Are you seeking a way to effectively communicate your premium refund approval? Writing a clear and concise letter can help you convey your message while ensuring that the recipient understands the necessary details. In this article, we'll guide you through a straightforward template that makes the process simple and professional. So, let's dive in and unlock the secrets to drafting the perfect premium refund approval letter!

Policy details and account information

A premium refund approval process involves several key steps and specific details essential for the accurate processing of requests. Refunds typically pertain to insurance premium payments associated with a policy, such as a health insurance plan or auto insurance coverage. Information required includes policy number (a unique identifier like 123456789), account details (such as the account holder's name, Jane Doe), date of policy inception (e.g., January 1, 2022), and the amount of premium paid (e.g., $1,200). Relevant events leading to a refund may include cancellation of policy (e.g., December 15, 2023) or changes in coverage terms. Communication channels used for the submission include emails or online claim forms for speed and efficiency. An efficient refund process ensures that clients receive their funds promptly, improving overall customer satisfaction.

Clear statement of refund approval

Refund approvals can significantly enhance customer satisfaction, particularly in financial services involving premium payments, such as insurance or subscription services. The confirmation notice typically includes the customer's identification number, the original premium amount (e.g., $1200), and the approved refund amount, ensuring clarity in transactions. For instance, the refund was processed following policy number 456789, allowing for a complete reimbursement due to a change in terms agreed upon on March 15, 2023. Additionally, the refund reflects compliance with internal guidelines and demonstrates the organization's commitment to customer service excellence. The notice is generally sent via email or postal service, ensuring timely communication, ideally within seven business days.

Explanation or reason for refund

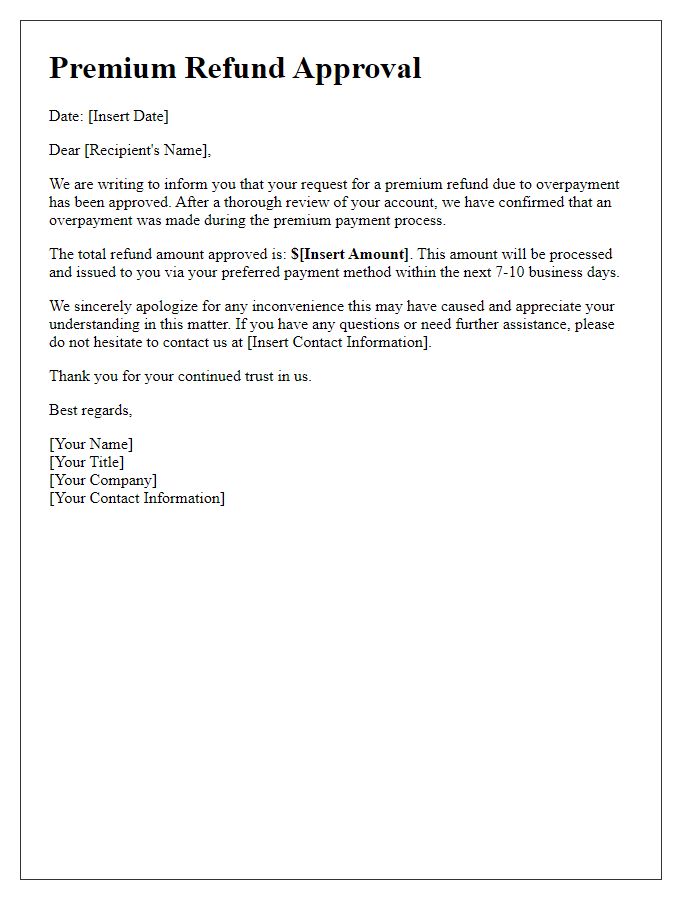

The premium refund approval process involves various factors, such as policy cancellation or premium overpayment. For instance, if a customer cancels an insurance policy within the free-look period, they may qualify for a full refund of their premium, usually within 15 days after cancellation. Similarly, if the premium amount paid exceeds the actual due amount due to an error in billing, the insurance provider needs to initiate a refund as per regulatory guidelines. Refund processing typically takes 7 to 10 business days, depending on the company's internal procedures. Clear documentation regarding the reason for the refund, including policy numbers, cancellation dates, and amount, is essential for a smooth approval process.

Refund amount and payment method

A premium refund approval process typically involves a detailed assessment of the refund request submitted by customers. The refund amount may vary according to the policy terms, often reflecting total premiums paid minus applicable deductions, such as administrative fees or coverage utilized. Payment methods for the refund can include options like bank transfers, credit card reimbursements, or checks sent via postal services, with timelines for processing varying from a few days to several weeks depending on the company's internal policies. Moreover, customer service representatives may provide updates throughout the refund process, ensuring transparency and communication about the status of the payment.

Contact information for queries and assistance

Premium refund approvals can involve various entities and technicalities. Customers may seek assistance regarding the refund process (often delayed, requiring several business days), coverage details (specific product or service included in the policy), and the customer service department (typically operational from 9 AM to 5 PM). It's essential for clients to provide relevant account information (policy number, name, or contact details) for efficient resolution of queries. Potential contact methods can include phone support (often using toll-free numbers), email communication (typically support@company.com), or online chat services available on the official website.

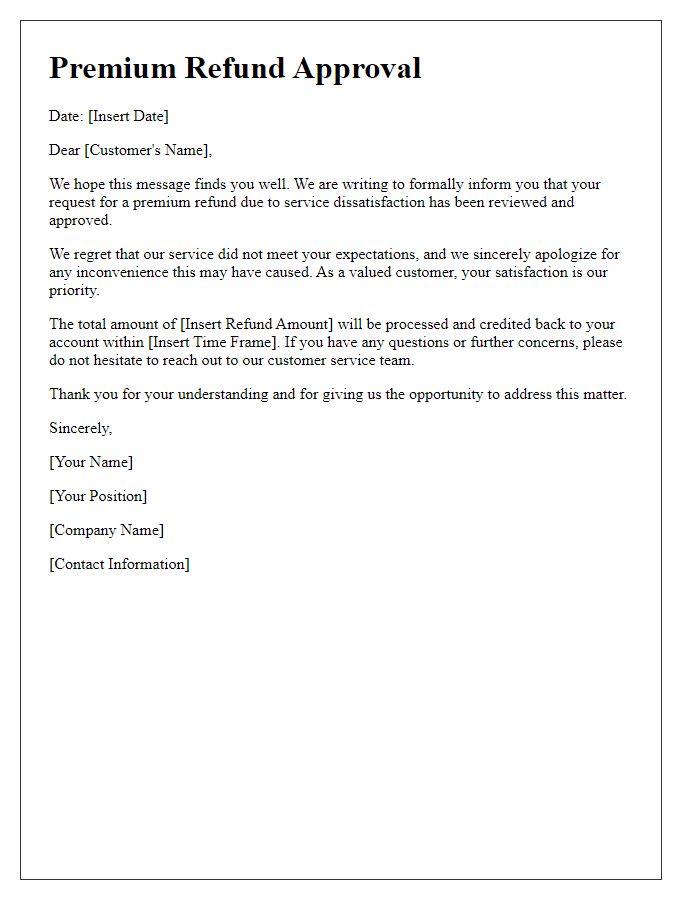

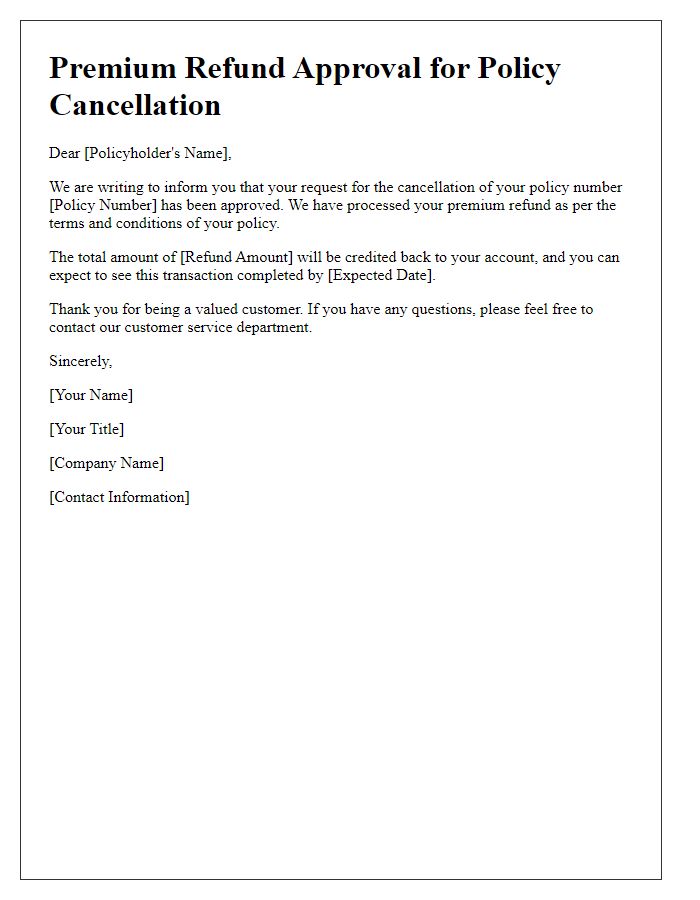

Letter Template For Premium Refund Approval Samples

Letter template of premium refund approval due to service dissatisfaction.

Comments