Are you feeling overwhelmed by the claims appeal process? You're not alone! Navigating the ins and outs of submitting an appeal can be tricky, but a well-structured letter can make all the difference in getting your case heard. Join us as we explore essential tips and a handy template to simplify writing your appeal letter, ensuring your voice is heard loud and clear!

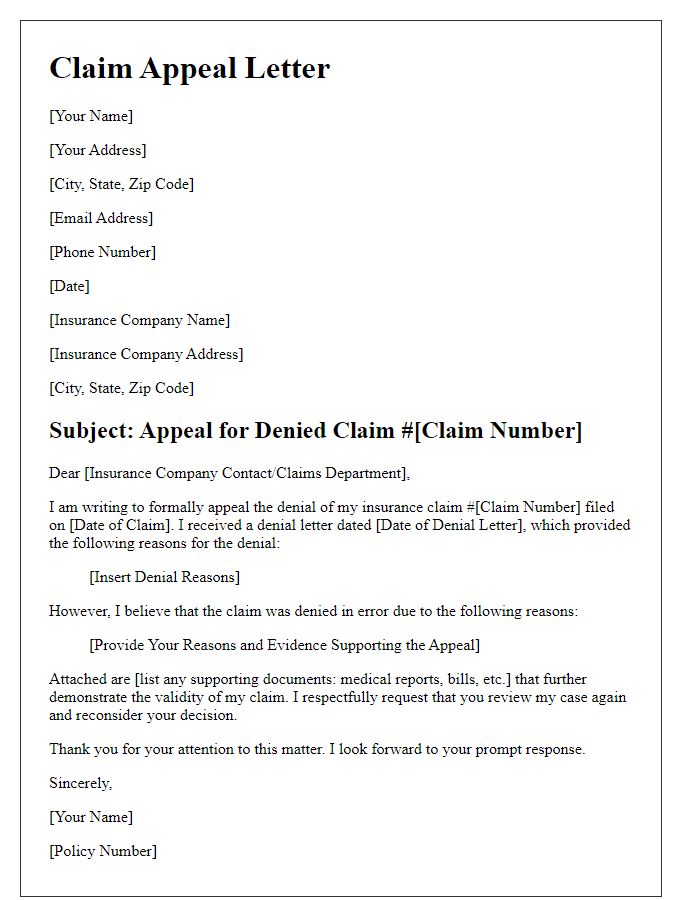

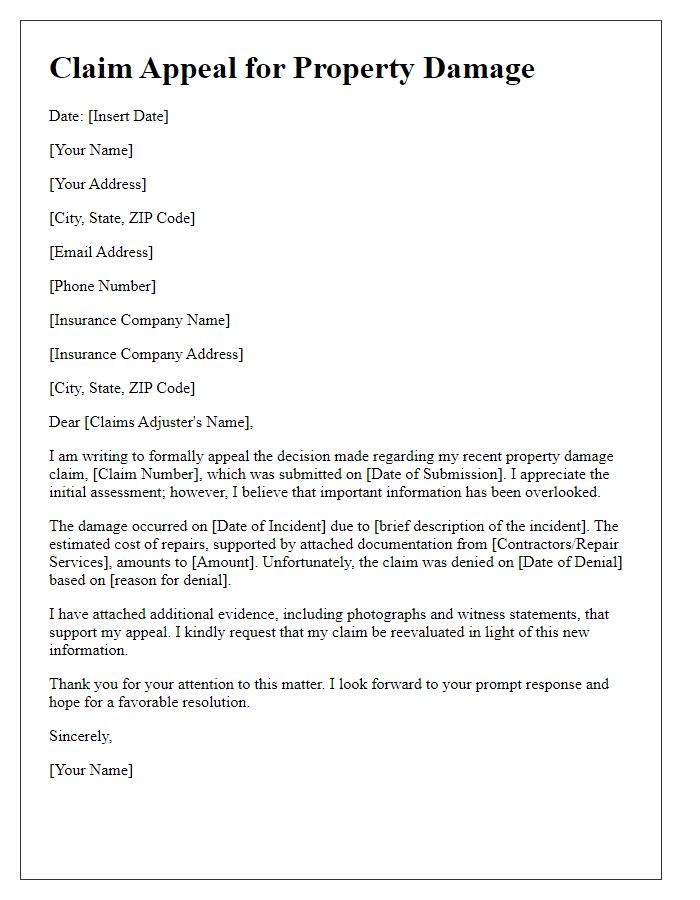

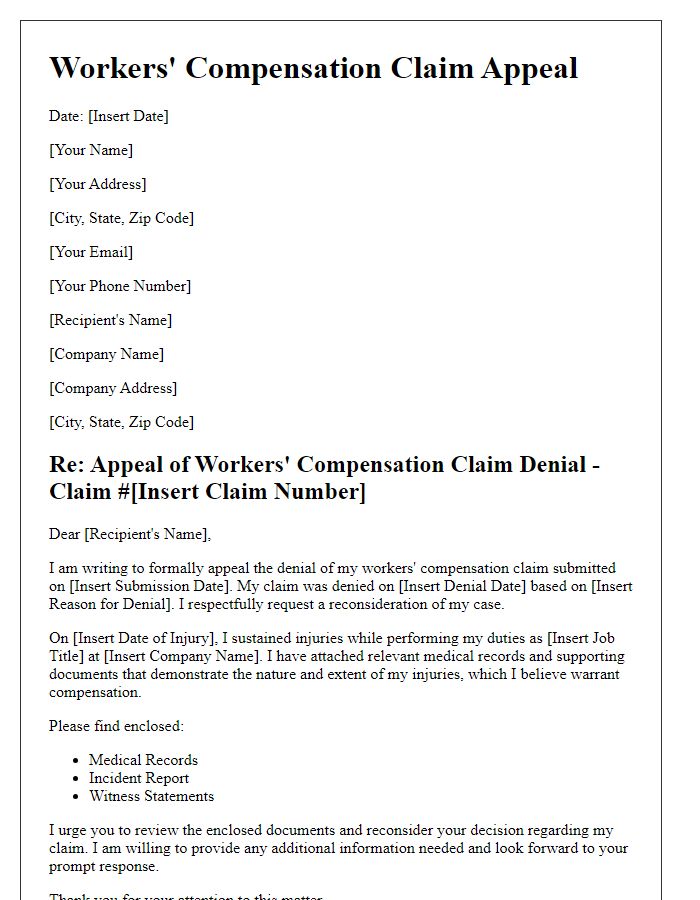

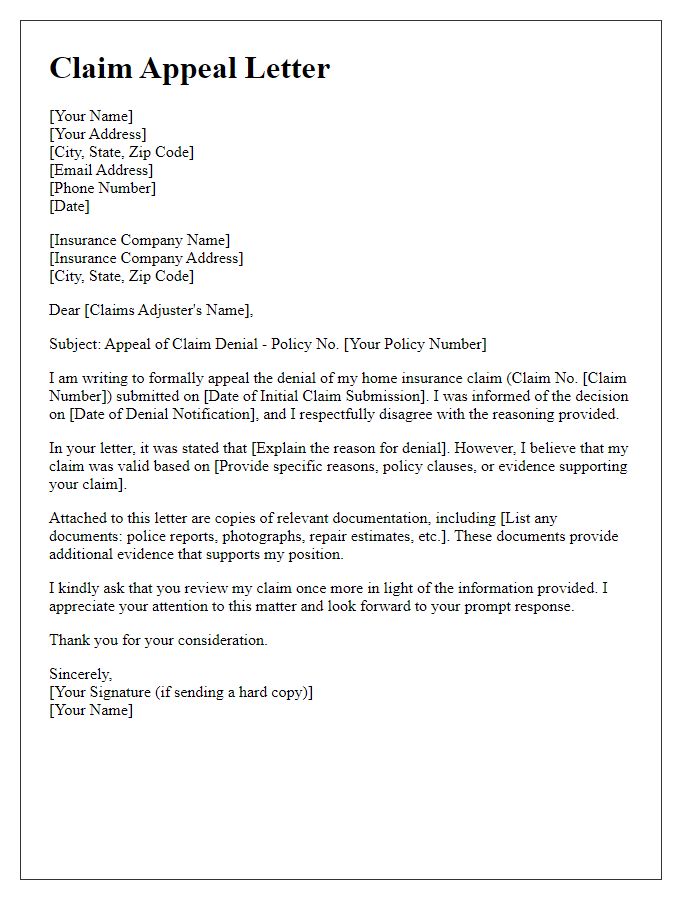

Policy and claim details

The appeal process for insurance claims involves reviewing specific policy provisions and claim details. Claim number 123456789 highlights the incident that occurred on January 5, 2023, in Springfield, Illinois. According to policy number ABCD-987654, coverage includes property damage and loss incurred due to fire. The initial claim submission, made on January 10, 2023, detailed damages amounting to $25,000, supported by an inspection report from XYZ Adjusters. Key policy sections to reference include "Section 4: Loss from Fire" and "Section 7: Claim Submission Procedures," which outline the necessary documentation and timelines for appeals. Engaging with the claims review team is crucial, ensuring all pertinent documents like receipts and photos are included in the appeal submission.

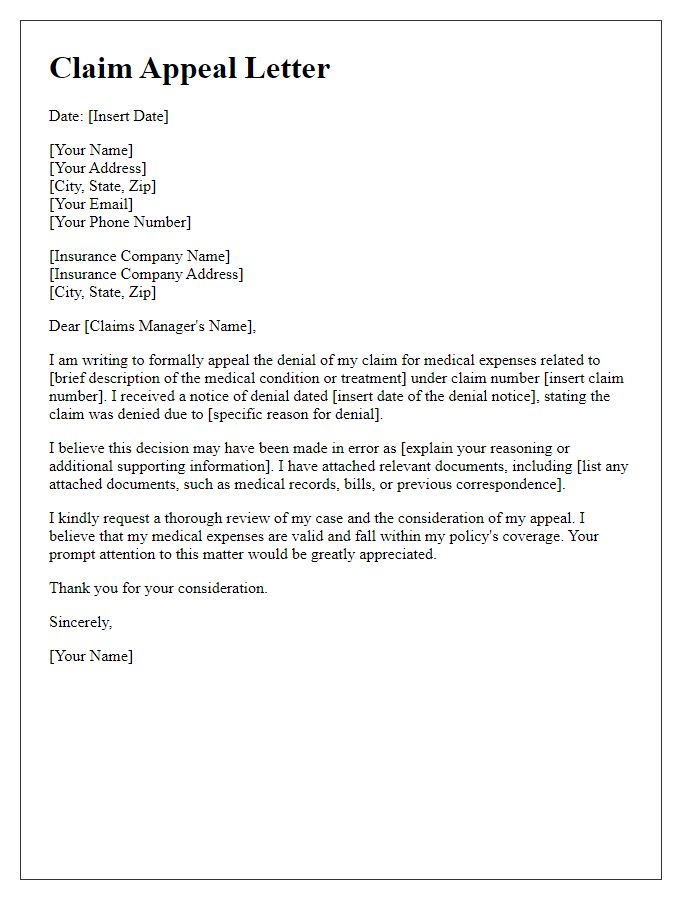

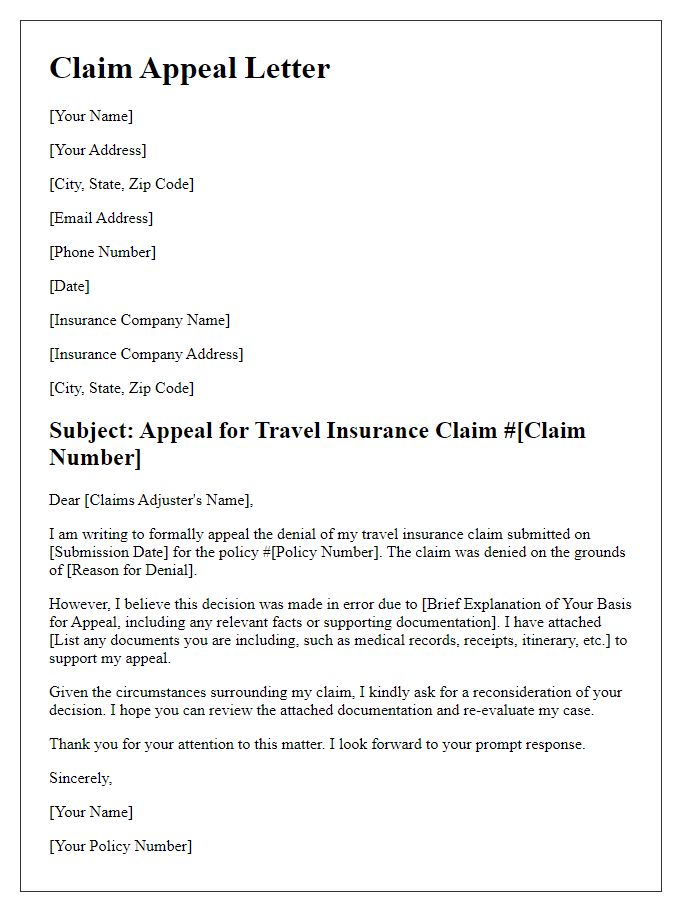

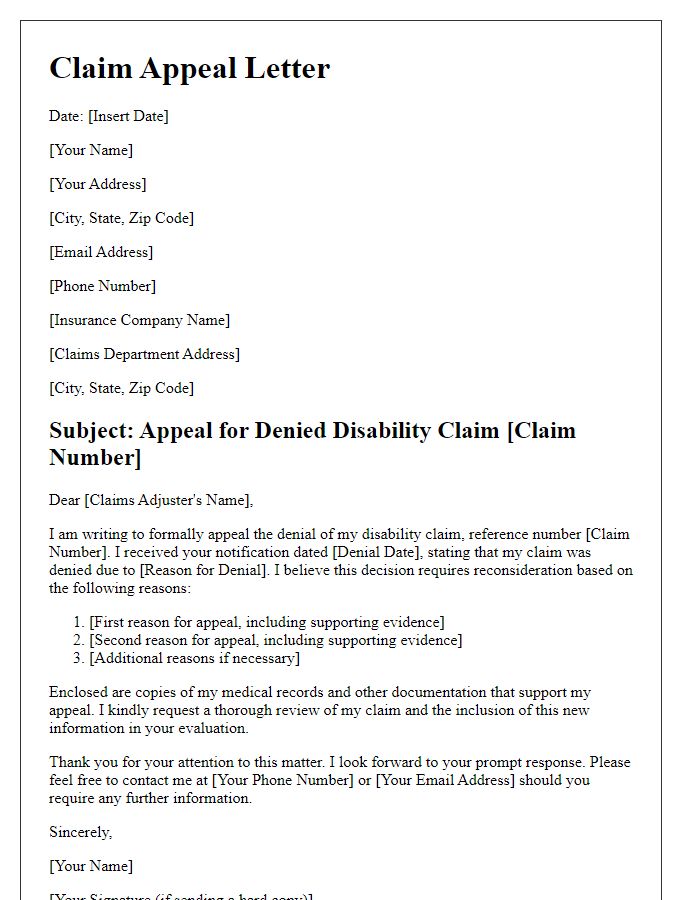

Specific reason for appeal

The lengthy appeal process for insurance claims, specifically in the case of denied medical expenses, can often cause stress. Common reasons for appeal include discrepancies in the medical coding used by healthcare providers. For example, a procedure performed on March 15, 2023, might be coded incorrectly, leading to denial. Paperwork submitted might lack necessary documentation, like prior authorization numbers required by Blue Cross Blue Shield. Timely appeals are crucial, as they typically must be submitted within 180 days of the denial letter. Precise evidence, such as itemized bills and detailed treatment records, plays a key role in validating the claim and improving chances of approval.

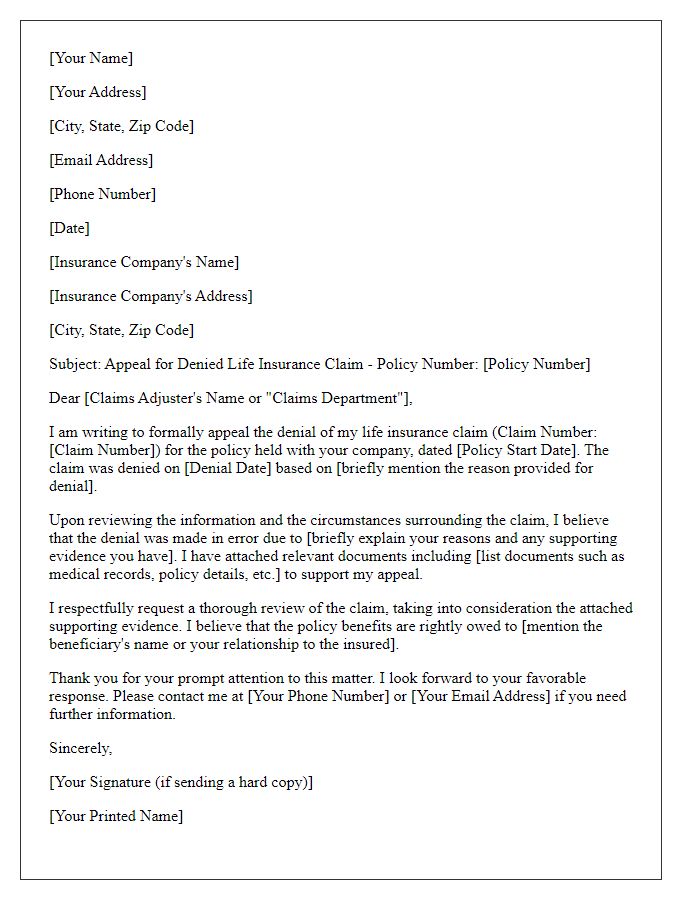

Supporting documentation

Important documentation plays a crucial role in the claim appeal process. Essential documents may include the original claim (detailed account of the initial request for coverage), supporting evidence (like medical records or repair invoices), and communication records (emails or letters exchanged with the claims department). The appeal letter should also incorporate policy numbers (unique identifiers for insurance policies) and claim numbers (specific identifiers for each claim), ensuring accuracy in reference. Additional documents, such as financial statements or expert opinions, may strengthen the case by providing further context. Thorough organization and clarity of these supporting documents enhance the likelihood of a successful appeal outcome.

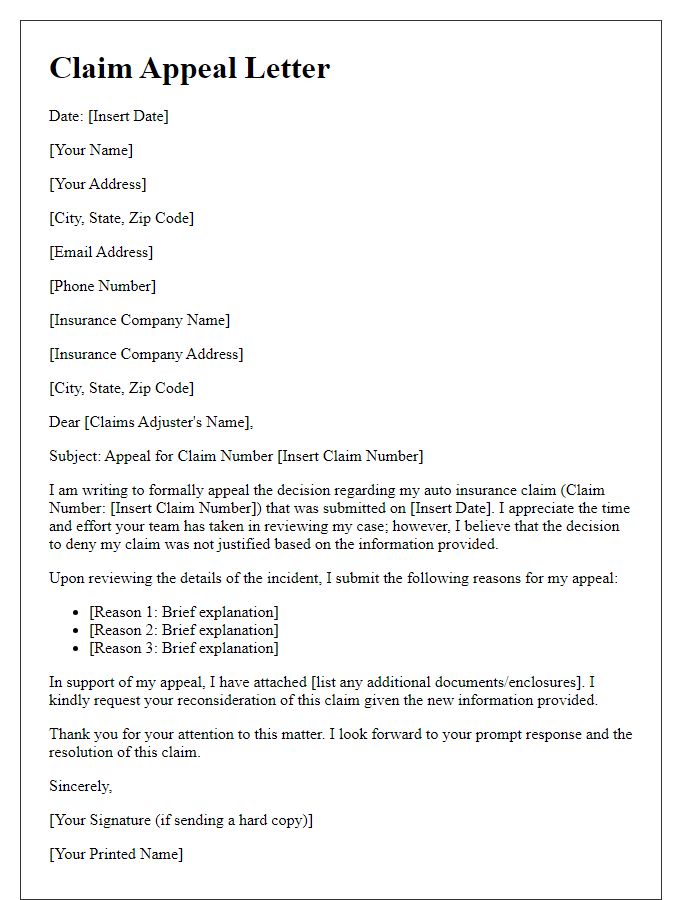

Clear and concise language

Submit a claim appeal with careful attention to specific details and clear language. Begin by stating the policy number associated with the claim. Reference key dates, such as the date of the initial claim submission and the date of the denial notification. Clearly outline the basis for the appeal, emphasizing any relevant documentation, such as medical records or receipts. Highlight any discrepancies between the claim submission and the reason for denial, providing factual evidence to support the appeal. End the letter by requesting a timely review and response, and include your contact information for further communication. Ensure professionalism throughout the document.

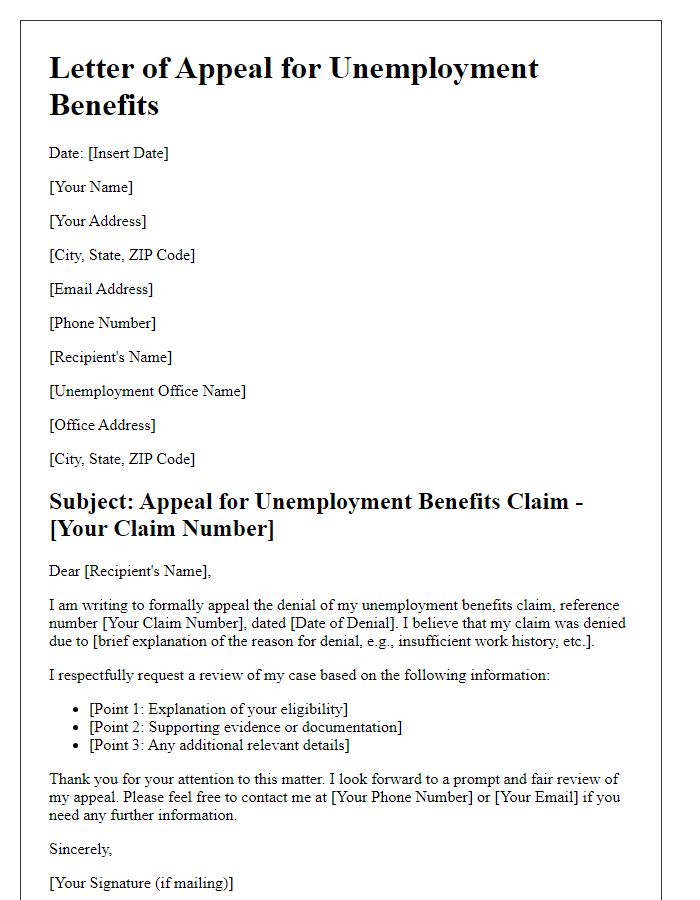

Contact information and follow-up plan

The claim appeal process involves critical steps to ensure effective communication and resolution. Clear contact information for all involved parties is essential, including names, phone numbers, and email addresses of representatives from both the claiming party and the insurance provider. Establishing a follow-up plan is crucial; setting specific dates for follow-up calls or emails can facilitate timely updates on the appeal's progress. Documentation, such as claim numbers, denial letters, and relevant correspondence, should be organized for reference during discussions. The process may require patience, typically lasting several weeks, depending on the complexity of the claim and the responsiveness of involved entities. Keeping thorough records of all interactions can support the appeal and increase the likelihood of a favorable outcome.

Comments