Are you familiar with the process of issuing a promissory note? It can seem a bit daunting at first, but breaking it down into simple steps makes it much more manageable. In this article, we'll explore the essential elements of a promissory note, including what information you need to include and how to ensure it's legally binding. So, if you're ready to take the next step in securing your financial agreements, keep reading!

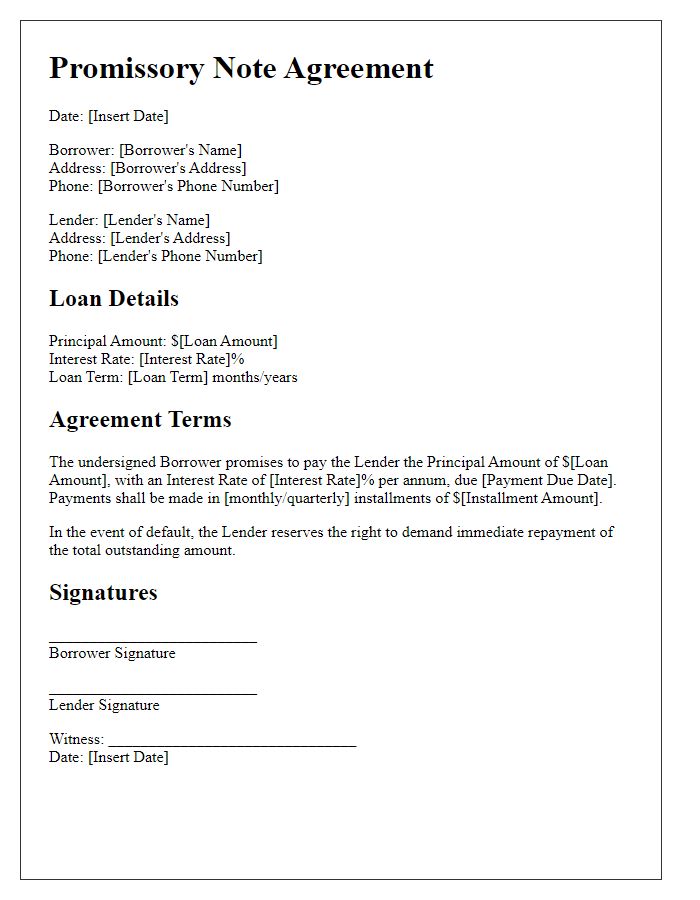

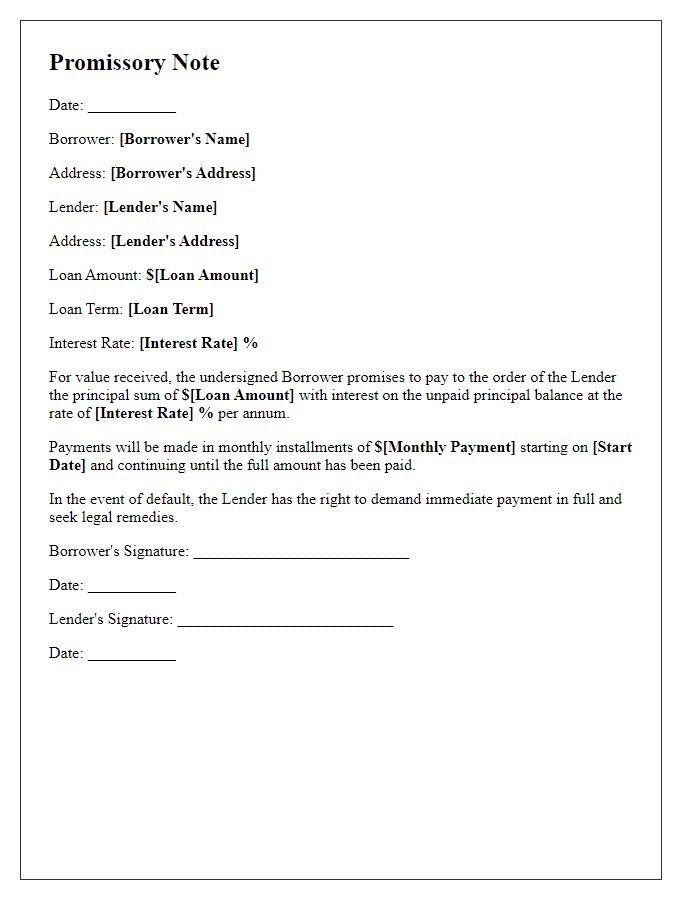

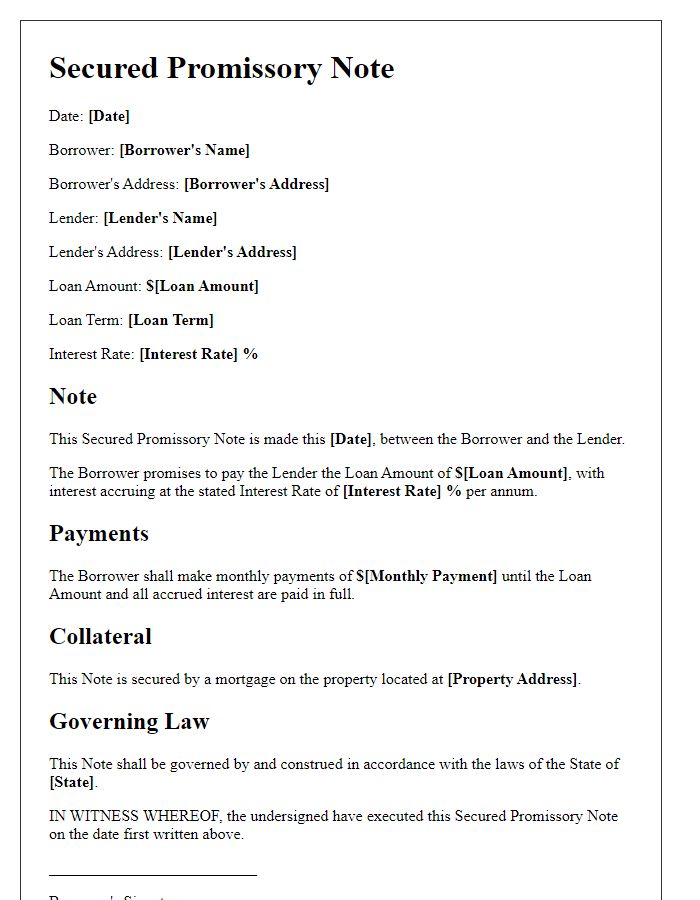

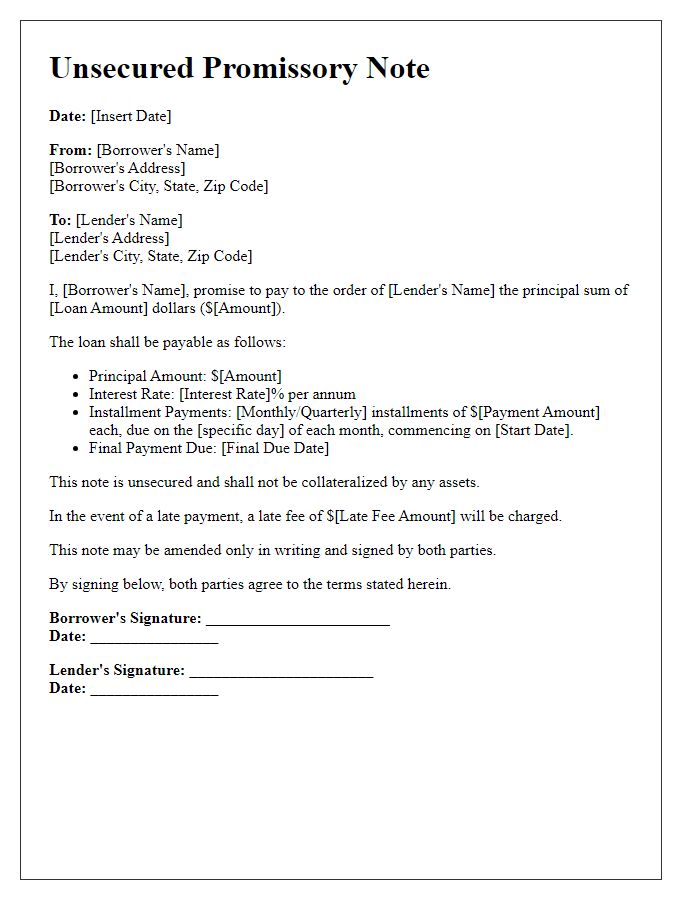

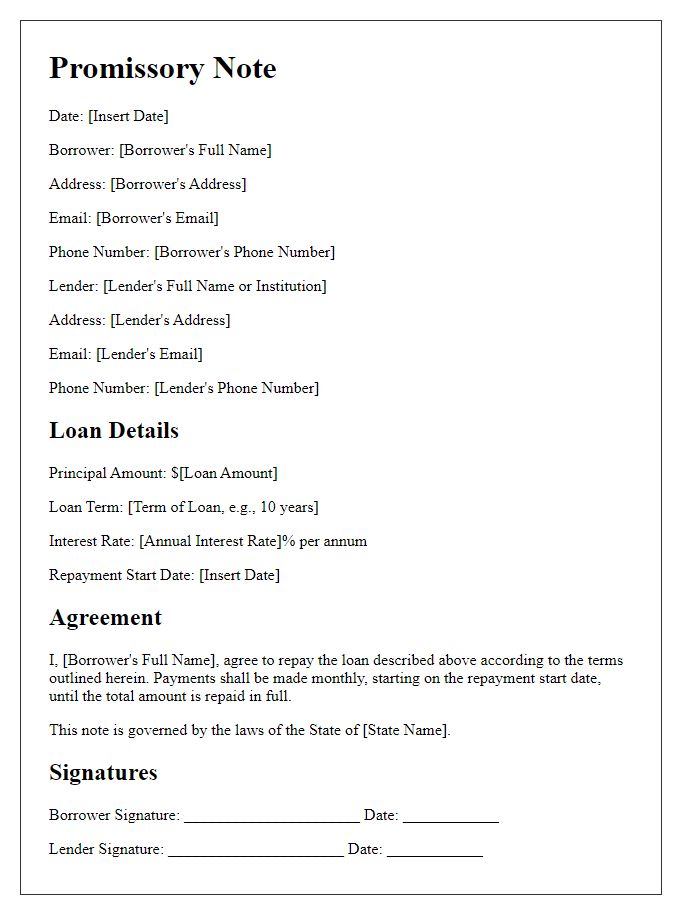

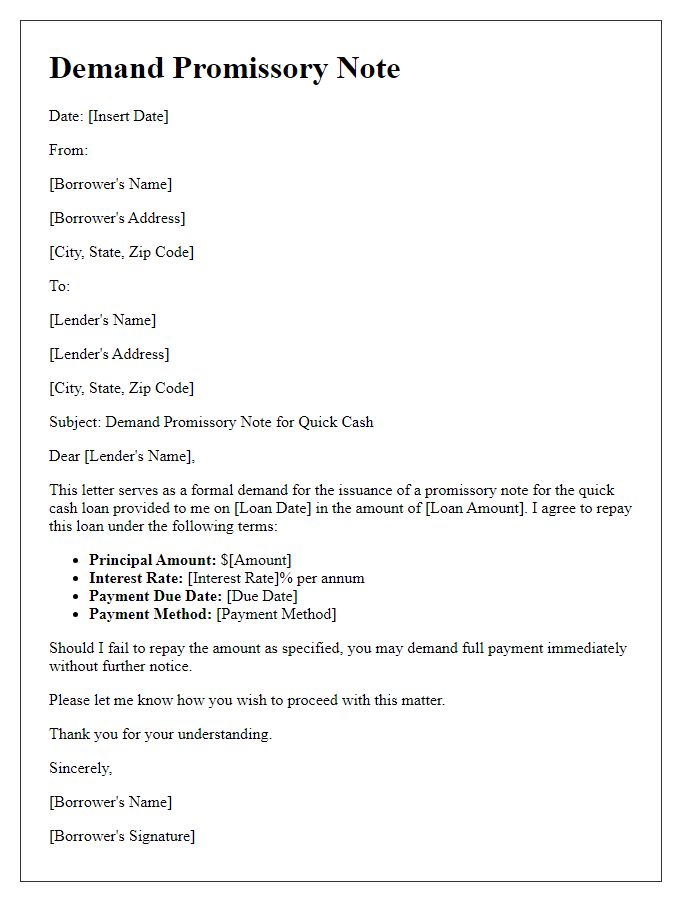

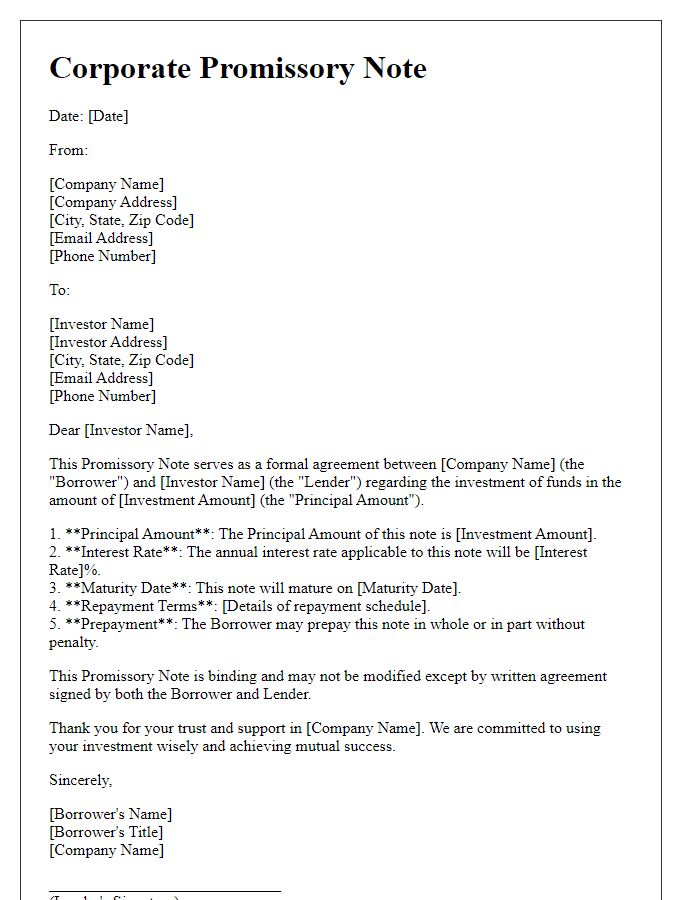

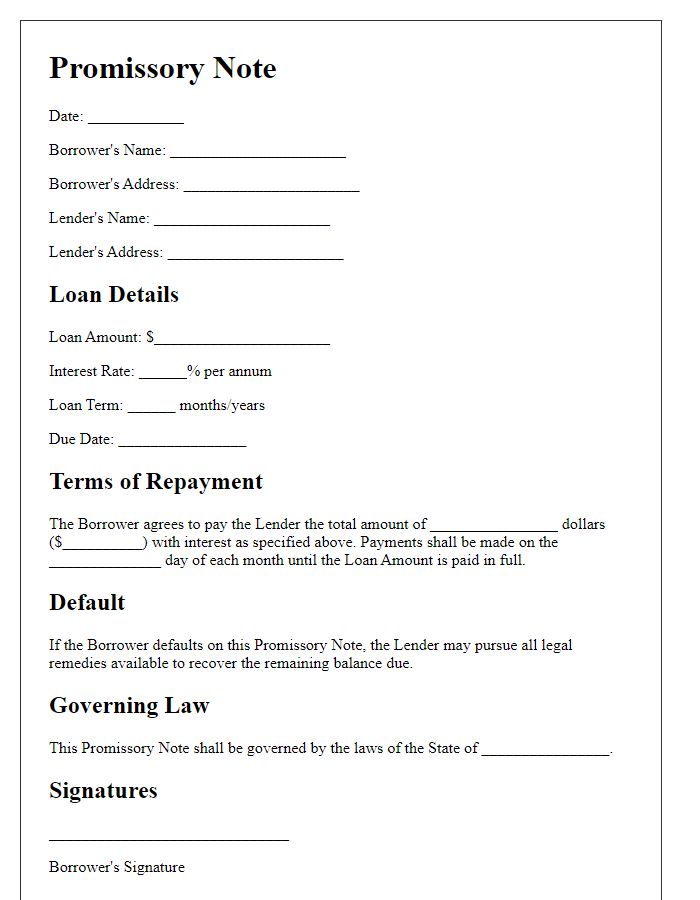

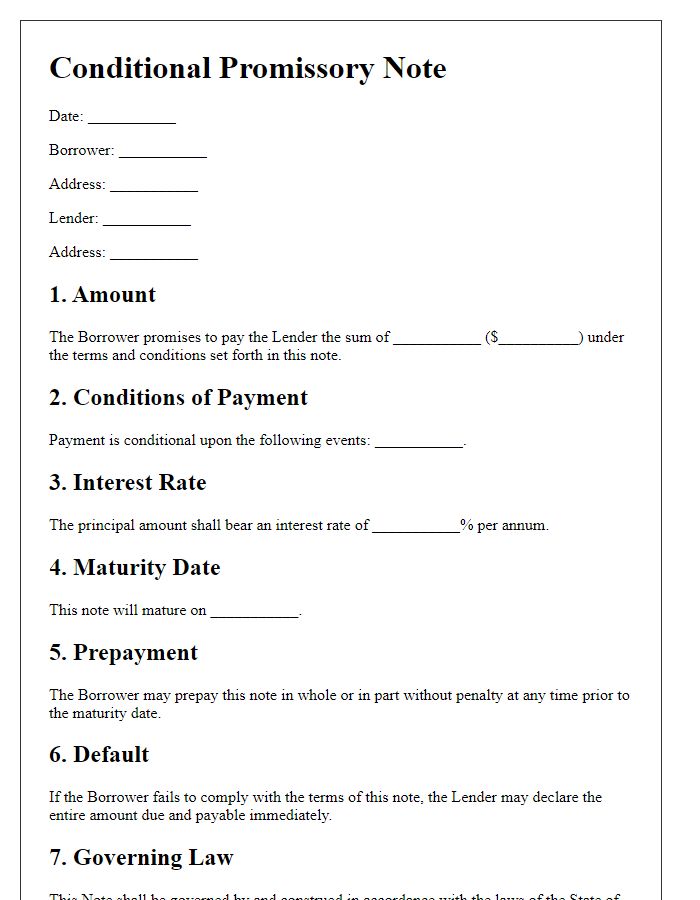

Creditor and Debtor Details

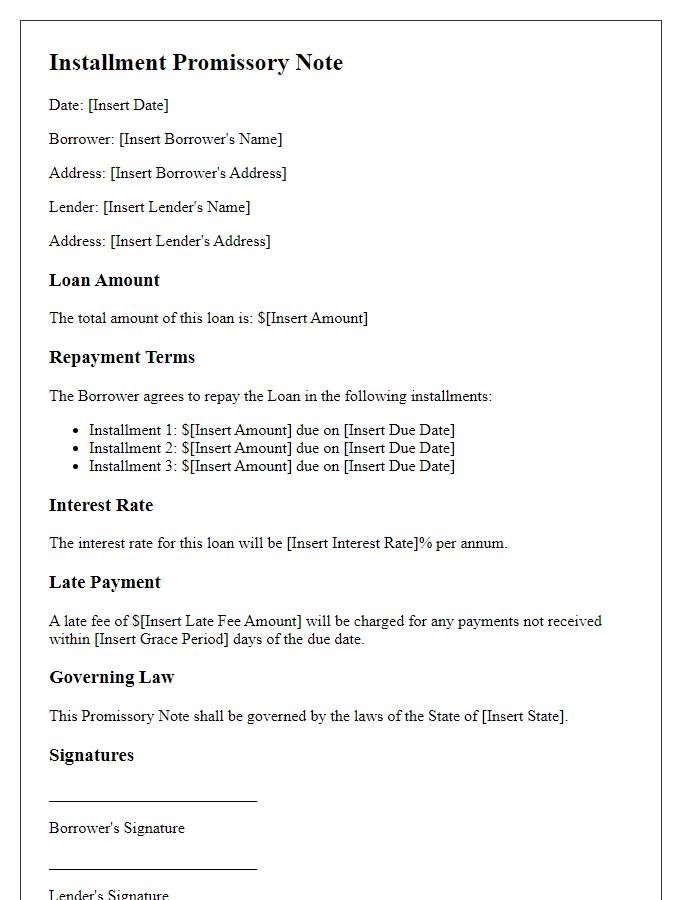

In the realm of financial agreements, promissory notes serve as crucial legal documents outlining the terms of a loan. The creditor, often a financial institution (such as a bank or a credit union) or an individual, provides the debtor (the borrower) with a specified sum of money (the principal amount, perhaps ranging from a few hundred to thousands of dollars) that must be repaid over a defined period, typically including interest rates (commonly between 5% to 15%). Essential components of this note comprise the full names and addresses of both parties, the loan amount, the repayment schedule (including start and end dates), and any conditions for default (such as late payment penalties). Ensuring these details are precisely documented is vital for both parties to maintain clarity and enforceability under the law.

Principal Amount

A promissory note is a financial instrument that involves a written promise by one party (the borrower) to pay a specified sum of money to another party (the lender) at a determined future date or on demand. Key elements include the Principal Amount, which represents the original sum borrowed, typically defined in numerical terms (e.g., $10,000), alongside the interest rate, repayment schedule, and any potential collateral securing the loan. The promissory note should specify the date of issuance, typically a date in numerical format (e.g., January 1, 2023), and include full legal names of the borrower and lender, which provides clarity and prevents disputes. The legal jurisdiction governing the agreement must also be indicated, often related to specific states or countries, ensuring enforceability of the terms outlined in the document.

Interest Rate Terms

A promissory note outlines the agreement between a borrower and a lender regarding a loan, often specifying key details such as interest rate terms. The annual interest rate, commonly expressed as a percentage, determines the cost of the loan, influencing the total amount payable over time. For example, an interest rate of 5% on a principal amount of $10,000 results in an annual interest payment of $500. Additionally, the compounding frequency can affect the total interest accrued; monthly compounding leads to a higher effective interest rate compared to annual compounding. Payment terms must also be clearly defined, including the repayment schedule, which can be structured as monthly or biweekly payments. Penalty clauses for late payments or default may also be included to protect the lender's financial interests. A well-structured promissory note serves as a legally binding contract, ensuring both parties understand their obligations regarding the loan.

Repayment Schedule

A well-structured repayment schedule is crucial for promissory notes, detailing the terms of repayment in a clear manner. For example, a borrower agrees to repay a principal amount of $10,000 over a period of 12 months. Monthly installments of approximately $850 are due on the 1st of each month, starting from January 1, 2024, until December 1, 2024. The note might stipulate a fixed interest rate of 5% APR, which translates to a total interest payment of $600 over the term. Delinquency terms can also be highlighted, specifying a late fee of $50 for payments made more than five days past the due date and the process for default, including a notice period of 30 days before further legal action is considered. This comprehensive structure ensures clarity for both parties in the lending agreement.

Legal Provisions and Default Clauses

A legally binding promissory note serves as a written promise to repay a specified sum of money under defined terms, commonly used in financial transactions. Essential elements include the principal amount (the original loan amount), interest rate (the percentage charged on the borrowed money), payment schedule (specific dates when payments are due), and maturity date (the final date when the full amount must be paid). Default clauses outline repercussions in the event of non-payment, including acceleration (the entire loan amount becomes due immediately), late fees (additional charges incurred for missed payments), and possible legal action (steps taken to recover owed funds). Legal provisions must conform to local jurisdiction laws, ensuring enforceability in courts, such as regulations outlined in the Uniform Commercial Code (UCC) in the United States. An effective promissory note protects lenders, fosters trust, and provides clear terms for both parties involved in the transaction.

Comments