Are you looking to understand the ins and outs of refinancing approval conditions? Navigating through the requirements can be a bit overwhelming, but it doesn't have to be! In this article, we'll break down the essential factors that lenders consider when evaluating your refinancing application. So, grab a cup of coffee and let's dive inâyour path to a smoother refinancing experience starts right here!

Loan Amount and Interest Rate

Refinancing approval conditions typically include critical financial components such as the loan amount and interest rate. A standard loan amount often ranges significantly based on property value and borrower qualifications; for example, a homeowner seeking to refinance may apply for a loan amount of $250,000 to $500,000. Interest rates can vary widely as well, currently hovering around 3% to 6% depending on market conditions and the borrower's credit score; lower rates generally provide substantial savings over time. Additionally, lenders may impose specific criteria regarding the debt-to-income ratio, which ideally should not exceed 43% to qualify for favorable terms. Understanding these elements is crucial in making informed refinancing decisions.

Repayment Terms and Schedule

Repayment terms and schedules play a crucial role in refinancing agreements, particularly in loans such as mortgages. Typically, borrowers need to adhere to a fixed or adjustable interest rate, which can significantly influence monthly payment amounts. For example, a 30-year fixed-rate mortgage may offer consistency with monthly payments remaining the same throughout the term, while a 5/1 ARM (Adjustable Rate Mortgage) could result in fluctuating payments after the initial five years. Borrowers must also be aware of specific condition requirements, such as payment frequency--monthly, quarterly, or biweekly--affecting the total interest paid over the loan's duration. Additionally, understanding amortization (the gradual reduction of debt through scheduled payments) is essential, as variations can impact the overall financial strategy and long-term budgeting. Consideration of prepayment penalties is necessary too, as some lenders impose fees on early loan repayment, affecting financial flexibility. Clearly defined repayment schedules help borrowers manage their finances effectively, ensuring timely payments and maintaining good credit standing.

Collateral Requirements

Collaterals for refinancing conditions typically refer to assets that secure the loan and mitigate risk for lenders. Common collateral types include real estate properties (such as homes or commercial buildings appraised at current market values) and vehicles (like cars or trucks with blue book valuations). Financial instruments, including stocks or bonds, may also serve as collateral based on their market performance. Lenders often require documentation such as property titles, recent appraisals, and vehicle registration to establish asset ownership and value. Ensuring that these collaterals exceed the loan amount (often a minimum of 20% more) serves to provide security and enhance the likelihood of refinancing approval.

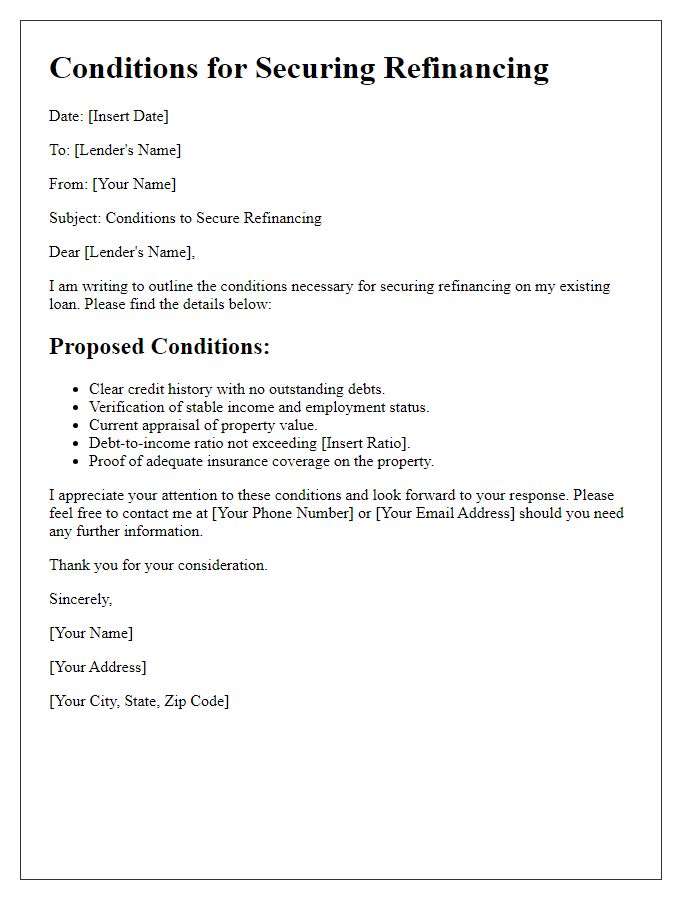

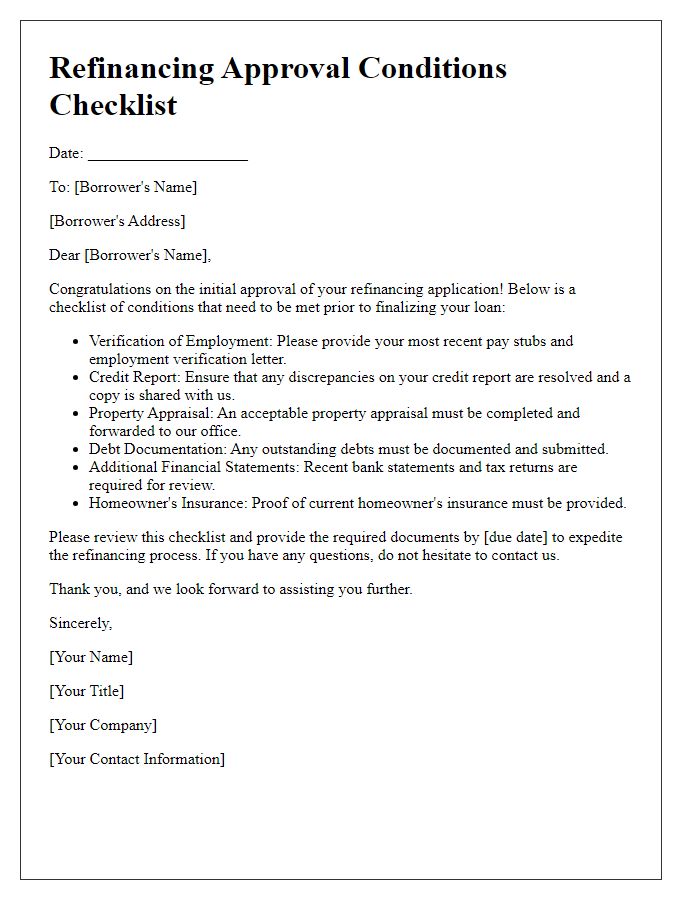

Documentation and Verification

Refinancing applications typically require comprehensive documentation and verification processes to ensure borrower eligibility and lender risk assessment. Essential documents include proof of income such as pay stubs, tax returns from the last two years, and bank statements demonstrating savings or account health, significantly influencing approval likelihood. Credit reports, highlighting credit scores and histories, reveal borrowers' creditworthiness, with scores above 620 generally considered favorable. Property-related documents, including appraisal reports estimating fair market value and mortgage statements showing current loan terms, are crucial for establishing equity. Additional verification steps may involve employment verification through employer contacts and debt-to-income ratio assessments to evaluate financial stability before refinancing approval.

Compliance with Regulatory Standards

Compliance with regulatory standards is crucial for refinancing approval, as it ensures that all financial practices align with established guidelines. Regulatory authorities, such as the Consumer Financial Protection Bureau (CFPB) in the United States, set specific criteria that must be met during the refinancing process. These may include verification of income documents (pay stubs or tax returns), assessment of credit history (FICO scores usually above 620 for favorable rates), and confirmation of property appraisals (especially if the home is in a declining market such as certain neighborhoods in Detroit, Michigan). Additionally, lenders often require adherence to the Truth in Lending Act (TILA), which mandates clear disclosure of loan terms and costs. Compliance with these standards not only facilitates smoother transactions but also protects borrowers from predatory lending practices often observed in the financial sector. Meeting these conditions is essential for both borrowers seeking better loan terms and lenders aiming to maintain their reputability in the market.

Comments