guaranteed Loan Program Participation outlines the commitment to facilitating access to financial resources for eligible borrowers. The program aims to support small business growth by providing low-interest loans, nurturing economic development in local communities such as urban and rural areas, and enhancing job creation. This initiative caters to diverse sectors, including agriculture, manufacturing, and technology, ensuring a wide-ranging impact across various industries. Additionally, the program strives to improve financial literacy among participants, fostering sustainable financial practices and empowering individuals through resources and support.

Loan Program Details

The Guaranteed Loan Program offers financial assistance to eligible participants seeking to fund various projects, especially in rural areas. This program provides up to $1 million in loans, with an interest rate capped at 4% annually. Established by the U.S. Department of Agriculture (USDA), the program aims to promote economic development by ensuring lenders have the necessary backing to finance small businesses and agricultural ventures. Participants are required to demonstrate a feasible business plan and provide an acceptable credit history. In addition, loan recipients must be located in designated rural areas identified in the USDA guidelines, ensuring that support reaches communities in need. Regular check-ins are mandated to assess project progress and compliance with program objectives.

Borrower's Financial Information

The Borrower's Financial Information serves as a crucial component in evaluating eligibility for the guaranteed loan program, which supports individuals seeking financial assistance. Essential details include total annual income, housing expenses, and existing debts, such as credit card balances and mortgage obligations. Additionally, lenders typically require documentation of employment history, including position and duration of employment at the current company, which helps establish stability. Furthermore, credit scores from agencies like FICO are analyzed, reflecting payment history across different accounts. Bank statements showcasing savings or checking account balances reveal available liquid assets, providing insight into the borrower's financial health. Understanding these elements is vital for both borrowers and lenders to ensure successful participation in the program.

Assurance of Compliance

Participation in guaranteed loan programs requires strict adherence to specific guidelines and regulations. Compliance with the U.S. Department of Agriculture (USDA) standards ensures program integrity. Key obligations include maintaining accurate financial records, meeting eligibility requirements, and adhering to loan processing timelines. Additionally, borrower education should be provided, focusing on repayment responsibilities and financial literacy. Entities involved in these programs must also implement anti-discrimination policies, aligning with the Equal Credit Opportunity Act (ECOA) to ensure fair treatment across diverse demographics. Regular audits can verify ongoing compliance, enhancing program transparency and credibility.

Contact Information

Contact information for guaranteed loan program participation must be clearly outlined. Include essential details such as the applicant's full name and date of birth, alongside the physical address, including street name, city, state, and ZIP code. Utilize a dedicated phone number for immediate communication, ensuring the number is operational with an area code for reference. Additionally, provide an active email address for digital correspondence, facilitating quicker responses from program administrators. If relevant, include the social security number to confirm identity, and any specific account numbers necessary for processing the application.

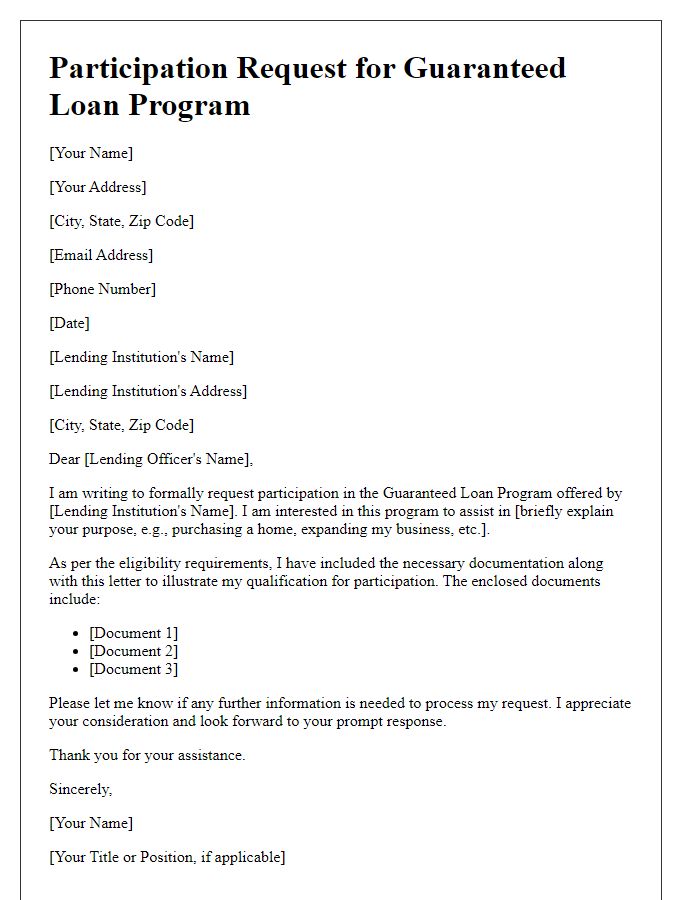

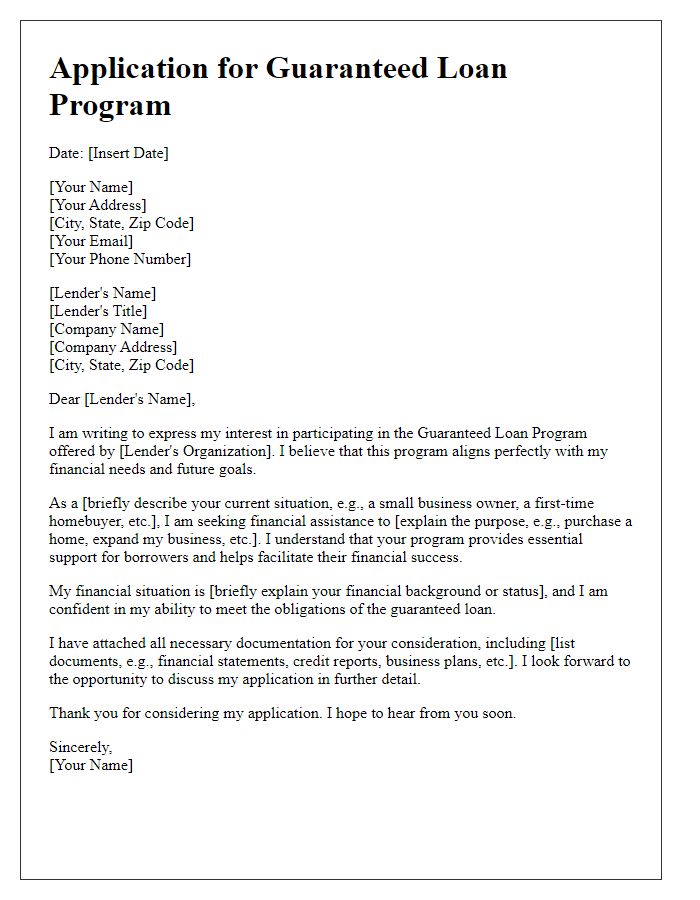

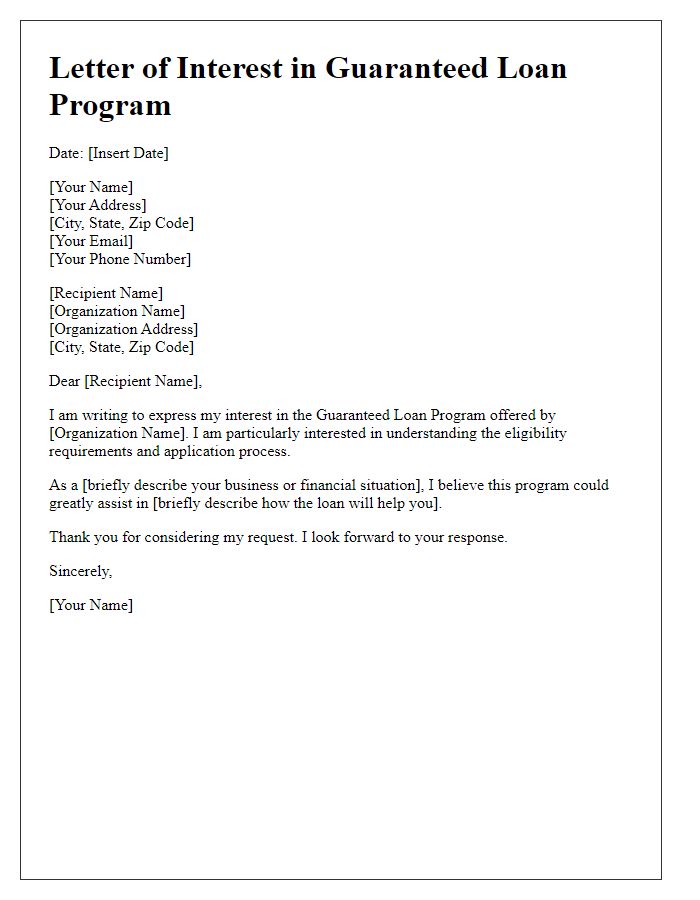

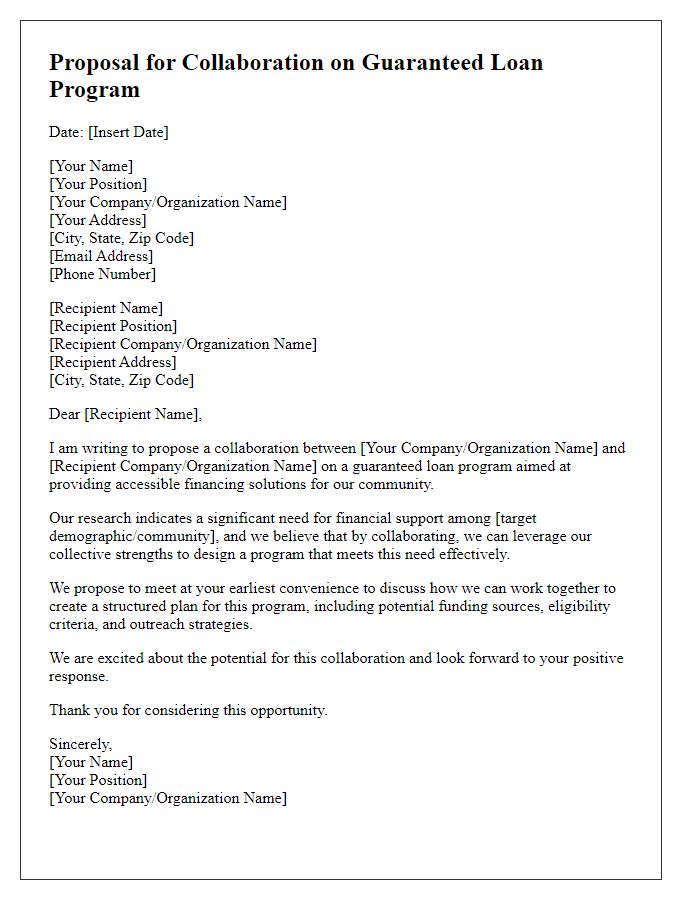

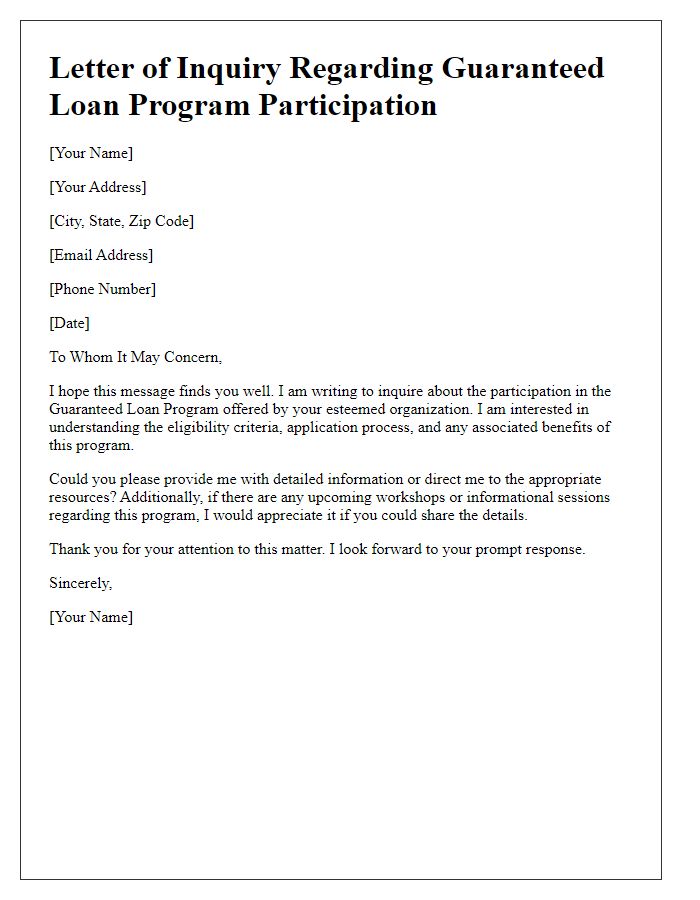

Letter Template For Guaranteed Loan Program Participation Samples

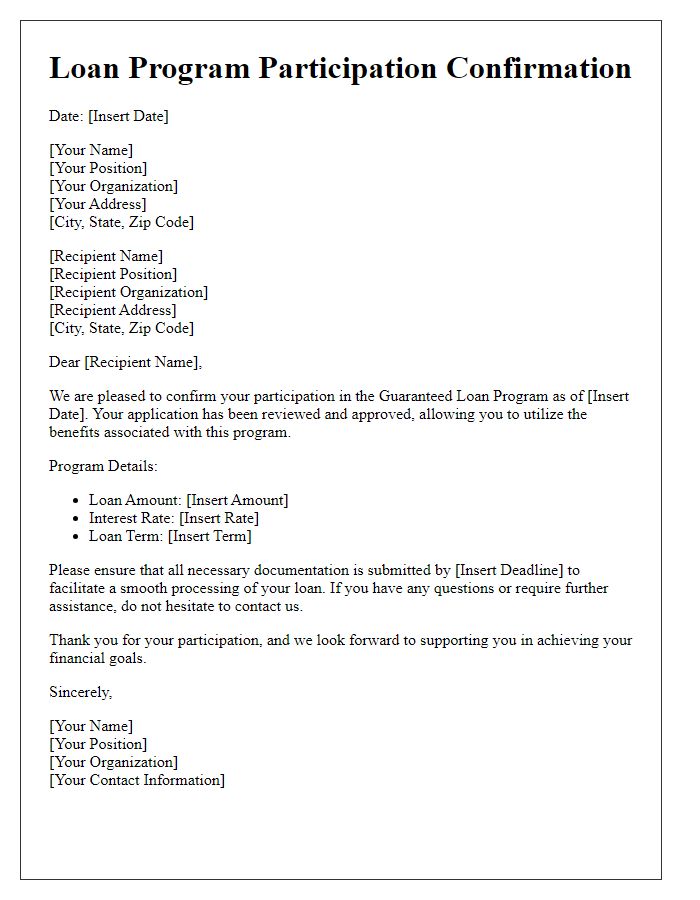

Letter template of confirmation for guaranteed loan program participation

Comments