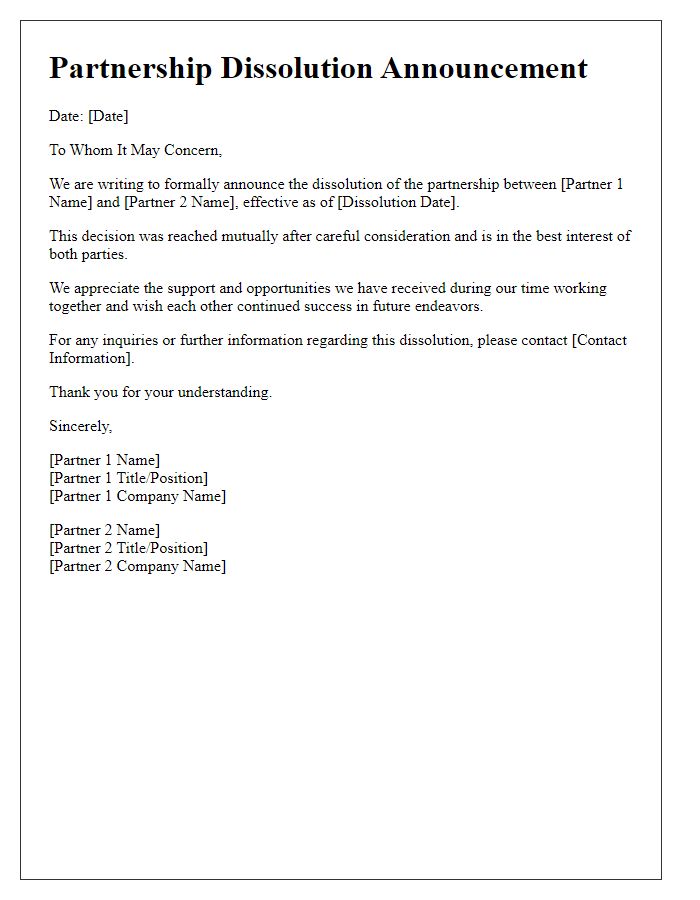

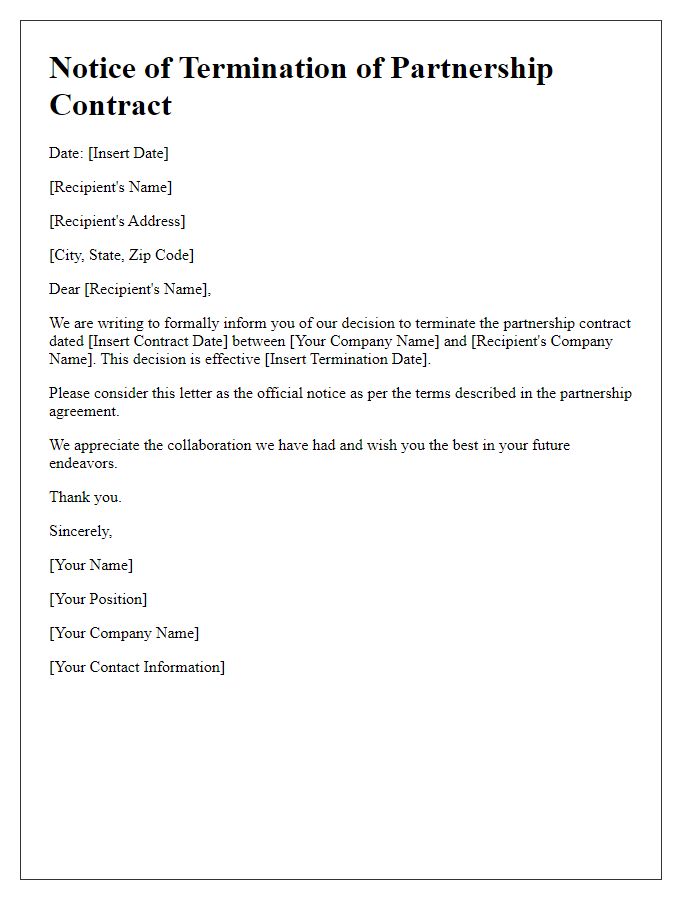

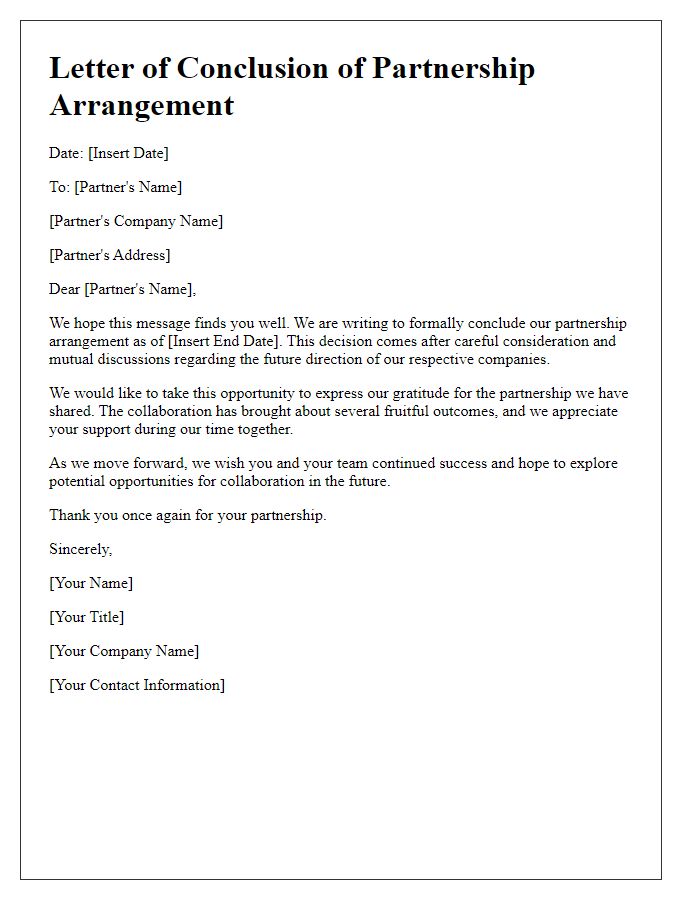

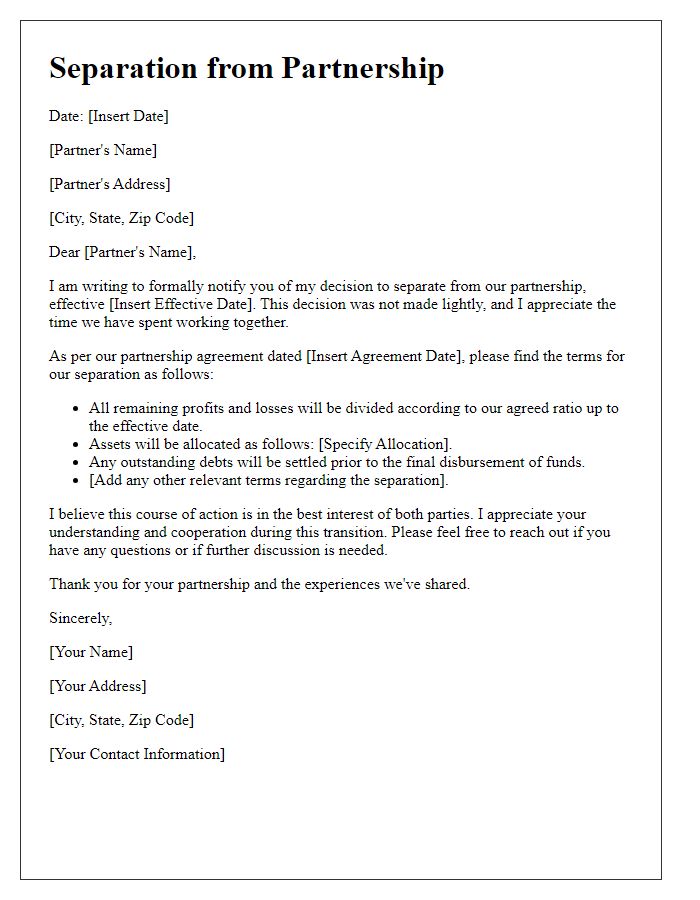

When it comes to ending a partnership, clarity and professionalism are key. A termination notice can provide a structured way to communicate your decision while preserving the relationship. It's important to outline the terms of the partnership, any outstanding obligations, and next steps. If you're looking for a guide on how to craft the perfect termination notice, keep reading for a detailed template you can customize for your needs.

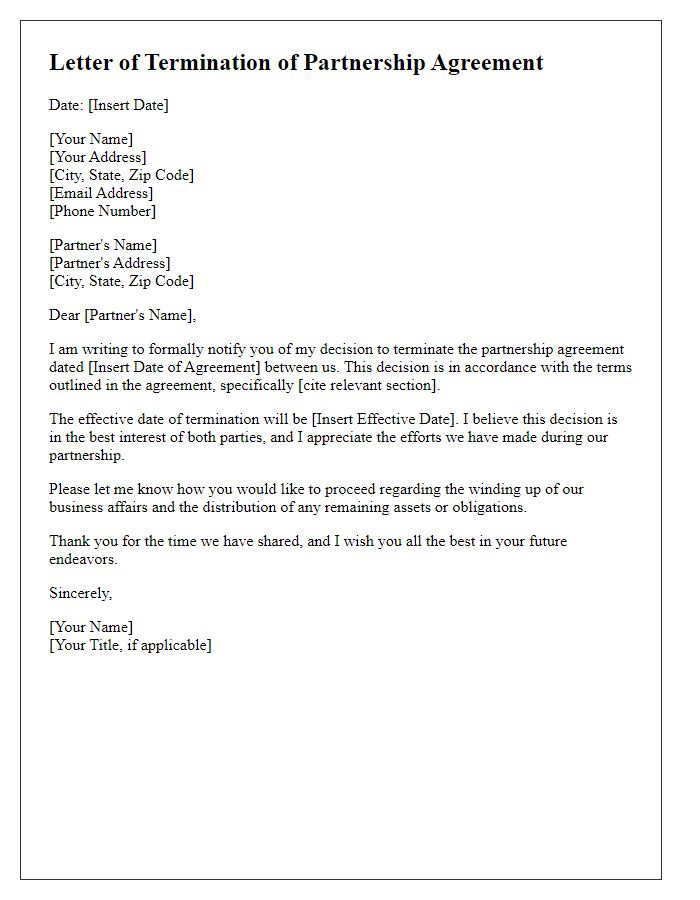

Clear Identification of Parties

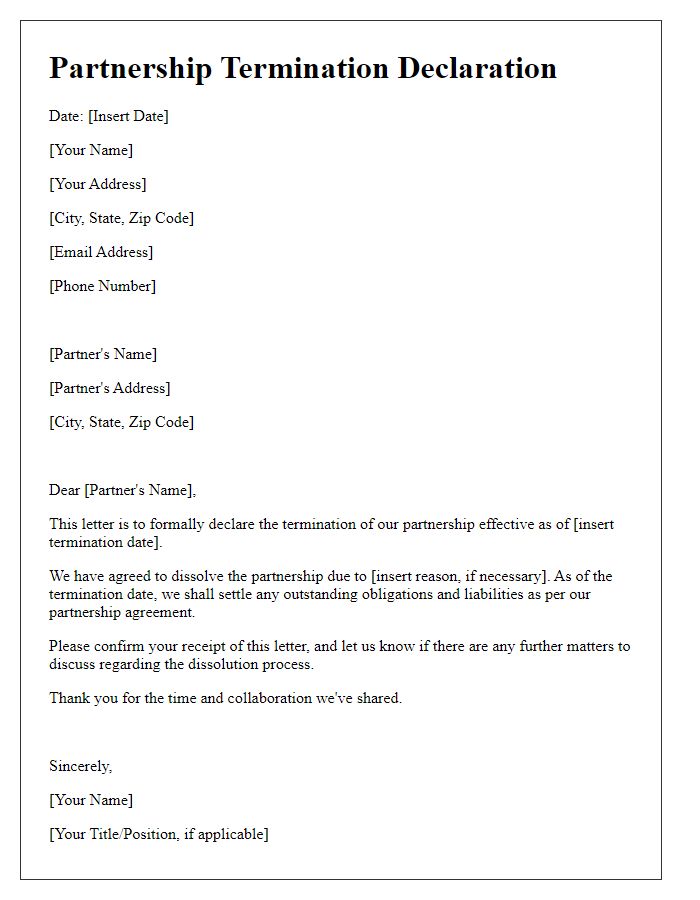

In the context of a partnership termination notice, clear identification of parties serves as a critical element. Each party involved should be distinctly named, including legal names and any business names used in official records. For example, if John Smith and Jane Doe are partners in a limited liability partnership (LLP) established in California, it is essential to include their full names, the LLP designation, along with the official registered address, such as 1234 Business Lane, San Francisco, CA, 94101. The notice should also specify any identifying numbers, such as the partnership tax identification number (EIN), to avoid ambiguity. This clarity ensures that both parties and relevant third parties accurately recognize the involved entities, which reduces the potential for disputes during the termination process.

Effective Termination Date

The effective termination date marks the conclusion of a partnership agreement, indicating the final moment when duties, responsibilities, and legal obligations cease. It is vital to specify this date clearly, ensuring all parties understand when the partnership officially ends. For instance, if the effective termination date is set for December 31, 2023, all financial settlements, asset distributions, and obligations must be finalized by this point. Proper communication of this date helps facilitate a smooth transition and avoid potential disputes or misunderstandings regarding ongoing commitments. Furthermore, documenting the effective termination date in written notices guarantees legal clarity and provides an official record for future reference, such as during audits or potential legal inquiries.

Reason for Termination

The partnership termination notice should clearly articulate the reasons for the termination to ensure transparency and avoid misunderstandings. Common reasons may include breaches of contract, inability to meet financial commitments, or a shift in business strategy. For instance, a decline in profitability of 15% over the past two fiscal years may necessitate reevaluation of the partnership. Additionally, consistent non-compliance with agreed-upon operational standards, such as failure to deliver products on time or inadequate quality control measures, can prompt a decision to end the partnership. Documenting these issues within the notice enhances clarity and serves as a formal record of the factors that led to the termination.

Obligations Upon Termination

Upon termination of a partnership, both parties must fulfill certain obligations to ensure a smooth transition. Final financial settlements should be conducted, encompassing all outstanding invoices and profit-sharing distributions. Additionally, the dissolution of partnership assets requires a comprehensive inventory to assess the division of tangible and intangible assets, including intellectual property rights. Confidentiality agreements remain in effect post-termination, safeguarding proprietary information obtained during the partnership. The parties should also communicate the termination clearly to clients and stakeholders to maintain transparency. Finally, any legal documents need to be formally executed to document the termination process and ensure compliance with applicable laws and regulations governing partnerships.

Contact Information for Follow-up

A partnership termination notice consists of key elements detailing the end of a collaborative agreement. Legal entities, such as corporations or LLCs, may require specific documentation reflecting the decision made by partners. The date of termination, usually set in compliance with the partnership agreement, is crucial. Including a clear statement of intent to terminate the partnership protects all parties involved. A detailed explanation of the reasons for termination may also be required, reflecting mutual understanding or specific events leading to this decision. Additionally, follow-up contact information should be provided for ongoing communication during the transition process, ensuring that all stakeholders are adequately informed and any unresolved business matters can be addressed promptly.

Comments