Are you considering transitioning to a fixed rate mortgage? This decision can provide you with the stability of predictable monthly payments, protecting you from fluctuating interest rates. The process may seem daunting at first, but understanding your options can make it much smoother. Join us as we explore the key steps and benefits of making the switchâlet's dive in!

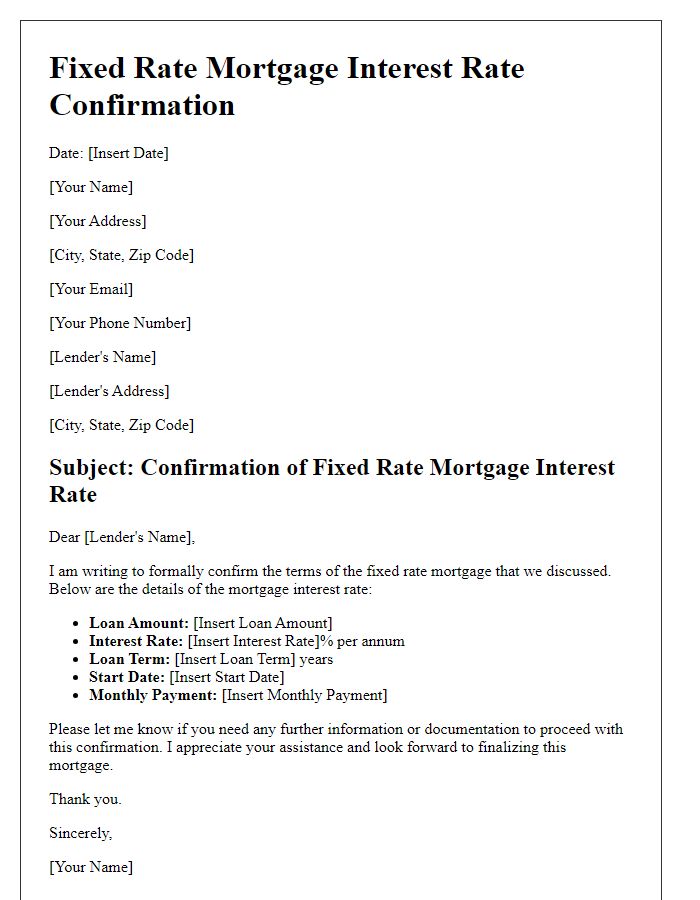

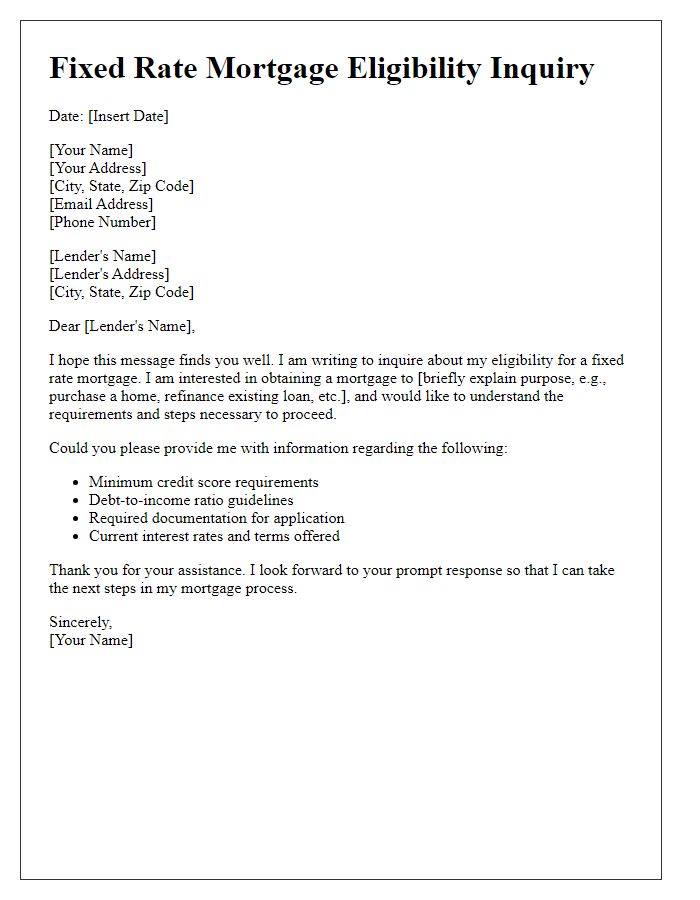

Clear identification of parties involved

A fixed-rate mortgage transition involves multiple parties, including the lender (for instance, Bank of America, established in 1904, serving millions of customers), the borrower (individual or entity, often a first-time homebuyer), and potentially a mortgage broker (such as Quicken Loans, offering advice and acting as an intermediary). Each party holds specific responsibilities during this process. The lender is accountable for providing terms and conditions of the fixed-rate mortgage, typically offering interest rates locked for 15 to 30 years. The borrower must review and accept these terms, including monthly payment schedules and penalties for early payments. The mortgage broker, if involved, assists in navigating the process, ensuring that the borrower understands implications of the mortgage transition. Clear identification and documentation of all parties are essential for legal contracts and successful property transfer.

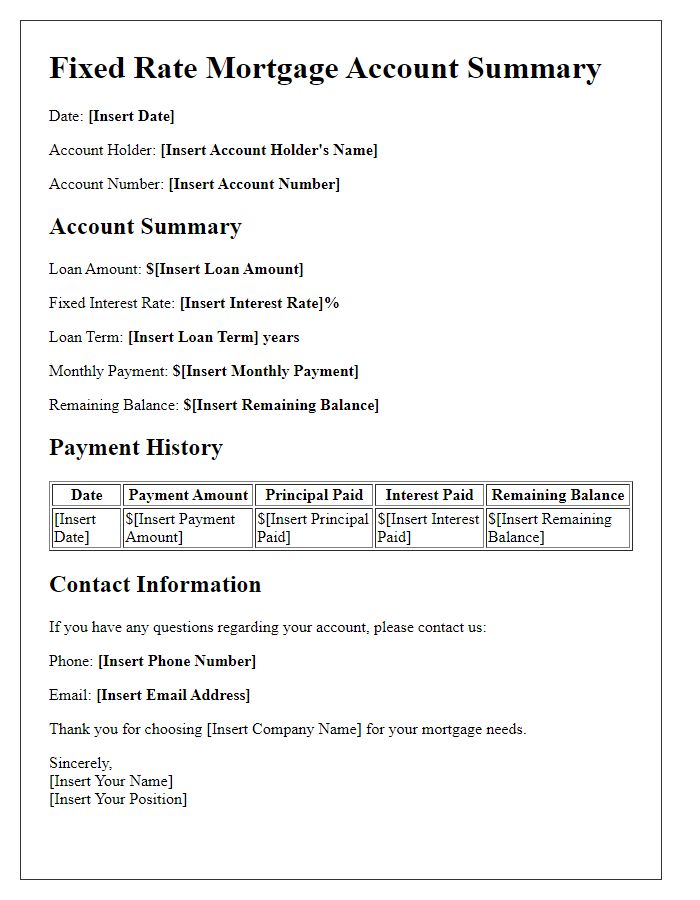

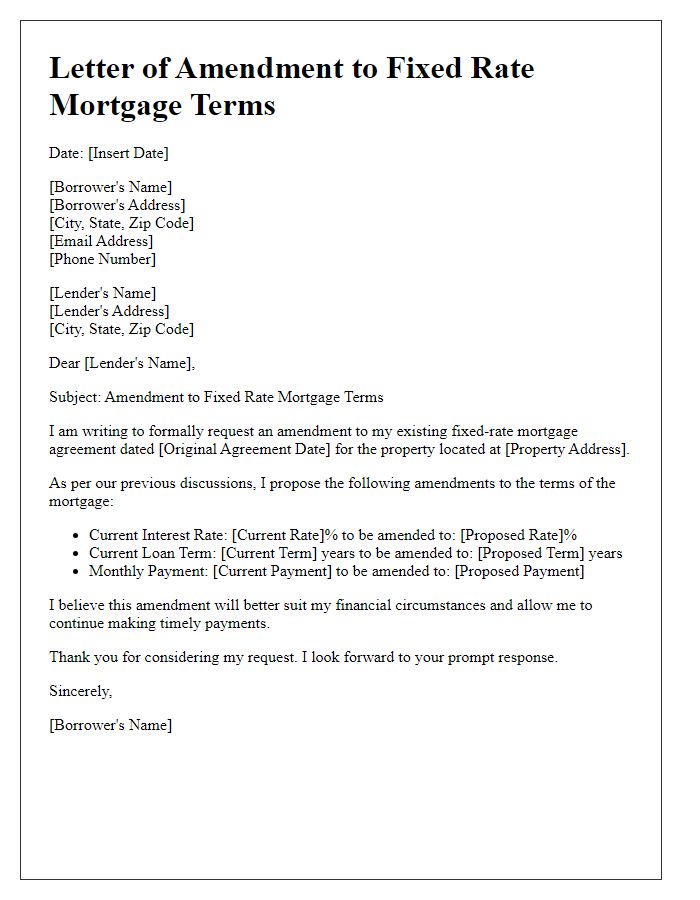

Precise mortgage details (loan amount, interest rate, term)

The fixed-rate mortgage transition involves significant financial details essential for homeowners. A precise mortgage detail consists of the loan amount, typically denoted in thousands or millions of dollars, which represents the total borrowed for purchasing a property, such as a residential home. The interest rate, expressed as a percentage, remains constant throughout the mortgage term, significantly impacting monthly payments; for instance, an interest rate of 3.5% is common in current market trends. The mortgage term, often 15, 20, or 30 years, defines the repayment duration, determining the monthly installment amounts; shorter terms generally lead to higher payments but lower overall interest paid. Understanding these key components is crucial for effective financial planning and long-term cost management.

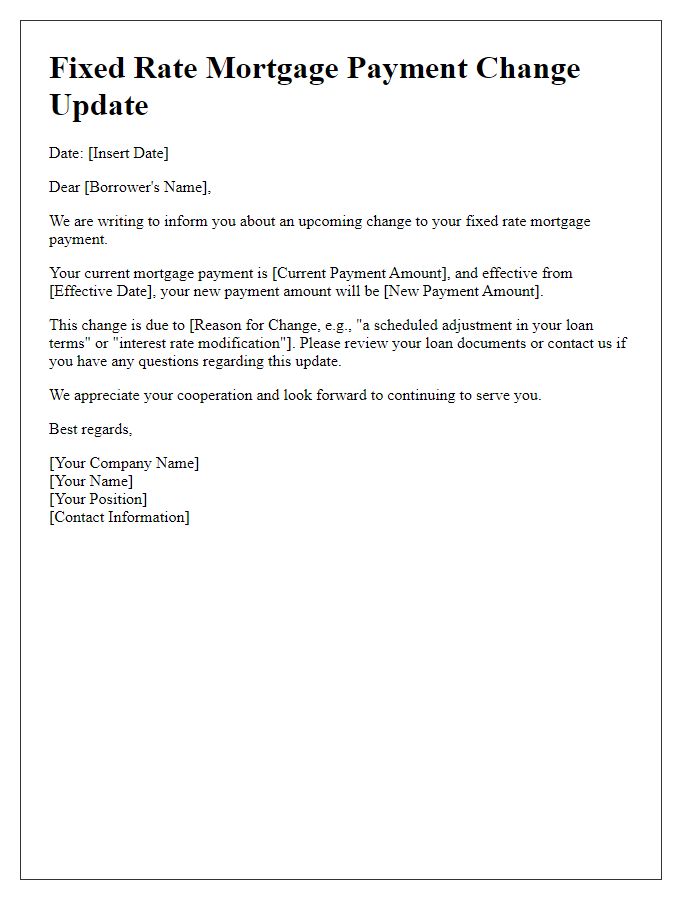

Transition date and terms of change

Transitioning to a fixed-rate mortgage involves significant financial adjustments and a clear understanding of new terms. The transition date, which is essential for planning, typically falls on the first day of the next billing cycle, allowing homeowners to prepare for alterations in payment schedules. The new terms, defined by the lender, may include a set interest rate, such as 3.5% annually, fixed for 30 years, providing stability against market fluctuations. Additionally, the total loan amount could be around $250,000, subject to monthly payments structured to cover both principal and interest, potentially leading to a better budgeting strategy. Homeowners should also consider associated costs, such as closing fees and any potential penalties for switching, which can influence overall savings. Understanding these factors is pivotal for making informed financial decisions during the transition process.

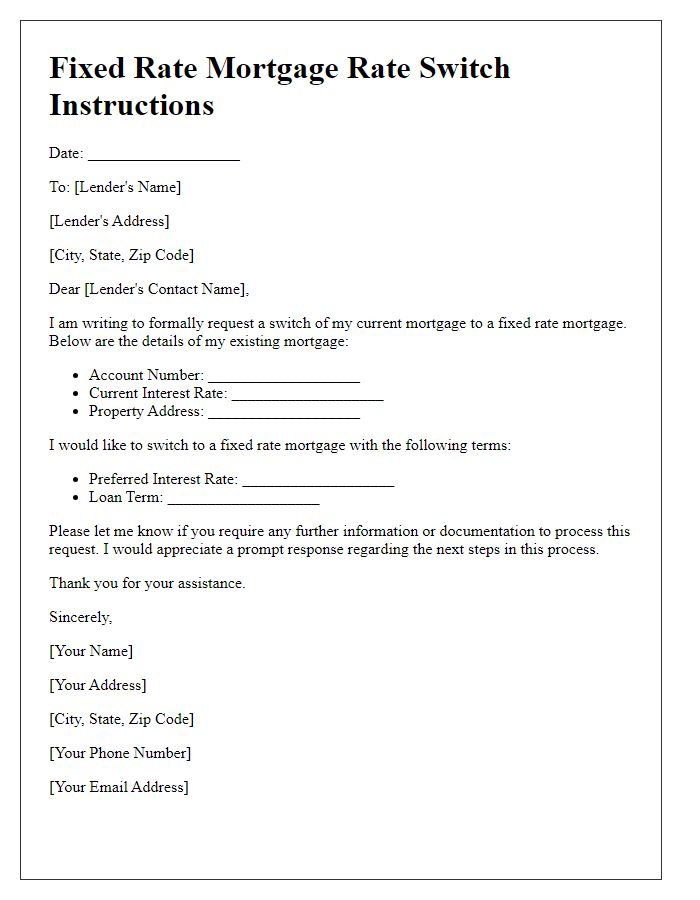

Instructions for any required actions by the borrower

When transitioning to a fixed-rate mortgage, borrowers must complete several essential actions to ensure a smooth process. First, review the mortgage documentation provided by the lender, focusing on key terms such as the interest rate, loan duration, and payment schedule. Next, gather financial documentation, including recent pay stubs, tax returns, and bank statements, as these may be required for assessment. Borrowers should also communicate with their lender regarding any potential changes in personal circumstances that could affect the mortgage agreement. Additionally, it is crucial to confirm that any required insurance policies are in place, such as homeowners insurance or mortgage insurance, to protect the investment. Lastly, borrowers should be prepared to sign necessary documents during the closing process, finalizing the transition to the fixed-rate mortgage.

Contact information for further inquiries or assistance

A fixed-rate mortgage transition offers homeowners the opportunity to secure a stable interest rate over the life of their loan, typically ranging from 15 to 30 years. This transition process usually involves refinancing existing mortgages, allowing homeowners to benefit from potentially lower rates or improved financial terms. Homeowners may need to gather income verification documents, credit reports, and property appraisals, all of which can vary widely depending on the lender's requirements. Financial institutions such as Wells Fargo and Bank of America provide dedicated support teams to assist customers with the mortgage transition process. Individuals considering this transition should be aware of fees associated with refinancing, which can include application fees, appraisal fees, and closing costs, impacting overall savings. For further inquiries or assistance during this process, homeowners can contact their loan officer directly or reach out to their institution's customer service department for tailored guidance.

Comments