Hey there! We all know that life can get a little hectic, and sometimes we might overlook important things like our insurance policies. Unfortunately, letting your coverage lapse can lead to some serious financial consequences that might catch you off guard. Curious about what happens when your insurance lapses and how to avoid those pitfalls? Stick around to learn more!

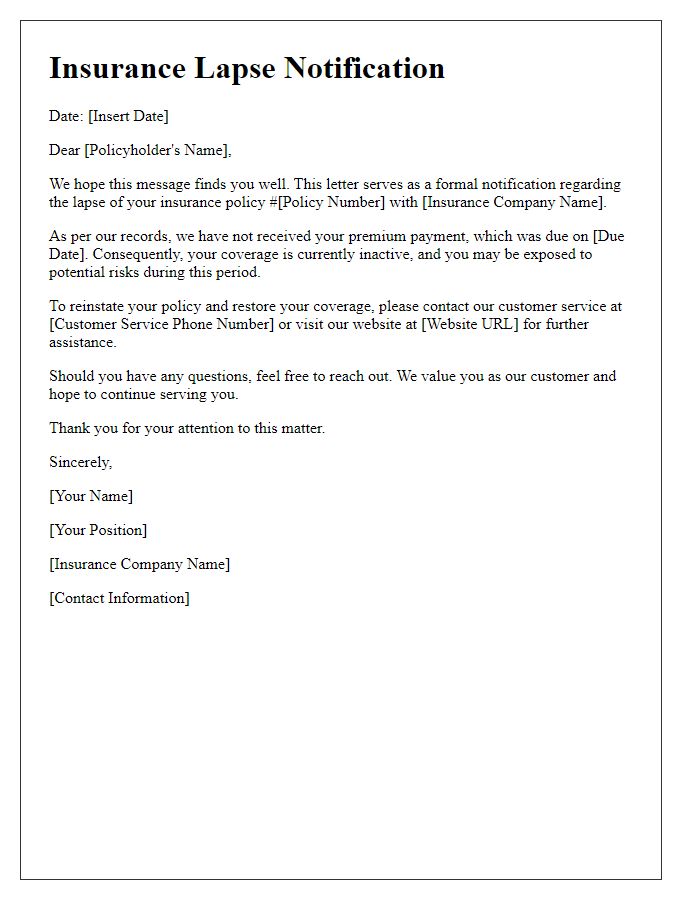

Policy Details

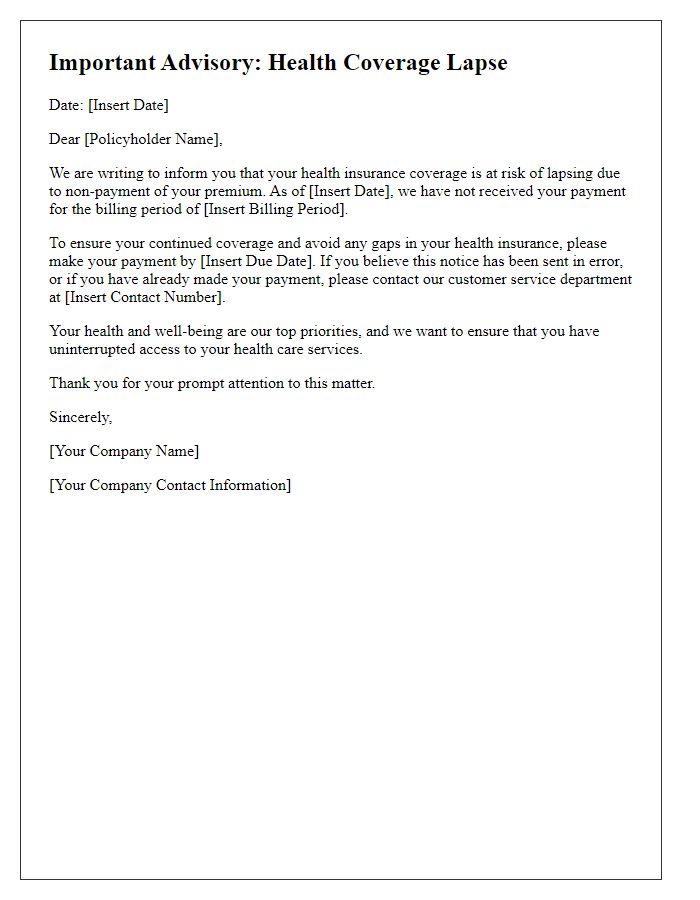

Insurance policy lapses can lead to significant consequences, affecting coverage and claims. A lapsed policy, due to non-payment (typically after a grace period of 30 days), can leave policyholders vulnerable. For instance, life insurance policies, such as whole or term insurance, may require reinstatement applications, which could involve additional underwriting reviews and potential health assessments. Property insurance, particularly homeowners or renters insurance, may expose homeowners to risks, such as damage from natural disasters (hurricanes, floods), without financial protection. Premiums are often increased upon reinstatement, reflecting the policyholder's higher risk status. In some cases, claims made during the lapse period may be denied, causing severe financial strain. Understanding the specifics of each policy, including deadlines and reinstatement procedures, is critical for maintaining continuous coverage.

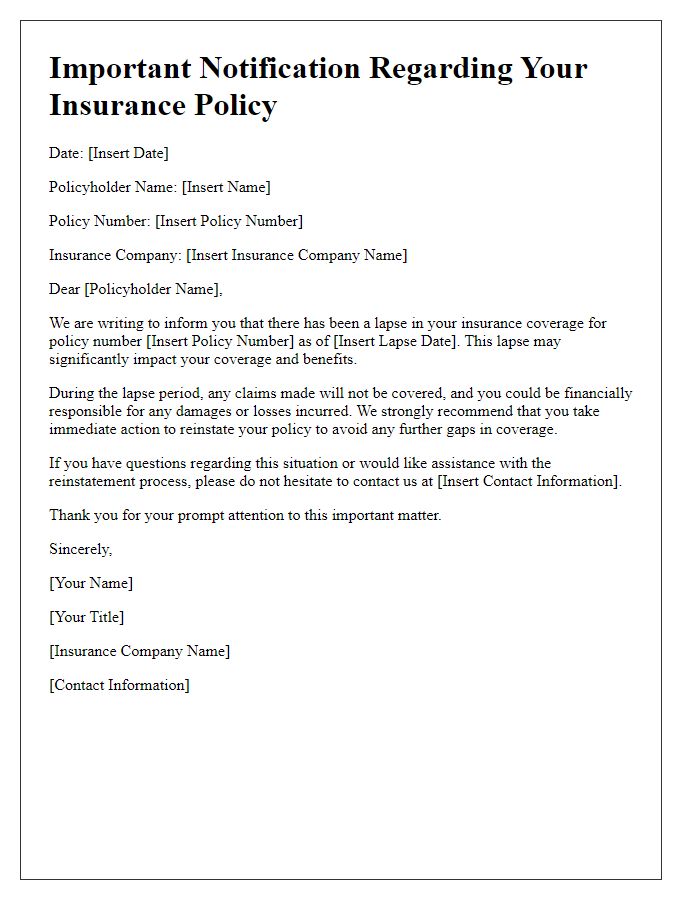

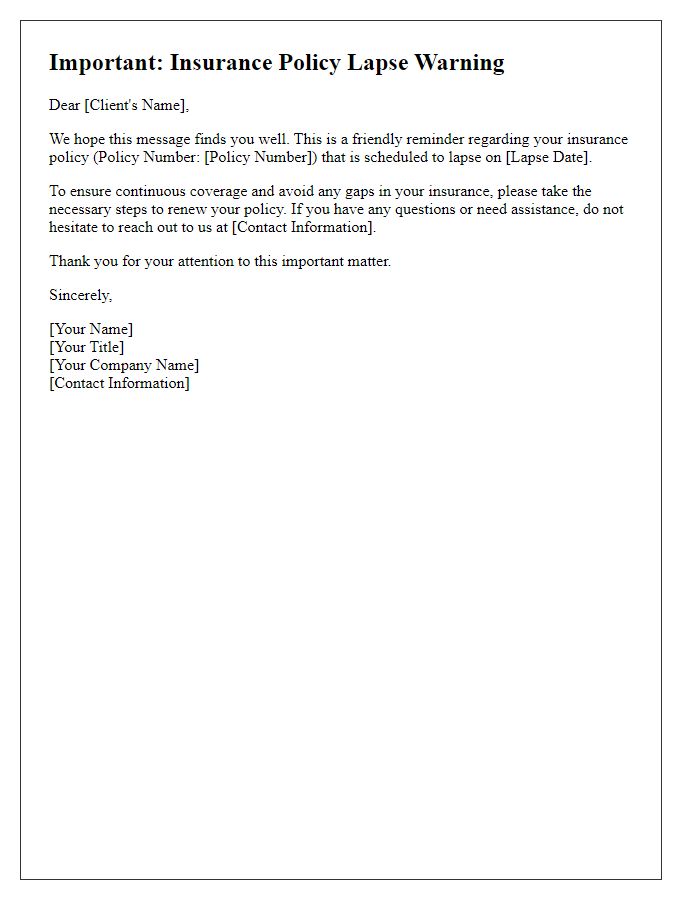

Lapse Date

A lapse in insurance coverage can lead to significant financial consequences for policyholders. When a policy lapses, usually due to non-payment of premiums by a specified date, the insured loses essential protections against unforeseen events. For instance, auto insurance (required by law in most U.S. states) can lead to hefty fines or legal repercussions if driving without valid coverage. Homeowners insurance lapse can leave a property vulnerable to damages or theft, which may result in substantial out-of-pocket expenses during unexpected incidents. Additionally, health insurance gaps can lead to high medical costs and an inability to receive timely and necessary care. The reinstatement process can be burdensome, often requiring extra fees or penalties and proof of insurability, further complicating the situation for those affected. Understanding the lapse date and its consequences is crucial for maintaining continuous coverage and safeguarding financial security.

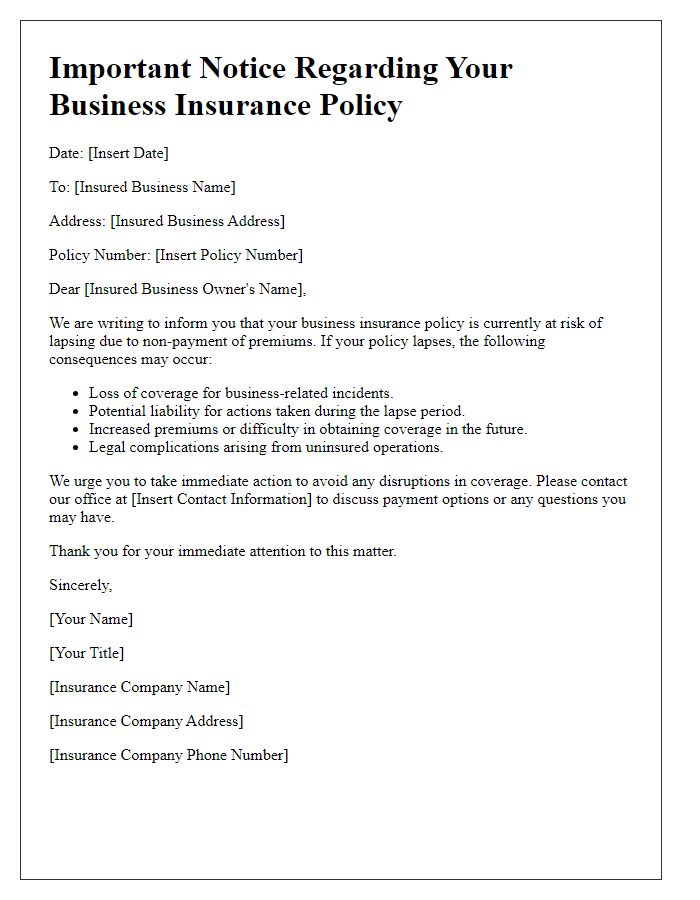

Consequences of Lapse

A lapse in insurance coverage can result in significant consequences for policyholders. Without active insurance, drivers face legal penalties (fines can exceed $1,000 for repeat offenses in states like California). Homeowners risk losing their mortgage protections, with lenders often requiring proof of insurance to avoid default on home loans. Health insurance lapses may lead to high out-of-pocket medical expenses, sometimes reaching thousands of dollars for emergency care. Furthermore, recovering a lapsed policy can be stressful, as insurers may impose higher premium rates or deny coverage for pre-existing conditions. Financial burdens intensify, with potential impacts on credit scores if medical bills go unpaid, reminding individuals to stay informed about renewal dates and payment options.

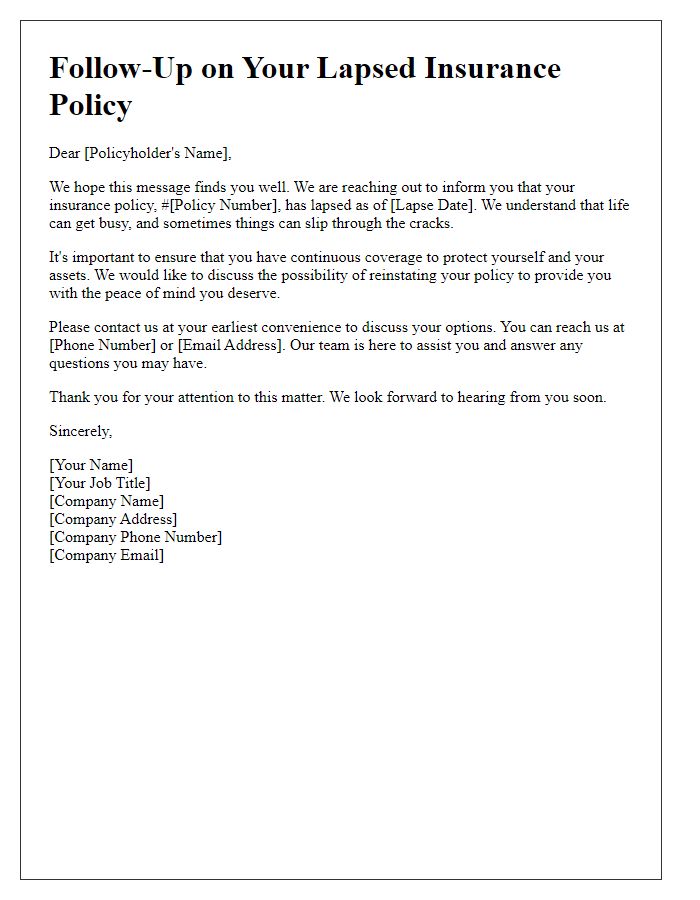

Reinstatement Options

Insurance coverage lapses can result in significant financial consequences for policyholders. Policies that lapse can lead to gaps in coverage, exposing individuals to potential liabilities or catastrophic events without protection. Reinstatement options typically vary by insurer and may include requirements such as payment of outstanding premiums and potential late fees. For example, many insurers like State Farm or Geico provide a grace period of 30 days post-lapse during which policyholders can restore their coverage without penalty. Failure to reinstate within the stipulated timeframe could result in higher premiums upon renewal or even denial of coverage, particularly for high-risk individuals. It's essential to understand the specific terms outlined in the insurance policy document to navigate the reinstatement process effectively.

Contact Information

An insurance lapse can lead to significant consequences for policyholders, including loss of coverage and potential legal issues. When insurance policies, such as auto or health insurance, expire without renewal, individuals may face penalties, increased premiums, or a lack of financial protection during claims. For instance, a car accident occurring during a policy lapse may result in out-of-pocket expenses exceeding thousands of dollars. Additionally, states like California impose fines for driving without insurance, which can further inflate costs for policyholders. Reinstating lapsed coverage can require proof of insurability, leading to more extensive underwriting processes and potential denials for those with pre-existing conditions. The implications are particularly severe in high-risk sectors, such as homeowners insurance, where lapses might lead to loss of mortgage coverage or increased risk of foreclosure.

Comments