Hey there! Are you exploring options for short-term health insurance? It's a smart move to stay protected, especially when life throws unexpected surprises your way. Our comprehensive short-term health insurance plans offer flexible coverage tailored to your needs, ensuring peace of mind without breaking the bank. So, let's dive in and discover how these plans can provide you with the security you deserveâread on to find out more!

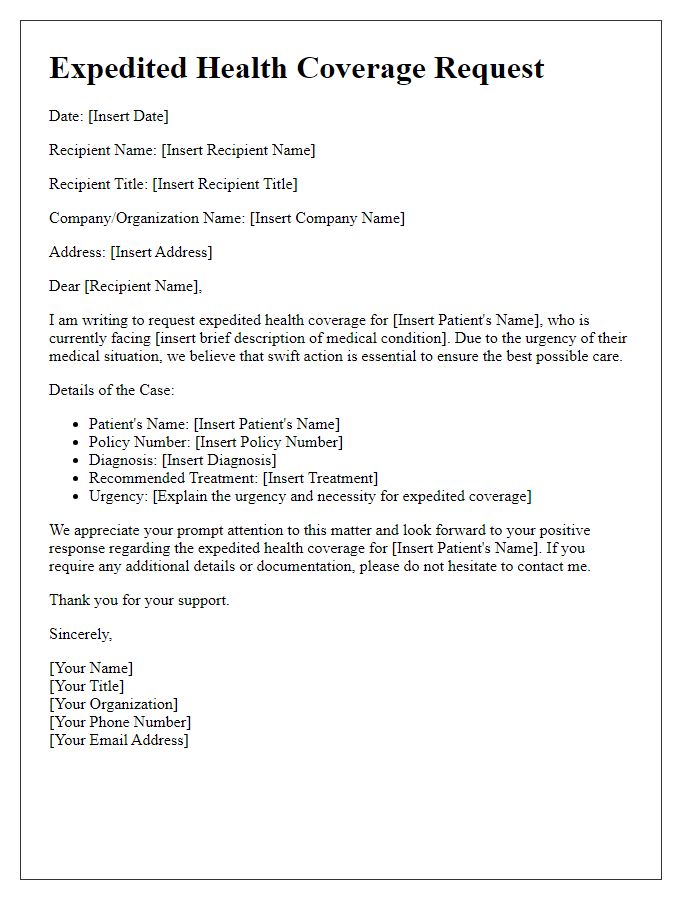

Personalization and customer details

Short-term health insurance plans are designed to provide temporary medical coverage for individuals facing life transitions, such as job changes or waiting for other health insurance to start. Typically, these plans can last from a month up to a year, catering to diverse needs. Policyholders often benefit from lower premiums compared to traditional plans, which can be crucial for managing healthcare expenses in financially challenging times. Enrollees should be aware that these plans might have limitations, including exclusions for pre-existing conditions, which can impact coverage extent. It's vital for consumers to review policy details carefully, ensuring that their specific health care needs are adequately addressed during the period of short-term coverage.

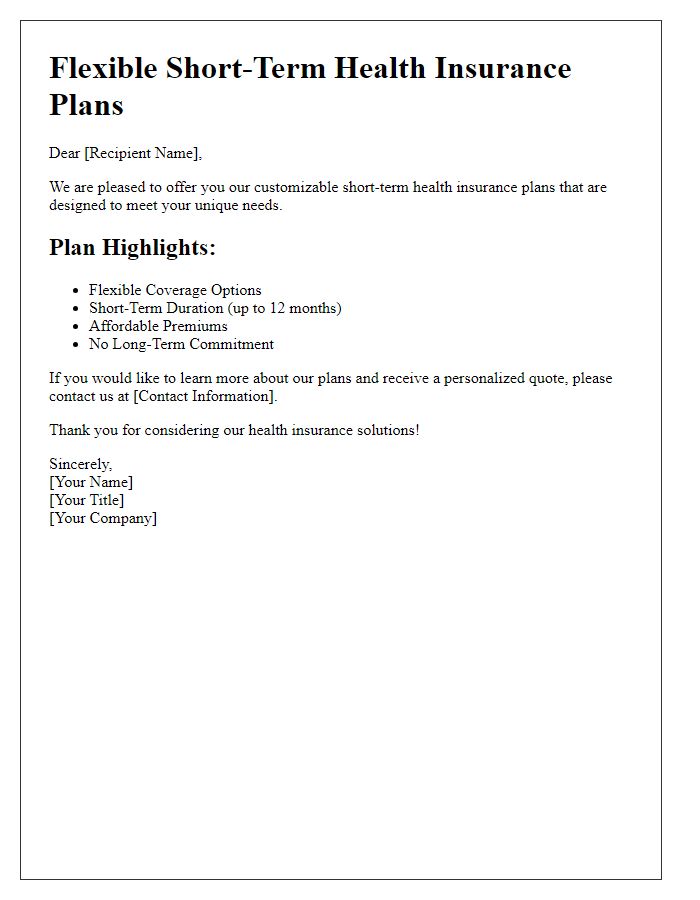

Clear summary of coverage and benefits

Short-term health insurance plans provide temporary coverage designed to fill gaps in your health insurance during transitional periods. Commonly lasting from one month to a year, these plans often include essential health benefits such as emergency room services, hospital stays, and outpatient care. Additionally, they may cover preventive services and prescription medications, although specific benefits can differ by plan. Most short-term policies typically do not cover pre-existing conditions, maternity care, or mental health services. Applicants should carefully review the terms and conditions, including deductible amounts, premium costs, and coverage limits, to ensure that the selected plan meets personal healthcare needs effectively.

Terms and conditions of the policy

Short-term health insurance offers crucial financial protection during transitional periods, covering essential medical expenses such as hospitalizations, outpatient care, and emergency services. Policies typically span 1 to 12 months, designed for individuals recently transitioned into new jobs or experiencing gaps in coverage. Premium rates fluctuate based on age, location, and chosen deductible amounts. Limits apply to pre-existing conditions, often excluding them for the initial period, thus affecting eligibility for claims. Additionally, coverage might vary between in-network and out-of-network providers, influencing co-pays and overall costs. Understanding age-based adjustments is vital, as premiums can sharply increase with age. Remember to consider out-of-pocket maximums, as exceeding them could significantly impact personal finances. Enrolling before specific deadlines ensures continuous coverage, preventing lapses that could lead to financial loss. Policyholders must strive to fully comprehend their benefits, limitations, and claim procedures to make informed healthcare choices.

Contact information for inquiries and support

Short-term health insurance, often referred to as temporary health coverage, provides essential financial protection during transitional periods. This type of insurance can bridge gaps, such as when individuals are between jobs or awaiting Medicare eligibility. Coverage typically lasts up to 12 months, depending on the provider and policy specifics. Major medical expenses may be covered, including hospital visits, emergency care, and preventive services, subject to the policy limits and exclusions. It's crucial to compare different insurance plans and understand nuances, such as deductibles, copayments, and out-of-pocket maximums, to select a suitable option that meets individual health needs and financial situations. Inquiries about policy details or claims support can often be made through dedicated customer service lines or online chat options.

Call-to-action with deadline for acceptance

Short-term health insurance plans provide essential coverage for individuals seeking temporary protection during life transitions, such as job changes or waiting for long-term coverage activation. Various options are available, including plans with coverage limits up to $1 million and flexible durations ranging from 30 days to 12 months. Customers can select benefits tailored to their needs, such as doctor visits, emergency services, and prescription medications. To take advantage of this limited-time offer, interested individuals must complete their applications by June 30, 2024, to secure immediate coverage and avoid potential gaps in healthcare access.

Comments