Are you looking to streamline your insurance payments and simplify your financial management? A direct debit authorization can make your life easier by ensuring timely payments without the hassle of manual transactions. By setting up this convenient payment method, you'll never miss a premium due date again. Ready to learn how to create your direct insurance debit authorization letter? Dive in to discover the essential steps!

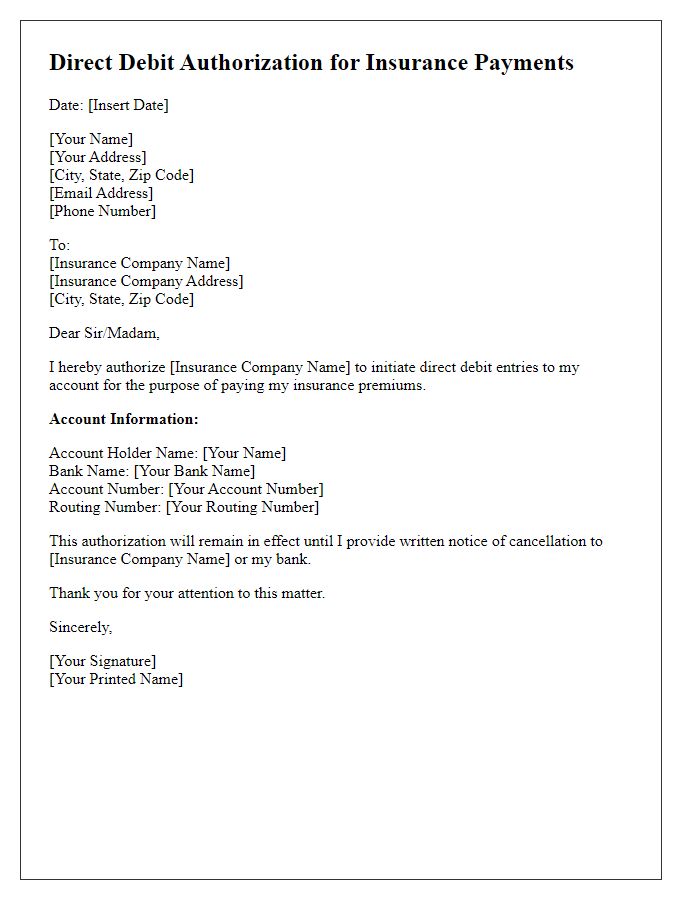

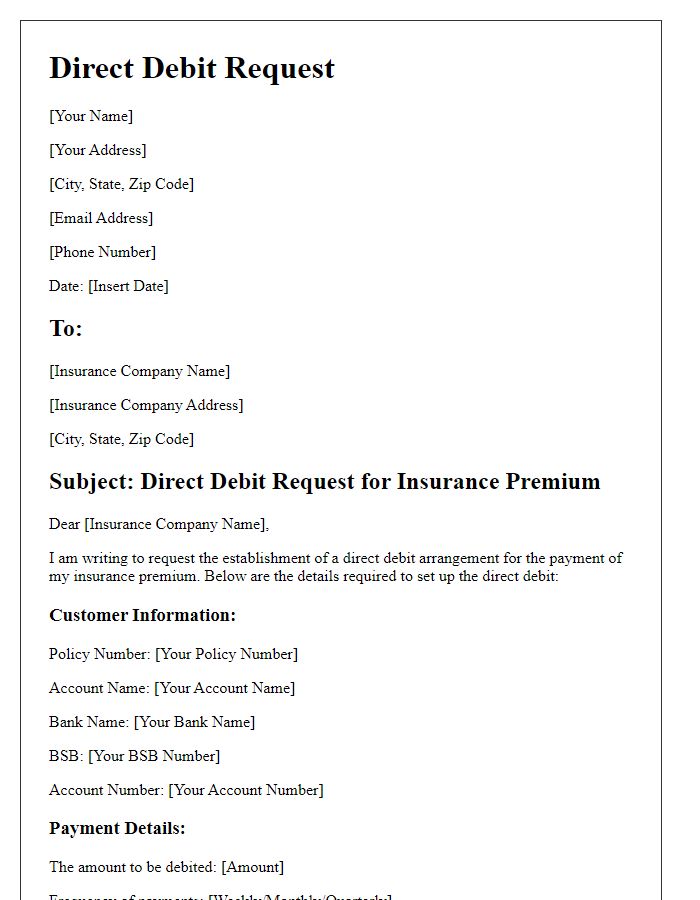

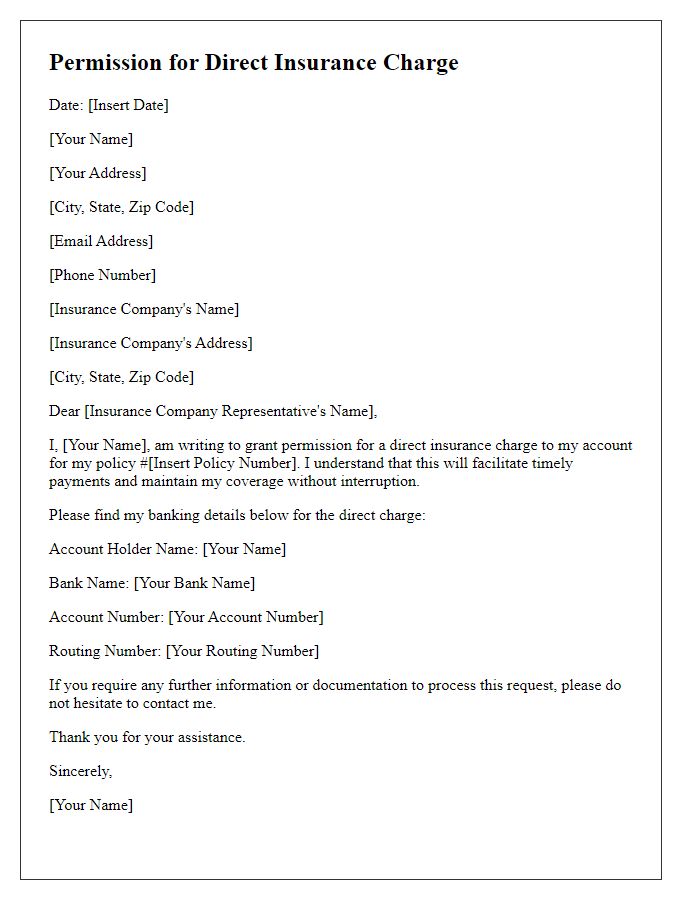

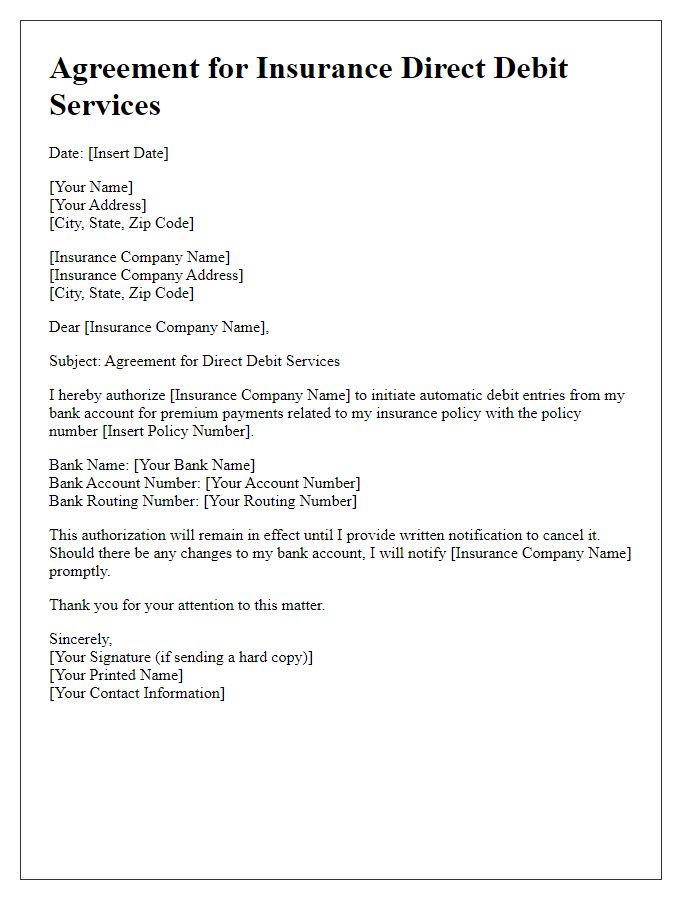

Personal Information

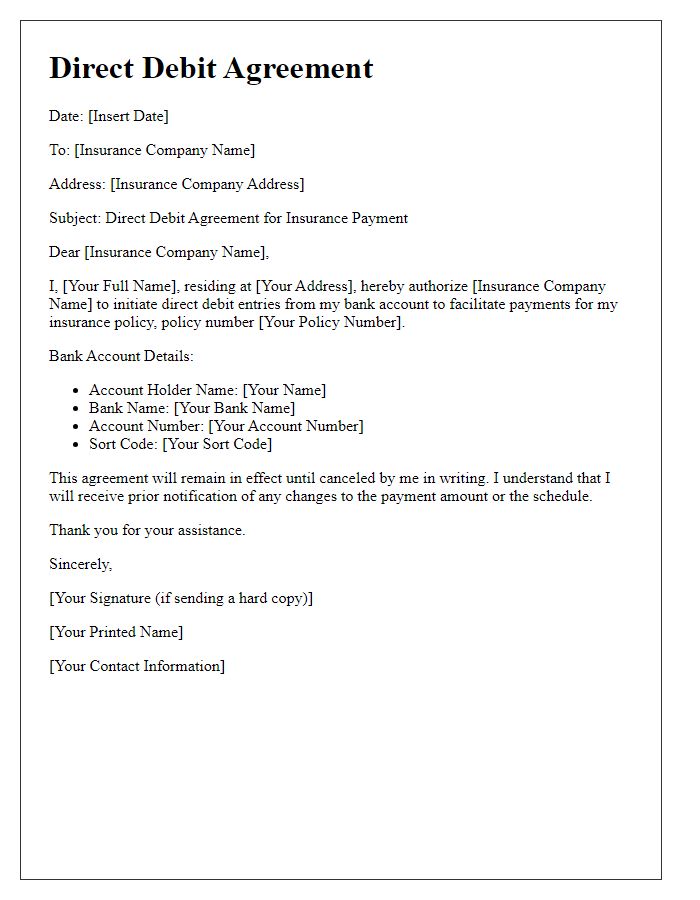

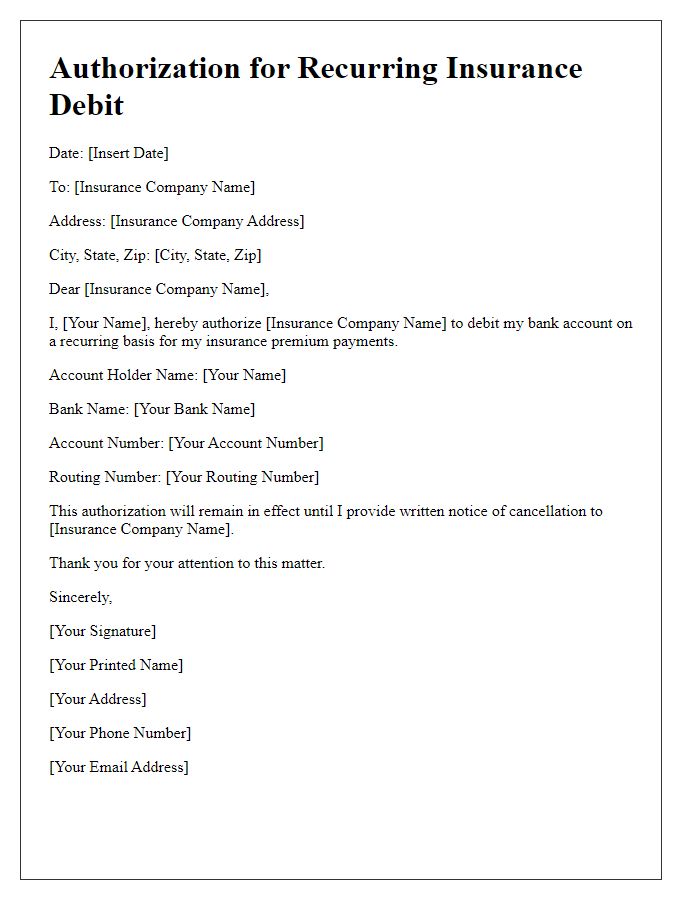

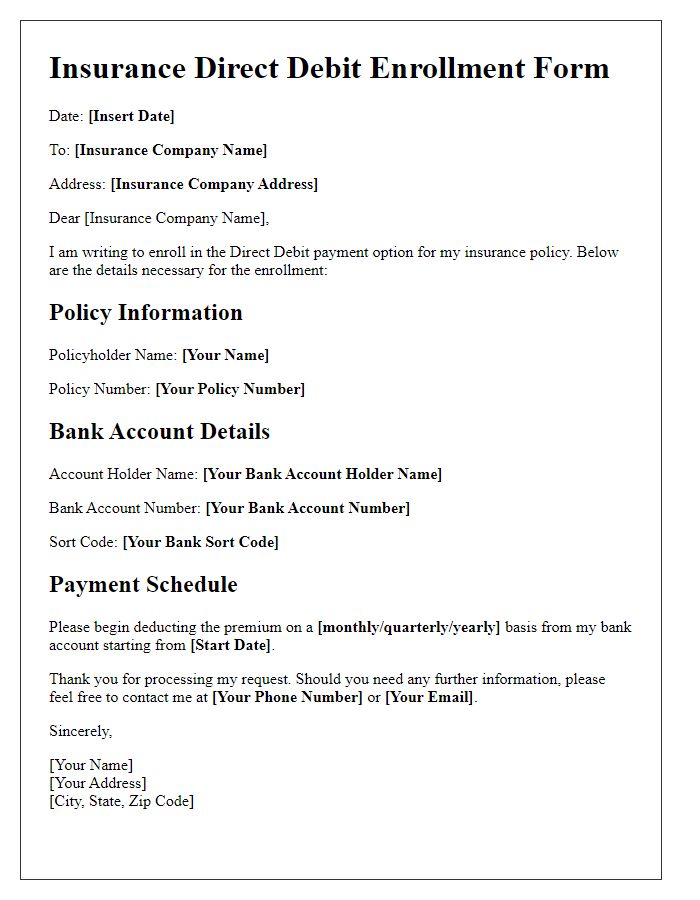

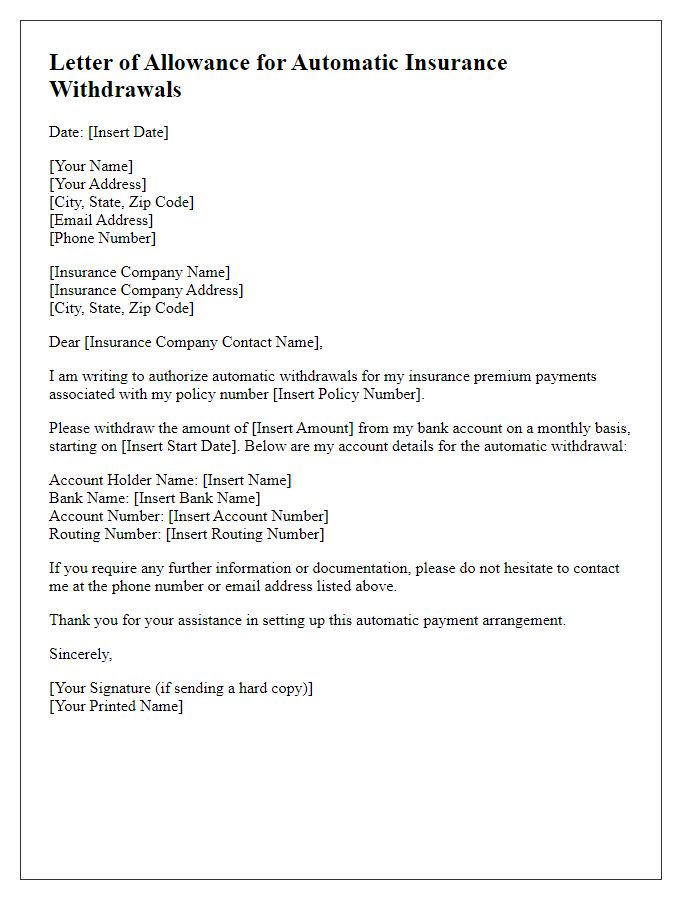

Direct insurance debit authorization often requires precise personal information to ensure accurate processing. This typically includes full name, date of birth, and address, which help identify the individual and their residence. Important details such as bank account number and sort code are crucial for facilitating monthly premium payments. Additionally, contact information, including phone number and email address, is essential for communication regarding the insurance policy. The authorization should also contain policy number and insurer's details, ensuring that payments are correctly allocated to the specific insurance coverage, like health, auto, or home. Providing this information securely is vital for safeguarding against identity theft and ensuring uninterrupted insurance coverage.

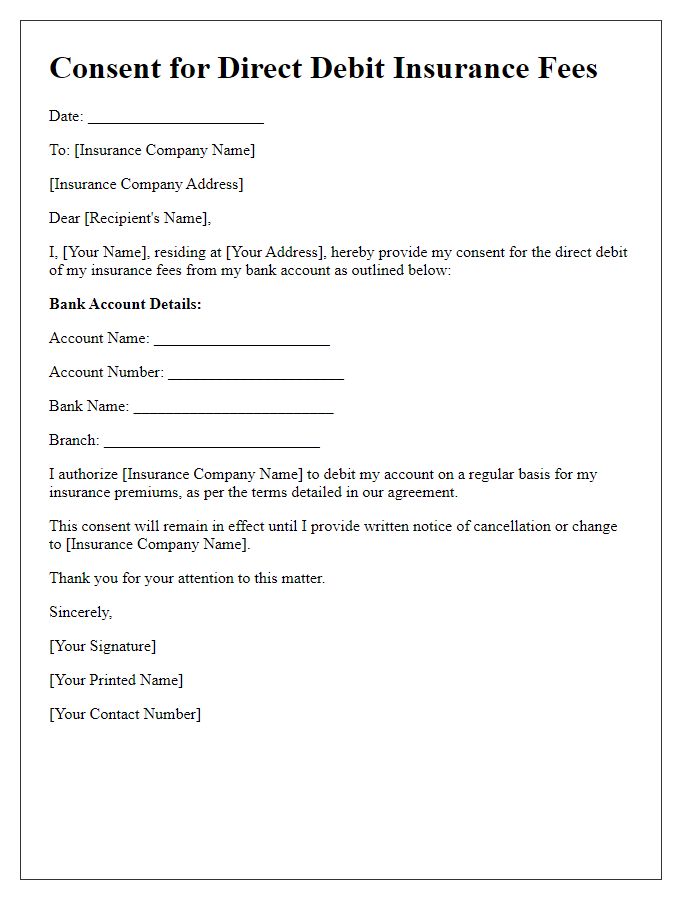

Bank Account Details

A direct insurance debit authorization facilitates automated premium payments from a bank account, ensuring timely coverage renewal. This process typically requires bank account details such as account number (usually 10-12 digits), sort code (a 6-digit number identifying the bank branch in the UK), and the account holder's name (as registered with the bank). Accurate information is crucial to prevent payment errors and ensure compliance with regulatory frameworks governing automated debits. Additionally, consumers may need to provide their insurance policy number, specifying the insurer and coverage details, to link the debit to the correct account, ensuring uninterrupted service for policies such as health, auto, or home insurance.

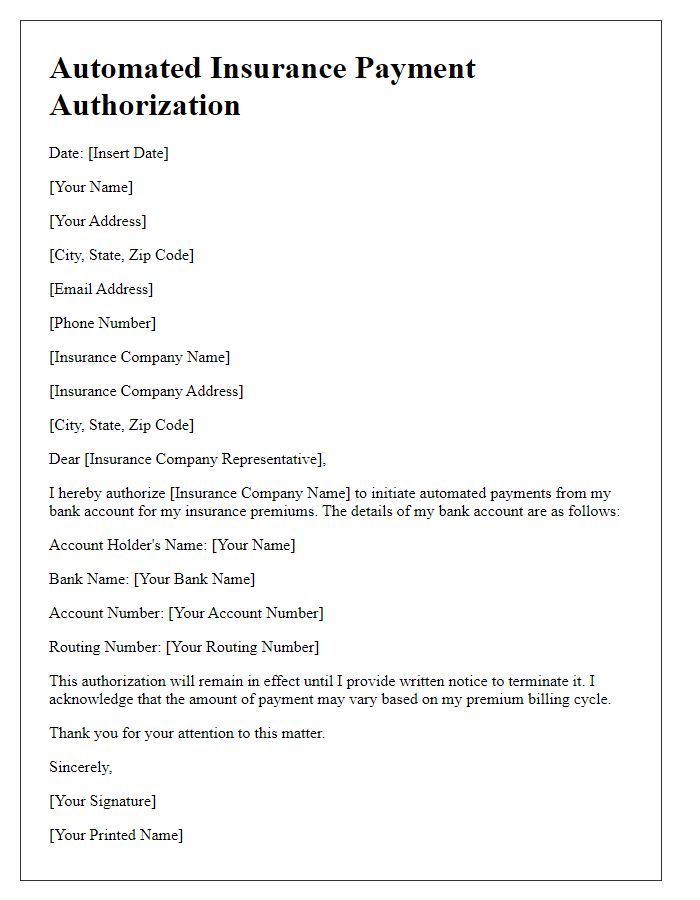

Authorization Statement

In a direct insurance debit authorization statement, policyholders provide consent for recurring payments to be automatically deducted from their bank accounts. This authorization typically includes key details such as the policy number, the insured's name, and the financial institution's name from which the funds will be withdrawn. The amount specified for deduction is often noted, alongside the payment frequency (monthly, quarterly, or annually). Specific dates for withdrawals, such as the initial payment or subsequent deductions, may also be included to ensure clarity. It is essential that individuals understand their rights regarding cancelled payments and the procedures for amending or terminating the authorization.

Insurance Policy Information

Insurance policy holders must provide direct debit authorization for premium payments to ensure timely coverage. Essential details include policy number (e.g., 123456789), premium amount (e.g., $150 monthly), and payment frequency (monthly, quarterly, or annually). The insurance provider, such as Acme Insurance Company, requires bank account information, including the account holder's name, bank name (e.g., First National Bank), account number, and routing number. Authorizing this direct debit simplifies payment processing and minimizes lapses in coverage due to missed payments.

Contact Information and Signature

A direct insurance debit authorization form includes essential contact information, such as the policyholder's full name, address (including city, state, zip code), email address, and phone number for verification purposes. Additionally, it requires the bank details of the policyholder, including the name of the bank, account number, and sort code, to facilitate direct transactions. A signature line is necessary for the policyholder's consent, indicating approval for the insurance company to debit the specified amount from the bank account on a set schedule, typically monthly or annually. Clear instructions should accompany the signature area, outlining the importance of reviewing the terms and conditions of the policy.

Comments