Are you looking to dissolve a partnership and feel overwhelmed by the process? It's completely normal to have questions about how to navigate this often complex situation. In this article, we'll break down the key considerations, essential steps, and important tips to ensure a smooth transition. Ready to dive deeper into the details? Keep reading to explore further!

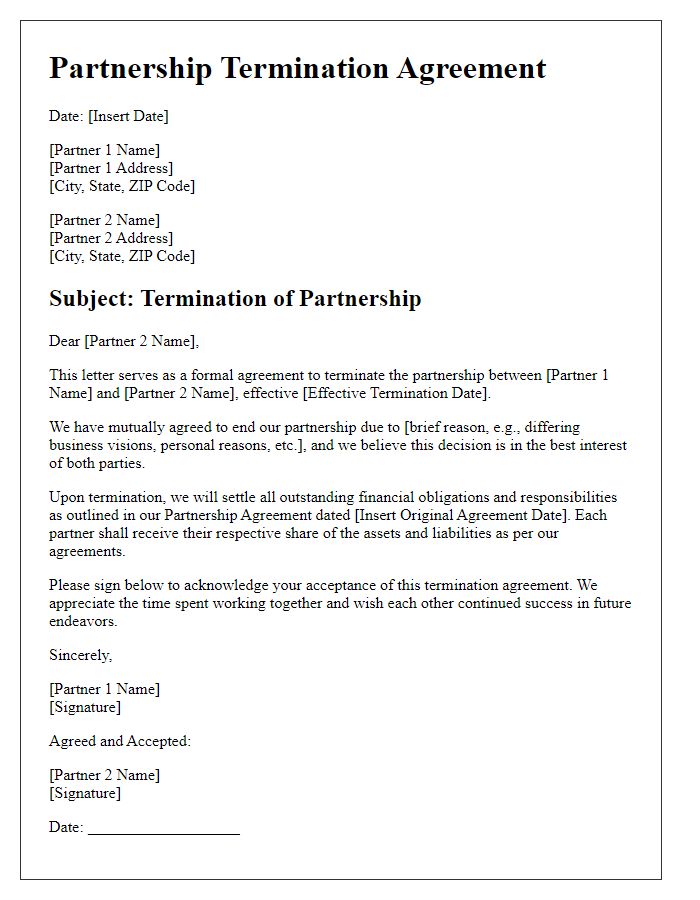

Parties Involved

The dissolution of a partnership agreement involves crucial elements such as the names of the involved parties, their roles within the partnership, and the effective date of dissolution. For example, in a partnership such as Smith & Co., formed in 2018 in Los Angeles, California, the initial partners, John Smith and Emily Coe, must outline their individual contributions and any existing liabilities. Additionally, legal representation may be necessary for compliance with state laws, particularly California Corporations Code Sections 16800-16803, ensuring that responsibilities concerning assets, debts, and ongoing obligations are clearly defined. Proper documentation will help prevent future disputes.

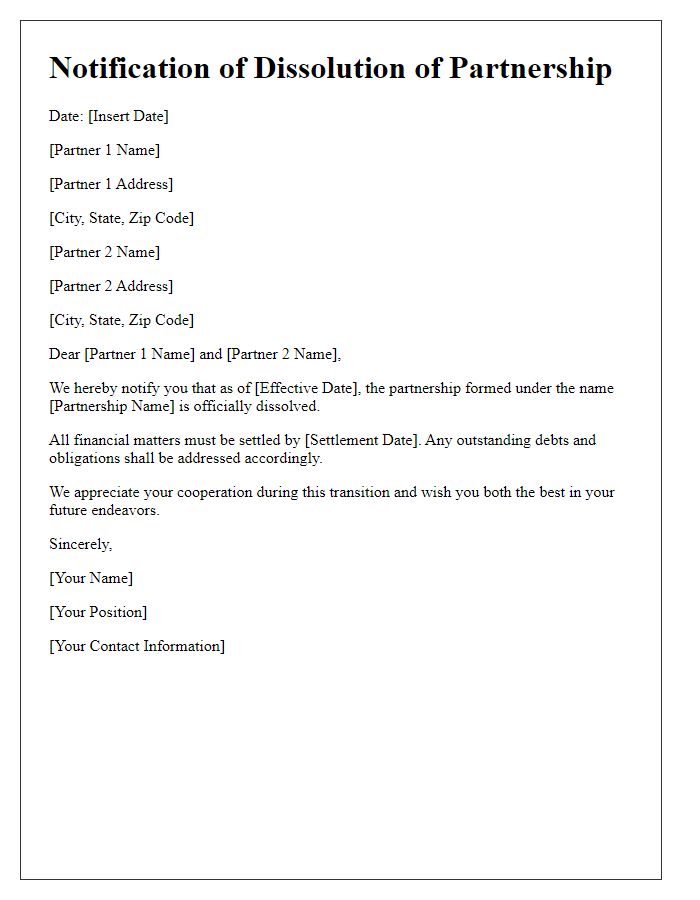

Date of Dissolution

The date of dissolution refers to the specific day when a partnership agreement officially terminates, marking the end of business operations under that agreement. According to the Uniform Partnership Act (UPA) guidelines, this date could be influenced by multiple factors, including mutual consent, completion of a specified project, or a predetermined expiration stated in the original contract. Moreover, when a partnership dissolves, it is crucial for partners to address outstanding liabilities and allocate remaining assets based on ownership percentages outlined in the initial agreement. Proper documentation and formal notifications may be required to ensure compliance with legal obligations, especially in jurisdictions like California or New York where state laws dictate formal dissolution procedures.

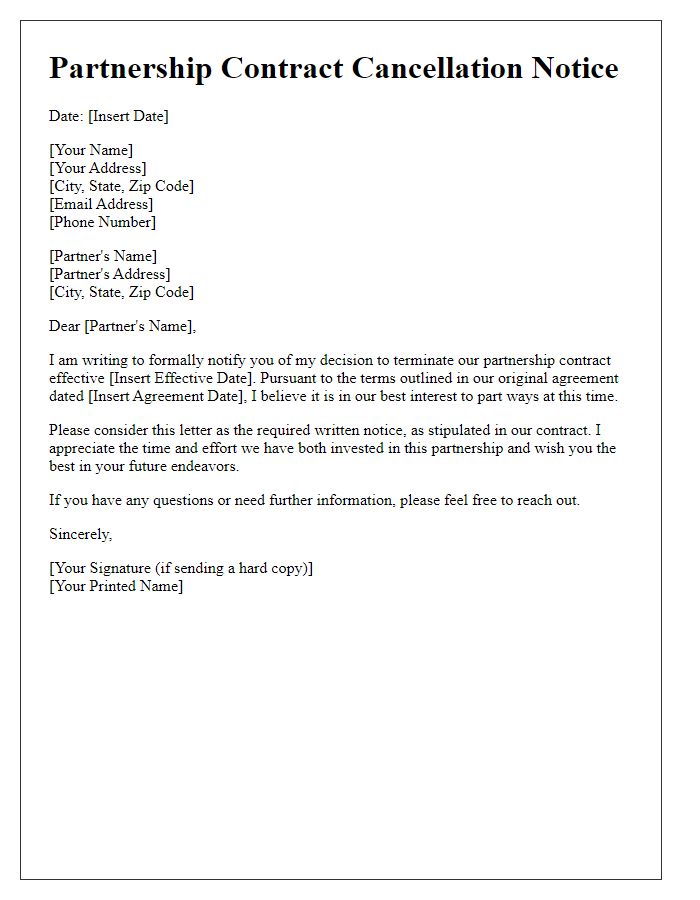

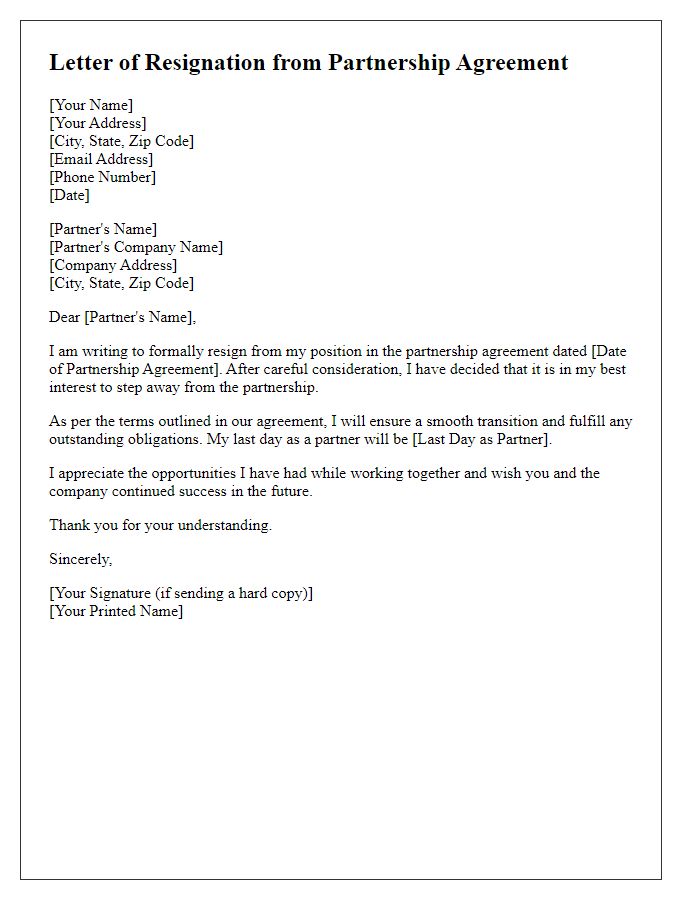

Reason for Dissolution

Partnership agreements can become necessary to dissolve due to various reasons such as financial instability, differences in vision, or changing market conditions. A common reason for dissolution includes consistent disagreements (over 30% of decision-making) between partners on strategic directions, leading to inefficiencies in operations and a toxic working environment. Changes in personal circumstances (such as a partner's health issues or relocation) can also necessitate dissolution. The legal framework governing partnerships (such as state laws and regulations) often outlines procedures for dissolution and may require formal notices, asset distribution strategies, or addressing liabilities. Documenting these factors can provide clarity and support the transition to new business arrangements.

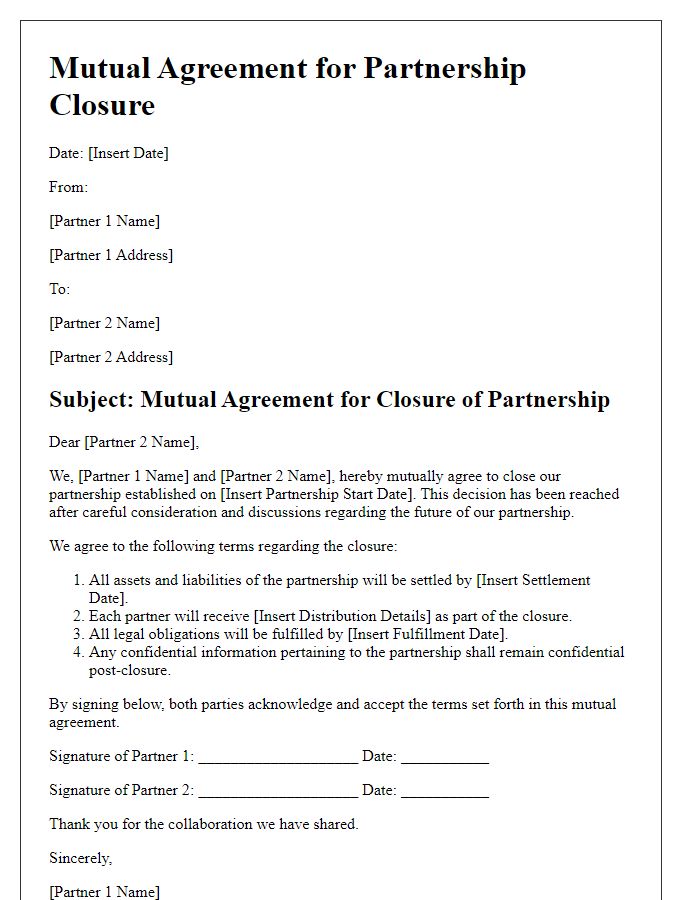

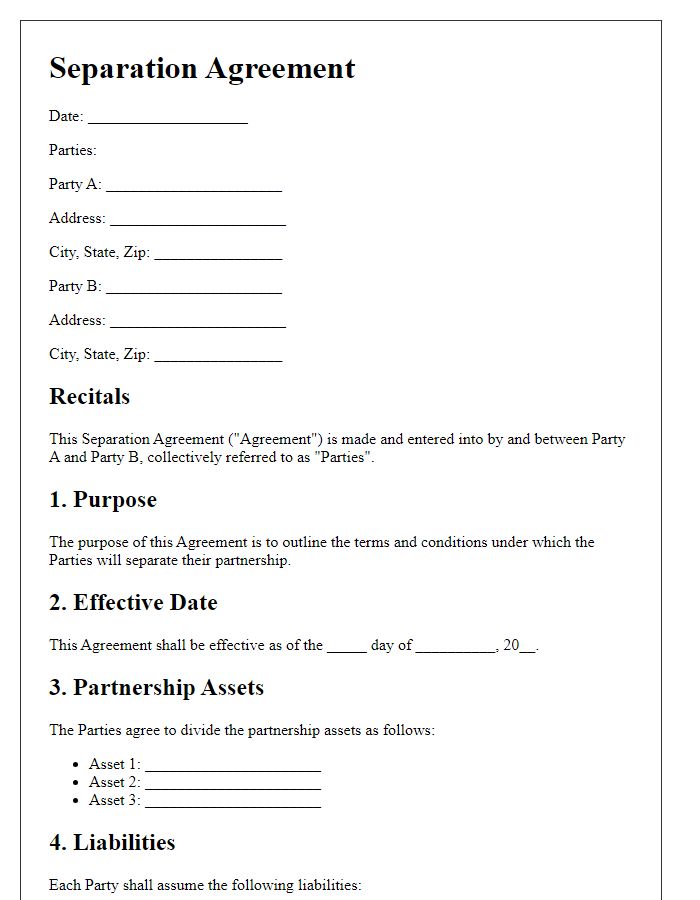

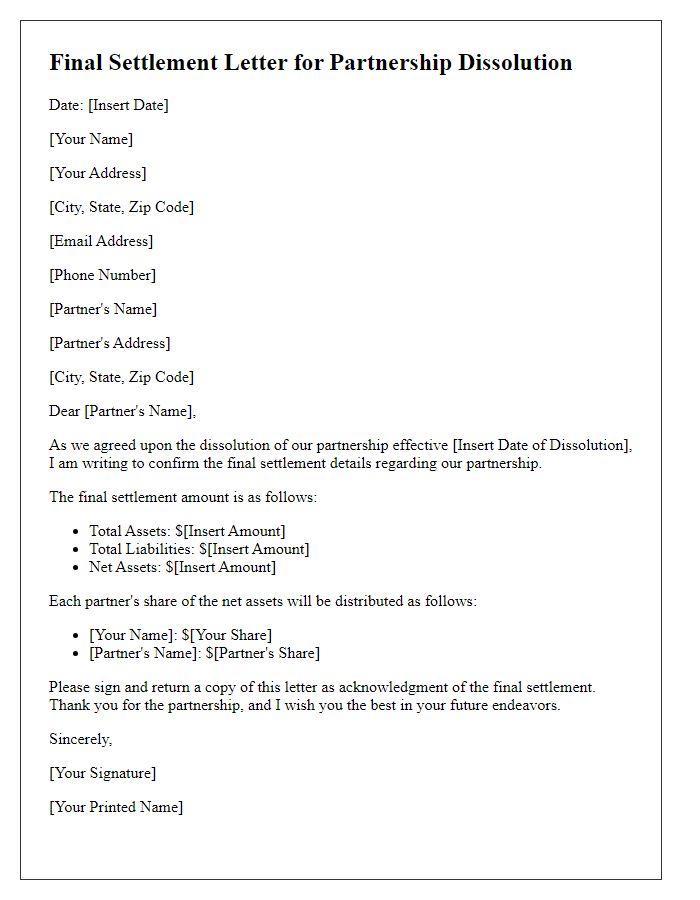

Asset and Liability Distribution

Dissolving a partnership agreement involves a thorough process for the distribution of assets and liabilities. Each partner must assess the total value of assets, including tangible items such as real estate (property valued at $200,000 in downtown locations), equipment (machinery worth $50,000), and inventory (goods estimated at $30,000). Partner liabilities must also be clearly identified, including outstanding debts (loans of $100,000 owed to financial institutions), unpaid invoices (totaling $20,000 from suppliers), and any related legal obligations. A clear and detailed agreement outlining the equitable distribution of assets, along with the responsibility for liabilities, is essential. This process typically requires adherence to legal standards, ensuring compliance with applicable laws such as the Uniform Partnership Act. Professional consultation may be necessary to navigate complexities, particularly if the partnership involved multiple stakeholders or significant financial stakes.

Confidentiality and Non-Compete Clauses

The dissolution of a partnership agreement necessitates careful attention to confidentiality and non-compete clauses to protect both parties' interests. Confidentiality clauses outline the obligation of both partners to safeguard sensitive information (such as trade secrets, customer lists, and financial data) acquired during the partnership, typically extending for a period of two to five years following dissolution. Non-compete clauses, often enforceable under state laws, prevent one partner from entering into a similar business within a specified geographic region (which might include specific cities or counties) for a defined duration, generally ranging from one to two years. These provisions aim to mitigate potential harm from competitive actions post-dissolution, ensuring that proprietary knowledge does not benefit rival businesses.

Comments