Are you curious about how to effectively verify the usage of a personal loan? This process is crucial not only for lenders but also for borrowers who want to ensure that their funds are allocated wisely. By keeping clear documentation and understanding the requirements, you can streamline the verification process and maintain financial accountability. Join us as we dive deeper into the steps and tips for personal loan usage verification!

Borrower's Full Name and Contact Information

Borrowers often need to provide detailed information and documentation for personal loan usage verification, especially when dealing with lenders like banks and credit unions. Applicants should include their full name, contact information (such as home address, phone number, and email), as well as any identification numbers like Social Security Number or loan application ID. Lenders typically request specific details about the intended purpose of the loan, such as the amounts ($2,000, $5,000, etc.) for home renovations, medical expenses, or debt consolidation. Clear documentation, such as invoices, receipts, or contracts, is often required to support the stated usage capabilities. When verifying usage, lenders may also ask for employment verification and income statements, ensuring the borrower has the capacity for loan repayment without defaulting. Accurate information fosters transparency and strengthens the borrower's credibility.

Lender's Details and Loan Account Number

Lenders must collect essential information to verify personal loan usage, particularly regarding the lender's details and loan account number. Specific lenders, such as major banks or credit unions, may require accurate identification including the lender's name, contact information, and specific loan account number (typically a unique sequence of digits). This loan account number is crucial for tracking the loan's financial activities and ensuring compliance with usage regulations. Furthermore, it helps in assessing the loan's progress in repayment and maintaining accurate records. Accurate documentation aids both the lender and borrower in understanding the financial terms and obligations tied to the loan agreement.

Purpose of Loan and Detailed Usage Description

Personal loans serve various purposes, often tailored to individual financial needs or aspirations. Common uses include consolidating high-interest debt (averaging 15% APY on credit cards), financing major purchases (like a new car averaging $30,000), covering medical expenses (with average costs rising to $10,000 per person), funding home renovations (often exceeding $15,000), or even paying for education (with an average annual cost nearing $35,000 at private universities). Detailed usage descriptions may require outlining specific expenses, such as listing out credit card balances aimed to be consolidated, detailing medical bills with corresponding providers, or itemizing renovation materials and labor costs. Overall, a precise breakdown of intended loan utilization can facilitate the verification process, ensuring clarity and transparency for both lenders and borrowers.

Date and Location of Loan Usage Verification

A personal loan usage verification document typically includes specific details to confirm the allocation of funds received from the loan. The date of usage verification may indicate when the funds were utilized, reflecting the timeline of financial activities. Notably, the location (such as a city or state) can provide context regarding the geographic area where the loan funds are spent, which may affect local financial regulations. Additionally, it's essential to outline the purpose of the loan, whether it is for home improvement, medical expenses, or educational costs, illustrating the direct impact of the loan on the borrower's financial strategy.

Borrower's Signature and Date of Submission

A personal loan typically requires verification of intended use to ensure responsible borrowing. Borrowers often provide necessary documentation along with their signature, confirming the accuracy of their requested financial aid. This verification might include specific details about planned expenditures, such as home improvements, medical expenses, or debt consolidation, ensuring transparency in financial matters. The date of submission marks the official entry of the application into the lender's system, initiating the approval process and subsequent disbursement of funds. Properly collected signatures hold legal accountability, fostering trust between borrowers and lending institutions.

Letter Template For Personal Loan Usage Verification Samples

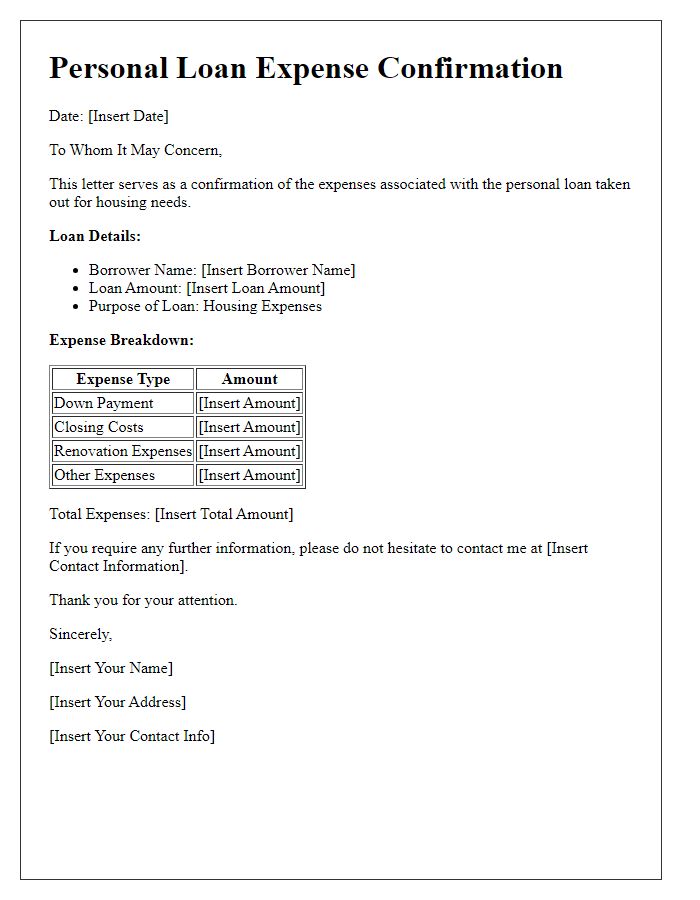

Letter template of personal loan expense confirmation for housing needs.

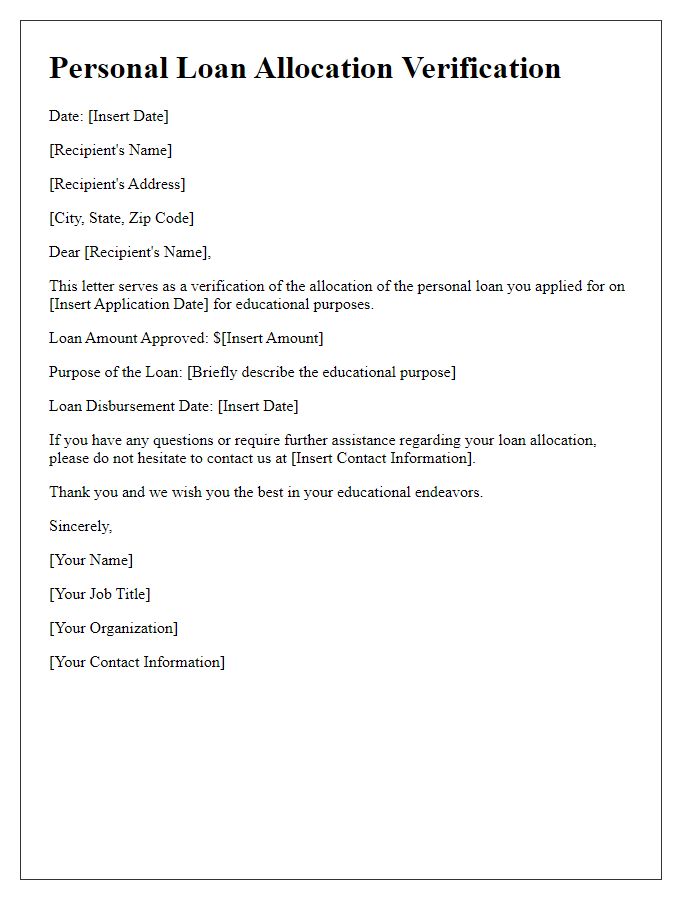

Letter template of personal loan allocation verification for educational purposes.

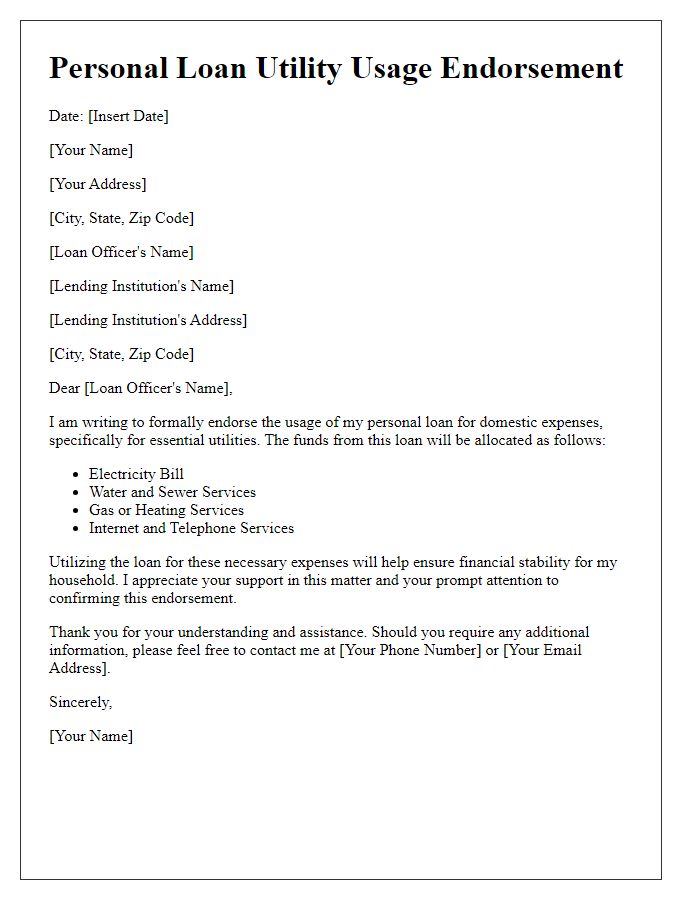

Letter template of personal loan utility usage endorsement for domestic expenses.

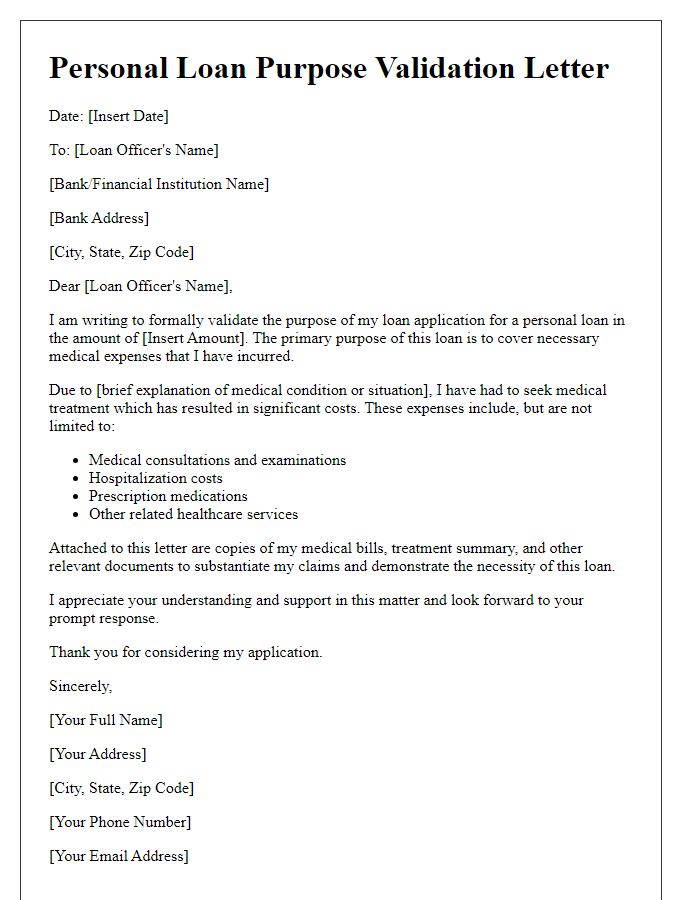

Letter template of personal loan purpose validation for medical expenses.

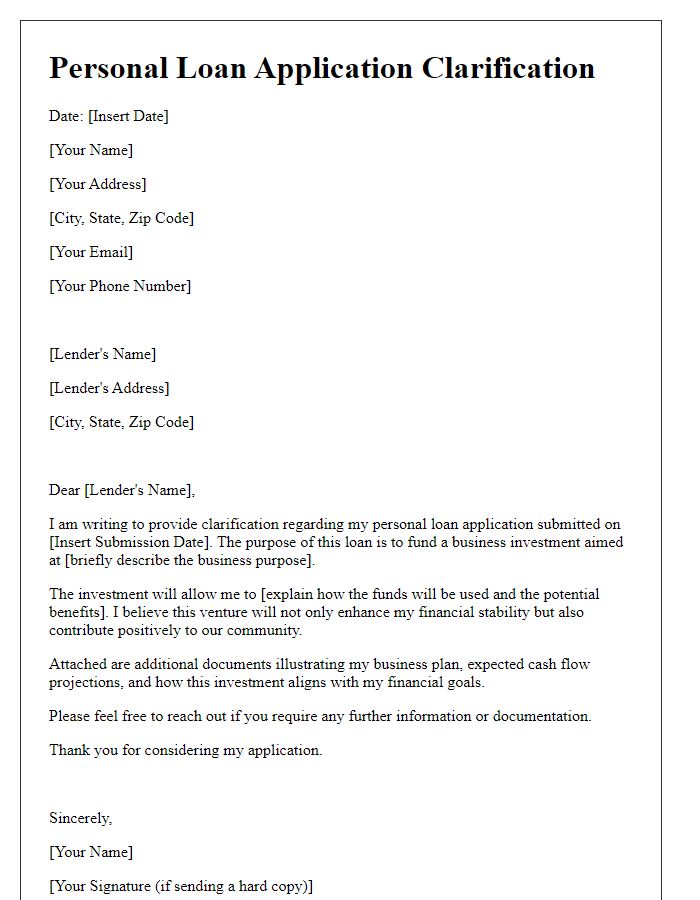

Letter template of personal loan application clarification for business investment.

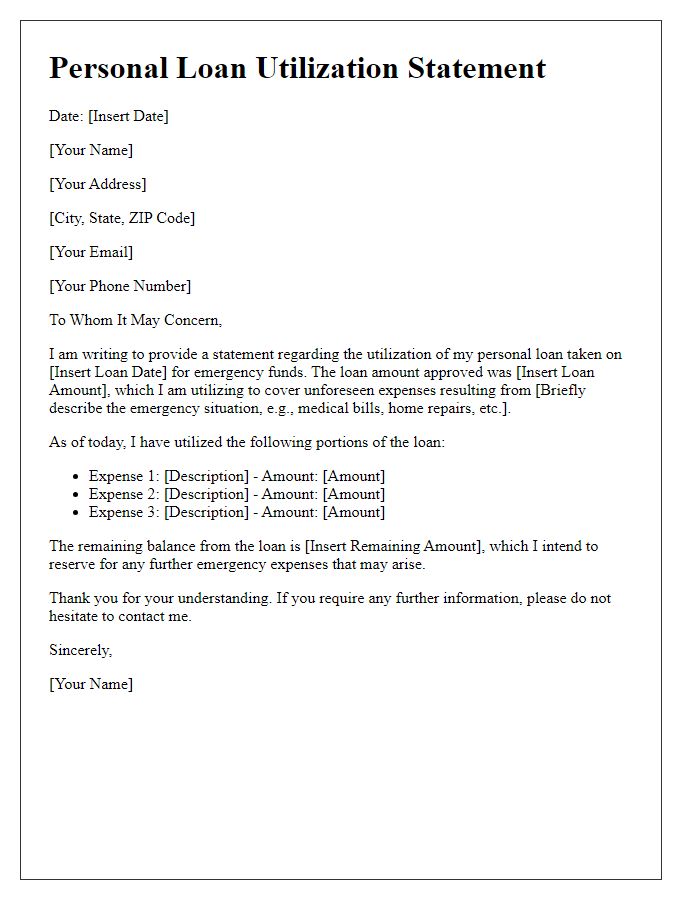

Letter template of personal loan utilization statement for emergency funds.

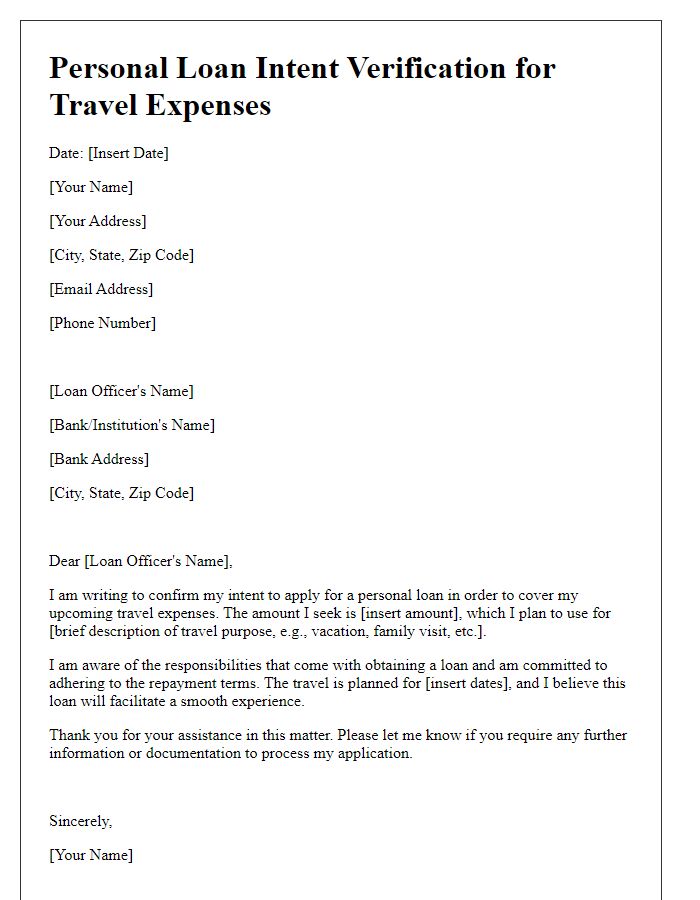

Letter template of personal loan intent verification for travel expenses.

Letter template of personal loan resource documentation for debt consolidation.

Comments