Are you ready to secure your future with the right group insurance plan? Navigating the world of insurance can be overwhelming, but understanding your options is key to making the best choices for you and your family. In this article, we'll break down essential information and steps for successful group insurance enrollment, ensuring you feel confident every step of the way. So, grab a cup of coffee and dive in to learn more about how you can benefit from group insurance!

Clear subject line

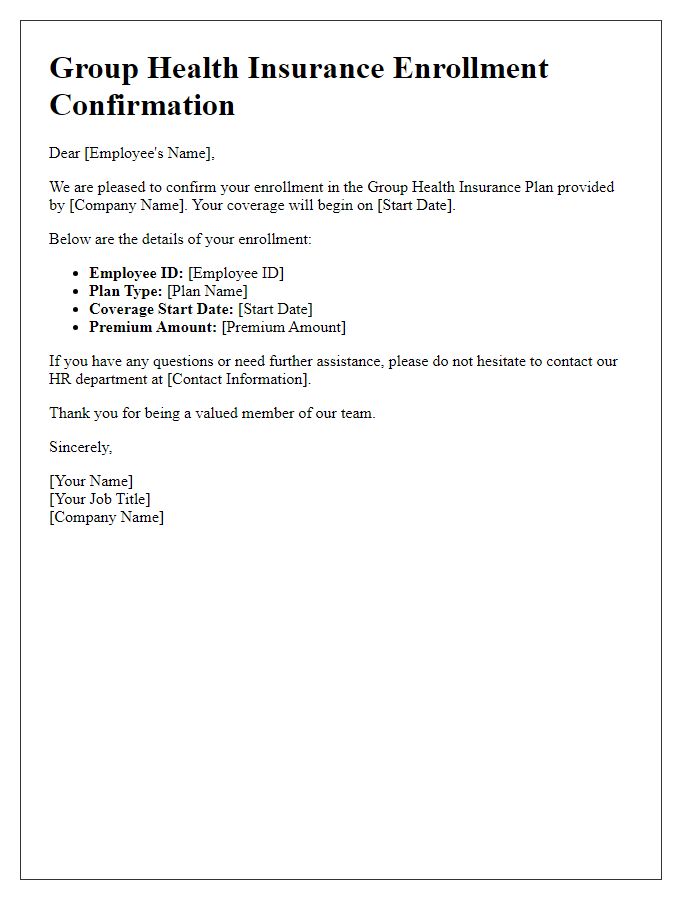

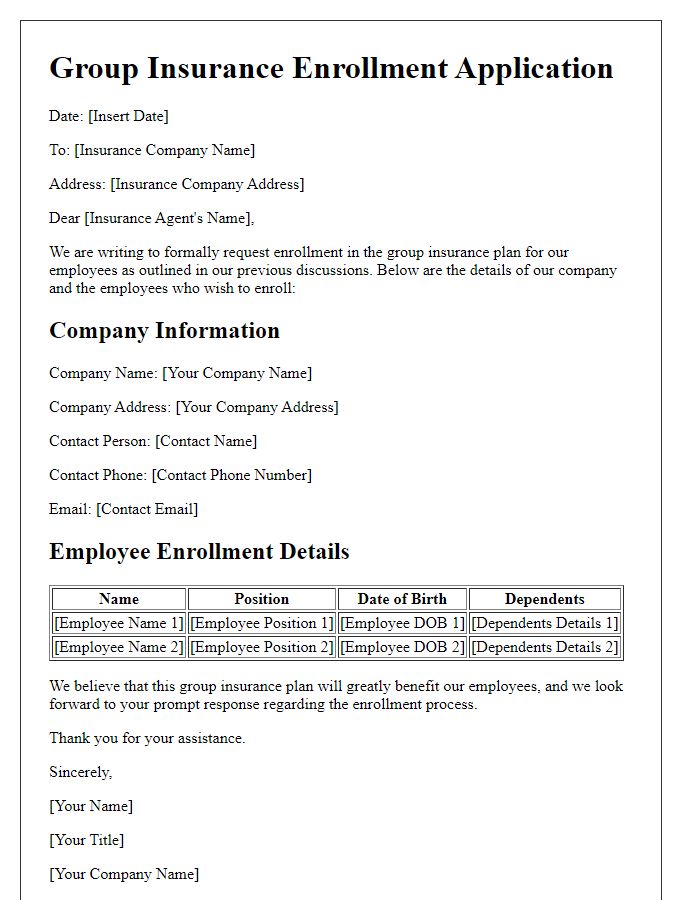

Subject: Group Insurance Enrollment Instructions and Information This communication outlines the essential steps for enrolling in the group insurance plan offered by your employer for the upcoming coverage period, scheduled to begin on January 1, 2024. Eligible employees will have access to various plans, including health, dental, and vision coverage, provided by XYZ Insurance Company. It is critical to complete enrollment by the deadline of December 15, 2023, to ensure coverage initiation. Detailed information regarding eligibility criteria, coverage options, and premium rates can be found in the benefits booklet attached to this email. Additionally, an enrollment form must be submitted electronically or via mail to the human resources department by the specified date. For any questions or support during this process, employees can contact the HR team at hr@company.com or call (555) 555-0123.

Purpose of enrollment

Group insurance enrollment serves the vital purpose of providing employees access to essential financial protection against unforeseen medical expenses and risks. This process enables companies to offer health, dental, and vision insurance plans, enhancing employee well-being and job satisfaction. The enrollment period typically occurs annually, allowing employees to choose their coverage options based on individual and family needs, including premiums and co-payments. By participating in group insurance, employees benefit from lower rates that come from the collective bargaining power of the group, significantly reducing out-of-pocket costs. Additionally, enrolling in available plans fosters a sense of security among employees, knowing they have resources to support their health and lifestyle, promoting a healthier workforce.

Enrollment deadline

Group insurance enrollment for employees at XYZ Corporation begins on January 5, 2024, and runs until January 20, 2024. This critical enrollment window allows eligible employees to select coverage options from providers such as Blue Cross Blue Shield and Aetna. Employees must review all available plans, including health, dental, and vision insurance, to make informed decisions. Additionally, employees should gather necessary documentation, including Social Security numbers and beneficiary details, to ensure a smooth enrollment process. Anyone missing the deadline may not have another opportunity until the next enrollment period, which is scheduled for January 2025. Timely action is vital to secure health benefits for the upcoming year.

Required documents

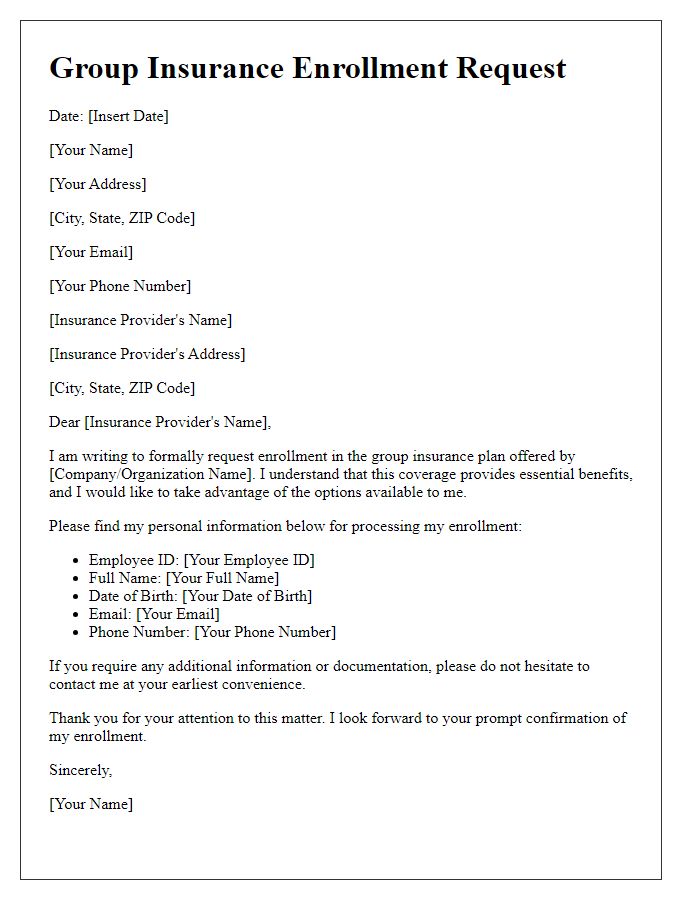

Group insurance enrollment requires several essential documents for processing. Participants must submit a completed enrollment form, which includes personal information such as name, address, social security number, and dependent details. Additionally, proof of eligibility, such as employment verification or a pay stub reflecting current employment status, is necessary. Participants may need to provide identification documentation, like a driver's license or passport, to confirm identity. Health status disclosure forms are often requested to assess any pre-existing conditions that may affect coverage. Lastly, beneficiaries' information, such as names and relationships, must be submitted for proper designation in the policy.

Contact information

Group insurance enrollment requires specific contact information for effective communication and processing. Essential details include the primary applicant's full name (first, middle, last), along with their personal identification number (Social Security Number in the United States) for verification. Mailing address must be complete, including street address, city, state, and zip code, ensuring any correspondence reaches the correct destination. A current phone number (preferably mobile) provides a direct line for follow-up questions or concerns. Additionally, an email address is essential for digital communications and confirmations related to enrollment and policy details. Accurate contact information streamlines the enrollment process, thereby minimizing delays and ensuring seamless access to insurance benefits.

Comments