Have you ever found yourself scratching your head over an unexpected mismatch in your insurance payment? It can be frustrating when the numbers don't add up, and you're left wondering what went wrong. In this article, we'll guide you through the steps of addressing these discrepancies with your insurance provider. So, if you're ready to untangle the confusion and take charge of your policy, keep reading to discover how to resolve your payment issues effectively!

Clear subject line

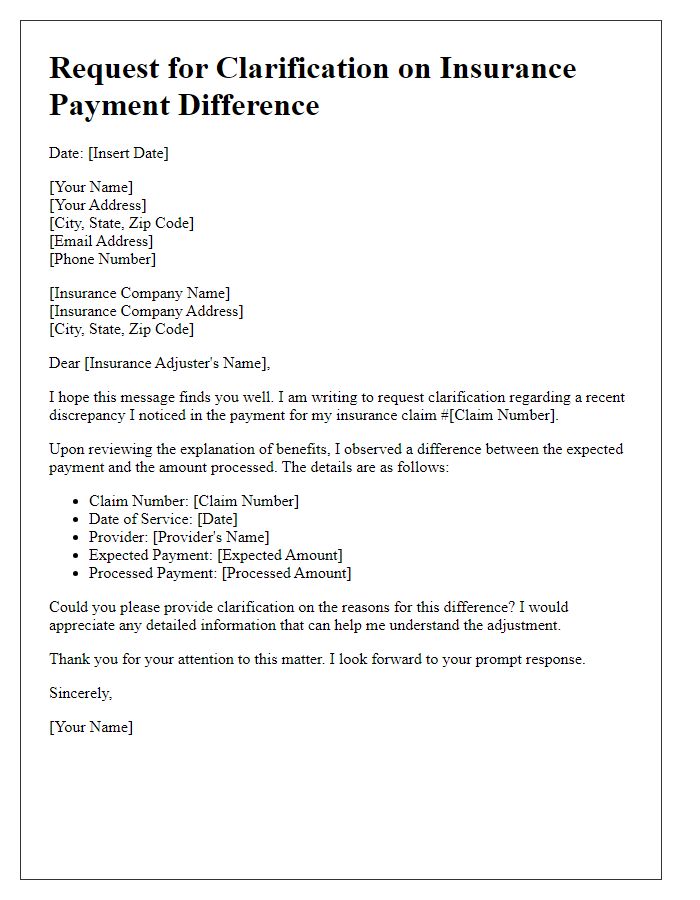

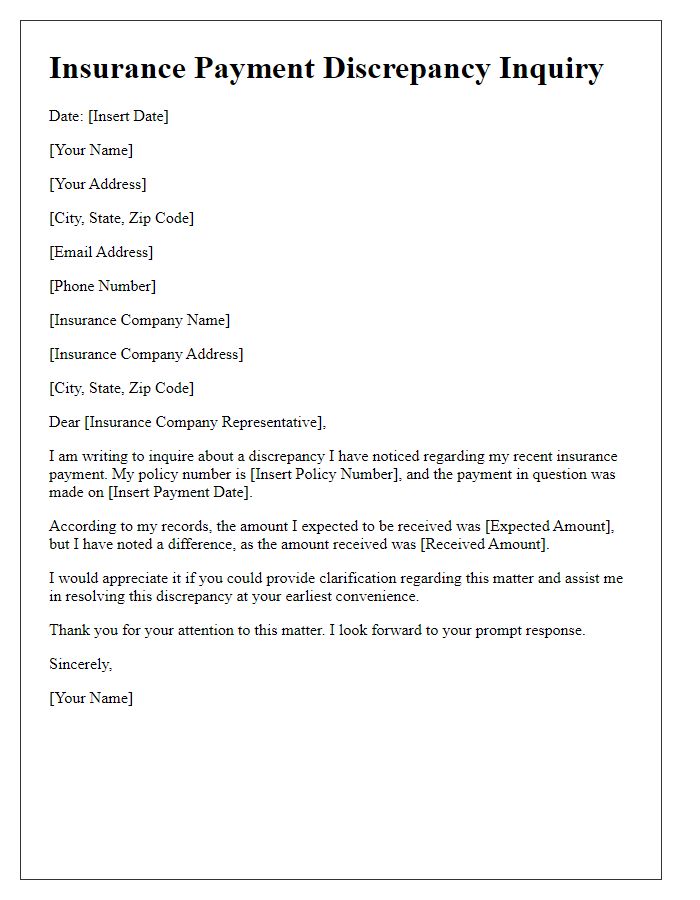

Subject: Inquiry Regarding Insurance Payment Mismatch In reviewing recent statements from XYZ Insurance Company, discrepancies have emerged regarding the expected payment amount for my policy number 123456. According to my records, the agreed payment due for the month of October 2023 was $500, yet I noted an amount of $350 processed on October 15, 2023. This mismatch raises concerns about my coverage status and potential lapses in service. Verification of the payment amount, alongside clarification of any potential errors or adjustments made to my account, would be greatly appreciated. Early resolution of this matter is crucial to maintain uninterrupted coverage under my health insurance policy.

Policyholder's details

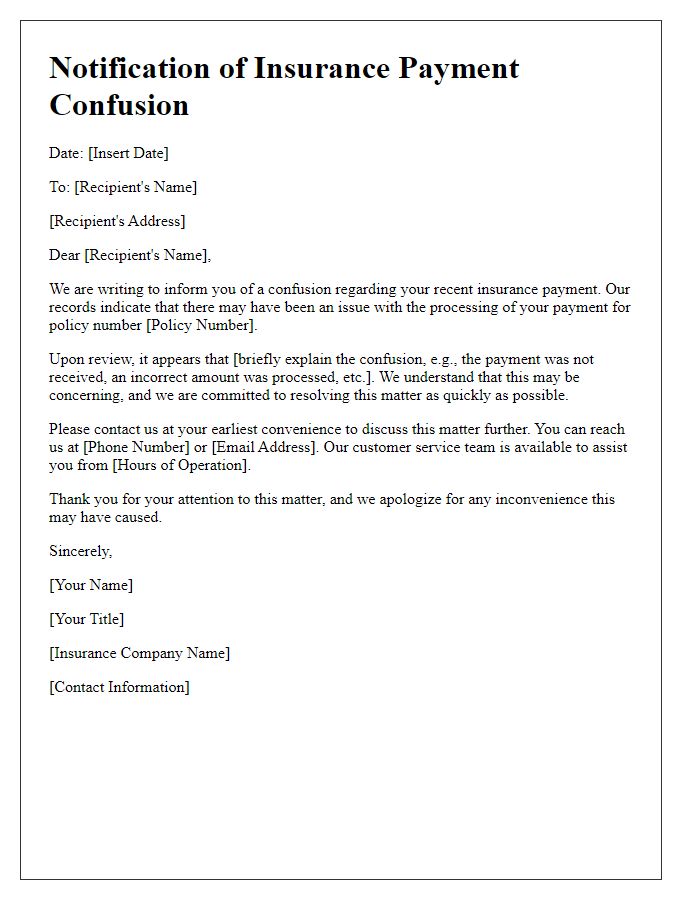

The insurance payment mismatch can significantly impact the financial stability of policyholders, such as individuals with an active home insurance policy. Common reasons for discrepancies include miscalculated premiums based on policyholder information, such as annual income or property value, resulting in improper payment processing. Policyholders, often located in various regions, may experience delays if their claim numbers, which can range in the hundreds, are not aligned with the insurer's records. Furthermore, the payment processing times can vary by state or insurance company, leading to additional confusion and frustration. Accurate communication of personal details and policy specifications is essential for resolving payment discrepancies and ensuring timely reimbursement for covered damages or losses.

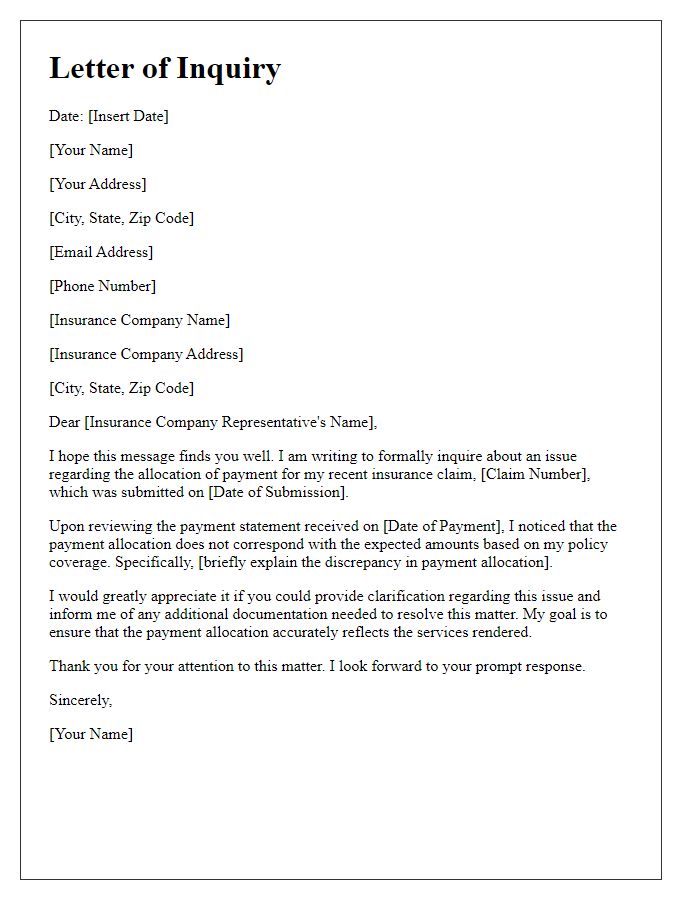

Payment details and discrepancies

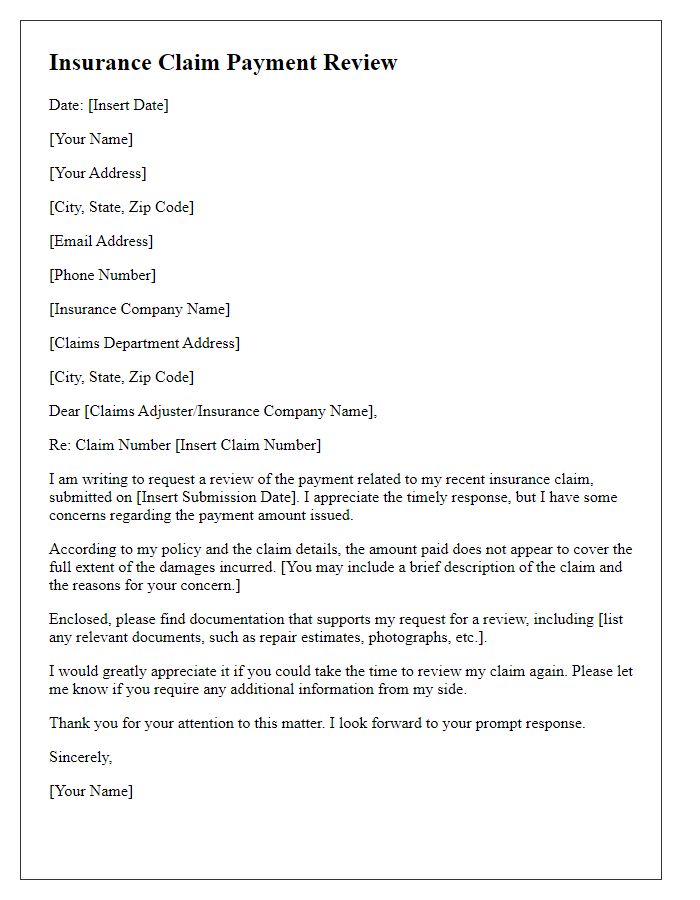

Insurance payment discrepancies can significantly impact financial planning and coverage assurance. Policyholders often encounter situations where the received payment amount varies from expected sums outlined in policy terms. Common issues may include underpayments, missed reimbursements, or delays in processing claims. For instance, a claim submitted for medical treatments totaling $5,000 may result in a payment of only $3,500 due to an oversight in the claim processing department of the insurance company. Furthermore, terminology such as "deductibles," "co-payments," and "out-of-pocket maximums" can create confusion regarding actual outlays versus reimbursable amounts. Communication with the insurance provider is essential to clarify discrepancies and understand the rationale behind adjusted payments, which can involve reviewing specific claim codes and coverage limits. Keeping organized records of all policy documents, correspondence, and payment receipts can aid in resolving issues efficiently.

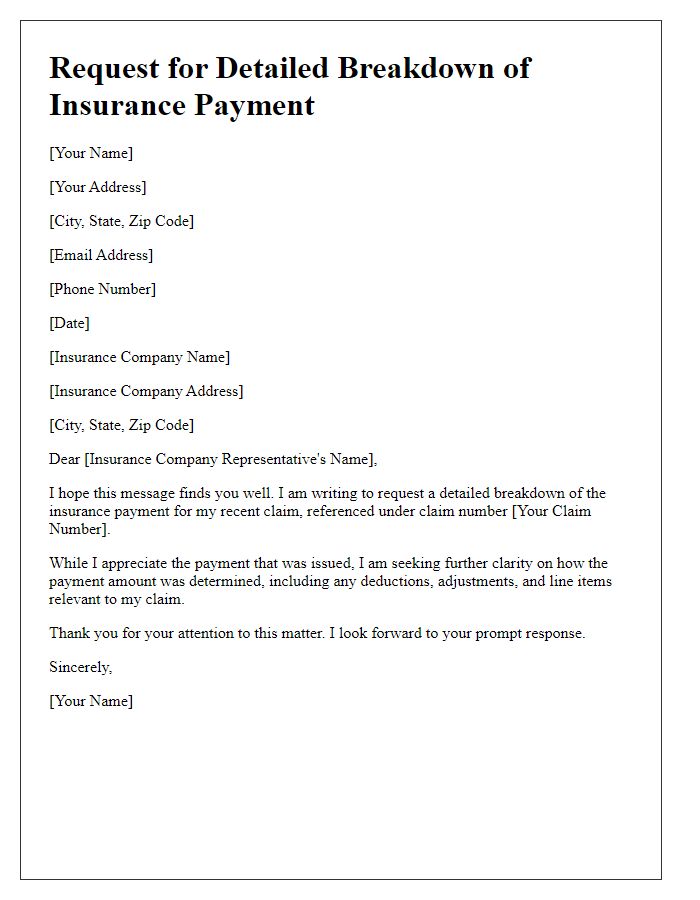

Request for clarification or correction

An insurance payment mismatch can lead to financial confusion and stress for policyholders. Policyholders may receive notifications from their insurance providers, such as State Farm or Allstate, indicating discrepancies in their recent claims. For instance, a homeowner might notice that the damage reimbursement for a roof repair claimed after a severe storm in the Midwest has been significantly lower than expected, leaving the total insufficient to cover the repair costs. This discrepancy could stem from various factors, including administrative errors or incorrect policy interpretations. Timely clarification on payment calculations, such as the percentage of coverage applied or any deductibles considered, is crucial for ensuring that claims are settled fairly and accurately. Additionally, contacting customer service representatives or claims adjusters for detailed explanations can help resolve these issues efficiently, allowing policyholders to regain peace of mind regarding their financial obligations.

Contact information for follow-up

Filing an insurance payment mismatch inquiry requires careful attention to detail. In the context of a specific case, individuals must reference the insurance policy number (commonly a series of digits unique to each account), the date of the service (which may range from January to December), and the name of the healthcare provider (such as a clinic or hospital) who rendered the services. Including precise contact information is crucial; this typically consists of a phone number (usually ten digits long) and an email address (with a domain such as .com or .net) for efficient follow-up. Additionally, mentioning the discrepancy amount (which could be in hundreds or thousands of dollars) assists in clarifying the issue. Providing these details ensures that the inquiry is processed swiftly and accurately.

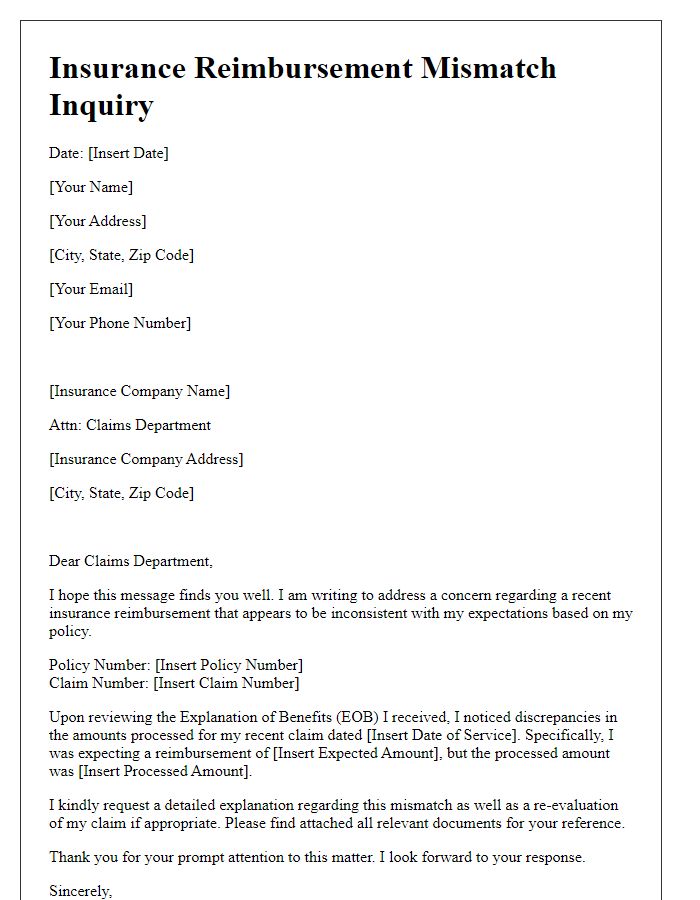

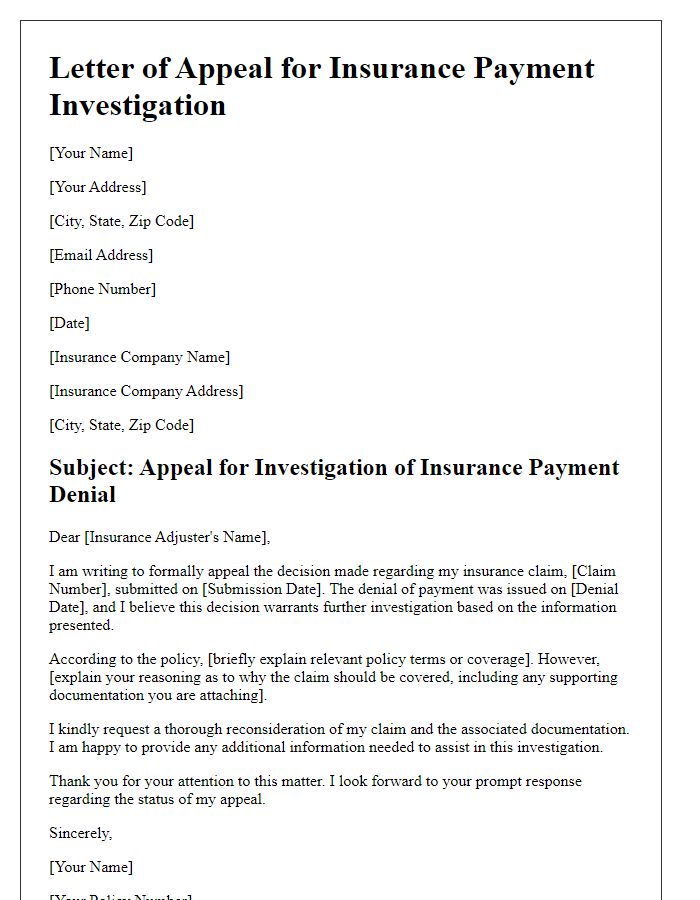

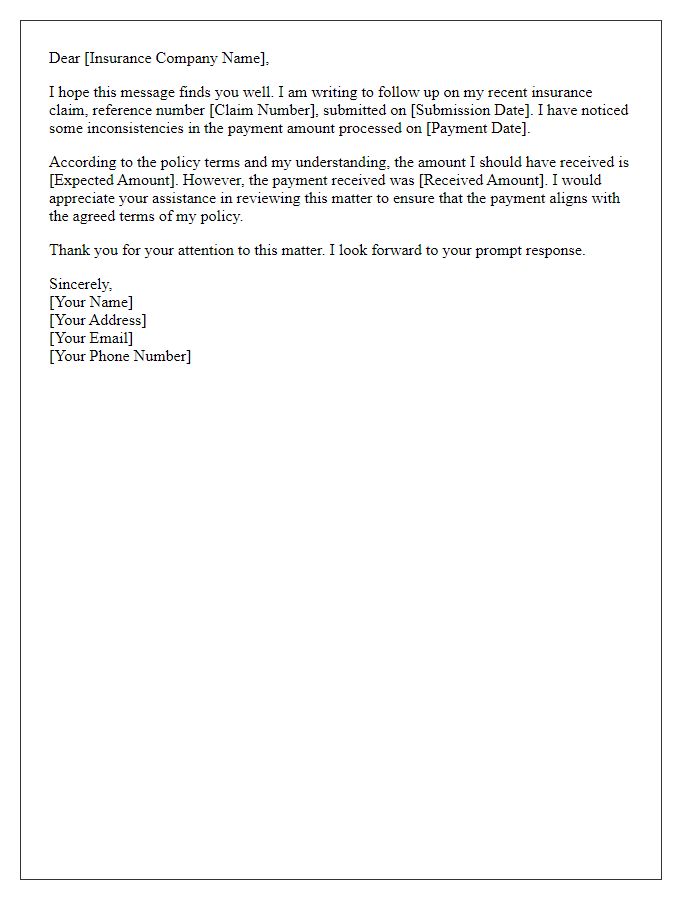

Letter Template For Insurance Payment Mismatch Inquiry Samples

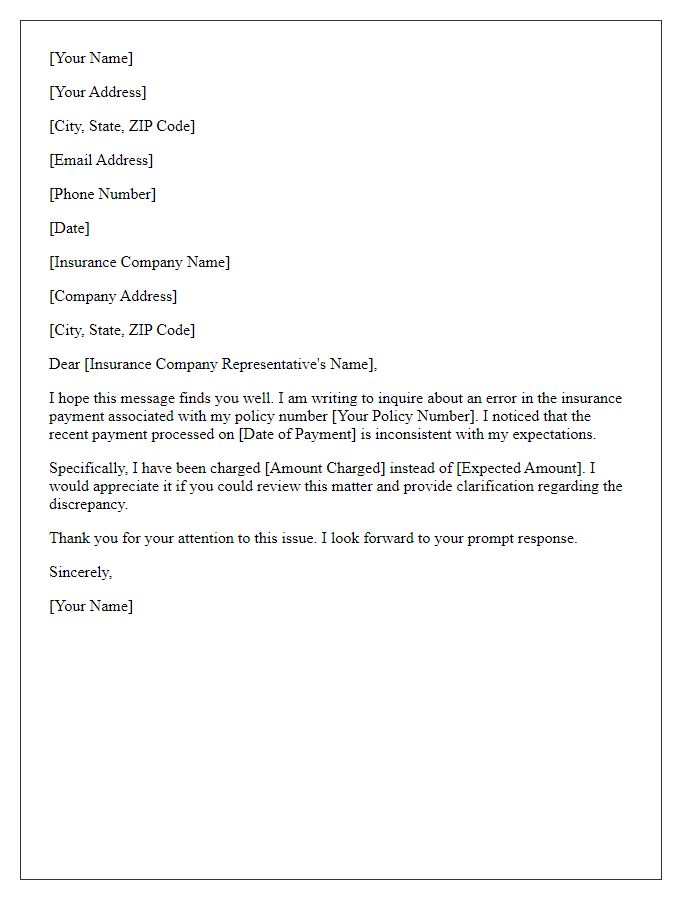

Letter template of request for clarification on insurance payment difference

Comments