Are you feeling overwhelmed by an insurance policy issue? You're not aloneâmany individuals face challenges when trying to navigate their policies and seek redressal. In this article, we'll break down a straightforward letter template that can help you communicate your grievance effectively to your insurance provider. So, if you're ready to take the next step in resolving your insurance concerns, keep reading!

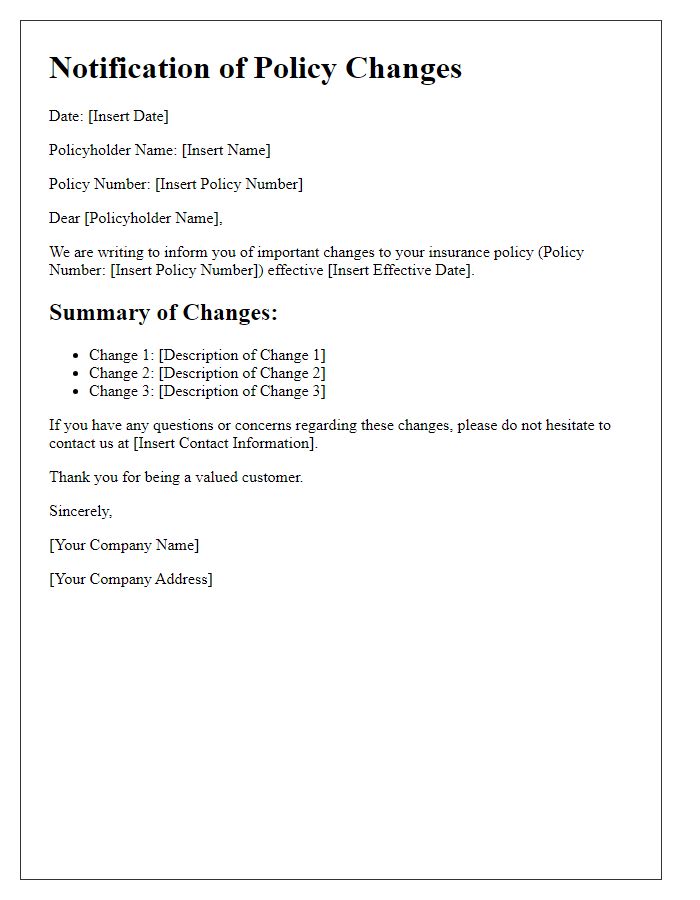

Policyholder Information

A prominent grievance redressal mechanism exists for policyholders encountering issues with insurance policies. Comprehensive policyholder information, including name, address, policy number, and contact details, serves as the foundation for addressing grievances effectively. Clear documentation of the concern, specifying the nature of the complaint, such as claim rejection or delays, ensures that the process is streamlined. Additionally, referring to relevant policy clauses and past communication records enhances the grievance's context, enabling a thorough evaluation. To facilitate prompt resolution, adherence to stipulated timelines, such as the insurance ombudsman guidelines, is crucial for all parties involved.

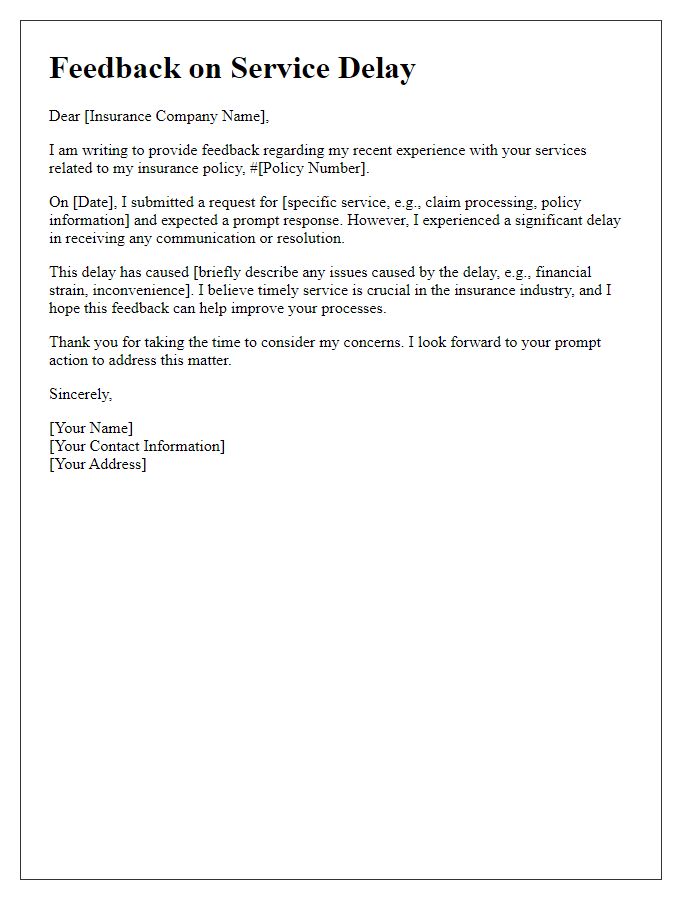

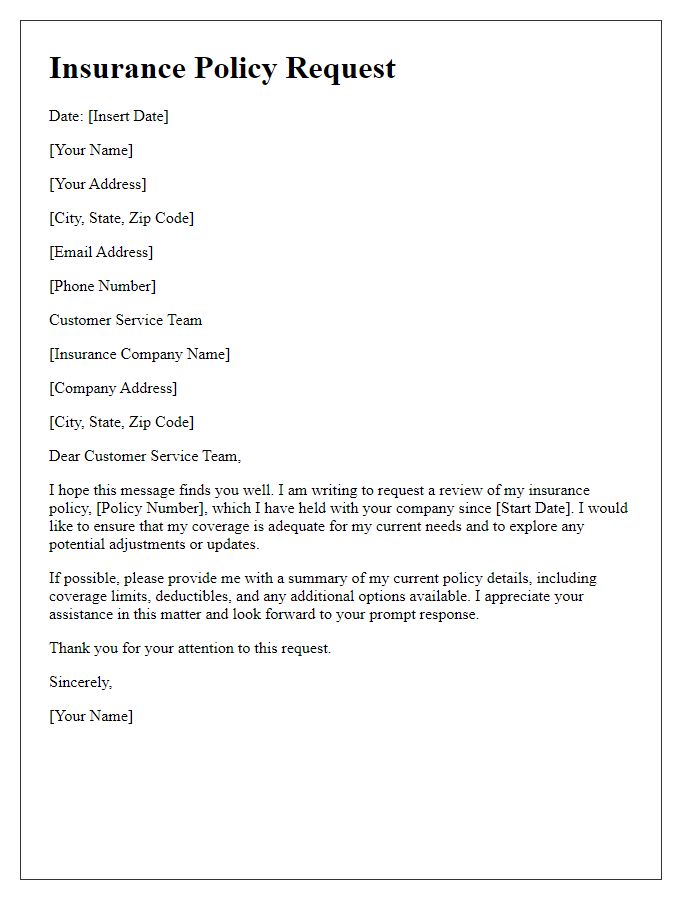

Description of Grievance

A policyholder experiencing delayed claims processing from an insurance provider, such as XYZ Insurance Company, may encounter significant frustration. Claims submitted on January 15, 2023, regarding a car accident (Event ID: 2345) involving a policy number (PN: 987654321) remain unresolved after multiple follow-ups. The policyholder's vehicle (make: Toyota, model: Camry, year: 2020) suffered extensive damage estimated at $10,000 following the collision. Despite providing necessary documentation, including police reports and repair estimates, there has been no clear communication or timeline regarding the status of the claim. This lack of response hampers timely repairs and affects the policyholder's daily commute, highlighting an urgent need for the insurance provider's attention and resolution.

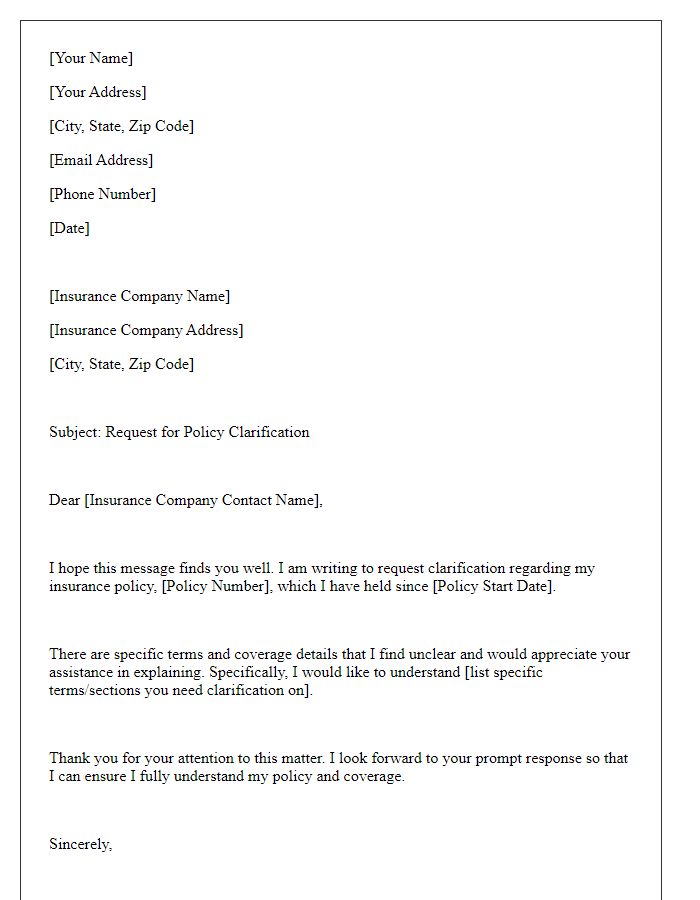

Relevant Policy Details

When addressing insurance policy grievances, relevant policy details must be meticulously presented. Policy number, a unique identifier for the insurance plan, should be clearly stated. The policyholder's name, which connects directly to the specific contract, is essential for identification. Coverage details, including the type of insurance (health, life, auto), identify the specifics of the agreement. Dates of policy commencement and renewal, especially if they highlight coverage duration or lapses, are critical for context. Premium payment history, including amounts and due dates, can indicate compliance and potential reasons for grievances. Lastly, claim numbers associated with any past or current claims solidify the link to the grievance, providing a comprehensive overview for the redressal process.

Supporting Documents

Supporting documents play a crucial role in the grievance redressal process for insurance policies, particularly in cases where clients seek resolution for disputes regarding coverage, claims, or service issues. Essential documents include the original insurance policy (a detailed contract outlining coverage terms), any correspondence with the insurance provider (emails, letters, or recorded conversations), claim forms submitted (including those pertaining to specific incidents), and evidence of loss or damage (photos, police reports, or medical records). Additionally, financial statements related to the claim (such as invoices or payment receipts) can further substantiate the grievance. Maintaining organized digital or physical files of these documents ensures a smoother process while pursuing the grievance resolution with regulatory bodies, such as the Insurance Regulatory and Development Authority of India (IRDAI).

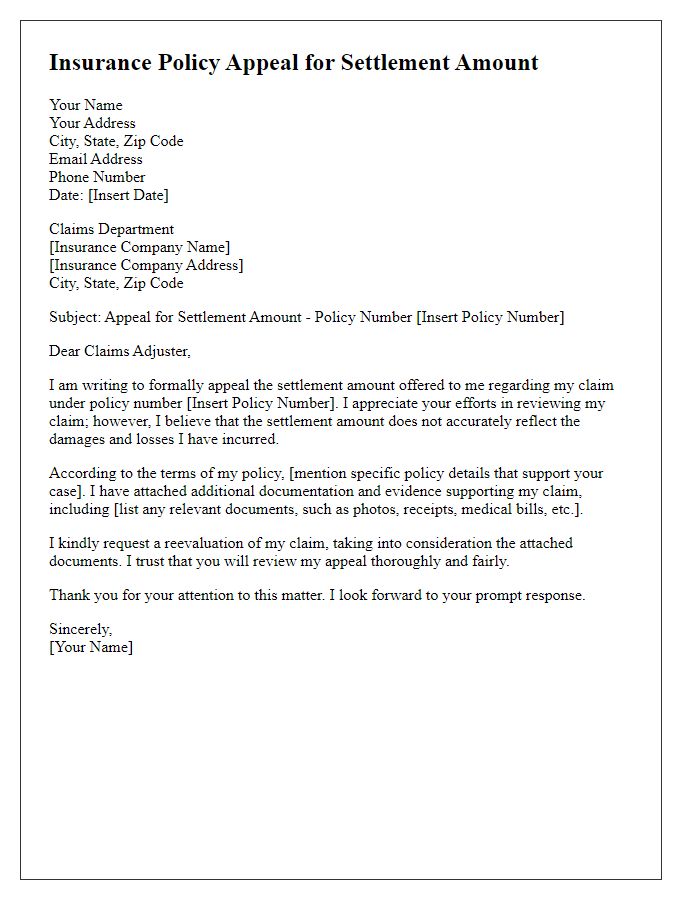

Desired Resolution

In the process of addressing insurance policy grievances, the desired resolution typically involves thorough investigation and clarification of the policy terms. A comprehensive review of claim denials, including examination of the underlying reasons such as policy exclusions or insufficient documentation, should follow. A prompt response from the insurance company regarding the resolution timeframe, alongside clear communication of the next steps, is essential. Additionally, a reassessment of the claim may lead to compensation provided for eligible expenses incurred, ensuring alignment with policy coverage limits and conditions. Continuous customer support from the insurance service team, potentially through designated grievance officers, enhances the resolution experience.

Comments