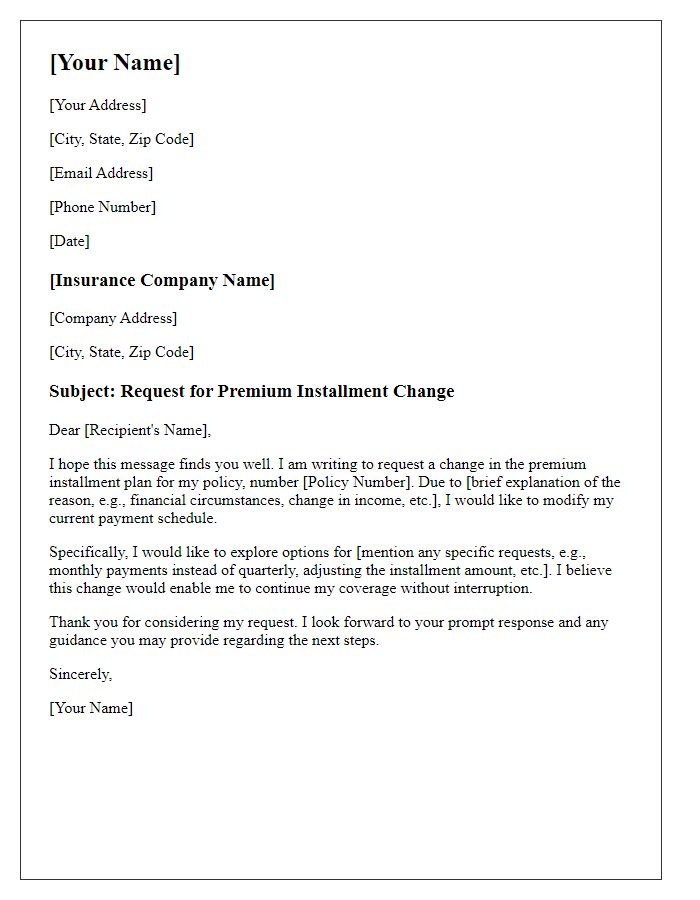

Are you looking to adjust your premium installment payments but don't know where to start? Navigating financial adjustments can feel overwhelming, but it doesn't have to be! In this article, we'll break down the process of writing a letter for premium installment adjustments in a way that's easy to understand and implement. So, if you're ready to take control of your payments, keep reading to discover our helpful template!

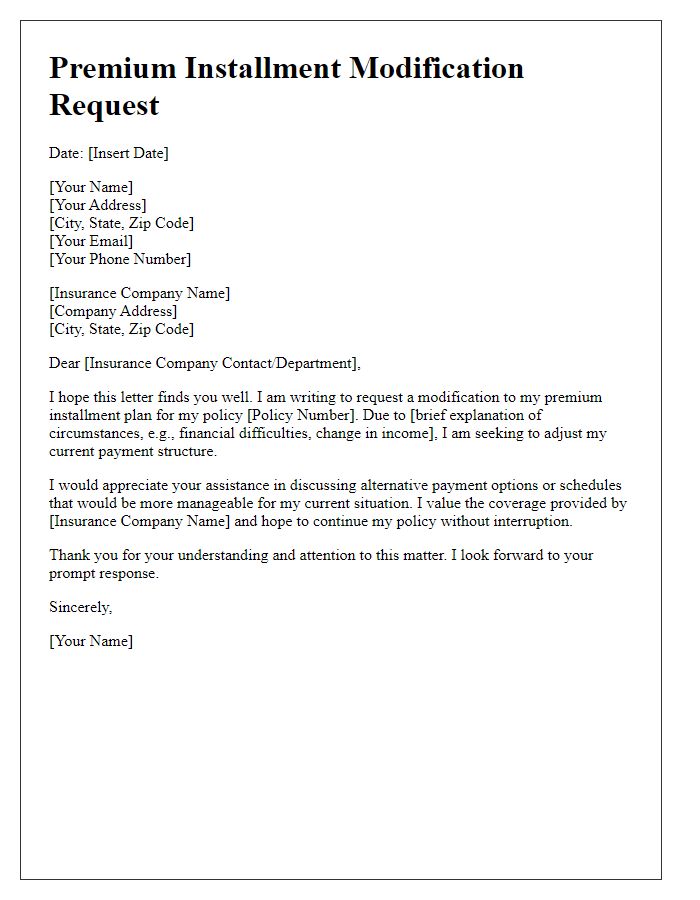

Polite greeting and address

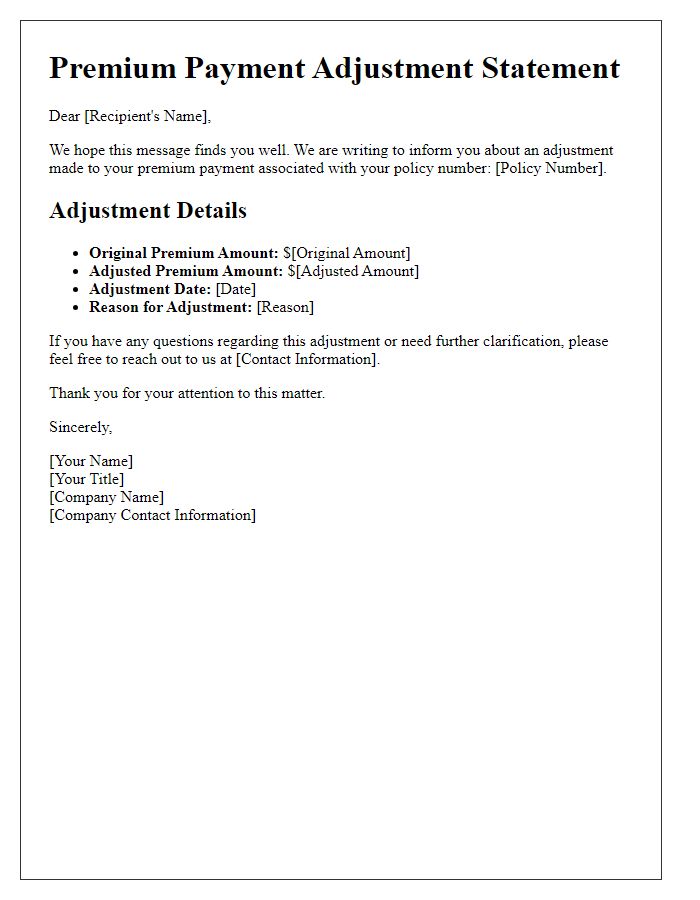

Premium installment adjustments can significantly impact financial planning and budgeting for policyholders. A policyholder may request a premium installment adjustment due to changes in income, lifestyle, or unexpected expenses. Insurance companies typically assess factors such as policy coverage amount, payment frequency, and the policyholder's claims history. The aim is to provide a revised installment that aligns with the policyholder's current financial situation while ensuring continued coverage. Timely communication regarding such adjustments is essential for maintaining a positive relationship between the insurer and the policyholder, fostering trust, and enhancing customer satisfaction.

Detailed account and policy information

A premium installment adjustment can significantly impact your insurance policy, especially when considering factors such as account details and specific policy terms. The insurance policy number (e.g., 456789123), issuers (like AXA Insurance), effective dates (e.g., January 1, 2023), and premium amounts (e.g., $1,200 annually, $100 monthly) should all be clearly outlined. Account information must include your name (e.g., John Doe), address (e.g., 123 Main Street, Cityville, State, ZIP Code), and contact details (e.g., phone number 555-123-4567) to ensure accurate processing of your request. Additionally, specifying the reason for the adjustment, such as changes in coverage needs or financial circumstances, will aid the review process. Always include a request for confirmation of receipt and estimated timelines for the adjustment assessment.

Reason for requesting adjustment

Premium installment adjustments can arise from changes in personal circumstances, such as job loss or a significant reduction in income, affecting individuals' financial capabilities. Policyholders may also seek adjustments due to updated underwriting practices that alter premium calculations based on risk assessments. Another common reason involves life events like marriage, divorce, or the purchase of a new home, which can necessitate reevaluation of coverage needs and corresponding premiums. Additionally, significant regulatory changes within the insurance industry can prompt customers to request adjustments to align with current market standards.

Specific adjustment terms and proposal

Premium installment adjustments can significantly impact policyholders' financial planning. Premium rates, determined by factors such as claim history and market trends, should reflect a fair assessment of risk. For instance, a policyholder in New York, with a recent claim affecting their auto insurance premium, may propose a revised payment structure to accommodate budgetary constraints. A common adjustment entails increasing the payment period, spreading the premium over 12 months instead of 6, which lowers monthly costs. Moreover, policyholders often seek loyalty discounts based on tenure or bundling policies for home and auto, which may lead to a more beneficial rate adjustment. Clear communication of these specific adjustment terms can promote customer satisfaction and retention while ensuring adequate coverage.

Gratitude and contact information for follow-up

Adjusting premium installments reflects a significant decision in financial planning, often necessitating appreciation for the ongoing relationship between the insurer and the policyholder. Expressing gratitude can enhance engagement, emphasizing the importance of effective communication. Contact information is vital for facilitating follow-up discussions regarding specific adjustments to premium schedules. Including details such as direct phone numbers, emails, or office hours encourages prompt responses, ensuring clarity and satisfaction in future interactions. Providing this information fosters a sense of trust and reliability, key aspects in the insurance sector.

Comments