Hey there! If you're receiving this letter, it's time to think about renewing your policy. Renewing not only ensures you maintain your coverage but also helps you stay protected against unexpected events. We're here to guide you through the renewal process and answer any questions you might have, so don't hesitate to read more about what's in store for you!

Personalization and Recipient Details

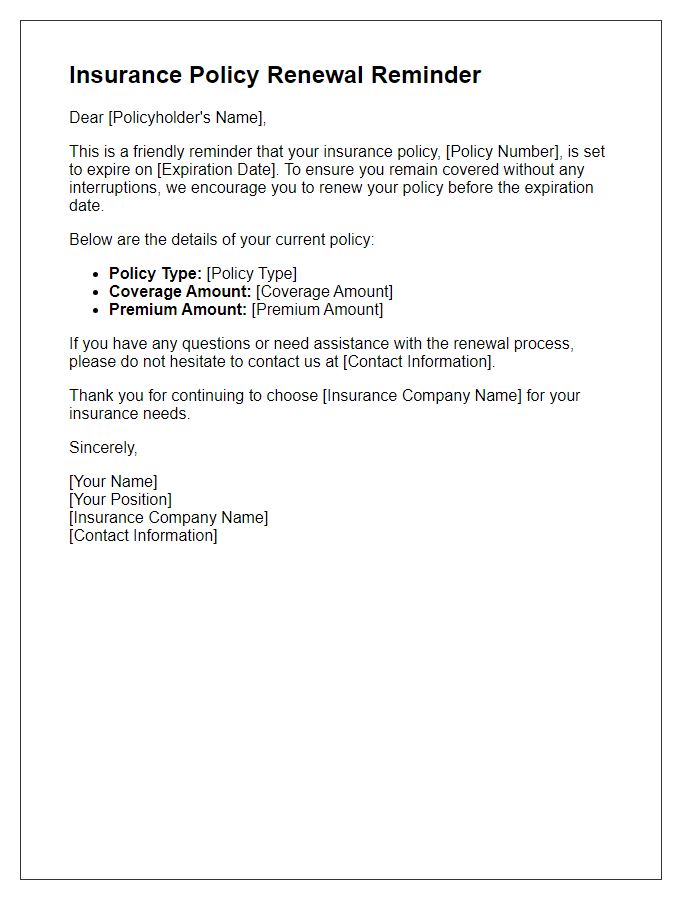

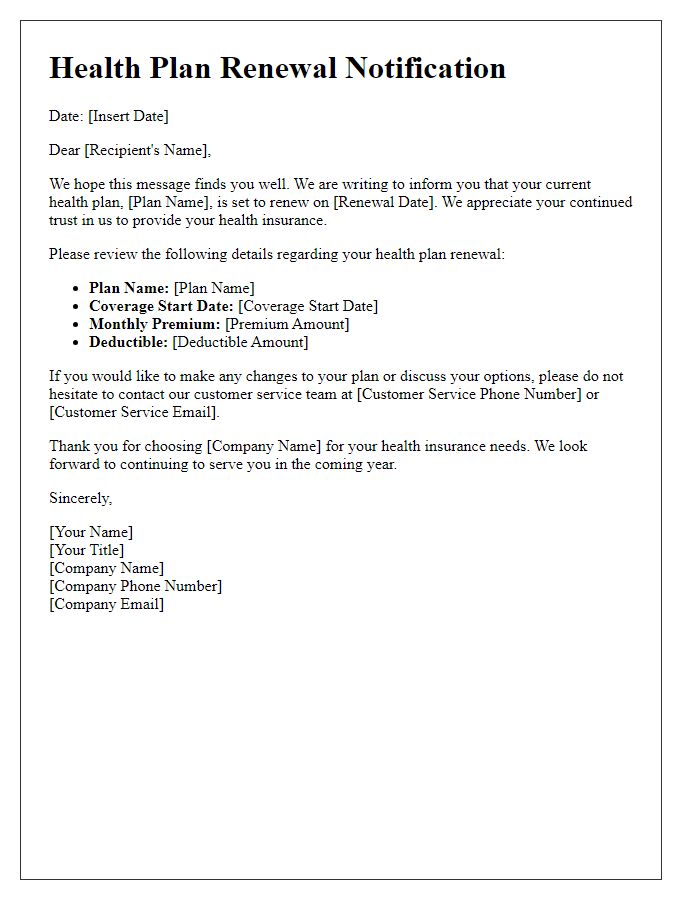

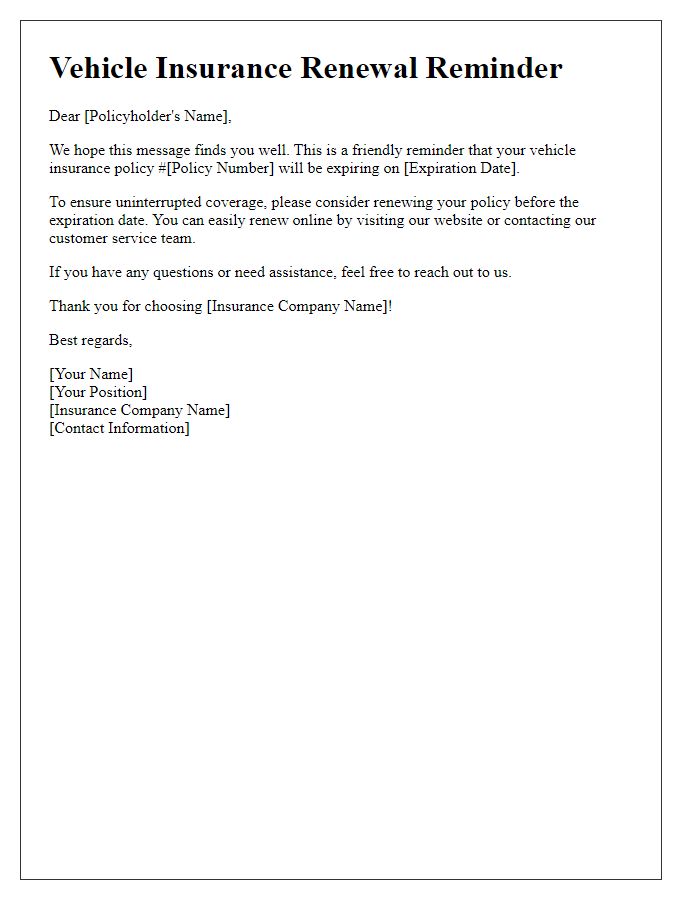

A policy renewal notification letter outlines important information regarding an insurance policy. Each policyholder's name, policy number, and renewal date must be included for clarity. Recipient details should encompass full address, including street, city, state, ZIP code, to ensure accurate delivery. Personalization can enhance engagement; adding a greeting like "Dear [Policyholder's Name]" establishes a direct connection. Alongside these details, emphasize the importance of reviewing coverage terms and conditions before renewing, as well as any changes in premium rates or policy features. This structured approach fosters transparency and helps recipients make informed decisions about their insurance needs.

Policy Summary and Coverage Details

Policy renewal notifications are essential for reminding policyholders about the upcoming expiration of their insurance agreements. Accurate and timely communication can help ensure continuous coverage, preventing gaps that may expose individuals to financial risk. Policy summaries should clearly outline the specifics of coverage, including limits, deductibles, and any endorsements that enhance protection. For instance, a homeowner's policy may detail coverage for property damages (up to $500,000), liability protection (up to $300,000), and additional living expenses (up to $10,000) in case of displacement. Providing detailed information on renewal dates, premium changes, and available discounts can encourage clients to review their options, ensuring the policy meets their evolving needs. A well-structured notification also helps maintain customer loyalty and fosters trust in the insurance provider.

Renewal Terms and Conditions

Policy renewal notifications serve as important communications between insurers and policyholders. Effective notifications clearly outline essential details, such as the policy number, renewal date (often within 30 days of expiration), premium amount, specific terms of the renewed coverage, and any changes in conditions or exclusions. The notification should highlight significant factors, such as claims allowances and deductibles, to ensure the policyholder understands their coverage and potential costs. It is also advisable to include renewal instructions, along with contact information for customer service departments to assist with inquiries or concerns regarding the renewal process, ensuring clarity and transparency.

Payment Instructions and Options

Policy renewal notifications for insurance policies provide essential information to policyholders regarding payment instructions and available options. For example, a typical notification might indicate due dates for payment, methods of payment including check, credit card, or online banking transfers, and any applicable discounts for early payments. Additionally, it may outline the consequences of non-payment, such as potential policy lapses or coverage interruptions. Key details such as policy numbers (unique identifiers for the specific insurance plan), renewal premium amounts (the cost required to maintain coverage), and customer service contact information (for queries regarding payments) are typically emphasized to ensure clarity and provide support.

Contact Information for Queries and Support

Policyholders should be aware that for inquiries regarding their policy renewal, support contacts such as customer service representatives and dedicated account managers available through various communication channels are essential. Direct phone numbers, typically 1-800-XXX-XXXX for immediate assistance, email support at support@insurancecompany.com, or the online chat option can facilitate real-time responses. Additionally, policyholders can visit the official website of the insurance provider for detailed guides and FAQs to address common concerns regarding renewal processes and documentation requirements.

Comments