Navigating a billing dispute can be a daunting experience, but it doesn't have to be. We understand that discrepancies can arise, leaving you feeling frustrated and confused. In this article, we'll walk you through the essential steps to effectively resolve any billing issues with your clients, ensuring clear communication and a smoother process. So, if you're ready to turn misunderstandings into resolutions, keep reading to discover some helpful strategies!

Client Information Accuracy

Accurate client information is crucial for effective billing processes in businesses, such as accounting firms or service providers. Ensuring correctness involves verifying essential details like name, address, and account number, which can prevent discrepancies. A typical billing dispute may arise from inaccuracies leading to delayed payments or misallocated charges. For example, a single typo in the address can hinder timely receipt of invoices, causing cash flow issues. Moreover, maintaining updated records is vital for compliance, particularly in industries governed by regulations, such as healthcare or finance. Regular audits or automated systems can help in achieving data integrity, reducing the chances of billing disputes.

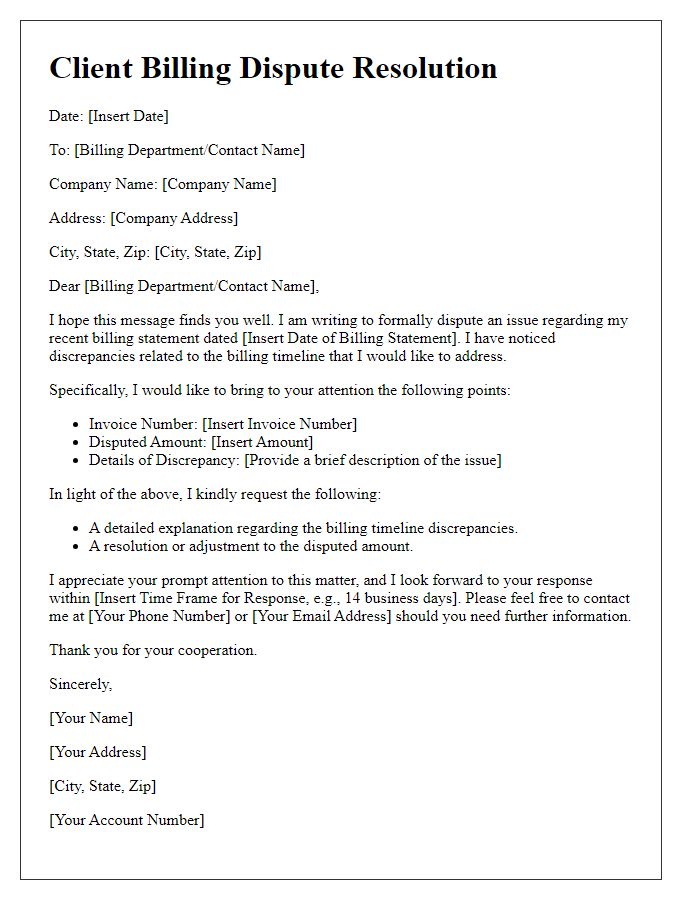

Clear Explanation of Dispute

A client billing dispute can arise from discrepancies in invoices or unexpected charges, often leading to confusion and frustration. In the case of a disputed invoice, an extensive review reveals issues such as duplicate charges totaling $500 for services rendered in July 2023 at XYZ Marketing Agency (a digital marketing firm based in New York City). Services like social media management and pay-per-click advertising were contracted but resulted in overbilling. Additionally, a lack of clarity regarding the payment terms, particularly the late fee policy, has added to the client's concerns. Effective communication with the billing department is crucial, ensuring that all documentation, including the original service agreement and previous correspondence, is readily available for review. By addressing these elements, the resolution process can proceed more smoothly and lead to a fair outcome for both parties.

Relevant Documentation Attachment

In a billing dispute resolution, attaching relevant documentation is crucial for clarifying discrepancies. Essential documents such as invoices, transaction history (including dates and amounts), and any prior correspondence (emails or letters) regarding the billing issue provide a comprehensive overview. These attachments should also include contractual agreements that outline the terms of service or payment terms established between the client and service provider. The documentation should be organized and clearly labeled for easy reference, ensuring that each piece of evidence directly corresponds to specific billing items in question. By providing this detailed context, the resolution process can be expedited, allowing both parties to address misunderstandings or errors effectively.

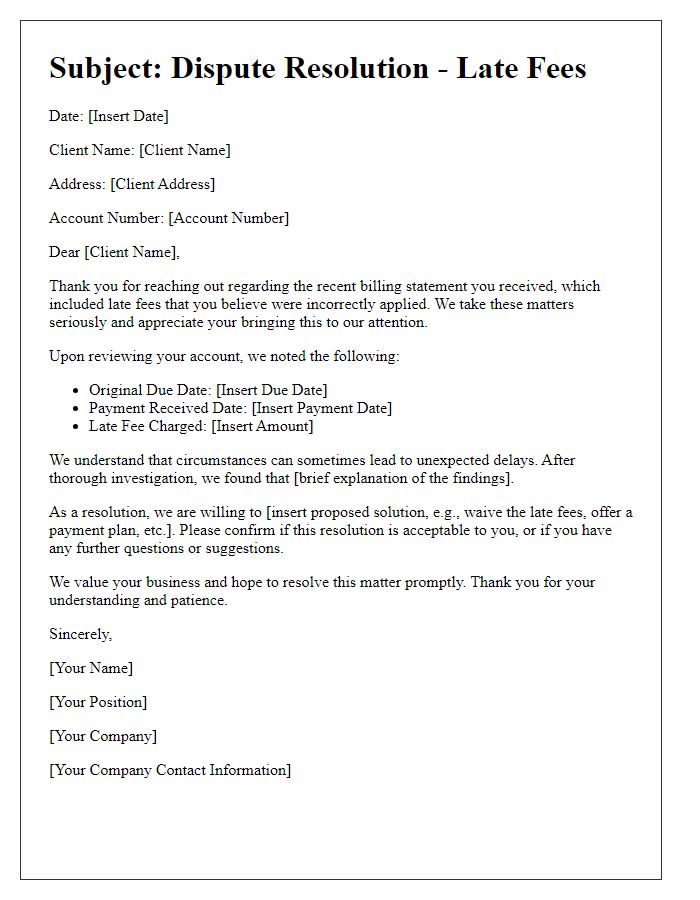

Professional Tone and Language

In many industries, billing disputes can arise from misunderstandings or errors in invoices. Timely communication with clients fosters trust and encourages prompt resolution. Detailed invoices should clearly outline services rendered, including specific dates, descriptions of work, hourly rates, and any additional charges. Accurate records, such as communication logs and signed agreements, aid in addressing discrepancies effectively. A professional tone that emphasizes collaboration rather than confrontation helps maintain strong client relationships during dispute resolution. Utilizing templates for formal letters ensures consistency and clarity, increasing the chances of reaching a satisfactory outcome for both parties involved.

Prompt Response Timeline

Prompt response timelines are critical in client billing dispute resolution processes. Typically, companies establish a response window of 3 to 5 business days to acknowledge receipt of the dispute. During this period, clients should receive confirmation via email or direct communication, detailing next steps. Investigations into the billing error typically begin immediately, often involving a review of invoice details and related documentation. Subsequently, a resolution is generally provided within 15 business days, allowing time for comprehensive analysis and potential adjustments to the client's account. Effective communication throughout this timeline ensures transparency and fosters trust between the client and service provider.

Letter Template For Client Billing Dispute Resolution Samples

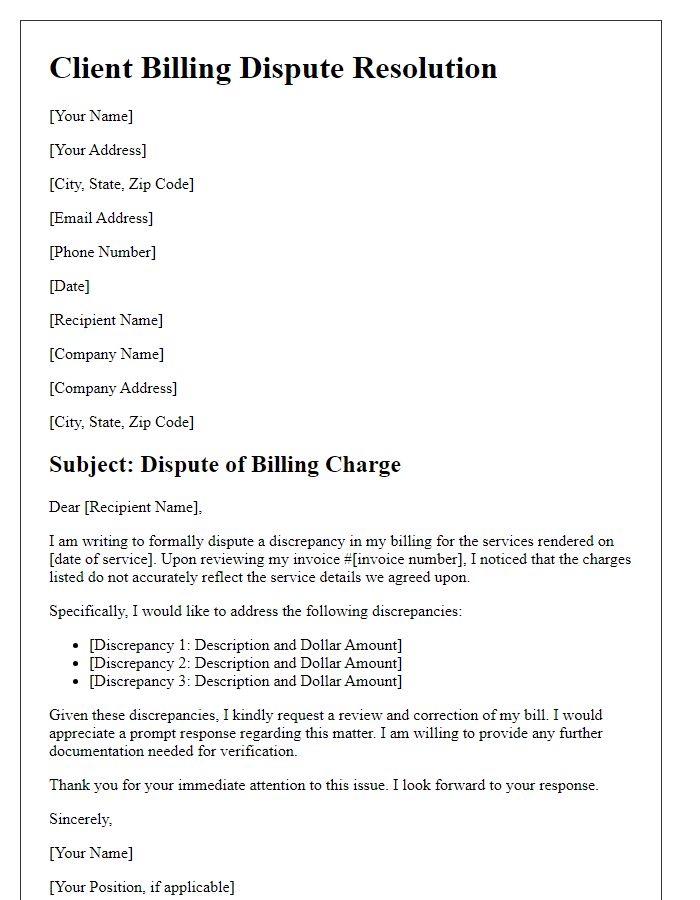

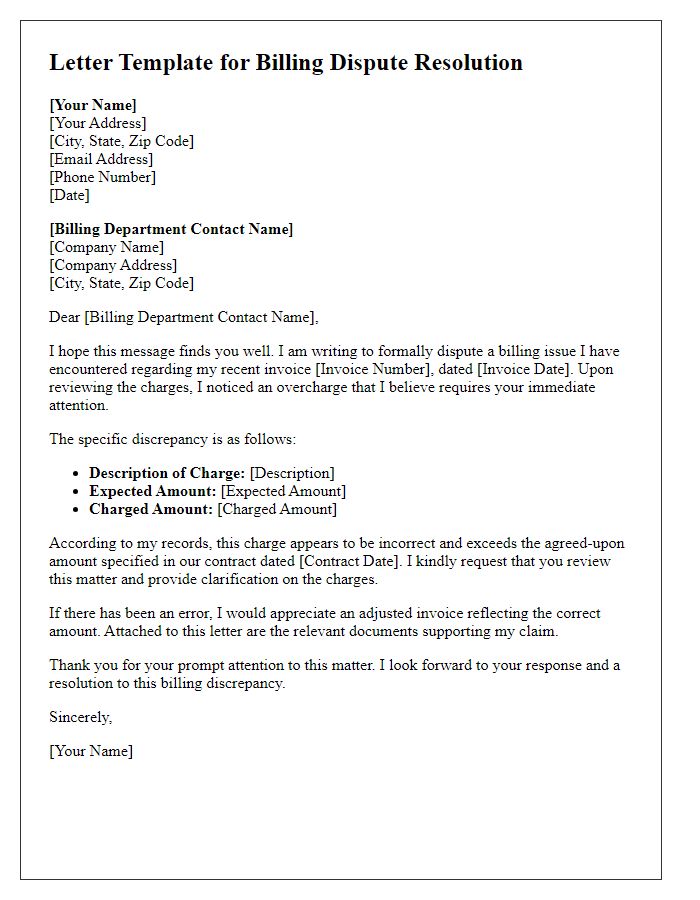

Letter template of client billing dispute resolution for service discrepancies

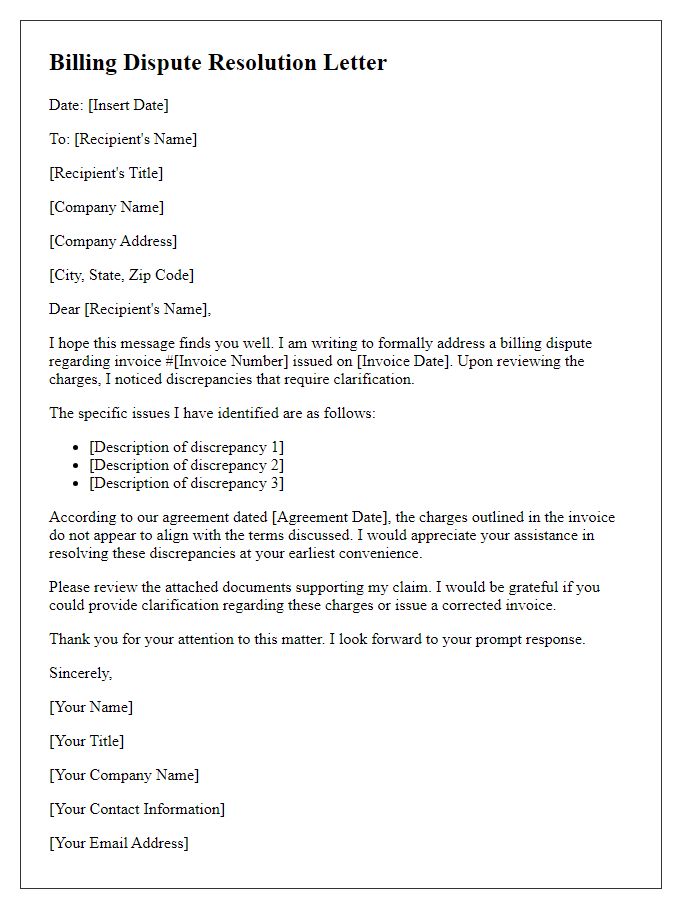

Letter template of client billing dispute resolution for incorrect invoices

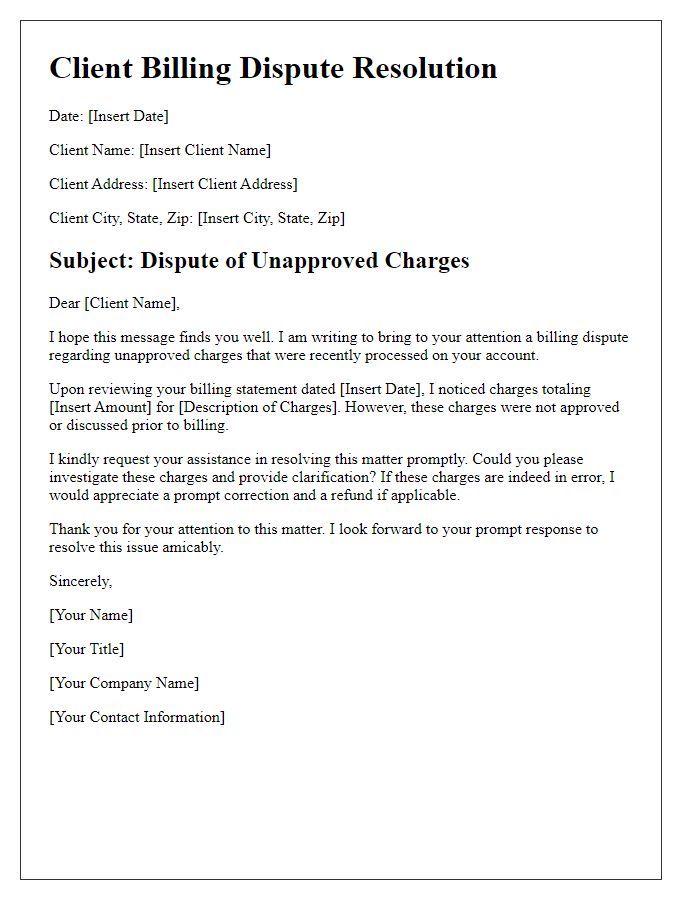

Letter template of client billing dispute resolution for unapproved charges

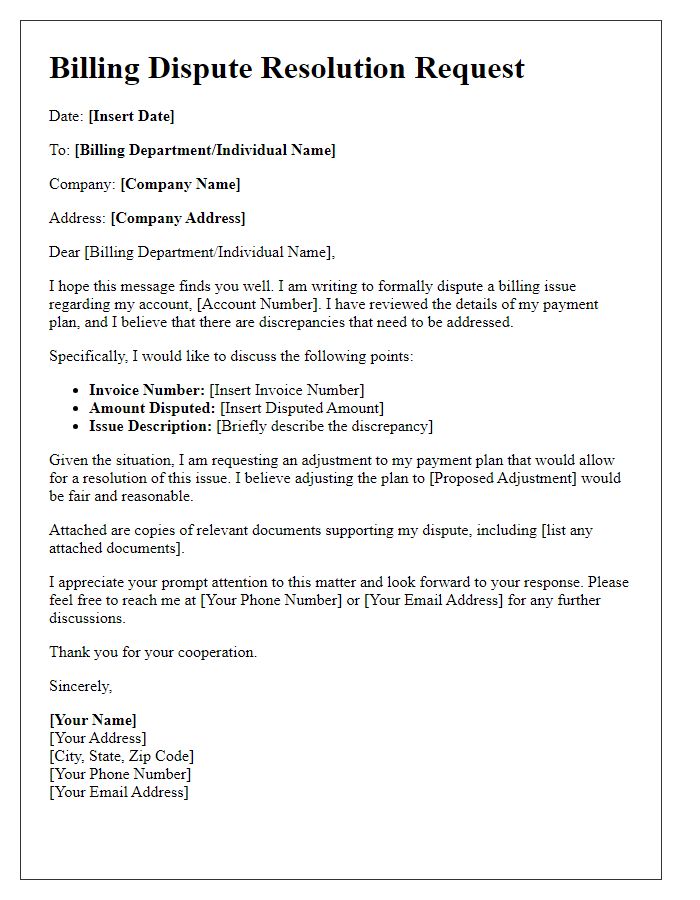

Letter template of client billing dispute resolution for payment plan adjustments

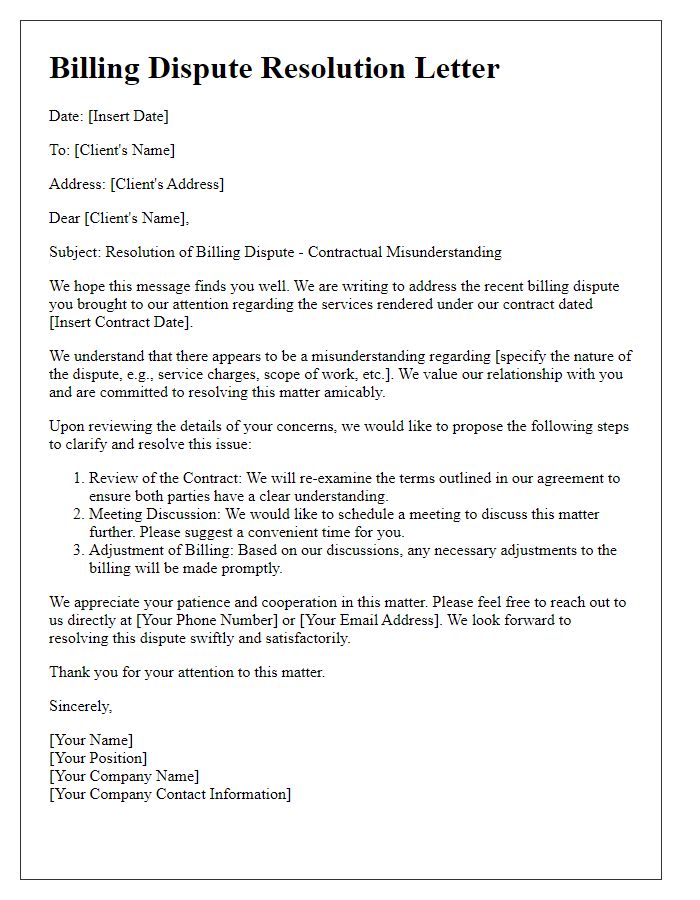

Letter template of client billing dispute resolution for contractual misunderstandings

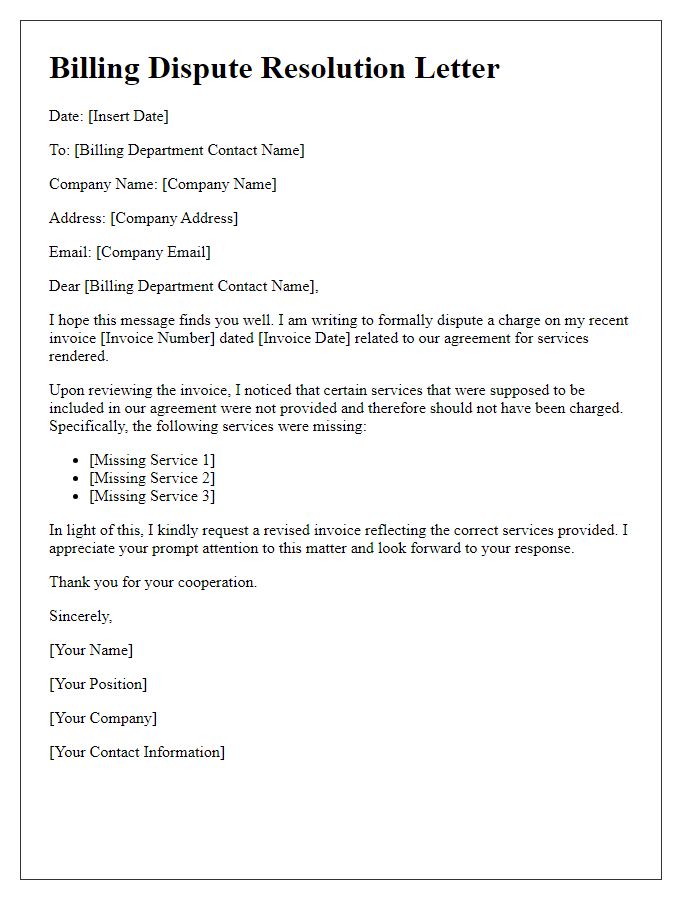

Letter template of client billing dispute resolution for missing services

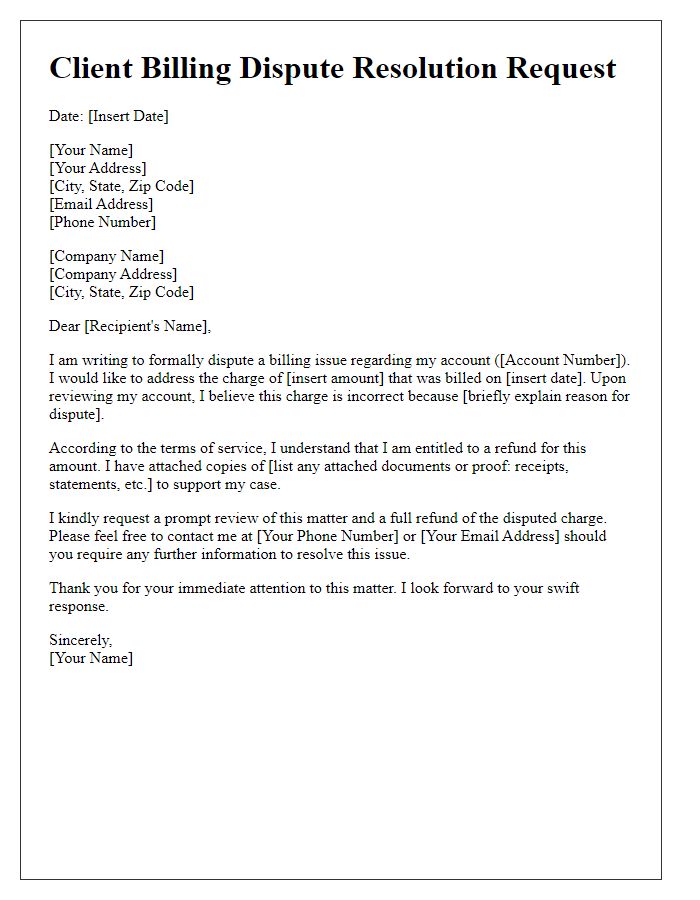

Letter template of client billing dispute resolution for refund requests

Comments