Are you ready to take control of your financial future? Crafting a tailored investment strategy can make all the difference in achieving your wealth management goals. In this article, we'll explore essential tips and insights to help you navigate the complex world of investments with confidence. So, grab a cup of coffee and join me as we delve into the nuances of smart investing!

Personalized Greeting

Wealth management investments often require a tailored approach to maximize returns and align with individual financial goals. A comprehensive portfolio review is essential, considering various asset classes such as equities, fixed income, real estate, and alternative investments. The financial market fluctuations, particularly in high-growth sectors like technology and renewable energy, demand careful analysis. Regular assessments, ideally every quarter, can help identify opportunities and risks, ensuring that the investment strategy remains responsive to changing economic conditions. Personalized advice from certified financial planners, with expertise in market trends and wealth preservation strategies, enhances the overall investment experience. Establishing goals, both short-term and long-term, provides a roadmap for sustainable growth and informed decision-making.

Investment Objectives Outline

Wealth management investment strategies often stem from clear, well-defined investment objectives tailored to individual financial aspirations. Among these objectives, capital preservation serves as a foundational goal, ensuring that the principal amount remains intact, particularly for retirees or risk-averse clients. Growth objectives focus on enhancing wealth over time, typically targeting an annual return of 7-10% through equities, real estate, or alternative investments. Income generation represents another critical objective, emphasizing cash flow through dividends or interest, often appealing to those seeking regular income streams. Additionally, diversification objectives aim to mitigate risks by distributing investments across various asset classes, thus lessening market volatility impacts. Specific timelines should also be outlined, such as short-term (1-3 years), medium-term (3-7 years), or long-term (7+ years), each influencing the risk tolerance and asset allocation strategy significantly. Frequent reassessments of these objectives ensure alignment with changing market conditions and personal situations, fostering a dynamic investment approach.

Risk Assessment and Analysis

Wealth management investment strategies require comprehensive risk assessment and analysis to optimize portfolio performance. Investors must evaluate market conditions, focusing on volatility indicators from stock exchanges such as the New York Stock Exchange (NYSE) and the NASDAQ. Individual risk tolerance levels (often measured by age, income, and financial goals) determine the asset allocation across equities, fixed income, and alternative investments. Factors like economic cycles, interest rates, and geopolitical events significantly influence risk levels. Additionally, understanding correlation coefficients between different asset classes helps in diversification, reducing overall portfolio risk. Regular stress testing under various scenarios, including economic downturns or market corrections, assists in preparing for potential losses, ensuring more informed investment decisions.

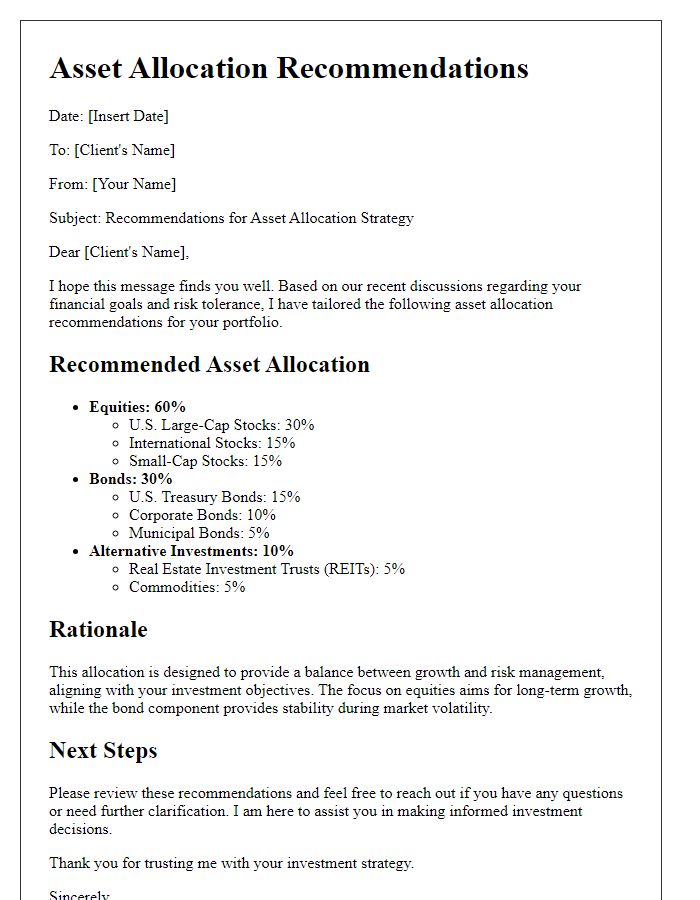

Diversification Strategy Details

Wealth management encompasses strategic diversification, vital for mitigating risks and maximizing returns. A well-structured portfolio might include a combination of asset classes, such as equities (stocks from different sectors like technology, healthcare, and energy), fixed income (bonds with varying maturities and credit ratings), real estate (investment properties or REITs), and alternative investments (hedge funds, private equity). The allocation percentages can vary, for instance, 60% equities, 30% fixed income, and 10% alternatives, tailored to individual risk tolerance and financial goals. Periodic rebalancing ensures maintenance of desired asset allocation (monitored quarterly) amid market volatility, enhancing overall performance. Historical performance data (such as the S&P 500's average annual return of about 10% over the last century) reinforces the importance of diversification as a foundational principle of resilient investing.

Contact Information and Next Steps

Wealth management investment involves strategic financial planning, typically tailored for high-net-worth individuals (HNWIs) with investable assets exceeding $1 million. Financial advisors assess the client's risk tolerance, investment goals, and time horizon to create a diversified portfolio, often including assets like equities (stocks from companies like Apple and Microsoft), fixed income (government bonds, corporate bonds), real estate (real estate investment trusts - REITs), and alternative investments (hedge funds, private equity). Regular performance reviews (quarterly or semi-annually) and communication of market trends empower clients to make informed decisions. Establishing clear contact protocols ensures prompt responsiveness to market shifts or personal financial needs while setting actionable next steps allows for continuous engagement through personalized meetings, portfolio adjustments, and lifelong financial education.

Comments