Have you ever faced the daunting task of filing a property loss claim? It can feel overwhelming, but you're not aloneâmany people find themselves navigating this complex process. Luckily, getting started is easier than you might think, and having the right letter template can make all the difference. So, let's dive in and explore how to initiate your claim, ensuring you're well-equipped to recover what you deserve.

Claimant's Contact Information

A property loss claim initiation process begins with the provision of the claimant's contact information, including essential details like full name, residential address (including zip code), phone number, and email address. This information ensures effective communication throughout the claims process, allowing the insurance company to reach the claimant easily. Accuracy in this data is crucial, as it facilitates prompt updates on claim status and necessary correspondence regarding documentation and investigations related to the property loss event.

Insurance Policy Details

Insurance policy documents hold critical information regarding coverage and claim procedures for property loss incidents. A standard insurance policy typically includes sections such as policy number, which uniquely identifies the coverage agreement, effective dates indicating when the policy provides protection, and the type of coverage (comprehensive, liability, etc.) specifying what incidents are included. Additionally, details such as the deductible amount set at a specified threshold, contact information for claims support, and exclusions outlining any non-covered events are crucial for understanding the extent of the policy's protection. Understanding these elements is essential for effectively initiating a property loss claim following incidents such as theft, fire damage, or natural disasters.

Description of Lost Property

Inadequate documentation can hinder the recovery of lost property, specifically items such as electronics, jewelry, or personal belongings. The lost property, which includes a 2019 Apple MacBook Pro (15-inch, space gray, model A1990) valued at $2,000, was last seen on March 5, 2023, during a business trip in New York City. Surrounding events involved attending the Tech Innovations Conference at the Jacob K. Javits Convention Center, where an unforeseen incident occurred during lunch at a nearby cafe, resulting in the item being misplaced. The MacBook contained sensitive data, including proprietary software codes and client information, heightening the urgency of recovery. Accompanying items included the original box, charger, and a protective case with a unique pattern, marking it as easily identifiable. Prompt action is critical in initiating the loss claim for successful compensation.

Circumstances of the Loss

A property loss claim can be initiated after experiencing significant events such as natural disasters or theft. For example, a homeowner may file a claim following a devastating flood, which occurred on October 10, 2023, impacting properties in New Orleans, Louisiana. The floodwaters, rising beyond three feet, caused extensive damage to the interior, including hardwood floors and drywall. Personal belongings like electronics, furniture, and family heirlooms suffered irreparable damage, totaling an estimated $50,000 in losses. In cases of theft, an individual may report stolen items after a break-in, detailing the loss of valuable jewelry, worth approximately $15,000, and essential documents, leading to potential identity theft risks. These circumstances must be documented thoroughly to ensure claims processes proceed efficiently.

Documentation Supporting the Claim

Property loss claims require comprehensive documentation to substantiate the claim. Essential documents include photographic evidence of the damage, which captures the extent and severity of the loss, along with dated images for accurate assessment. A detailed inventory list (including descriptions, purchase dates, and original values) of the lost or damaged items is crucial for insurance evaluation. Supporting documents such as police reports (in cases of theft), repair estimates from licensed contractors, and receipts or proof of ownership establish legitimacy. Any correspondence with third parties, such as appraisers or adjusters, should be meticulously documented to ensure a transparent claims process.

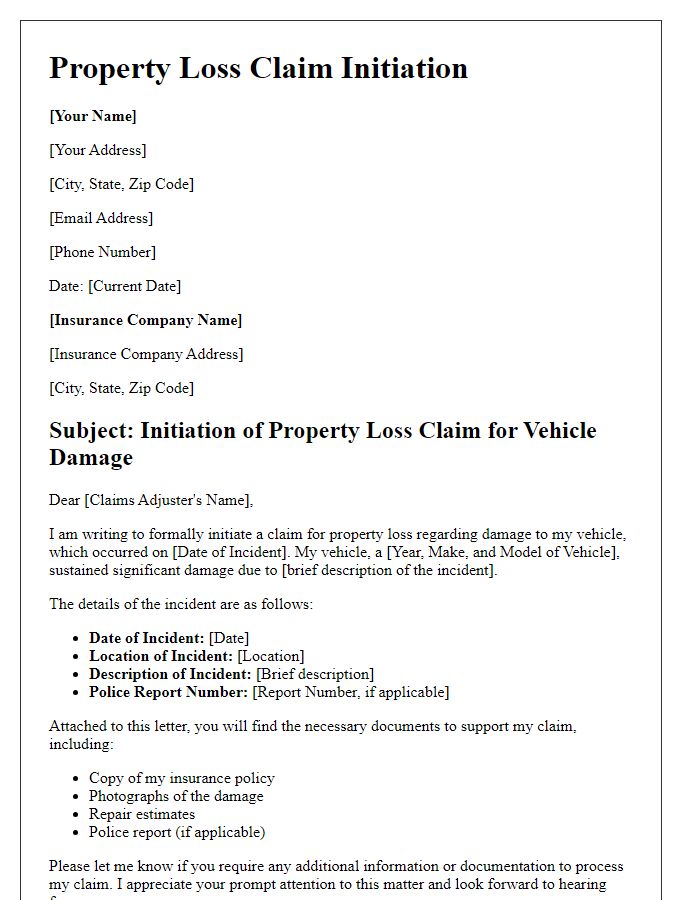

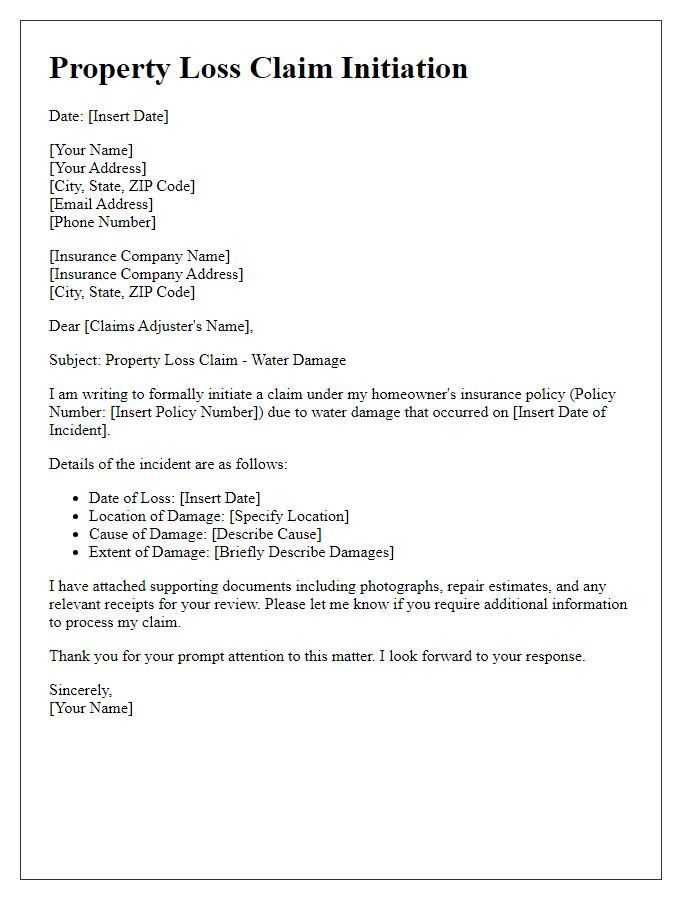

Letter Template For Property Loss Claim Initiation Samples

Letter template of property loss claim initiation for commercial property.

Letter template of property loss claim initiation for personal belongings.

Letter template of property loss claim initiation for natural disaster damages.

Letter template of property loss claim initiation for theft-related losses.

Letter template of property loss claim initiation for fire-related incidents.

Comments