Are you considering an adjustable-rate loan but feeling a bit overwhelmed by the details? You're not alone, as many borrowers find themselves navigating the complexities of fluctuating interest rates. In this article, we'll break down the essentials, ensuring you understand how these loans work and what you can expect. So, let's get started and explore everything you need to know about your adjustable-rate loan options!

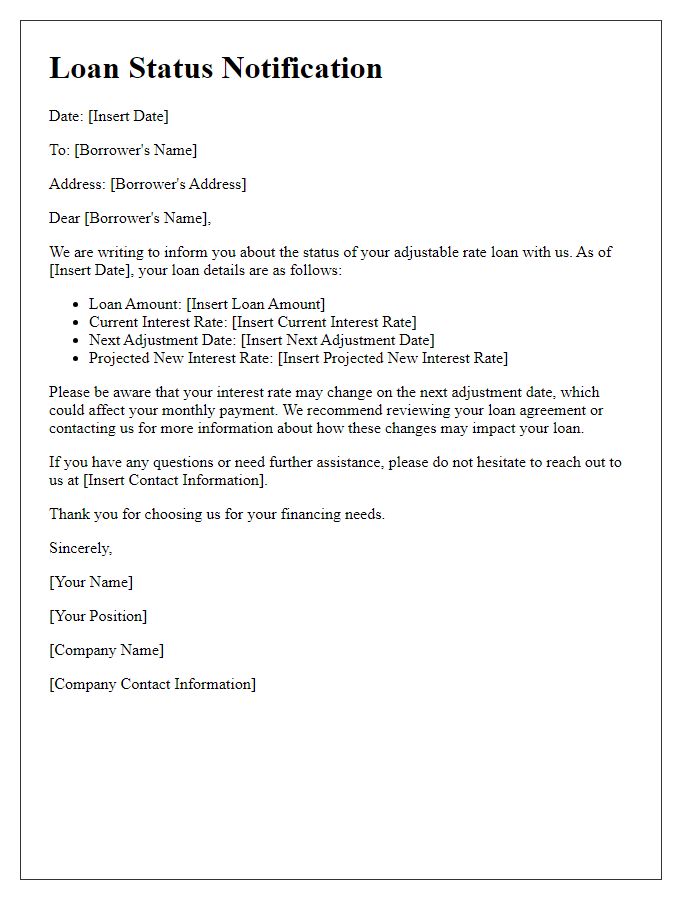

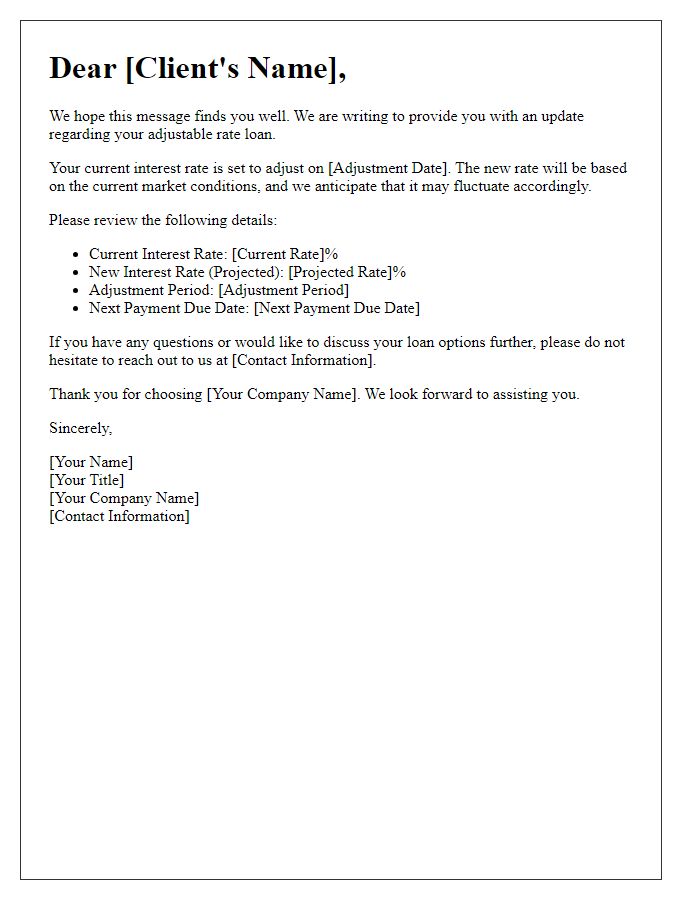

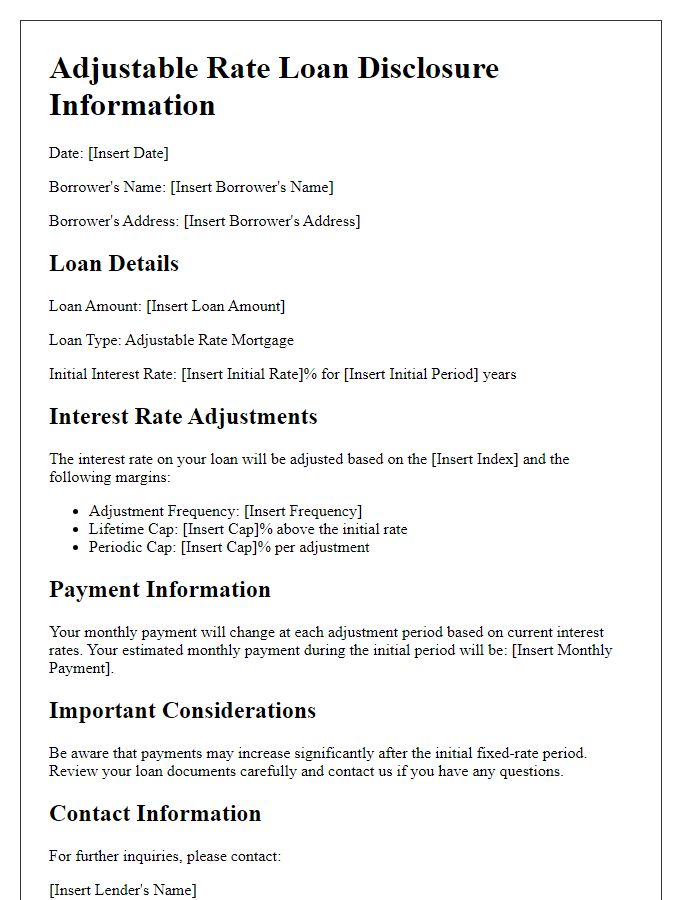

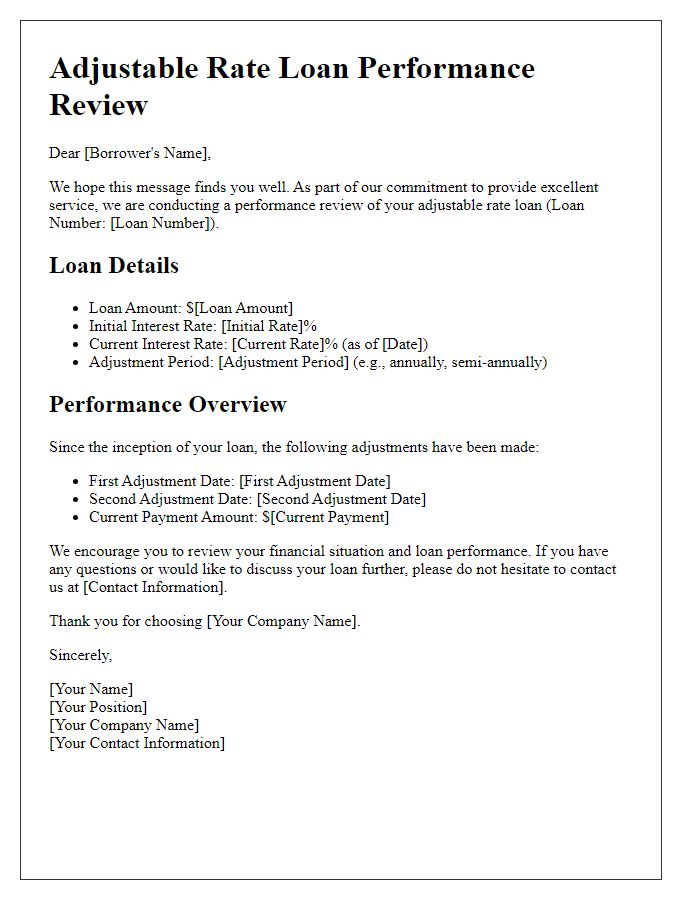

Loan account details

The adjustable-rate loan, commonly referred to as an ARM, has specific features that dictate the interest rate and payment adjustments based on market indices. Current loans under this category utilize benchmarks such as the London Interbank Offered Rate (LIBOR) or the Secured Overnight Financing Rate (SOFR). Updates to loan account details, including changes in interest rates, are communicated regularly--typically occurring annually or semi-annually--allowing borrowers to anticipate potential increases or decreases in their monthly payments. Relevant loan account details would include the original loan amount, initial interest rate, adjustment frequency, and the duration of the adjustment period, providing a complete picture of financial obligations. Understanding these elements is crucial for effective budget management and financial planning.

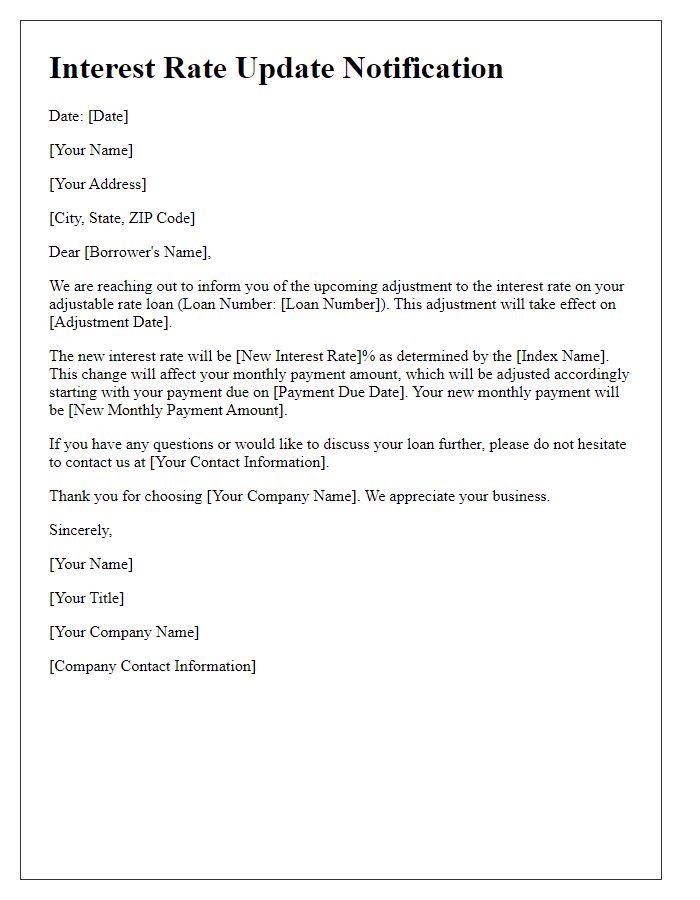

Current interest rate and new rate changes

Adjustable rate loans, commonly utilized in mortgages, are subject to periodic adjustments based on benchmark interest rates such as LIBOR (London Interbank Offered Rate) or the SOFR (Secured Overnight Financing Rate). As of October 2023, the current interest rate stands at 4.5%, a significant figure that reflects market fluctuations. The upcoming adjustment period is set for January 2024, during which the new rate will be recalibrated based on any changes in these benchmarks. Potential changes in the rates could lead to an increase of 0.5% to 1.0%, depending on economic conditions. Borrowers should prepare for potential payment adjustments that could impact monthly budgets, especially in light of recent inflation concerns and Federal Reserve policies aimed at controlling rising costs.

Upcoming adjustment date

Adjustable rate loans (ARMs) often undergo interest rate modifications based on market indices (such as the prime rate) on specified adjustment dates, typically every 6 or 12 months. The upcoming adjustment date for this loan is set for January 1, 2024. This adjustment may impact monthly payment amounts. As of October 2023, the current interest rate stands at 3.5%. Interest rate fluctuations can directly influence the loan's overall cost, potentially resulting in increased monthly payments if the rates rise significantly. Consulting the loan's terms and market conditions is advised to prepare for potential financial changes.

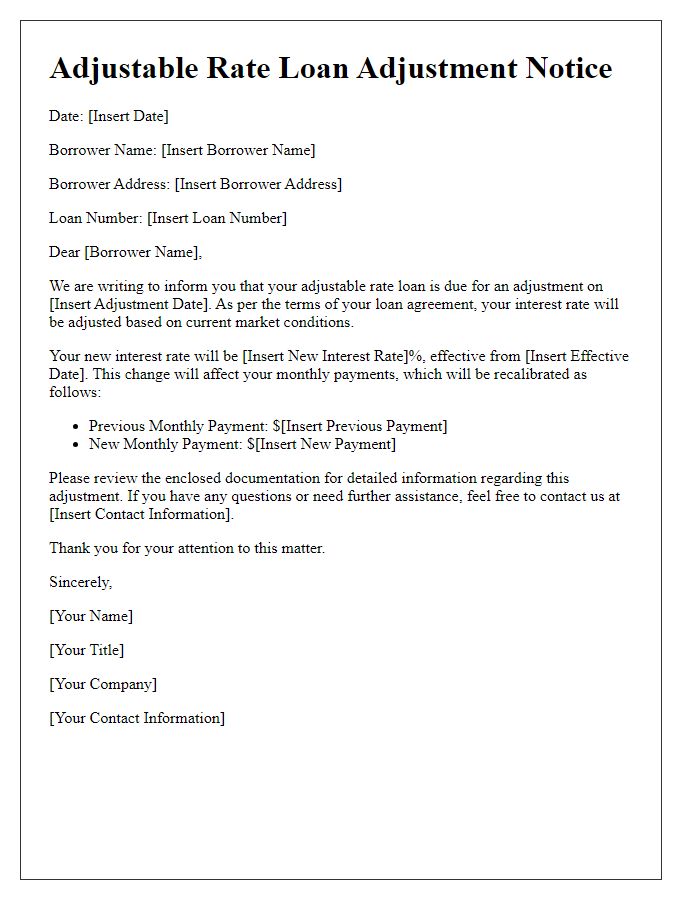

Impact on monthly payments

Adjustable rate loans, commonly linked to benchmarks like the London Interbank Offered Rate (LIBOR), can significantly impact monthly payment amounts. A rate adjustment, occurring annually or semi-annually according to the loan agreement, can lead to increases or decreases in interest rates, reflecting changes in the broader economy. For instance, recent fluctuations in rates, influenced by Federal Reserve policy shifts, may result in an adjustment of 0.5% or more. Consequently, monthly payments can vary; for a $200,000 loan, a 0.5% increase may raise payments by approximately $100. Borrowers should assess their financial readiness for such shifts and consider refinancing options if rates become unfavorable.

Contact information for inquiries

Adjustable rate loans often fluctuate based on market conditions, such as the London Interbank Offered Rate (LIBOR) or the U.S. Treasury Index. Borrowers should stay aware of their current rate adjustments, usually occurring every 6 or 12 months. Specific numbers associated with recent changes can significantly impact monthly payments, affecting individual financial plans. For any inquiries regarding the updated loan terms, it's crucial to contact the customer service department of the lender, typically available via a dedicated phone line or email address found on the official website. Keeping track of these details ensures that borrowers remain informed about their financial commitments.

Comments