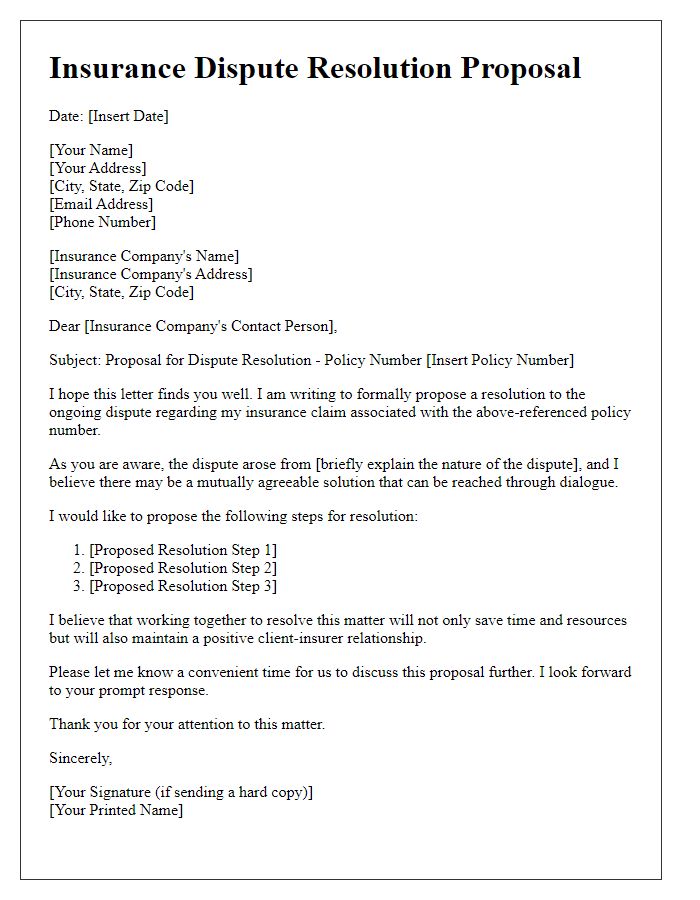

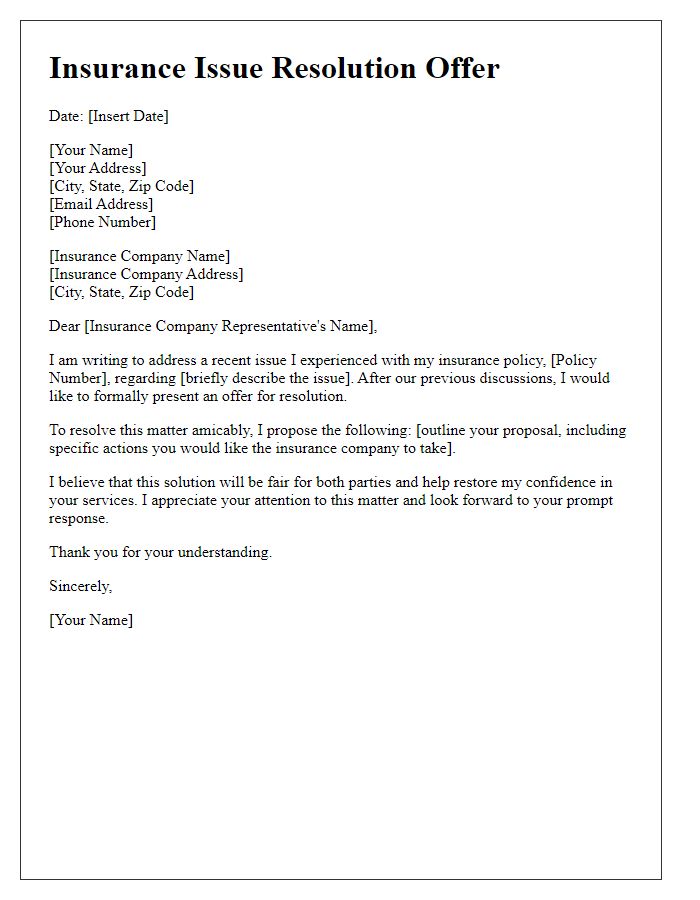

Are you tangled in a frustrating insurance dispute and unsure of your next steps? Navigating the complexities of insurance claims can often feel overwhelming, but the good news is that resolutions are within reach. With the right tools and knowledge, you can effectively advocate for your interests and possibly turn your situation around. Join me as we explore a practical letter template that can aid in your dispute resolution journey!

Clear identification of parties involved

In an insurance dispute resolution offer, accurate identification of the involved parties is crucial for effective communication and negotiation. The first party often represents the insurance company, such as XYZ Insurance Limited, headquartered in New York City, specializing in property insurance. The second party typically includes the policyholder, an individual or organization, for instance, John Smith, who resides at 123 Elm Street, Springfield, and holds a homeowner's insurance policy number 456789. Clear acknowledgment of each party's role and details ensures efficient processing of the dispute, leading to a resolution based on the terms of the insurance policy and applicable state laws.

Concise description of the dispute

The dispute concerns the denial of a claim submitted under policy number 123456789 with XYZ Insurance Company. The claim, filed on January 15, 2023, pertains to damages incurred during a severe storm on January 10, 2023, in Springfield, Illinois. The policyholder, John Doe, reported significant damage to his property, including a collapsed fence and roof leaks. Despite providing ample evidence, including photographs and contractor estimates totaling $15,000, the insurer denied the claim, citing lack of coverage for wind damage. This resolution offer aims to address the disagreement regarding the applicability of coverage and seek an equitable settlement for the damages sustained.

Detailed account of the proposed resolution

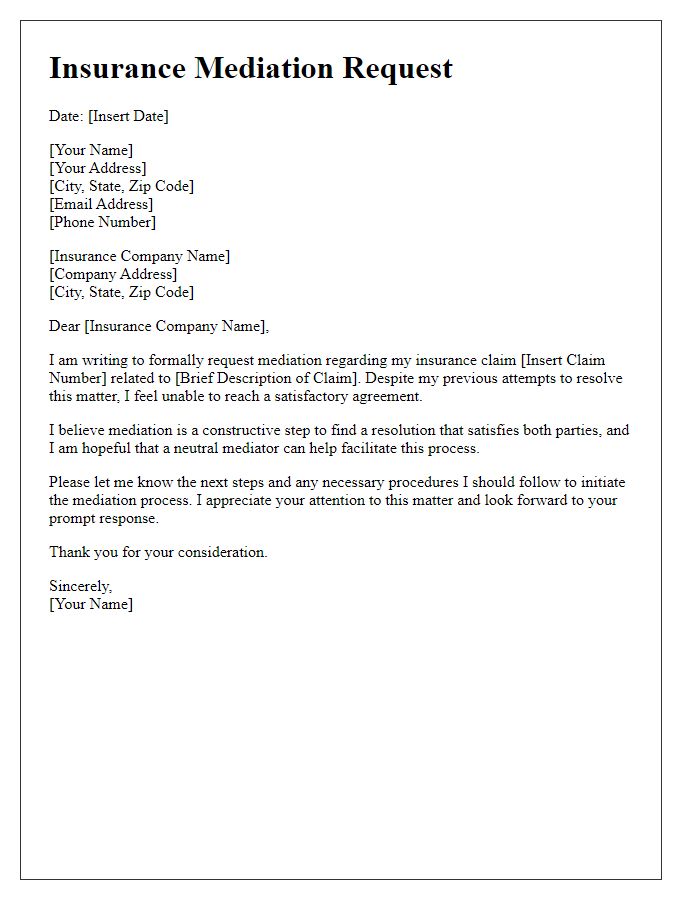

The proposed resolution for the insurance dispute involves several key steps aimed at addressing the issues raised by the claimant. First, an initial review of the claim file, including all documentation and communications regarding the incident, will be conducted by a designated claims adjuster specialized in the relevant insurance policy type. This review will assess the claim's merits based on policy terms, coverage limits, and any applicable state laws such as those specified under the California Insurance Code. Following this assessment, a comprehensive summary outlining the findings will be provided to the claimant and the insurance company. To facilitate an open dialogue, a mediation session will be arranged, involving a neutral third-party mediator from the American Arbitration Association. This session will allow both parties to discuss the details, express concerns, and negotiate in good faith towards a satisfactory settlement. Should the dispute remain unresolved post-mediation, the proposal includes access to an arbitration process in accordance with the rules established by the International Institute for Conflict Prevention and Resolution, ensuring a fair outcome. This structured approach aims to resolve the dispute efficiently, promote transparency, and minimize litigation costs for both parties.

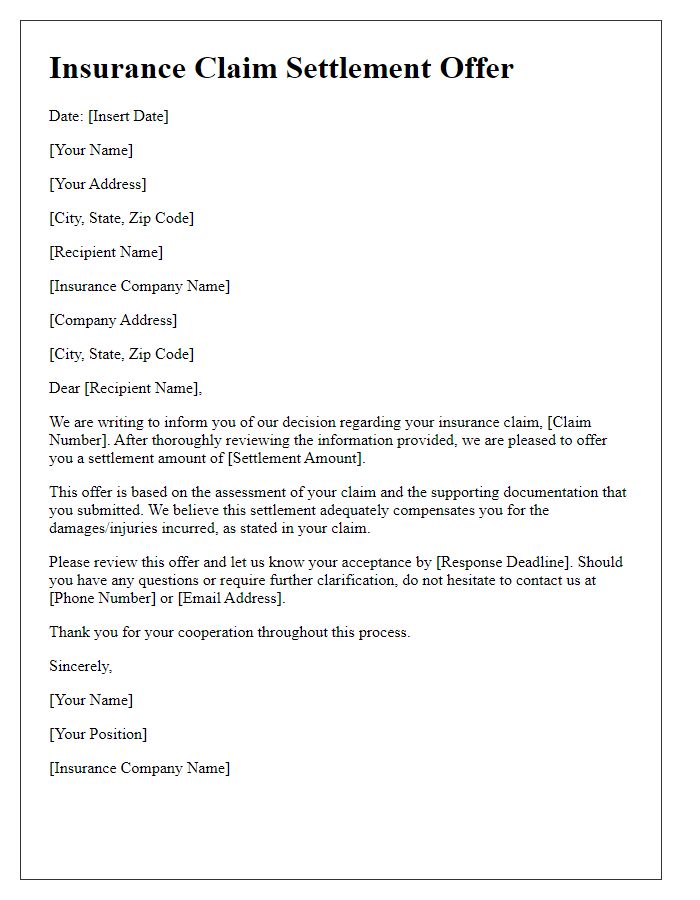

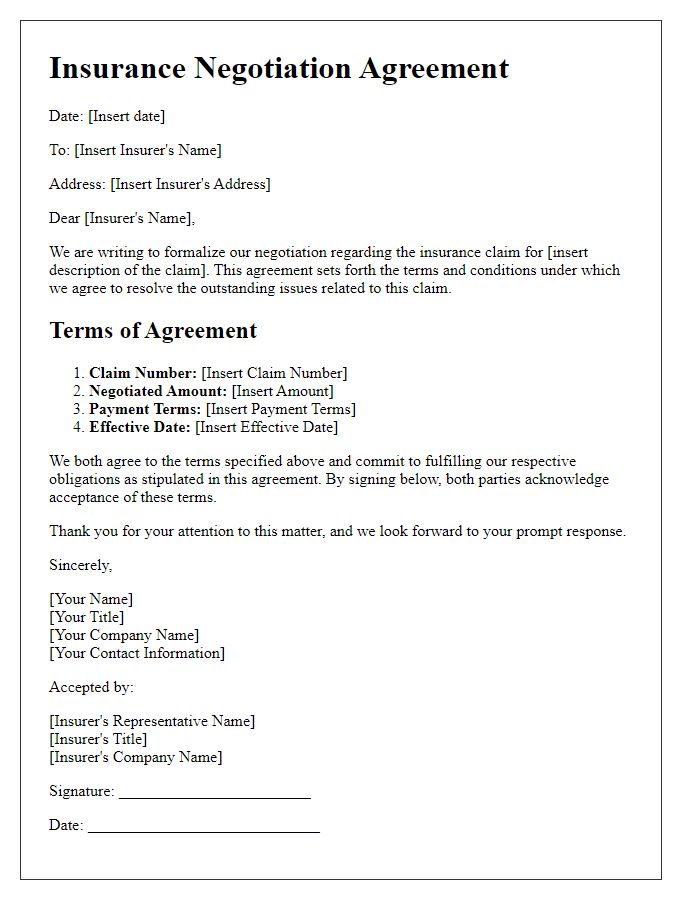

Specific terms and conditions

A comprehensive insurance dispute resolution offer outlines specific terms and conditions crucial for both parties. The dispute may involve claims disputes or policy misunderstandings outlined in various insurance types, such as health insurance, auto insurance, or homeowners insurance. Key conditions often include a defined timeline, typically 30 to 60 days, for both parties to present their documents and evidence. Mandatory mediation sessions are frequently scheduled at designated mediation centers in the claimant's locality, ensuring accessibility. Terms also include a confidentiality clause to protect sensitive information during the resolution process. A provision for attorney fees and costs is another critical aspect, determining whether each party bears their own expenses or shares them. Additionally, the offer may specify whether the resolution is binding or non-binding, influencing the enforceability of the agreement reached. Engaging an impartial third-party arbitrator, particularly experienced in insurance disputes, could also be highlighted as an option for further dispute resolution.

Deadline for response and acceptance

Insurance companies often provide a dispute resolution offer to settle claims amicably. Important details include a specified deadline for response, usually 30 days from receipt of the offer. Acceptance by the insured must be communicated in writing to ensure the resolution process begins. The offer might detail the monetary compensation amount, specific terms of the settlement, and any implications on future claims. For example, individuals must understand that accepting the offer may preclude them from pursuing further legal action related to the claim. Clear communication channels with the insurance claims adjuster are crucial during this process to avoid any misunderstandings.

Comments