Are you considering diving into the world of convertible note investments but unsure where to start? Navigating the intricacies of these financial instruments can seem daunting, but with the right guidance, it can also be a thrilling opportunity for growth. In this article, we'll break down the essentials of convertible notes, highlighting their benefits and how they work in the startup ecosystem. So, grab a cup of coffee and join us as we explore this exciting investment avenue together!

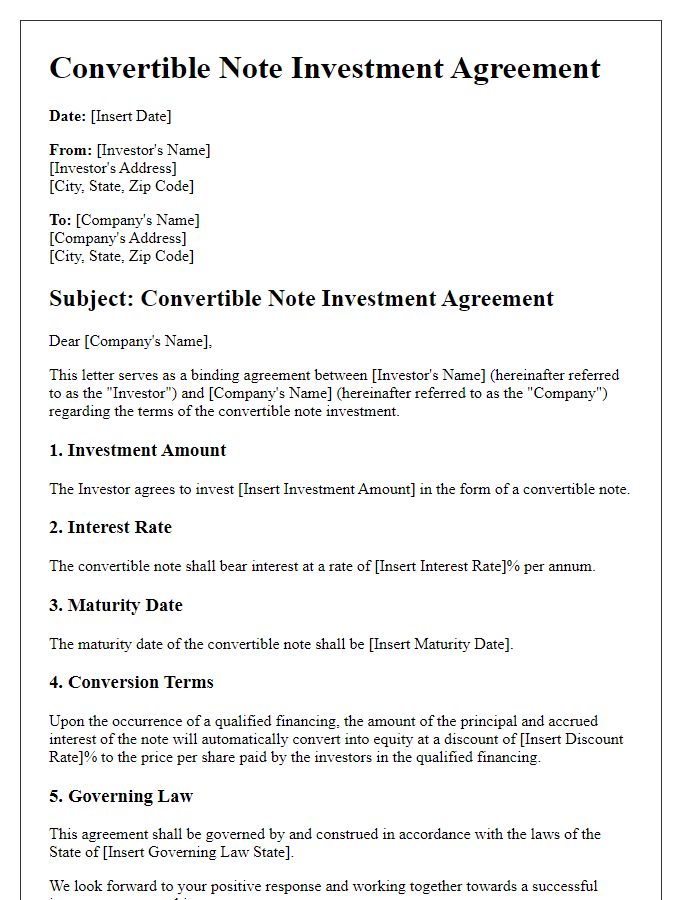

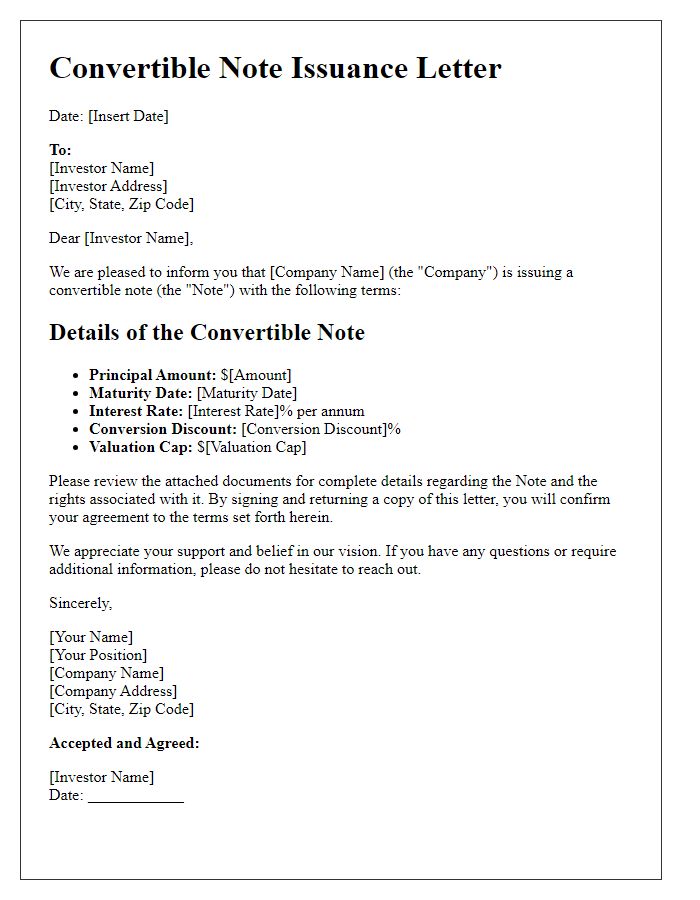

Investor Information and Details

Convertible notes represent a unique financing mechanism for startups, typically combining debt with the potential for equity conversion into ownership stakes. Often used during seed funding rounds, they allow investors to lend money with the promise that their investment can convert into equity at a later valuation event, such as Series A funding or an acquisition. Key terms often include a principal amount, maturity date, interest rate (usually ranging between 5-8% per annum), and a discount rate (commonly between 10-30%) that rewards early investors upon conversion. For instance, if an investor contributes $100,000 with a 20% discount in a company valued at $5 million during the next round, their equity stake would reflect a reduction in the valuation, making their investment more lucrative when converted. Additional important considerations may include valuation caps, which set a maximum company valuation for conversion, protecting investors from excessive dilution. Understanding these terms is crucial for evaluating investment risk and potential returns.

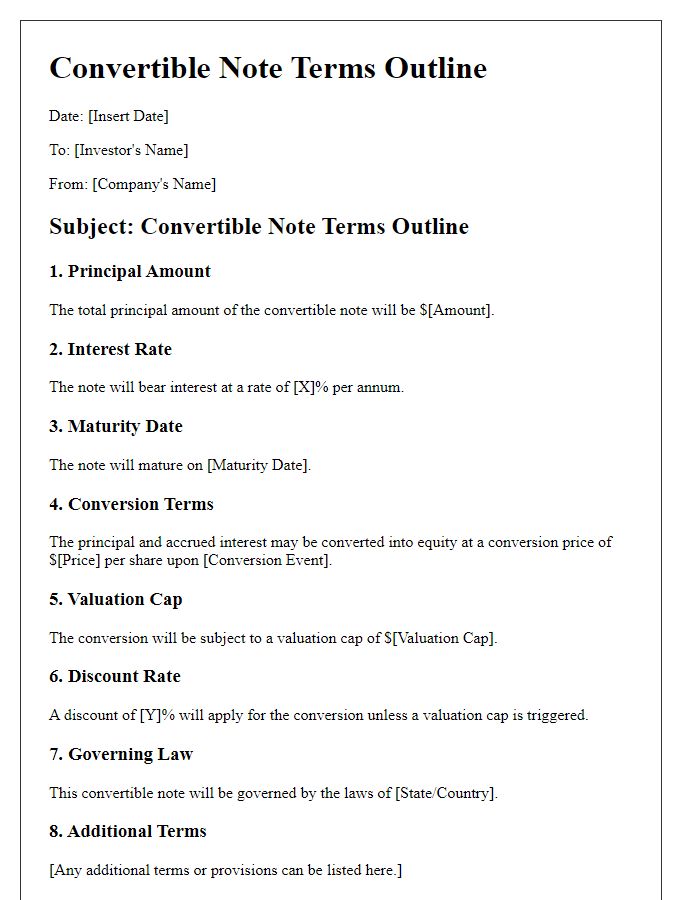

Terms of the Convertible Note

Convertible notes represent a form of short-term debt that converts into equity during a financing round, typically utilized in seed funding stages for startups. Terms of the convertible note may include a principal amount, often ranging from $50,000 to $500,000, with a specific interest rate--commonly between 5% to 8%--accruing over time. Key features also encompass a maturity date, usually set between 12 to 24 months, at which the note must convert or be repaid. Additionally, a conversion discount might apply, often between 10% to 30%, providing an incentive for early investors when converting the note during the next funding round. Valuation caps are significant, as they establish a maximum company valuation at which the investor's note will convert, protecting investors in high-growth scenarios. Legal documentation can often require compliance with regulations set by the U.S. Securities and Exchange Commission (SEC), ensuring that terms adhere to investment standards.

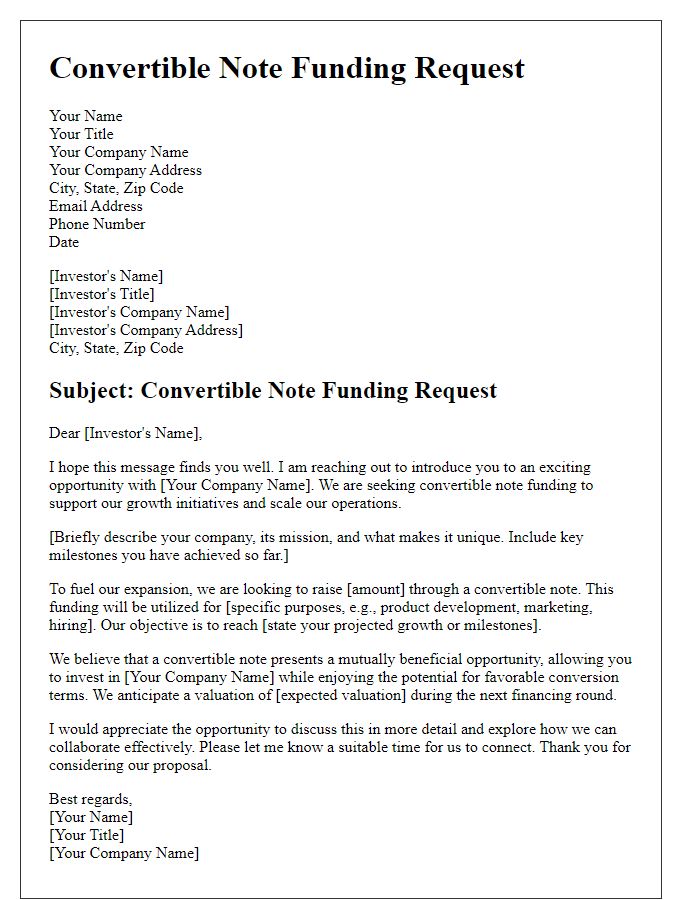

Investment Amount and Funding

Convertible notes serve as a bridge between debt and equity investments, facilitating startup financing. A typical convertible note might involve an investment amount of $100,000 from an angel investor or venture capital firm, allowing funds to be utilized for product development or market expansion. Upon a subsequent qualifying funding round, such as a Series A event, the note may convert into equity at a predetermined discount rate, often around 20%. Companies like Y Combinator have popularized this funding structure, enabling startups to secure necessary capital while avoiding immediate valuation negotiations. The maturity date, usually set at 18 months to 24 months, signifies when the note must be repaid or converted, adding urgency to future funding efforts.

Conversion Conditions and Triggers

The conversion conditions and triggers in convertible note investments are critical elements that determine how and when the debt can be converted into equity. Typically, at a qualifying financing round (often defined as a minimum capital raised, often starting at $1 million), the note automatically converts into shares of the company's preferred stock at a predetermined conversion price. Events such as acquisition or IPO (Initial Public Offering) can serve as triggers, allowing note holders to convert their investment into equity, often at a discount to the price set during the financing round. These conditions might also specify a maturity date (commonly ranging from 12 to 24 months), at which point the company must repay the principal amount plus interest or allow conversion into shares. Specific terms like "valuation cap" (the maximum company valuation at which the note converts) and "discount rate" (the percentage discount during conversion) also play pivotal roles in setting the terms of investment, impacting investor potential returns and risk mitigation.

Confidentiality and Legal Considerations

Convertible notes serve as a bridge between equity and debt financing for startups. They comprise promissory notes (written promises to pay) allowing investors to loan money, with the option to convert the amount into equity at a future funding round, typically at a discounted valuation. Legal considerations include compliance with regulations from the Securities and Exchange Commission (SEC) under the Securities Act of 1933, with particular emphasis on private placement exemptions. Confidentiality clauses within the investment agreement protect sensitive information shared during negotiations, ensuring trade secrets or business strategies are not disclosed. Investors should conduct thorough due diligence, examining the company's financials, market potential, and management team to mitigate risks associated with early-stage investments. Legal counsel is essential to navigate complexities and ensure adherence to local laws affecting convertible debts in various jurisdictions.

Comments