Are you considering protecting your assets and ensuring peace of mind? Personal liability coverage is a vital aspect of financial security that can safeguard you from unexpected events and claims against you. By understanding the importance of this insurance, you can make informed decisions about your personal risk management. Dive into our detailed article to explore the benefits of personal liability coverage and find out how it can work for you!

Clear Subject Line

Personal liability coverage protects individuals from financial loss due to legal claims of negligence or harm caused to others. Essential for homeowners (approximately 63% of Americans own homes) and renters, this insurance helps cover medical expenses, property damage, and legal fees that may arise from incidents like slip-and-fall accidents or unintentional injuries. Policies typically range from $100,000 to $1 million in coverage limits, tailored to the specific needs of the policyholder. Endorsements such as umbrella liability policies can further enhance coverage, extending protection beyond standard limits for complete peace of mind. Consideration of state regulations and personal risk factors is crucial when determining adequate coverage levels.

Personalized Greeting

Personal liability coverage offers essential protection against legal claims for damages or injuries that may arise from everyday activities. This insurance safeguards individuals, families, and homeowners against potentially expensive lawsuits resulting from incidents such as accidental property damage or bodily injury to others. Policies can differ in limits, typically ranging from $100,000 to several million dollars, ensuring peace of mind in various scenarios. Additionally, personal liability coverage may extend to incidents occurring away from home, providing a comprehensive safety net in various situations, including recreational activities or gatherings. Understanding the specific terms and conditions of coverage is vital to maximizing the benefits provided by this crucial insurance option.

Coverage Details and Benefits

Personal liability coverage provides essential financial protection against legal claims or lawsuits arising from injuries or damages caused to third parties. This type of coverage may include scenarios such as accidental bodily injury (like a slip and fall incident) or property damage (like accidentally causing damage to a neighbor's fencing). For instance, typical policies may offer limits ranging from $100,000 to $1 million, depending on the insurer and specific policy terms. Key benefits often include coverage for legal defense costs even if the case does not result in a judgment against the insured. Additionally, personal liability coverage may extend to incidents occurring at the insured's residence, encompassing events that happen on the property. Having comprehensive personal liability coverage ensures peace of mind, safeguarding individuals from potentially devastating financial losses due to unforeseen accidents and mishaps.

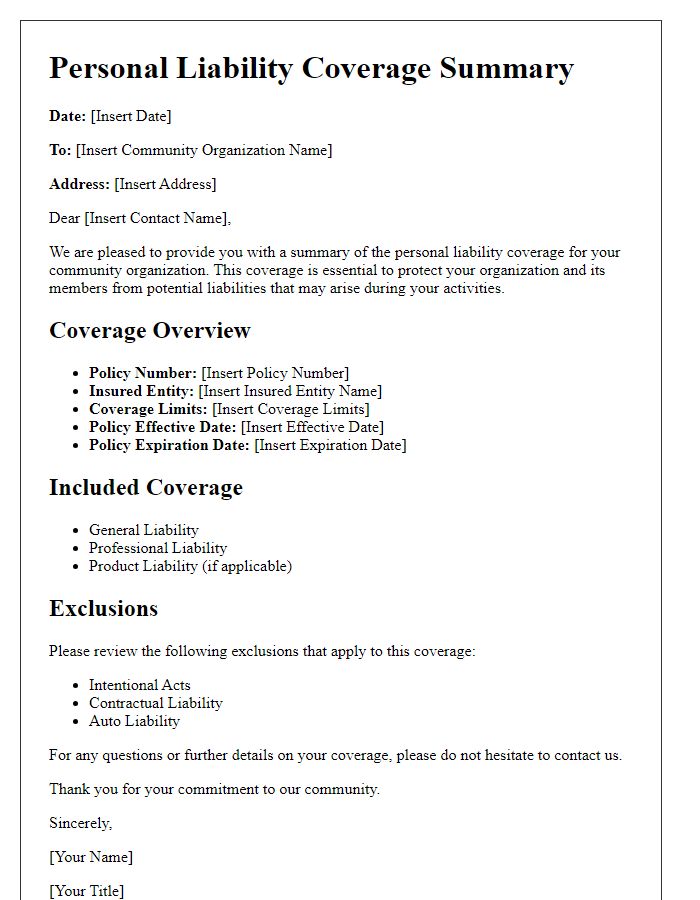

Terms and Conditions

Personal liability coverage provides essential financial protection against potential risks and liabilities that may arise from unforeseen events. This coverage typically protects individuals from legal expenses and damages related to accidents, such as slips and falls, on their property or incidents involving the insured's actions. Policies may vary, with limits often ranging from $100,000 to several million dollars, depending on the insurer and specific terms. Common exclusions include intentional acts, business-related liabilities, and certain types of vehicles. Premium costs can differ based on factors like location, property type, and claims history, typically ranging from $10 to $30 monthly. Understanding the nuances of coverage limits, deductibles, and additional endorsements is crucial to ensure comprehensive protection tailored to individual needs.

Instructions for Next Steps

Personal liability coverage provides essential financial protection against legal claims resulting from personal injury or property damage. This type of insurance is particularly important for homeowners, renters, and anyone engaging in activities that may inadvertently harm others. In the United States, the average personal liability coverage limit ranges from $100,000 to $1 million, with many policies offering additional umbrella coverage for extended protection. Potential events leading to claims could include accidental injuries on your property or damage caused by your pets. If you are interested in obtaining a policy, gather personal information such as property details (location, size, and value), and details about household members (age, occupation). Review existing coverage options you may have through homeowner's insurance or renter's insurance. Contact an insurance agent to discuss tailored coverage plans and quotes based on your individual needs and risk factors.

Letter Template For Personal Liability Coverage Offer Samples

Letter template of personal liability coverage package for small business owners

Letter template of personal liability coverage recommendations for freelancers

Letter template of personal liability coverage details for high-risk activities

Letter template of personal liability coverage features for vacation property owners

Letter template of personal liability coverage benefits for event organizers

Comments